- PEPE’s weighted sentiment shifted to the negative side along with a drop in bullish sentiment.

- Market indicators showed that the bulls and the bears were battling each other.

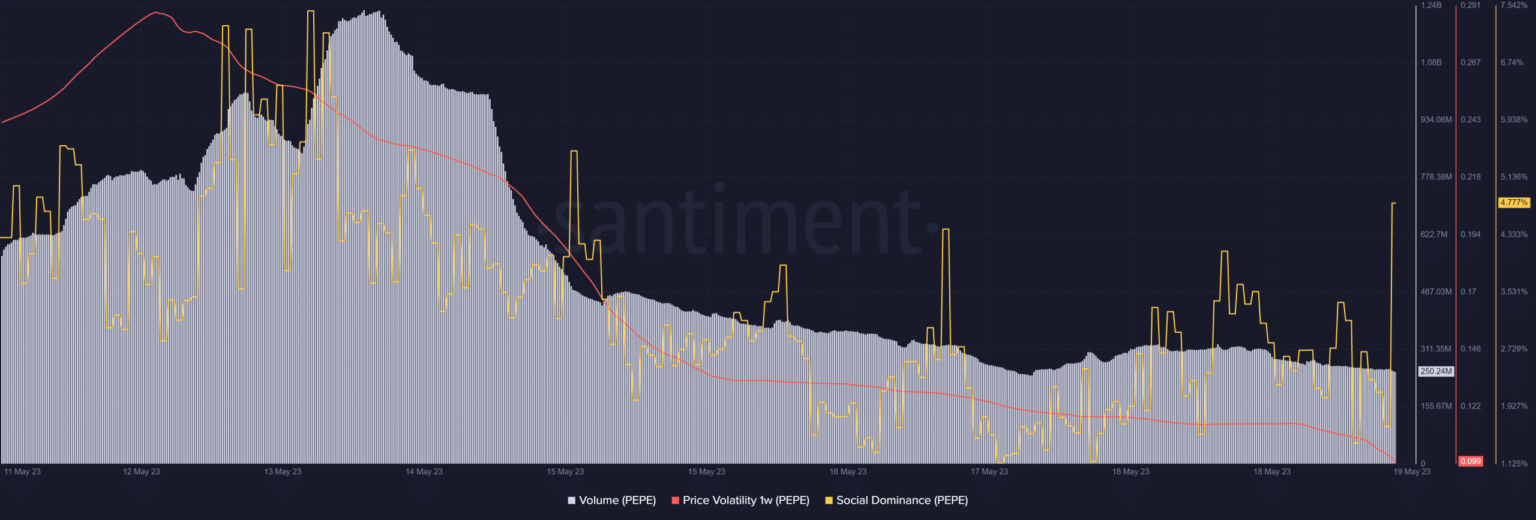

Pepe [PEPE] gained huge popularity since its inception and also quickly made it to the list of the top 100 cryptos by market capitalization. However, as time went on, the coin’s popularity seems to have waned as its trading volume dropped significantly.

Realistic or not, here it is PEPE market cap in BTC conditions

A drop in trading volume reflects less investor interest in trading the token. Not only that, but PEPE’s social dominance also declined last week, which also indicated less popularity.

Source: Sentiment

The memecoin price action was lazy last week

As shown in the chart above, PEPE’s 1-week price volatility plummeted. And therefore, PEPEThe price of s hasn’t changed much in the last 24 hours.

According to CoinMarketCap, at the time of writing, the memecoin was trading at $0.000001528. It had a market cap of $598 million making it the 69th largest crypto by market capitalization.

Source: Sentiment

Market sentiment around PEPE also turned bearish. Santiment’s chart revealed that PEPE’s weighted sentiments drifted into the negative zone after peaking. Also bullish sentiment around PEPE turned down by 56% in the past week.

Are whales buying PEPE again?

While memecoin price action continued to be sluggish, Lookonchain revealed an interesting development in terms of whale activity.

A whale withdrew 1.27 trillion PEPE which was worth nearly $2 million, from Binance on May 18. This suggested that whales might collect the coin. However, the ground reality was different.

1/ We noticed that BlackRock Fund has withdrawn 1.27T $PEPE ($1.98 million) of #Binance to 4 addresses 2 hours ago.

And BlackRock Fund earned $2.39 million (10x). $PEPE for! pic.twitter.com/WgVnCGXpnt

— Lookonchain (@lookonchain) May 18, 2023

According to Santiment data, the opposite happened as the supply of top addresses fell. In addition, the supply of PEPE on exchanges increased sharply, while the supply outside the exchanges plummeted.

This is a typical bearish signal. The token’s network growth also declined, indicating fewer new addresses have been created. Another bearish statistic was stock market outflows, which remained low.

Source: Sentiment

How many Worth 1,10,100 XRPs today

Bulls vs. Bears

A look at the cryptocurrency’s daily chart revealed an ongoing battle between the bulls and the bears. The 20-day exponential moving average (EMA) and the 55-day EMA were closely linked.

The struggle was also suggested by PEPE‘s MACD. The Chaikin Money Flow (CMF), on the other hand, registered an increase, which looked bearish. However, the Relative Strength Index (RSI) remained well below the neutral mark.

Source: TradingView