This article is available in Spanish.

Hedera’s native cryptocurrency, HBAR, has attracted the interest of investors and cryptocurrency enthusiasts due to its remarkable recent performance and increasing prominence in the blockchain sector.

Related reading

from Hedera HBAR token, backed by major tech companies like Google, IBM and Boeing, has the potential to revolutionize decentralized finance. Over the previous month, the HBAR increased by 430%, reaching a new peak of $0.392 and increasing the market cap to almost $13 billion.

Despite some skeptics, analysts believe a $100 price tag for HBAR is within the realm of possibility, although it would require substantial growth in both market capitalization and real world adoption.

🌐 CAN $HBAR REACH $100? THE CASE FOR AN INSANE RUN-UP

The crypto world is finally waking up to some Hedera Hashgraph and $HBAR bring to the table. But can $HBAR realistically reach $100? We think so, and here’s how it’s completely feasible based on math, market cap and practice… pic.twitter.com/zGtCN2EmU0

— Blokas (@BlockAxis) December 8, 2024

HBAR growth potential

HBAR’s upward trend is primarily related to its position within the broader industry cryptocurrency market. For the network to reach a price of $100, it would need a market value of $5 trillion, analysts said.

While it may seem unlikely, HBAR’s potential to penetrate the $110 trillion global stock market and the even larger derivatives market seems increasingly credible upon closer examination.

Tokenized assets, supply chain management and decentralized finance represent crucial areas where Hedera’s blockchain can generate value. The ability to deploy these applications at scale, along with support from leading companies, positions HBAR as a formidable competitor in the blockchain arena.

Essential statistics in the chain

Hedera’s latest on-chain metrics show a mix of opportunities and challenges. Growing user engagement led to a peak in on-chain volume of $68 million on December 3.

While that was an increase, Total Value Locked on the network still dropped from $211 million to $196 million. This decline indicates that while the network is active, investments in decentralized finance (DeFi) applications may be declining, or investors are reallocating their funds elsewhere.

Institutional support

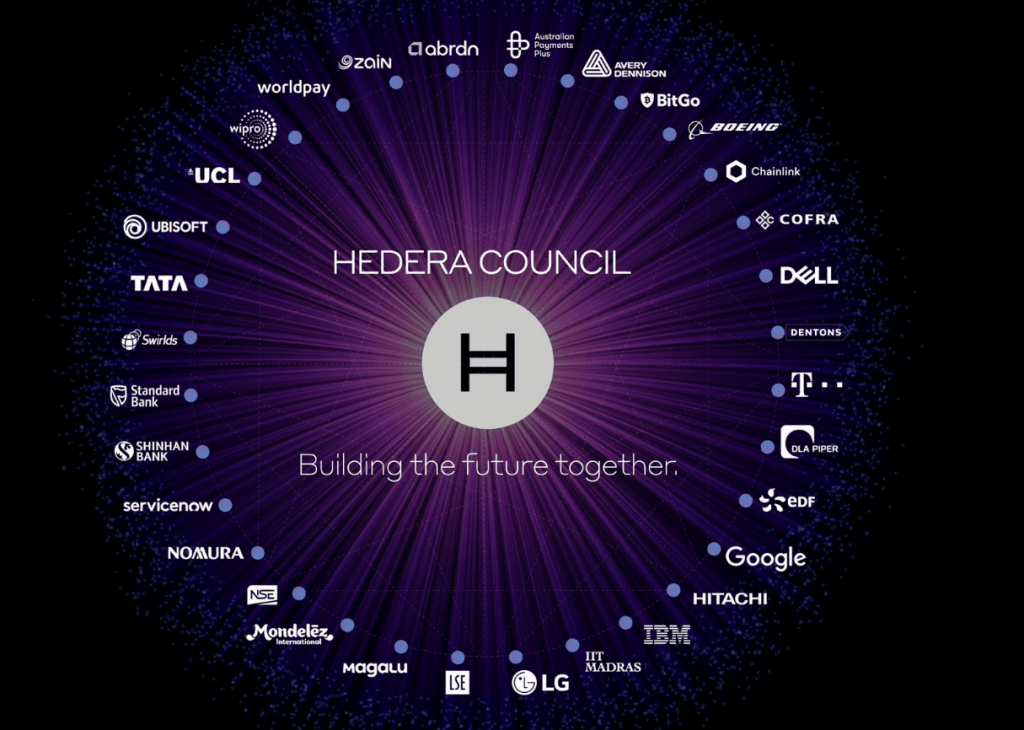

Hedera stands out strongly from many other cryptocurrencies based on the involvement of several leading, established companies, which are represented on the board of directors.

This gives HBAR a strong credibility boost over other decentralized tokens. As long as Hedera gets at least a fraction of the industries these companies are associated with, demand for HBAR could skyrocket.

Related reading

To reach the ambitious goal of $100, Hedera must focus on improving its ecosystem and continually attracting developers and enterprises to build on its platform. Crucial here is ensuring scalability, as Hedera can process 10,000 transactions per second. Its scale, together with minimal transaction costs, makes it a particularly attractive choice for global adoption.

While the $100 price target may seem ambitious, Hedera’s robust fundamentals and cutting-edge technology, backed by prominent industry figures, make it a project worthy of attention. Should the market persist in adopting decentralized financial and token economies, HBAR could experience significant growth in the coming years.

Featured image from Pixabay, chart from TradingView