- Can HBAR’s trend status guarantee an extension of the recent rally?

- Data from the chain indicated a renewed interest in the cryptocurrency at a notable level.

Hedera [HBAR] has made some progress behind the scenes. This despite not being in the spotlight as the market focused its attention elsewhere. However, that seems to be changing.

HBAR experienced significant social exposure this month. So much so that it was one of the most popular cryptocurrencies on X (formerly Twitter) in the past 24 hours.

This means it has received more attention from investors and could continue to do so in the coming days or weeks.

The recent social exposure may not be a fluke. It comes as the Hedera network celebrates major milestones.

For example, the network recently celebrated the crossing of the 70 billion transaction mark, a feat it managed to achieve faster than most other networks.

The development is also in line with the revival of bullish demand for HBAR. The cryptocurrency has been showing an overall bearish trend since April.

It recently found a local bottom around the $0.047 price level and has seen some upside since then. HBAR was trading at $0.057 at the time of writing, having rallied around 18% in the past seven days.

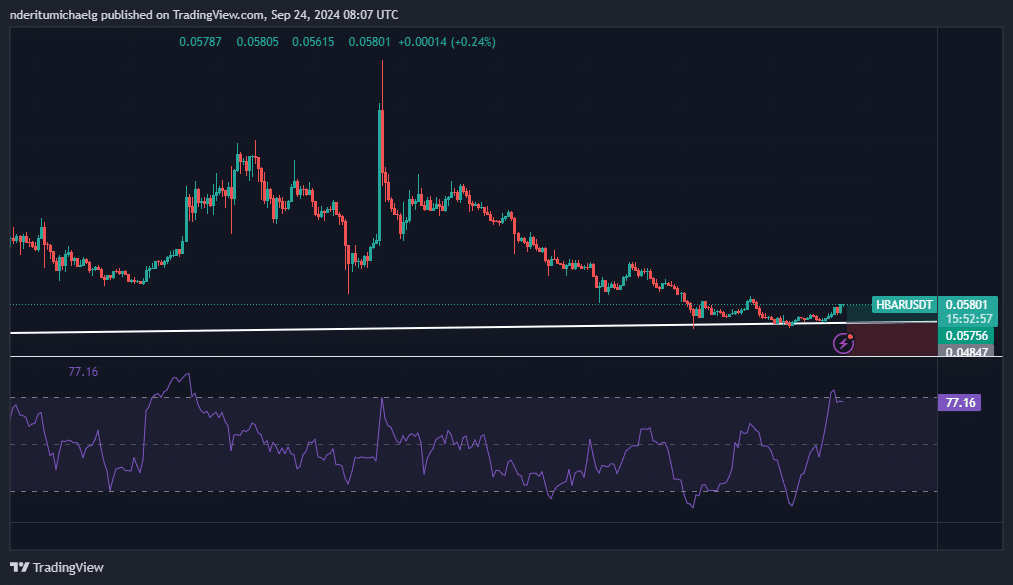

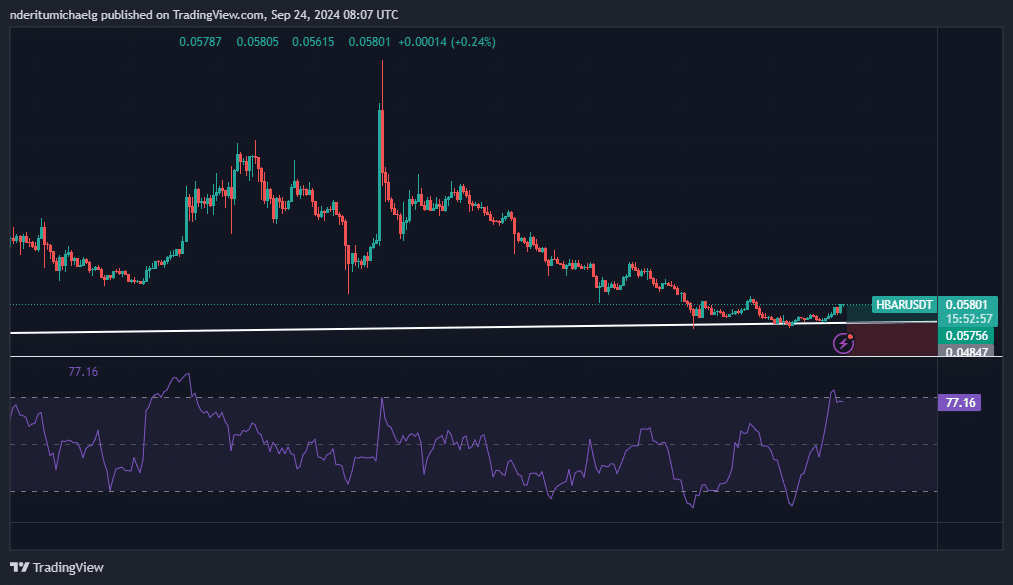

Source: TradingView

HBAR’s money flow indicator confirmed robust liquidity inflows, the highest since April. A potential sign that the cryptocurrency is in the early stages of a recovery rally.

