The NFT and Crypto room Has been a roller coaster of highlights and lows, but recent tweets and discussions suggest that the market may have to do with one of the most challenging periods to date. From failed projects to falling token values, the sentiment is overwhelming negative. Let’s dive into the details and analyze whether this is a temporary setback or a sign of a larger collapse.

What goes wrong with NFT projects?

The tweets paint a grim image of the current state of NFT and Crypto projects. Here is a breakdown of the most important problems:

Abstract’s spectacular failure

The tweet of @charcoonchain Emphasizes the catastrophic failure of abstract, a project that reportedly left many investors out of their own pocket. This raises questions about the viability of similar projects and the due diligence that is carried out by investors.

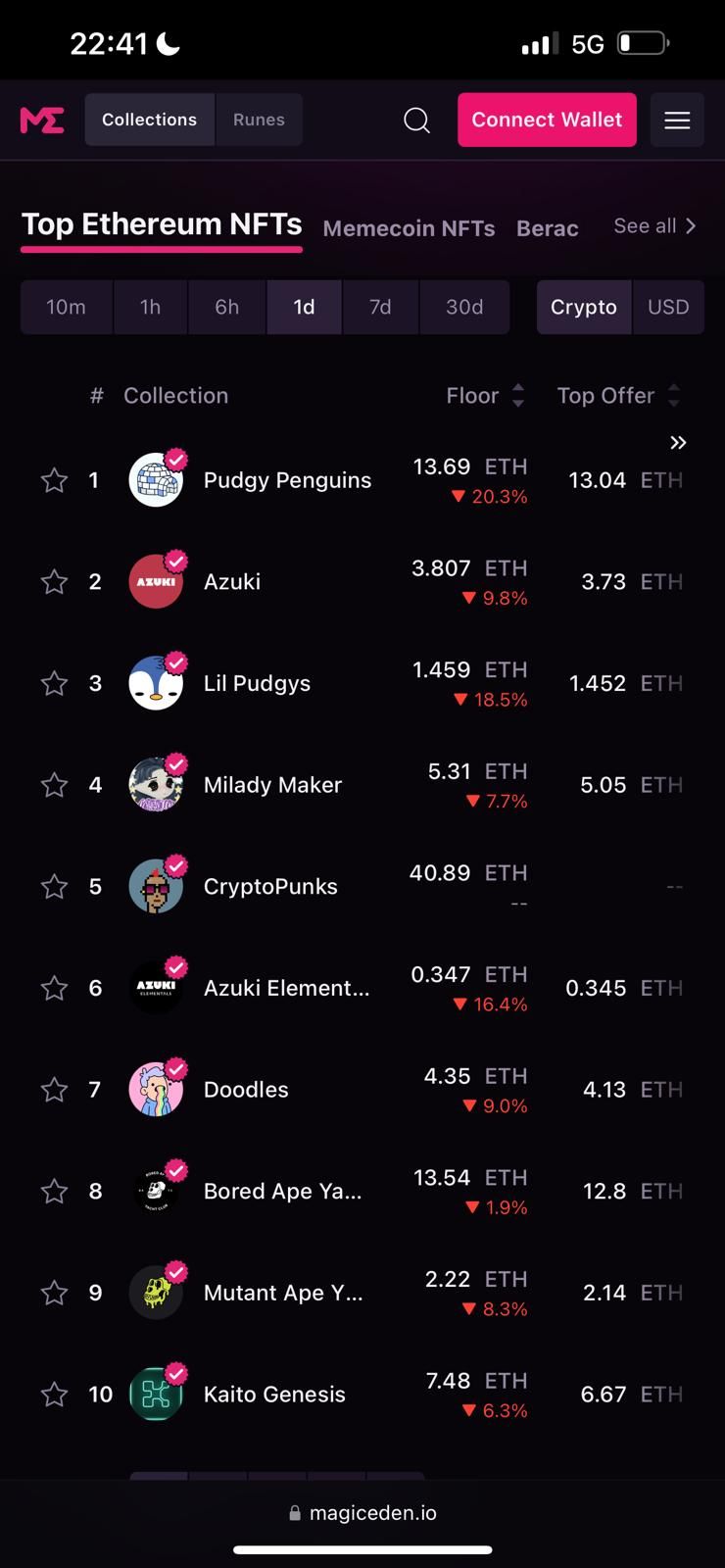

Pudgy’s downward spiral

Another tweet @carl_m101 suggests that Pudgy, an important project, is “Directly on the way to zero. The Pudgy game Hard hit indicates that even projects with gaming elements, which were seen as a potential savior for NFTs, are struggling. Is this a sign that the NFT gamingniche loses its appeal?

Yuga Labs Under Fire

Criticism of Yuga Labs, the makers of the Bored Ape Yacht Club (Bayc), is also assembly. A tweet from @kodama_eth Points that even the giants of the NFT world are not immune to recoil. What does this mean for the future of Blue-Chip NFT projects?

The fall of Apechain

The same tweet from @kodama_eth States that with almost all launched tokens that touch the bottom. Moreover, the return of AIP is due to “So many negative vibes” is a clear indicator for dissatisfaction of investors. Do these projects fail due to poor implementation, or is there a deeper problem with the NFT model itself?

Founder for return against Kol -Marketing

Garga, the founder of monkeys, is reportedly “Haten against Kol marketing.” Main opinion leaders (Kol’s) played an important role in promoting NFT projects, but this criticism suggests a growing disillusion with influencer-driven marketing. Is this a sign that the NFT space is leaving the hype and to more substantive value propositions?

Why do investors lose faith?

The recurring theme in these tweets is loss – loss of money, loss of trust and loss of Momentum. Here are some possible reasons for this downward trend:

Overhyped projects: Many NFT projects are highly dependent on hype and marketing instead of delivering tangible use or value. When the hype fades, this also applies to investors.

Lack of regulations: The absence of clear regulations in the crypto space makes it a breeding ground for scams and poorly managed projects.

Market saturation: With countless NFT projects that are launched every day, the market becomes overaturated, making it more difficult for a single project to stand out.

Economic factors: Broader Economic Conditions, such as inflation and rising interest rates, can lead to investors withdrawing from risky assets such as NFTs and crypto.

What can investors do to protect themselves?

Given the current state of the market, it is crucial for investors to bring caution. Here are some steps to consider:

Do your research: Before investing in a project, investigate the team, route map and the community sensiment thoroughly. Avoid projects that are exclusively dependent on the hype.

Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments over different activa classes to reduce the risk.

Stay informed: Stay informed of the latest news and trends in the NFT and Crypto room. Become a member of communities and forums to stay ahead of potential red flags.

Be skeptical about hype: If a project seems too good to be true, that’s probably. Be on your guard for projects that promise unrealistic return or are highly dependent on the notes of influencer.

Is this the end of NFTs and crypto?

Although the current situation is unmistakable, it is important to remember that the NFT and Crypto space is still in its infancy. Market corrections and failures are part of the natural evolution of an emerging industry. However, the recent wave of failures and criticism should serve as a wake-up call for both investors and project makers.

The most important question is: Will the NFT and Crypto space learn from these errors and will evolve, or will it continue to a path of decline? Only time will learn it, but one thing is clear – investors must carefully enter these turbulent waters.