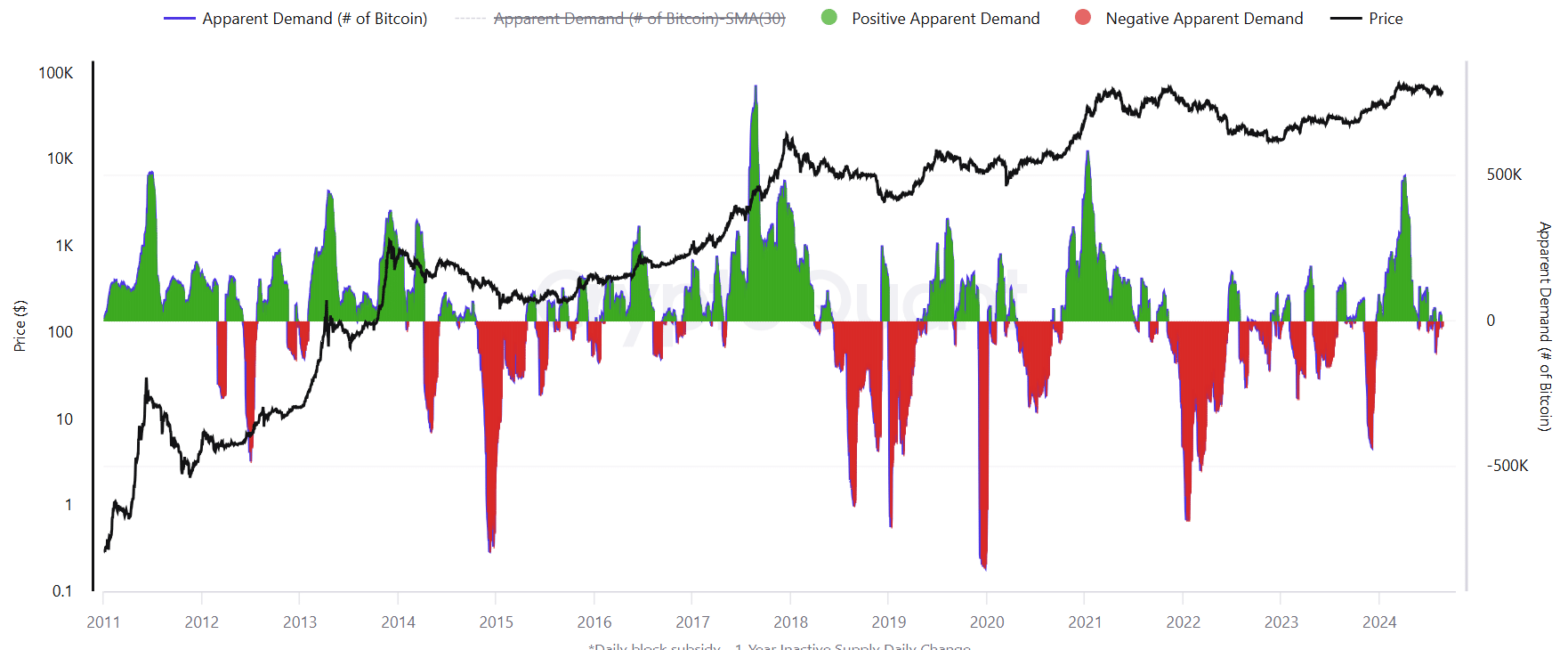

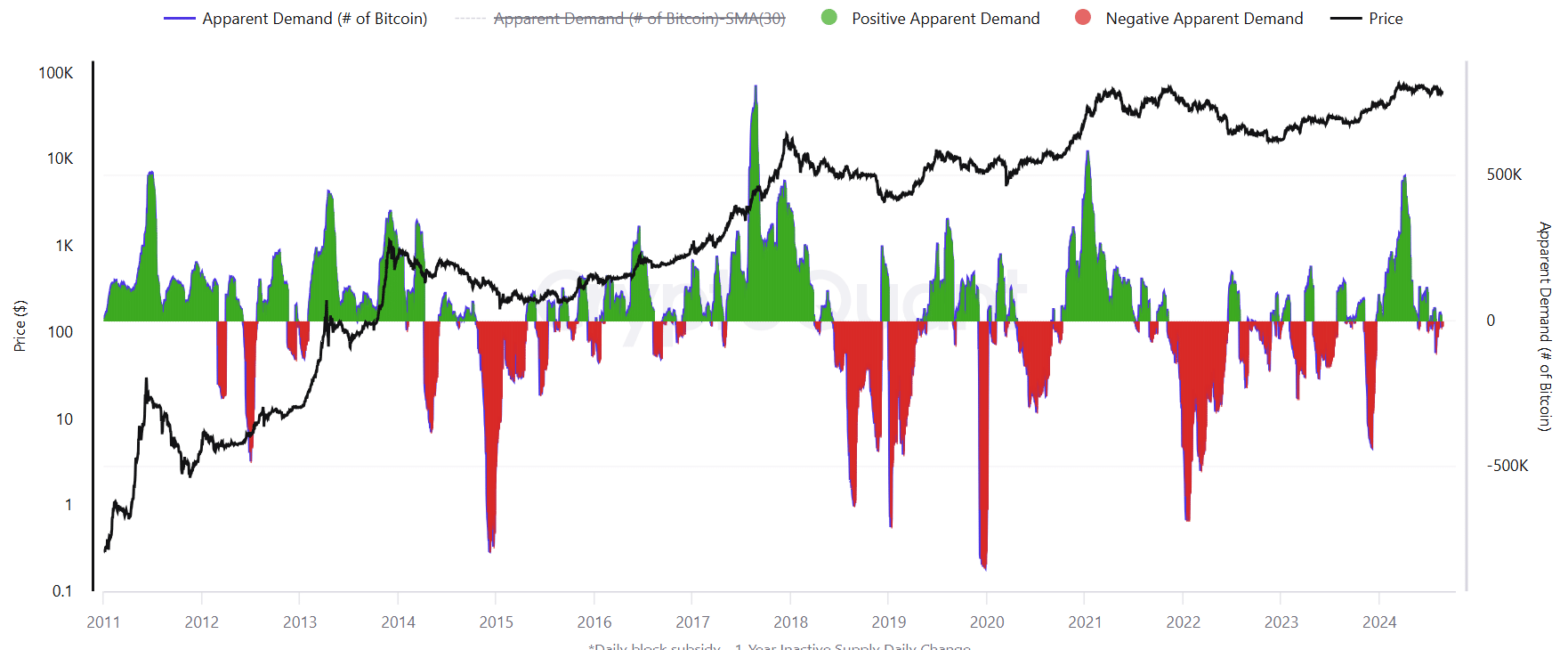

- Demand for Bitcoin has fallen to record lows in recent weeks as prices consolidated.

- However, the declining Bitcoin supply on the exchanges called for significant price declines.

