- SAND recently found strong support as bulls looked to provoke a break above the current pattern.

- Derivatives data showed a bearish edge, with some hope of a bullish rebound.

While the bears provoke another liquidation meeting at The Sandbox’s [SAND] in the market, price action struggled to stay above crucial support levels.

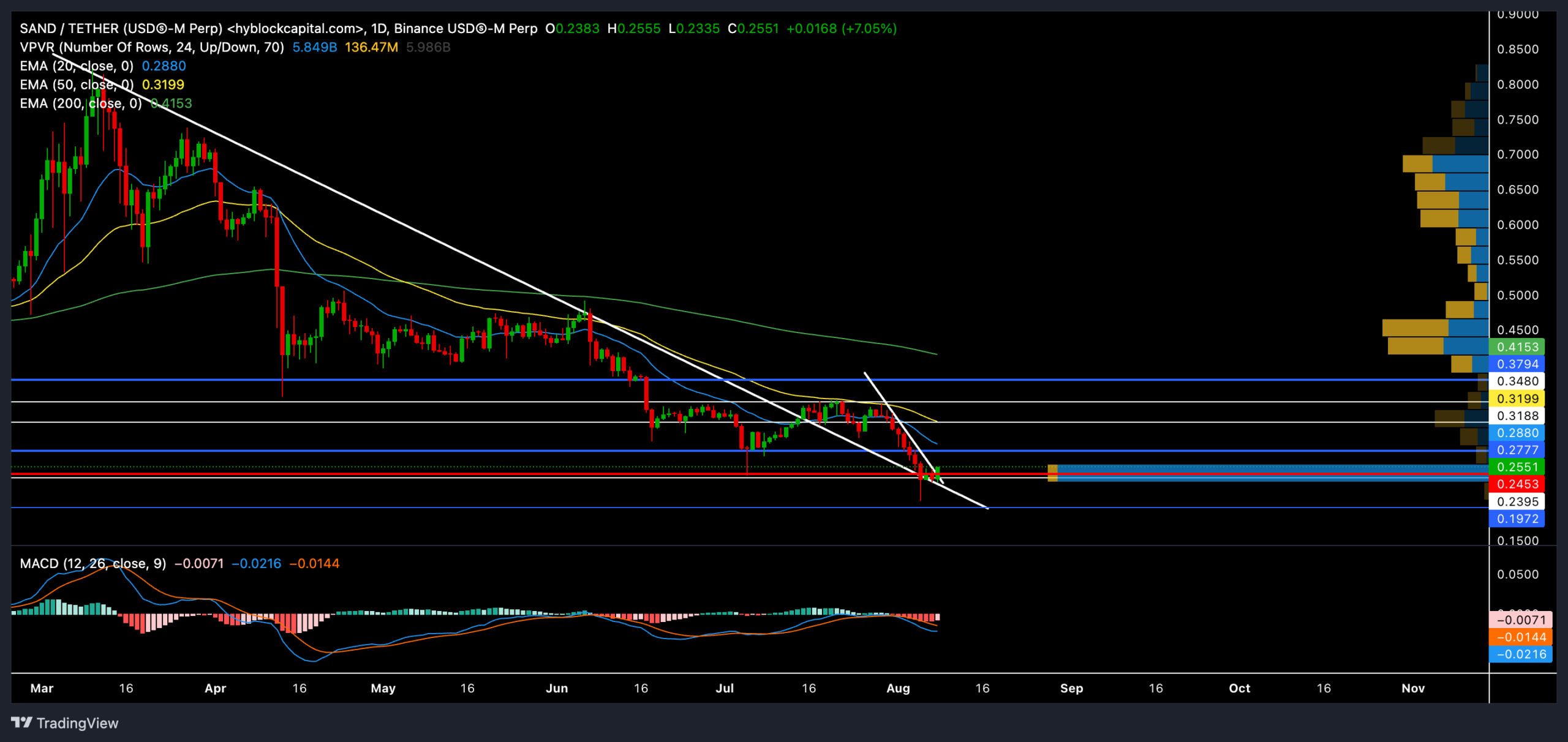

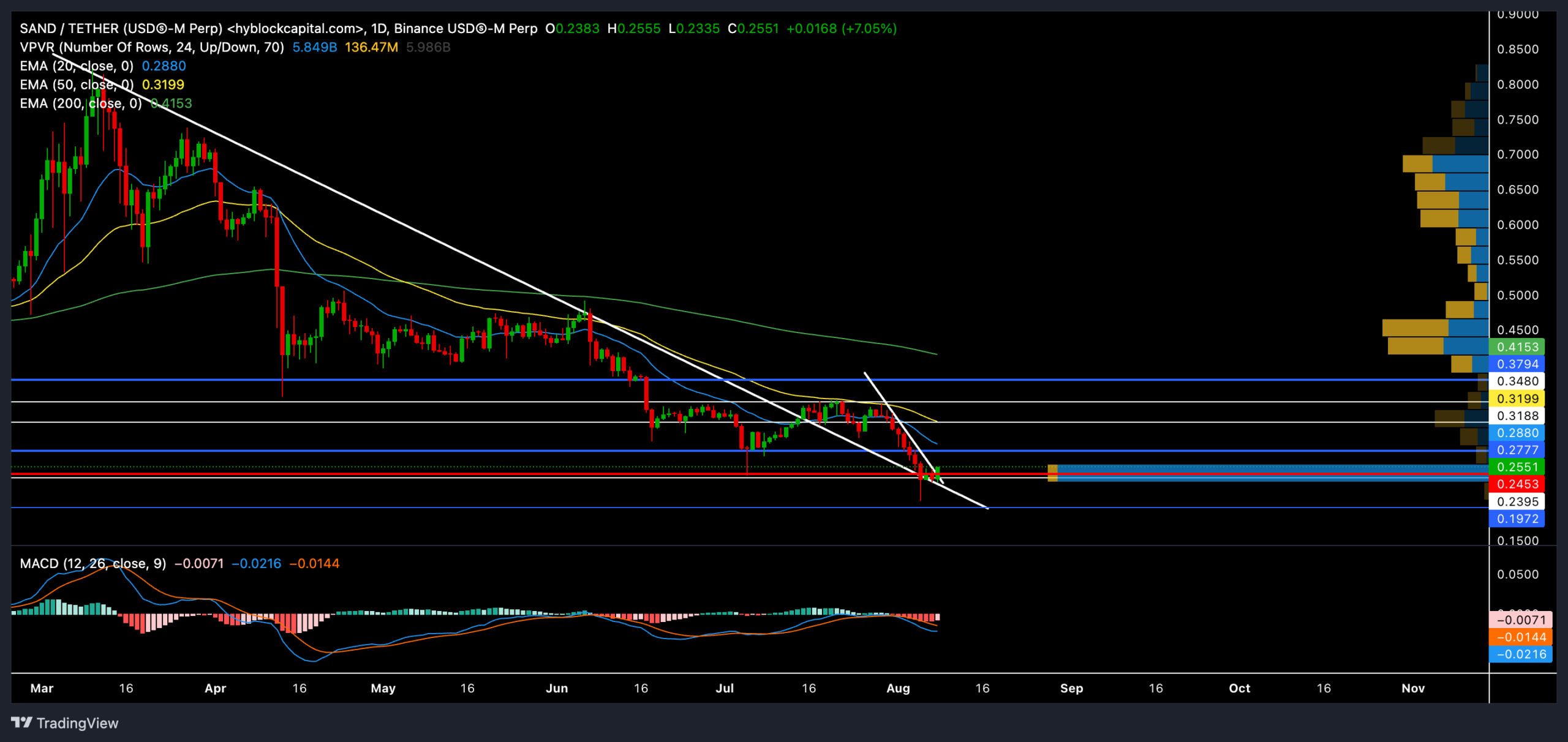

The recovery from the 50 EMA created a downtrend towards the $0.23 support at the time of writing.

The bulls would now try to break the bearish edge, especially as the price was approaching a high liquidity zone. At the time of writing, SAND was trading at almost $0.24, up almost 5% in the past day.

Can bulls intervene to stop the bleeding?

Source: TradingView, SAND/USDT

SAND bears found renewed strength after a recovery from the 200-day EMA (green) in early June. On the way down, the price action also dipped below the 20-day and 50-day EMAs, reflecting a strong bearish edge.

Here it is worth noting that the 200-day EMA coincided with the then trendline resistance (white), which caused some bearish pressure.

The resulting downward trend resulted in a drop of almost 49% in just two months. However, support at the $0.23 level has revived some bullish revival hopes at the time of writing.

In the meantime, SAND found a close above its long-term trendline resistance and reversed it to support its daily chart.

The altcoin has also formed a classic falling wedge pattern. The recent bullish recovery from $0.23 support could pave the way for bulls to break out of this pattern.

Should the bulls find a strong close above the current pattern, SAND could find a way to test the $0.28-$0.31 resistance band before a bearish reversal occurs.

On the other hand, should the price action fall below the immediate support level at $0.23, the altcoin could see a longer decline before recovering.

The MACD lines reaffirmed the overall bearish advantage in the SAND market. However, buyers should watch out for a possible bullish crossover on the MACD lines.

This crossover could confirm an easing of selling pressure and help SAND retest its short-term EMAs.

