The director of the Global Macro of Fidelity, Jurrien Timmer, works his prospects on markets after an over-the-sign correction in shares.

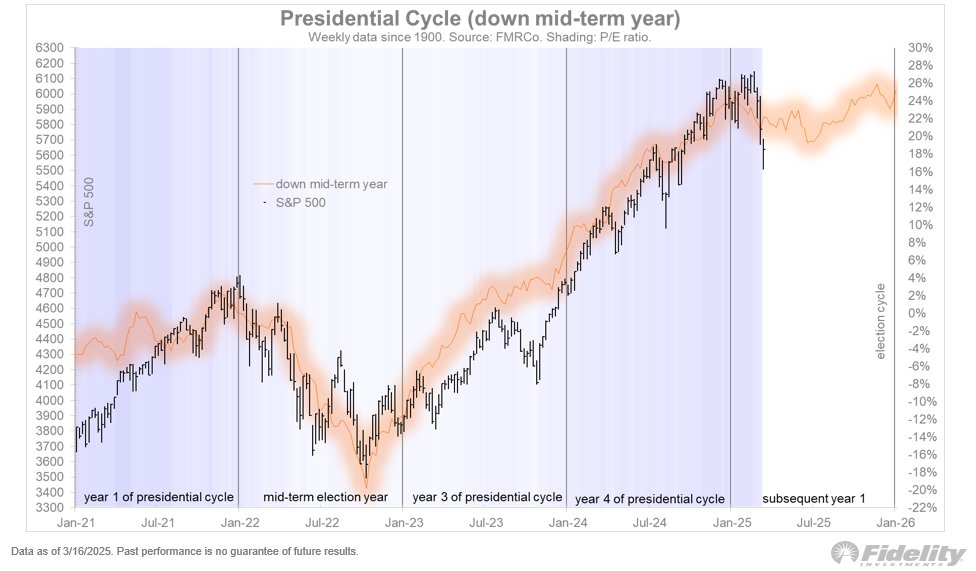

In a message on the social media platform X, Timmer with his 194,000 followers shares a graph with an average of the returns of the S&P 500 during the specific years of presidential conditions.

Timmer’s graph suggests that the S&P 500 more or less follows the historic average of earlier presidential cycles and that the current marking could be closed somewhere around July of this year.

“Although I would not put too much weight on this indicator, the iteration of the presidential cycle in which the medium term (2022) falls, continues to play neatly. We are now in ‘Year 5’ (if that makes sense), and that year has fallen on average for the first six months. It suggests a modest but much-correct period.”

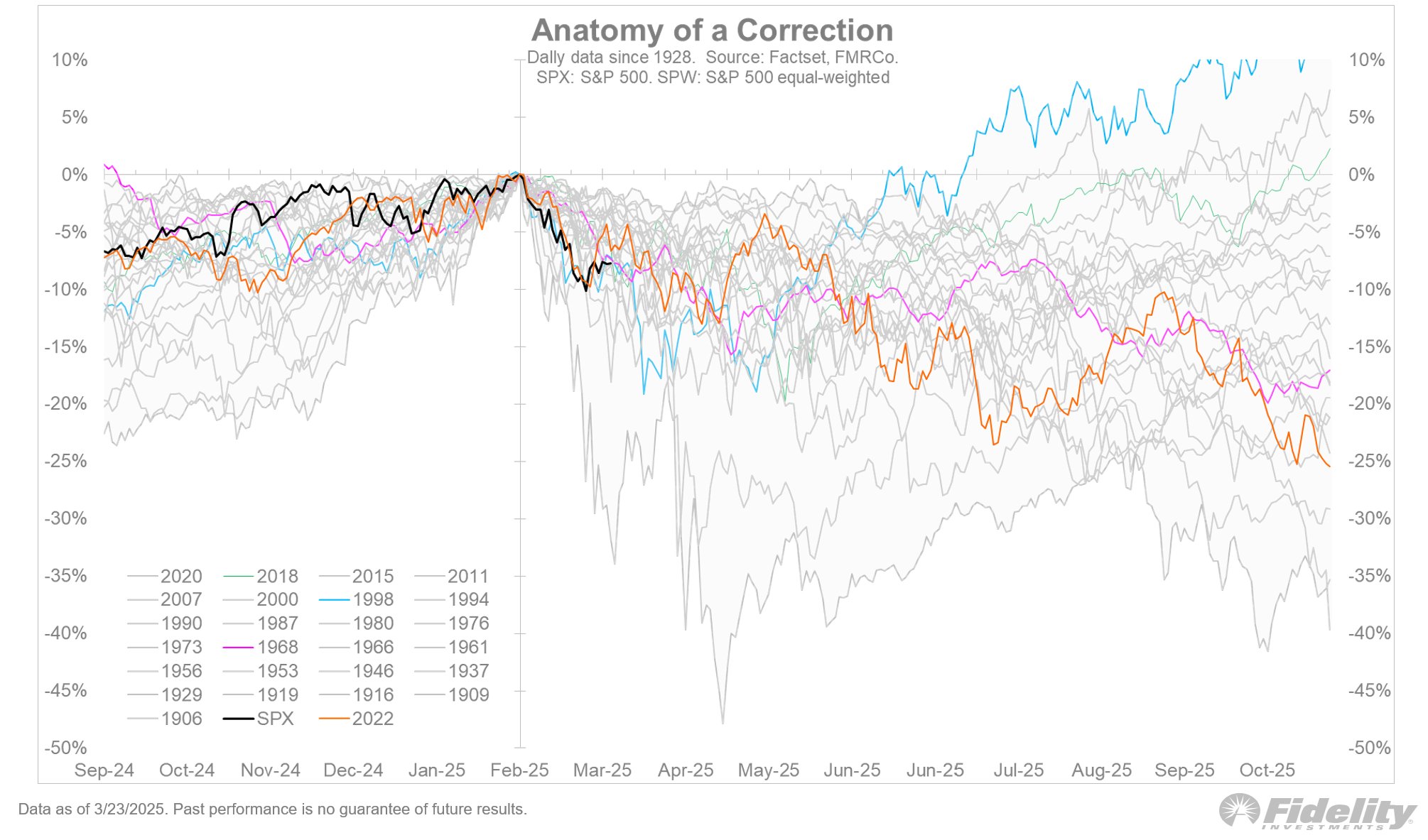

Zooming in, Timmer shares a graph that follows 26 different corrections in the S&P 500 all the way back to 1906. Looking at every correction, Timmer says that the current market dip seems to think of 2018, which implies that the S&P 500 could go out around the 4,900 level.

“Last week’s postponement of the band bombs (which became such a function in 2025) the markets allowed to catch your breath. For now we stay in 10% correction area while we wonder whether the next 10% will be up or down.

The graph below shows all corrections and bear markets since 1900. This feels a bit like the end of 2018, which was a correction of 20% that was pure driven by several compression. “

Follow us on X” Facebook And Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Featured image: Shutterstock/Tadashiart/Natalia Siiatovskaia