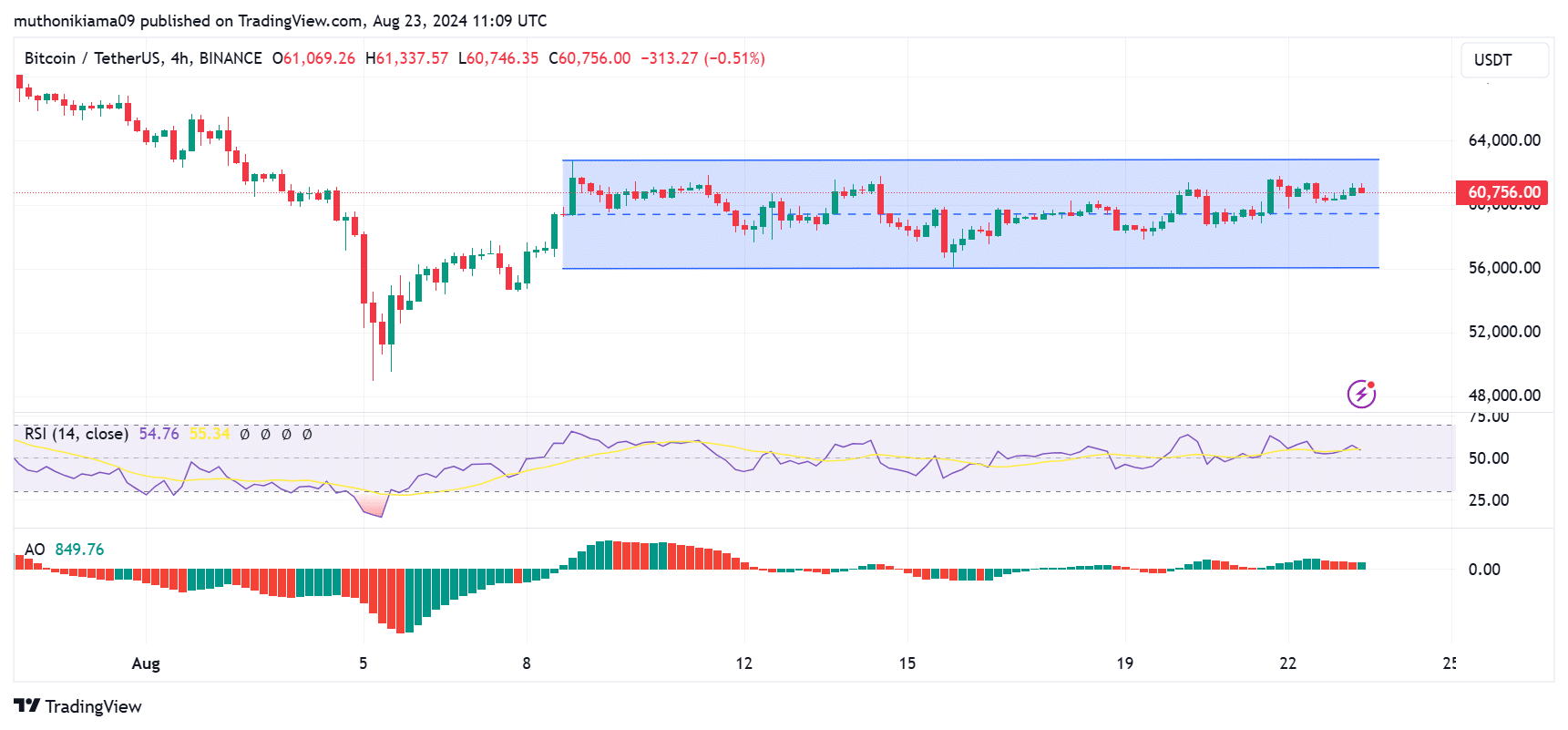

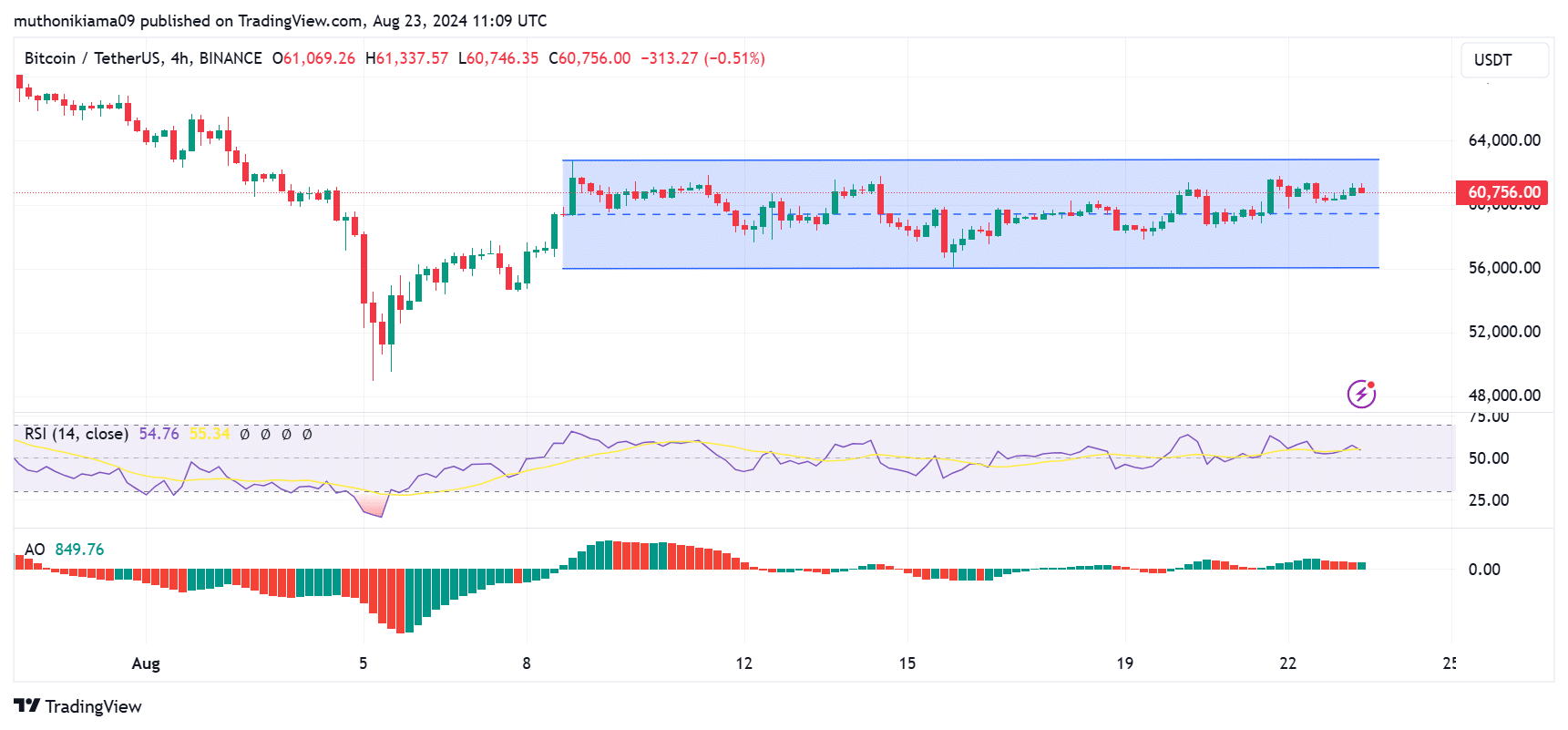

Since recovering from the August 5 drop, Bitcoin [BTC] has traded between $56K-$62K.

The price has not been below or above this range since August 8, indicating possible consolidation or market uncertainty.

One of the factors preventing major breakouts above this zone is the weak demand growth for Bitcoin, which remained at low levels CryptoQuant. This even became negative in recent weeks.

Source: CryptoQuant

Demand for Bitcoin reached a three-year peak in April 2024, coinciding with Bitcoin’s halving. However, it has since fallen to its lowest level this year.

So why is Bitcoin demand falling?

Looking at ETF and whale activity

The analysis pointed to drying up inflows into spot Bitcoin ETFs. In March, when BTC soared to record highs, average daily purchases in Bitcoin ETFs were 12,500 BTC.

This dropped to 1,300 BTC last week.

Total inflows into spot Bitcoin ETFs have remained below the $100 million mark since August 9, as seen on SoSoValue. While these products contain over $55 billion in net assets, purchasing activity is required to stimulate overall demand.

Whales also appear to be reducing their Bitcoin stakes. The 30-day average whale stock has fallen to 1% from 6% in February. This is the fastest decline since February 2021, according to CryptoQuant.

Whales play a crucial role in supporting Bitcoin’s price growth. The decreased whale inventory indicates a general bearish sentiment in the market.