Note that the price recently retested historically significant long-term bullish support, indicated in white. The selling pressure is evened out after interacting with this support line.

Previous interactions with the support line have provided significant benefit in the past.

Can HBAR sustain the current rally?

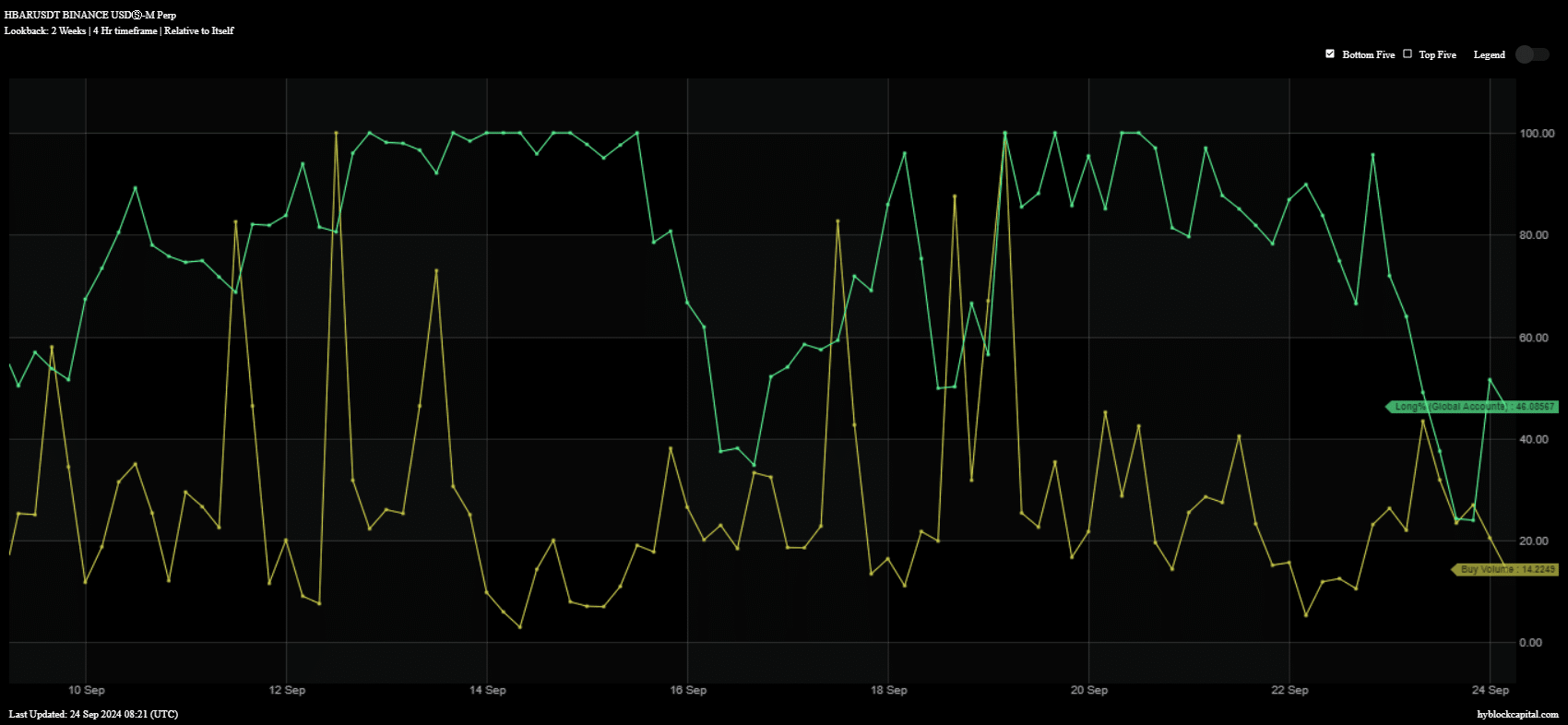

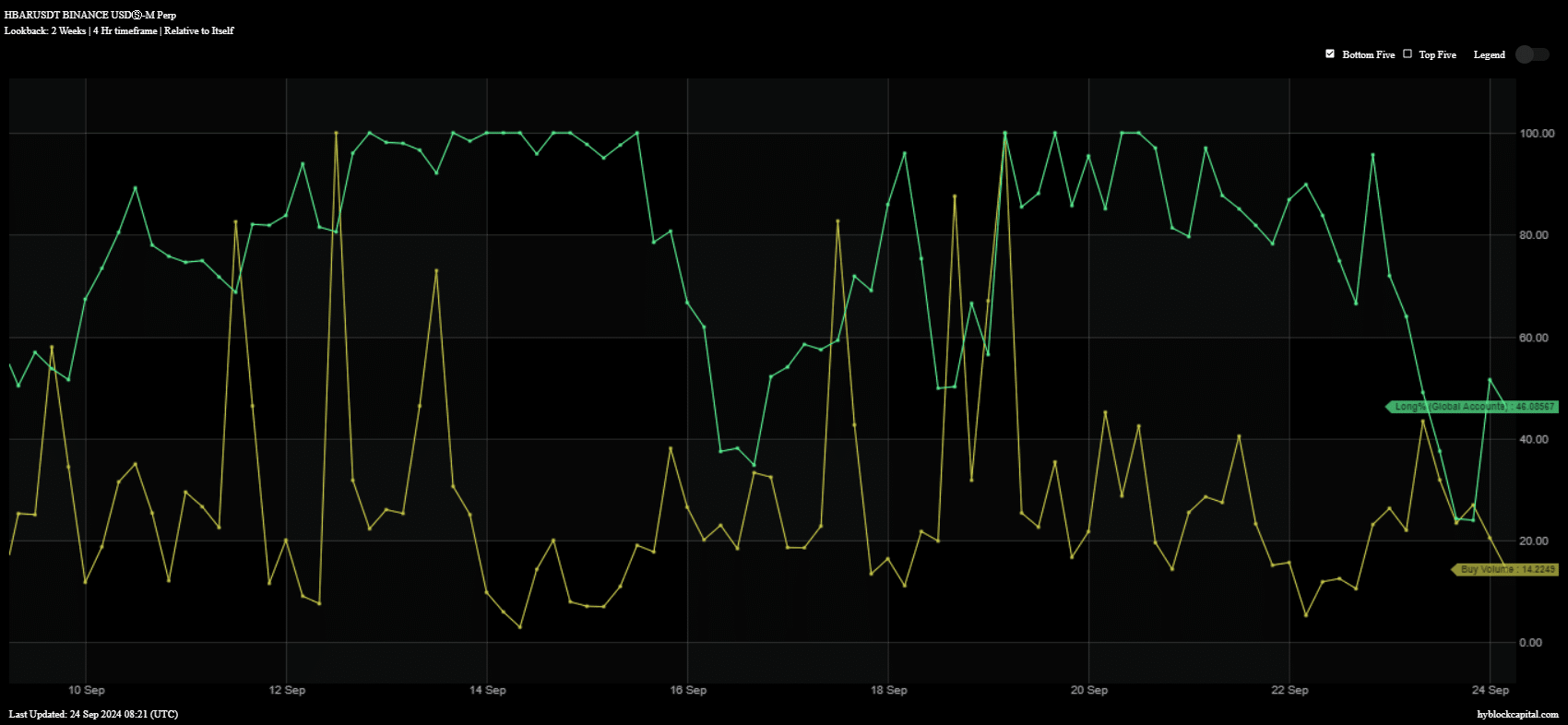

AMBCrypto’s look at Hyblock Capital’s data confirmed that there was an increase in purchasing volume around mid-September. This may have been the impetus for the last rally that has taken place since then.

The volume peak lasted from September 14 to 19.

Source: HyblockCapital

Similarly, our analysis revealed an increase in long positions (green indicator) between September 16 and 19.

On September 22, there was also another less intense peak in buying volume (yellow), followed by a rise in long positions the next day.

Read Hedera’s [HBAR] Price forecast 2024–2025

The renewed interest in HBAR at a major level suggests that the bulls may want to take over. However, that will depend on whether the country can support the inflow of liquidity.

A spike in social sentiment is a good sign, indicating that there is potential for more accumulation and thus an opportunity for the bulls to stage a relief rally.