Derivative data revealed THIS

Source: Coinglass

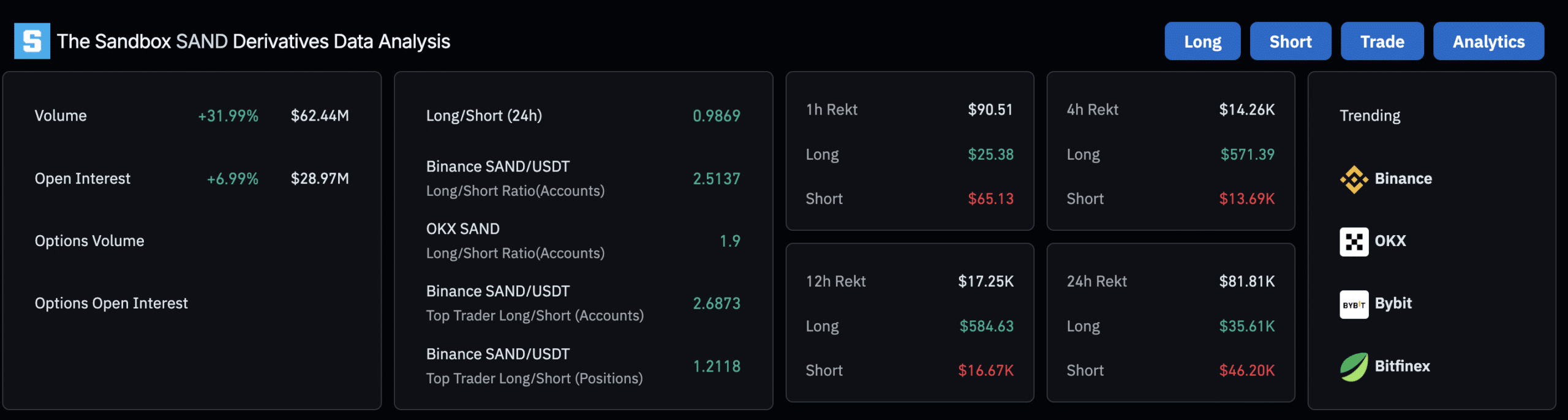

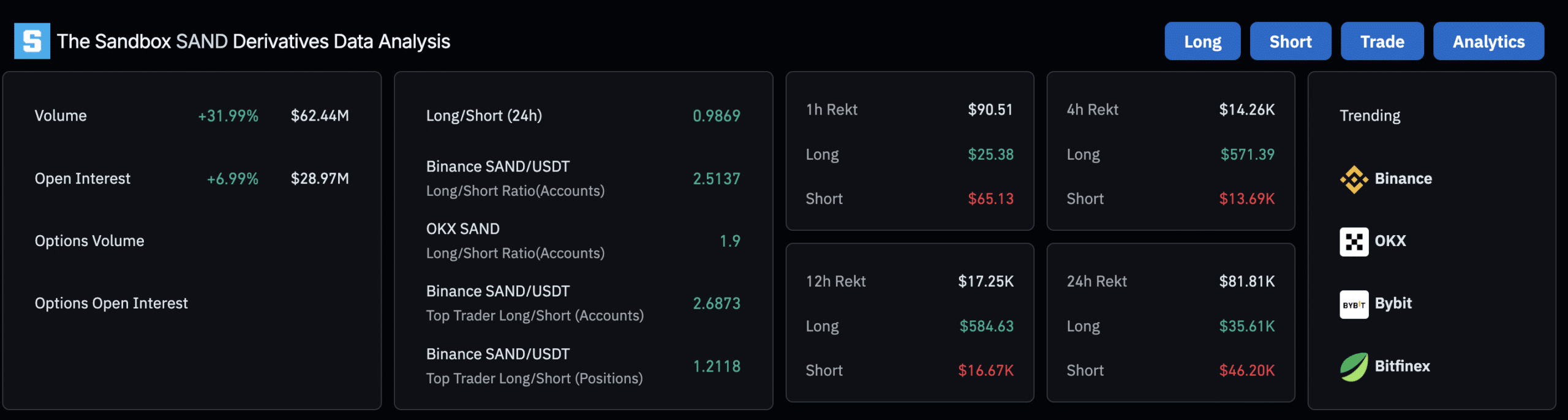

The overall long/short ratio is 0.9869, indicating a slight bias towards short positions. However, top traders on Binance [BNB] have a long/short ratio of 2.6873.

Realistic or not, here is the market cap of SAND in terms of BTC

Despite the slight overall short position in the long/short ratio, other indicators such as account ratios, top trader positions, funding rates and liquidations indicate a generally bullish sentiment for SAND.

The increased volume and Open Interest show growing market interest, which could potentially fuel further price movements.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.