- Bitcoin saw lever -driven pump as OI rose to $ 27.9 billion, which marked an increase of $ 3.3 billion

- Weak question Bitcoin saw investors signs of caution

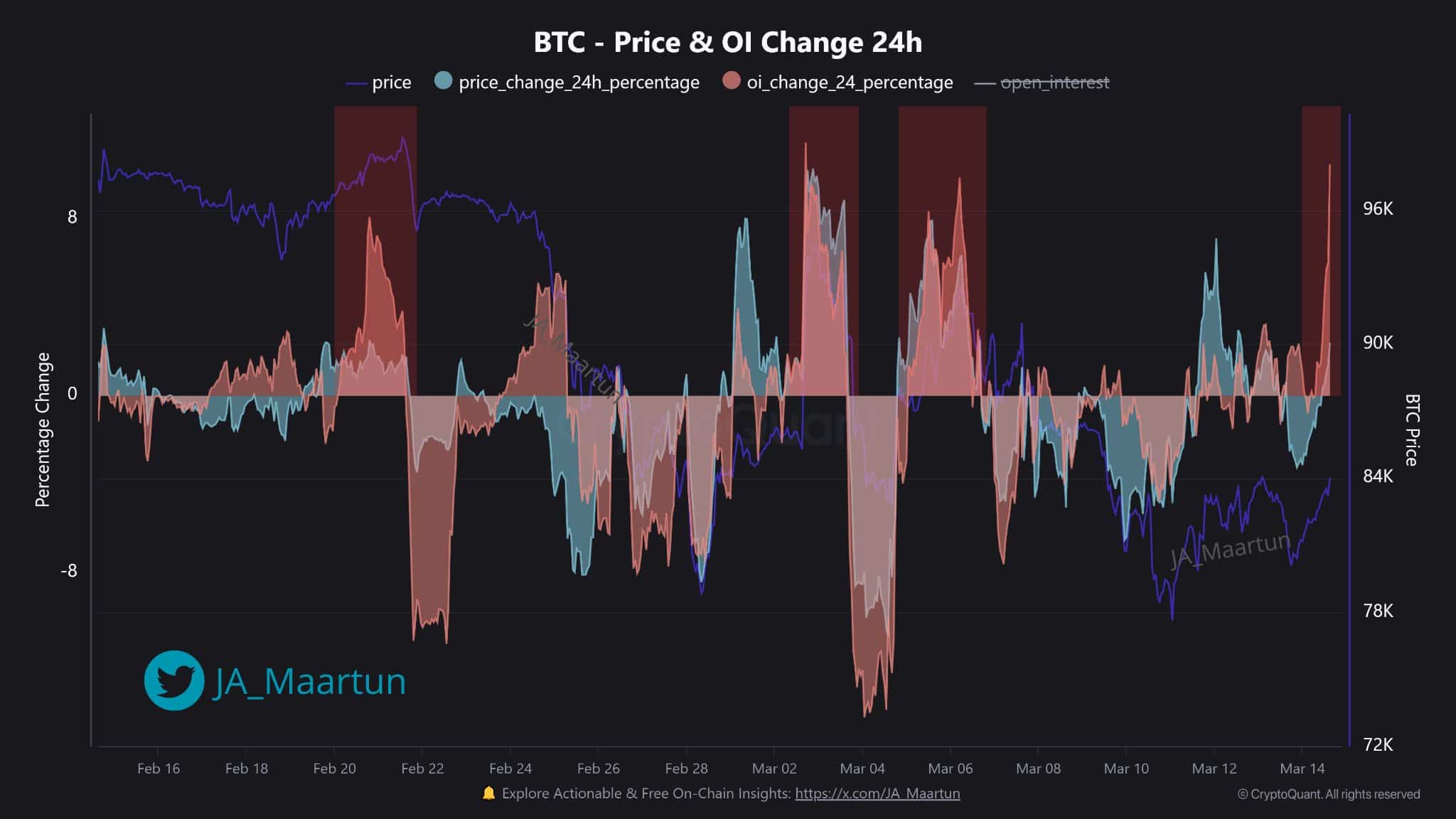

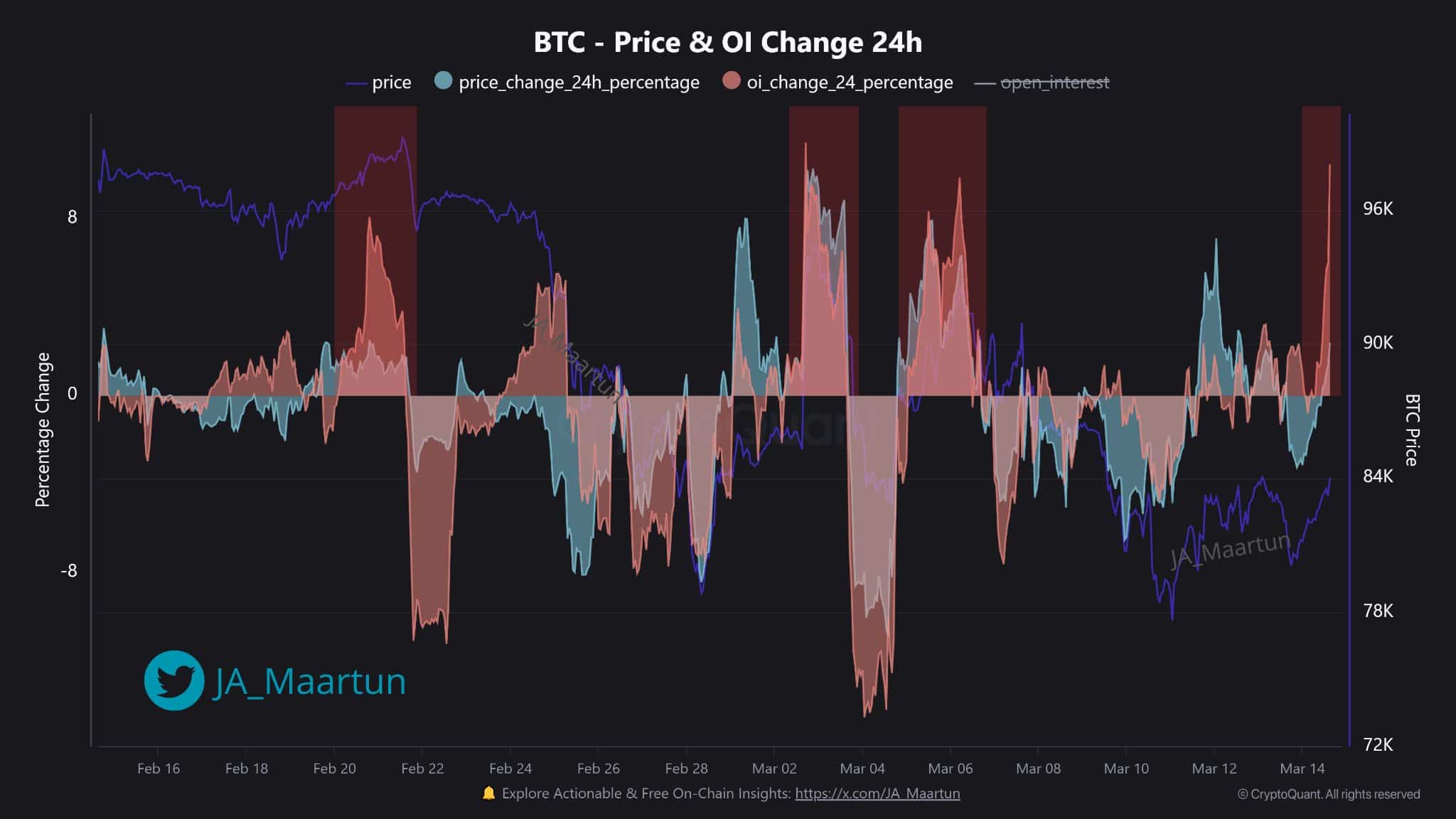

Bitcoin’s [BTC] Open interest (OI) climbed to $ 27.9 billion, indicating an increase in market actions after a $ 3.3 billion pump – a boost of 13%.

Earlier rebellion in open interest led to unpredictable price fluctuations. This caused market fluctuations that influenced the cryptocurrency on both February 20 and March 4. In fact, the lever -driven pump traders signaled to manage risks.