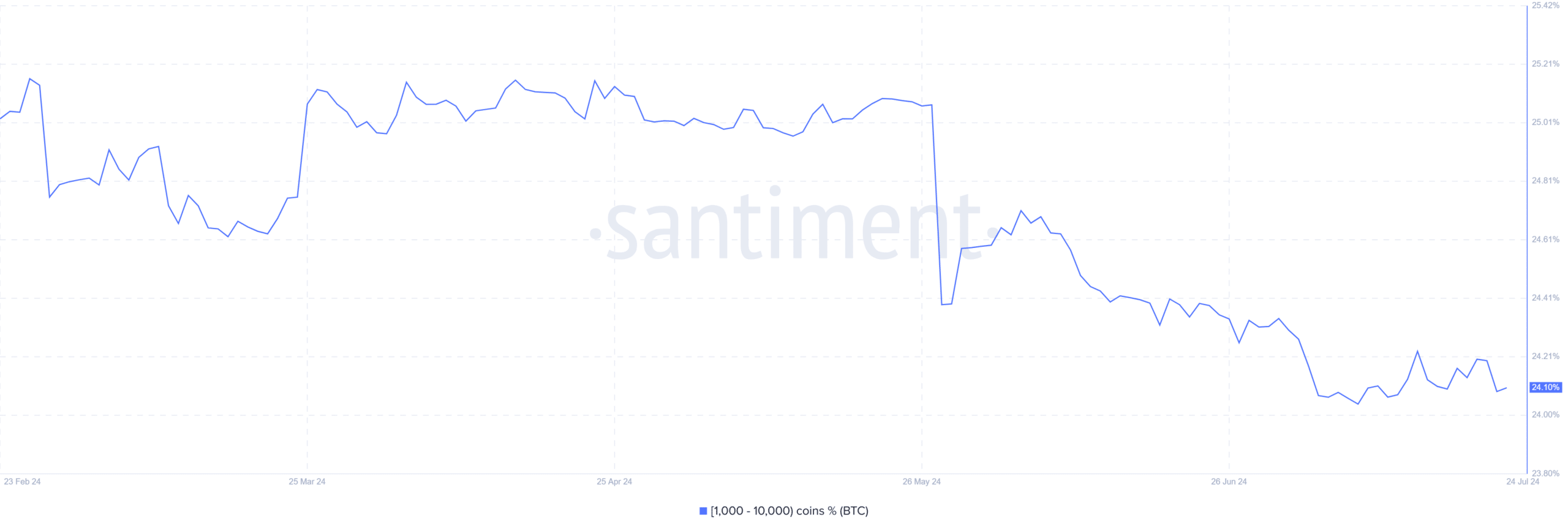

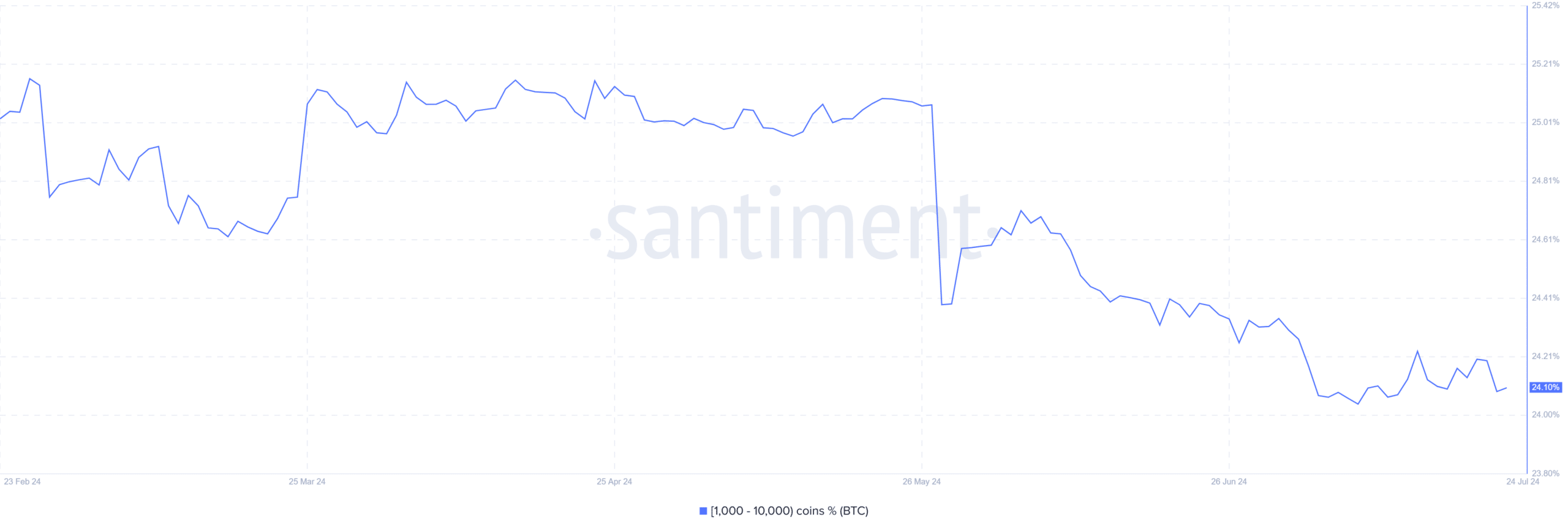

A decline in whale activity was further confirmed by data from Santiment, which showed that Bitcoin addresses holding between 1,000 and 10,000 coins have fallen significantly since March.

Source: Santiment

Despite the slower whale activity, long-time Bitcoin holders have increased their positions. These holders have increased their BTC holdings at a rate of approximately 391,000 BTC per month.

Will Bitcoin Break Out of Its Range?

As demand for Bitcoin slows, the question arises whether it will break beyond the $56,000-$62,000 range. A deeper look at the data in the chain paints a bleak picture.

According to InTheBlokmore than 3 million addresses bought Bitcoin in this price range. New investors who bought at these prices have not made significant profits.

Therefore, breaking above $62,000 will face selling pressure as they rush to take profits.

Technical indicators also do not argue for a breakout. The Relative Strength Index (RSI) also remained within the range, with no significant increases in buying momentum.

The Awesome Oscillator, which was in the positive region, showed an upward trend. However, the short histogram bars indicated a possible weakening uptrend.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2024-25

However, the possibility of a steep downtrend below the current range is unlikely in the near term, due to Bitcoin’s dwindling supply on exchanges.

Per CryptoQuantthe Exchange Supply Ratio has fallen sharply over the past year. Although demand is considerably low, the exchange supply is also low, which reduces the risk of sharp corrections.