Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

- ADA’s recovery stalled again at the $0.3 hurdle.

- The funding rate has fluctuated in recent days.

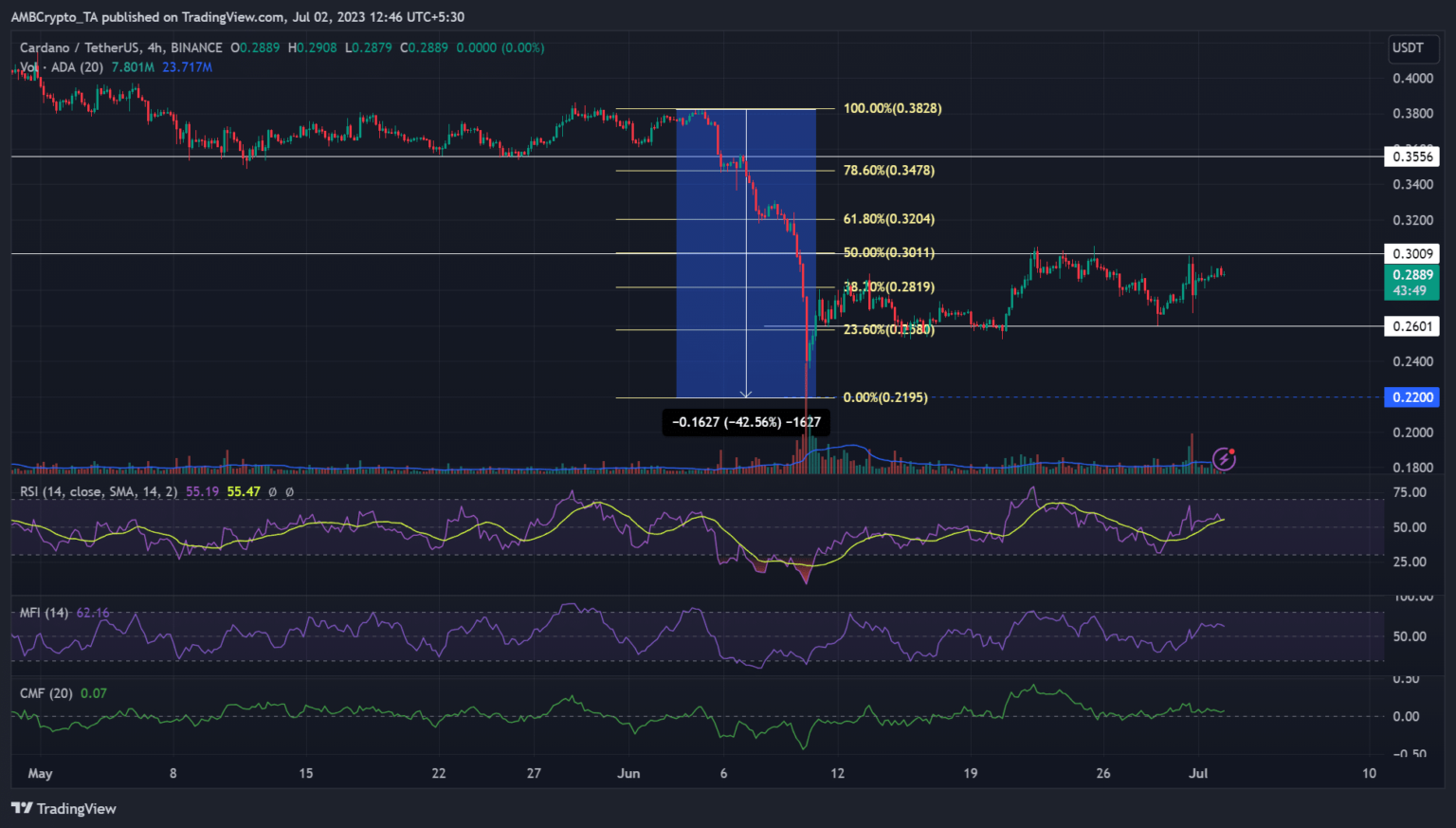

The US SEC Labeling Cardano [ADA] as safety still weighs on price performance in early June. The labeling dropped ADA from about $0.38 to $0.22, losing more than 40% of its value. Although ADA attempted price reversal amid BTCs sharp recovery, price has yet to climb above $0.30.

Is your wallet green? Checking out ADA Profit Calculator

In the meantime, BTC’s pierce consolidation above USD 30,000 continues, which could mean bullish sentiment on the one hand, but a possible pullback on the other.

Buyer exhaustion at $0.3?

Source: ADA/USDT on TradingView

The H4 market structure, like the D1 price chart, was bearish at the time of writing unless ADA zoomed past $0.3. Nevertheless, a candlestick session above $0.3 will only be a bullish intent and not a guaranteed rally.

Most importantly, the $0.3 is a March low and a bearish market structure breaker. That makes it a crucial resistance level for bulls in the near term. So far, the recovery from June 10 has failed to break the bearish market structure. Notably, ADA has been rejected four times at $0.3, further highlighting buyer exhaustion at this level.

Therefore, sellers can extend their profit to $0.26 if the roadblock continues. That could leave bulls with only two options: wait for a $0.26 support retest or a pullback retest at the $0.3 breakout level for buying opportunities.

Meanwhile, RSI and MFI fell above the median. MFI, in particular, signaled sideways movement, suggesting likely limited price consolidation below $0.3 with a possible clear direction from Monday (July 3).

Similarly, the CMF was above zero, indicating positive capital inflows for ADA.

The funding rate fluctuated

Source: Sentiment

How many 1,10,100 ADAs worth today?

As of June 10, ADA funding rates in Binance Exchange have been faltering, which could limit a strong recovery that could evade the $0.3 hurdle.

However, the negative sentiment eased, as evidenced by the rising weighted sentiment (blue). Also, the average coin age increased from 90 days, indicating network-wide accumulation of ADA. This could be a boon for bulls, but traders should monitor BTC price action for optimized settings.