At the time of the press, Bitcoin seemed to maintain a trading price of around $ 83k, although excessive leverage could lead to market liquidations. The depreciation of long positions would be a rapid withdrawal of the price to the range from $ 70,000 to $ 80,000.

Source: X

When OI exceeded 10% in the past, the price fell by 5-8%. The same was seen on February 22 and March 6. The prevailing market conditions create an opening for Short Sellers to take advantage of liquidations that can occur.

A sustainable price increase above $ 90K can generate conditions for extra market growth. An OI -Flush can quickly remove the current price increases, while traders must be careful with sudden changes in open interest.

How do traders respond to a weak question?

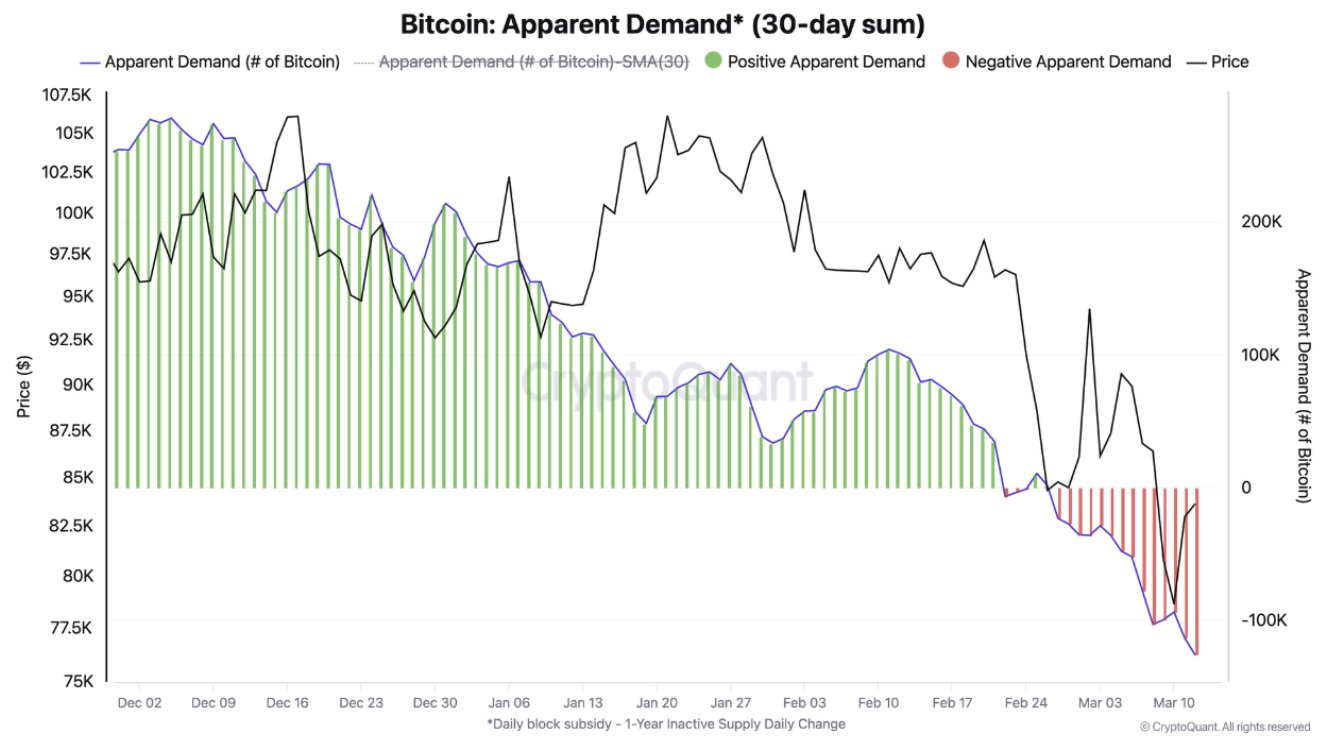

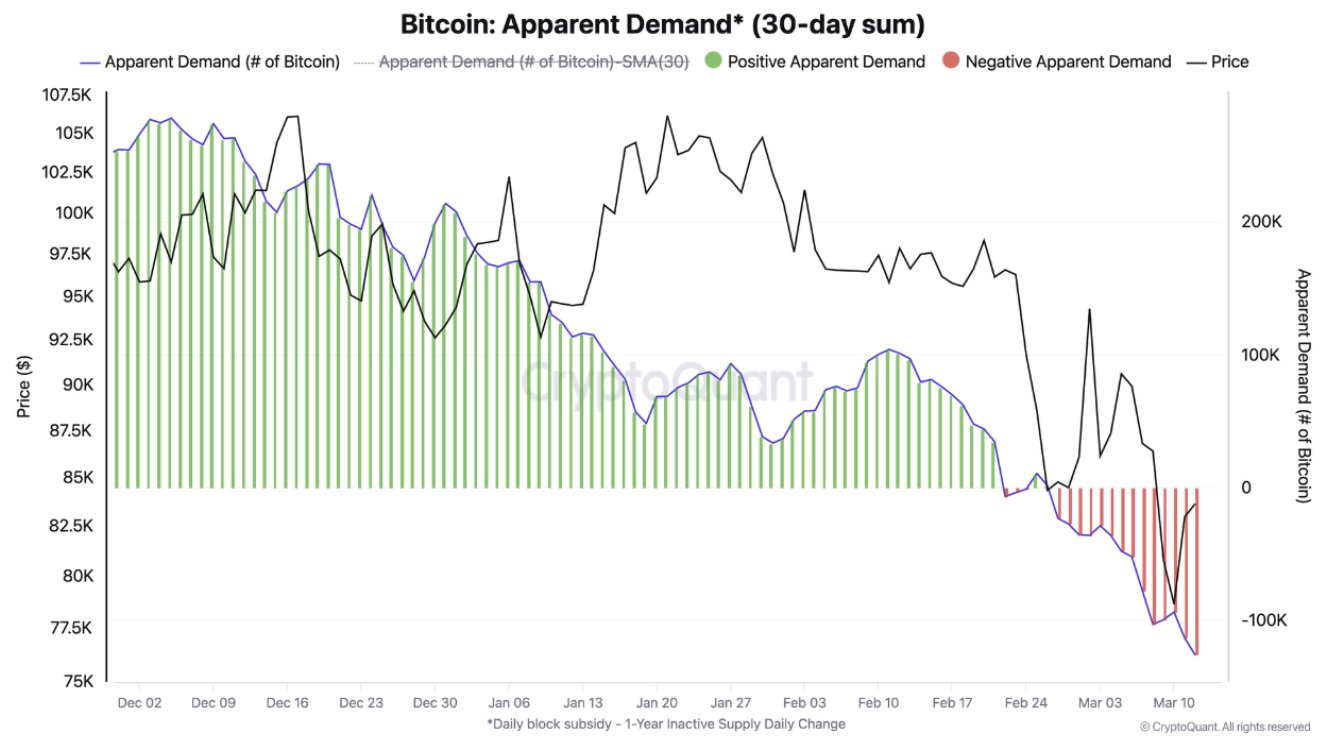

Again, a significant reduction in the BTC question was seen from December 2024 to March 2025. Bitcoin trade saw a low annual demand of -100k BTC that occurred in mid -March 2025 after the maximum demand had risen to 105k Bitcoin in early December 2024.

The south in market value, together with the negative demand structure, revealed a strong caution of investors. The circumstances became less favorable due to the amount of 30 days that positions under the demand line maintained, because the price of BTC fell from 105k to around 77k.

This hinted on the lack of specific information about investor movement, although investors tend to secure their capital by buying defensive assets that are less risky. These consist of metal and American government bonds and stable digital currency USDT.

Source: Cryptuquant

Market participants shift investments to safer assets during these uncertain times as Bitcoin’s price and market demand drops. This means that BTC holders of long positions can experience considerable risks, because market conditions seem to lay the foundation for an expected bear market.

The market can also expose livered livered lung-position holders to forced sale if the price drops to below the $ 80k level and the demand becomes negative at -100K.

This could lead to large losses that take place for holders, because analysis pointed out if the demand has been under -100k since December last December. Traders who invested in BTC who return to $ 100k can have losses.