Digital Asset Management giant Grayscale’s institutional crypto products are soaring as spot markets continue to recover.

Grayscale primarily offers institutional investors trusts that aim to provide exposure to digital assets in a compliant, simpler way than holding them directly.

The price of the trusts does not directly track the price of the assets, creating discounts and premiums depending on demand.

Amid a return of institutional interest, Grayscale’s products have exploded, creating huge premiums between the price of the trusts and the spot market.

At the time of writing, Coinglass data shows Grayscale’s Chainlink Trust (GLINK) is trading at $49, a 250% premium compared to LINK’s spot price.

The company’s Solana Trust (GSOL) is priced at $202, an 869% premium to SOL’s price, while its Filecoin (FIL) product trades at a 901% premium and the Decentraland (MANA) product a premium of 308%.

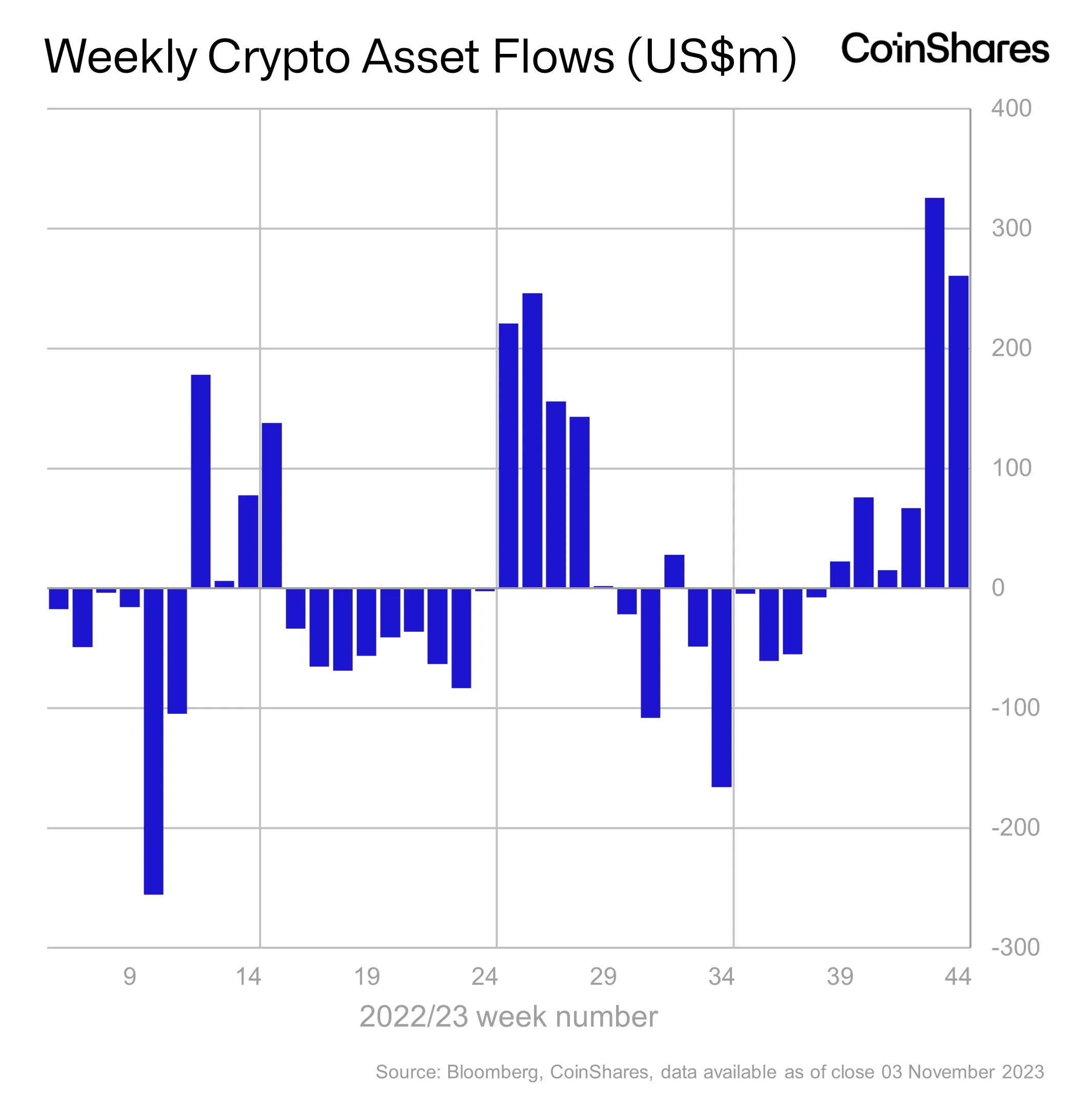

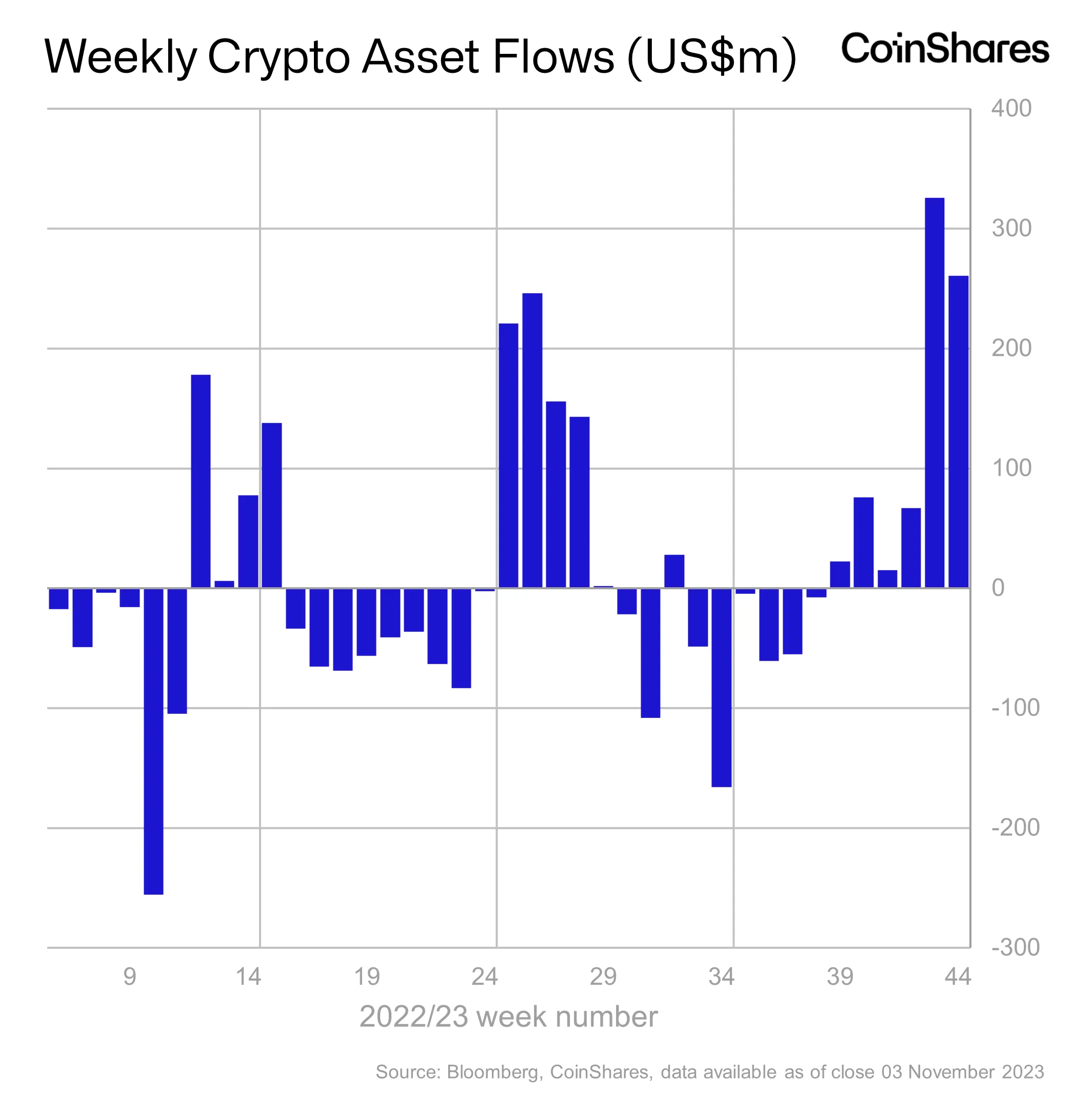

The large premiums for Grayscale’s products come after several positive reports from Coinshares suggesting that institutional demand for crypto assets is rebounding to levels last seen during the 2021 bull market.

In its latest Digital Asset Fund Flows report, CoinShares found it that institutional investors continue to invest in crypto as the asset class experiences its sixth consecutive week of institutional inflows.

“Digital asset investment products saw inflows totaling $261 million, marking the sixth week of consecutive inflows that now total $767 million, surpassing 2022’s total inflows of $736 million. This inflow now matches the July 2023 inflow and is the largest since the end of the bull market in December 2021.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/IM_VISUALS