This article is available in Spanish.

GRASS token, one of the latest DePIN projects, is attracting a lot of attention from analysts and the investing public. As a Layer-2 platform on the Solana blockchain, the Grass platform allows users to share unused internet bandwidth to train AI models using a browser extension. With its promising technology, it is no surprise that the token launch and airdrop last October 28 was highly anticipated.

Related reading

Although the airdrop was marred by a few issues, including a three-hour outage, the token’s price increase was successful. Last October 29, the token peaked on October 29 and then made a massive rally from October 31 to November 2, crossing the $1.50 level.

After reaching a high of $1.9175 on November 2, the price has slowed and fallen below the $1.75 level and is now trading at the $1.45 level. GRASS has rejected the $2 price, with analysts seeing a deeper decline. So is this the right time to buy?

A rough start for GRASS

GRASS began trading on October 28, but a few issues delayed the airdrop and launch of the token. The team recorded technical problems, including the fact that users cannot access their tokens on their Phantom wallet. Furthermore, the rush to claim the tokens was marred by the three-hour power outage. Additionally, some users reported flagged transactions, and many were disqualified from the airdrop.

WTF is this @getgrass_io @grassfdn I’ve been using it since Epoch 1 and after 10 months of use it says your wallet is not eligible? Real?#grassairdrop #grassfoundation #grassSCAM pic.twitter.com/wt7BWPBI1R

— Phantom Soul (@PhantomSoulll) October 28, 2024

A total of 1 billion GRASS tokens were distributed, with 10% given to early supporters and contributors. It is still too early to see the full extent of the effect of these issues on GRASS, but the token started off well price-wise.

Token tries to breach $2

Understanding GRASS’s price action is challenging as it was launched just a few days ago. However, analysts see a bullish trend in the lower time frames of the chart. The token has seen above-average volume in the last 24 hours.

Furthermore, the volume and price of the token increased from October 30. In short, there was buying pressure for the token, indicating that price increases could happen soon.

However, GRASS rejected $2, making this the short-term psychological resistance of the token. Analysts said the price could drop to $1.75 as the RSI reflects a bearish divergence.

Related reading

Other analysts see a deeper dive for GRASS

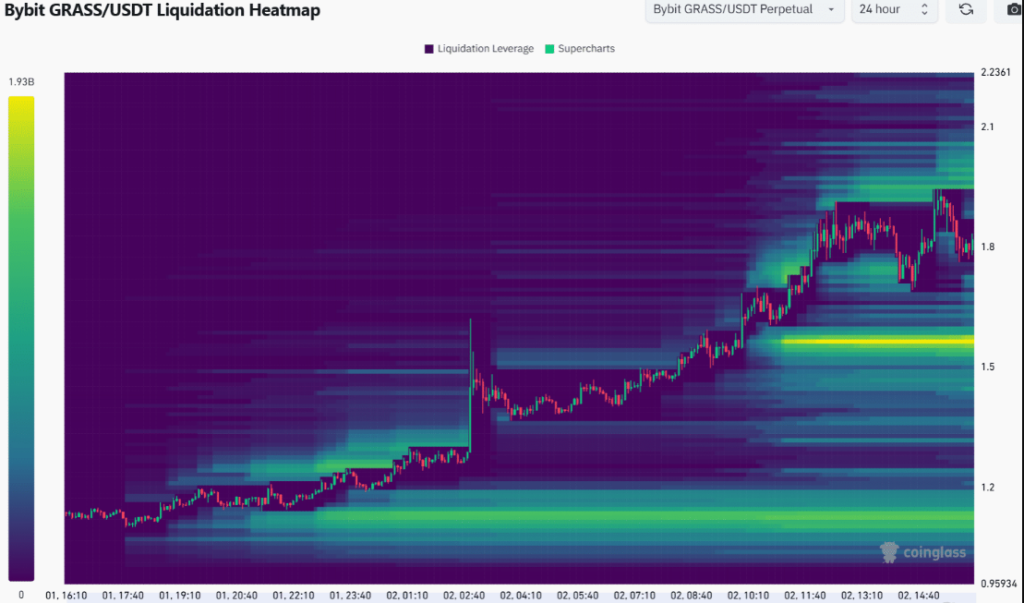

Based on the technical charts, the analysts found two notable liquidity pools at prices of $1.56 and $1.96. The current price is currently closer to the liquidity pool of $1.56, with the token appearing to reject the $1.96 level.

Since there is bearish momentum and a liquidity pool at $1.56, traders and holders can expect a price drop below $1.75. Swing traders and new buyers looking to enter a position can wait for the token to retest at $1.56 or even $1.4.

Featured image from Pexels, chart from TradingView