- Grass crypto shot past $3 thanks to high trading volume.

- It may take a day or two for further gains to materialize as expected.

Grass [GRASS] crypto has reached a new high and continues its price discovery phase. Daily trading volume increased by 21.6% over the past 24 hours to an impressive $601 million.

Technical analysis showed that the token could see a pullback and fall below the $3 mark. Such a dip would likely be a buying opportunity as the market structure is bearish. A retracement below $2.5 could be the first sign of a prolonged correction.

Bearish divergence indicates an overloaded market

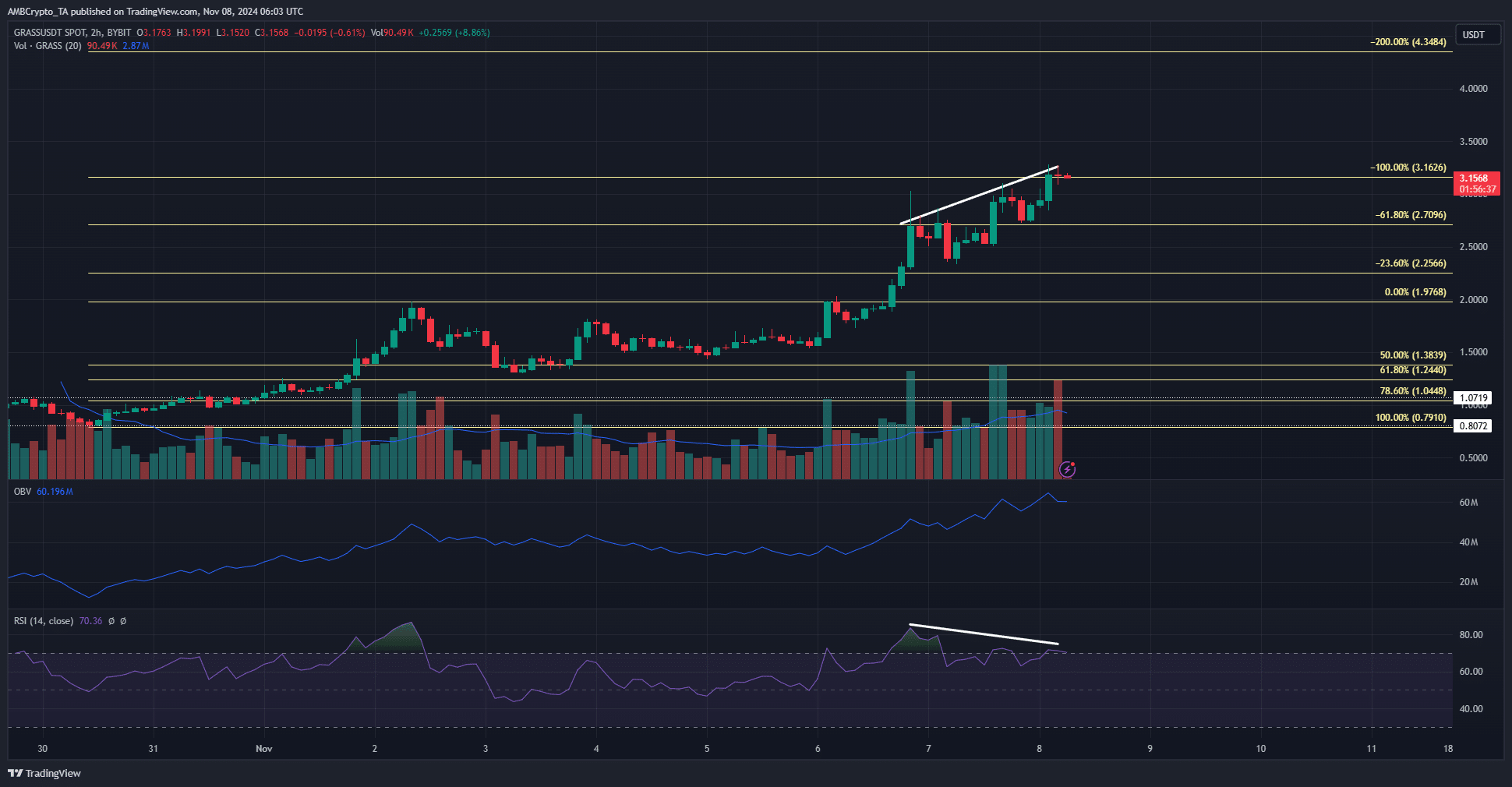

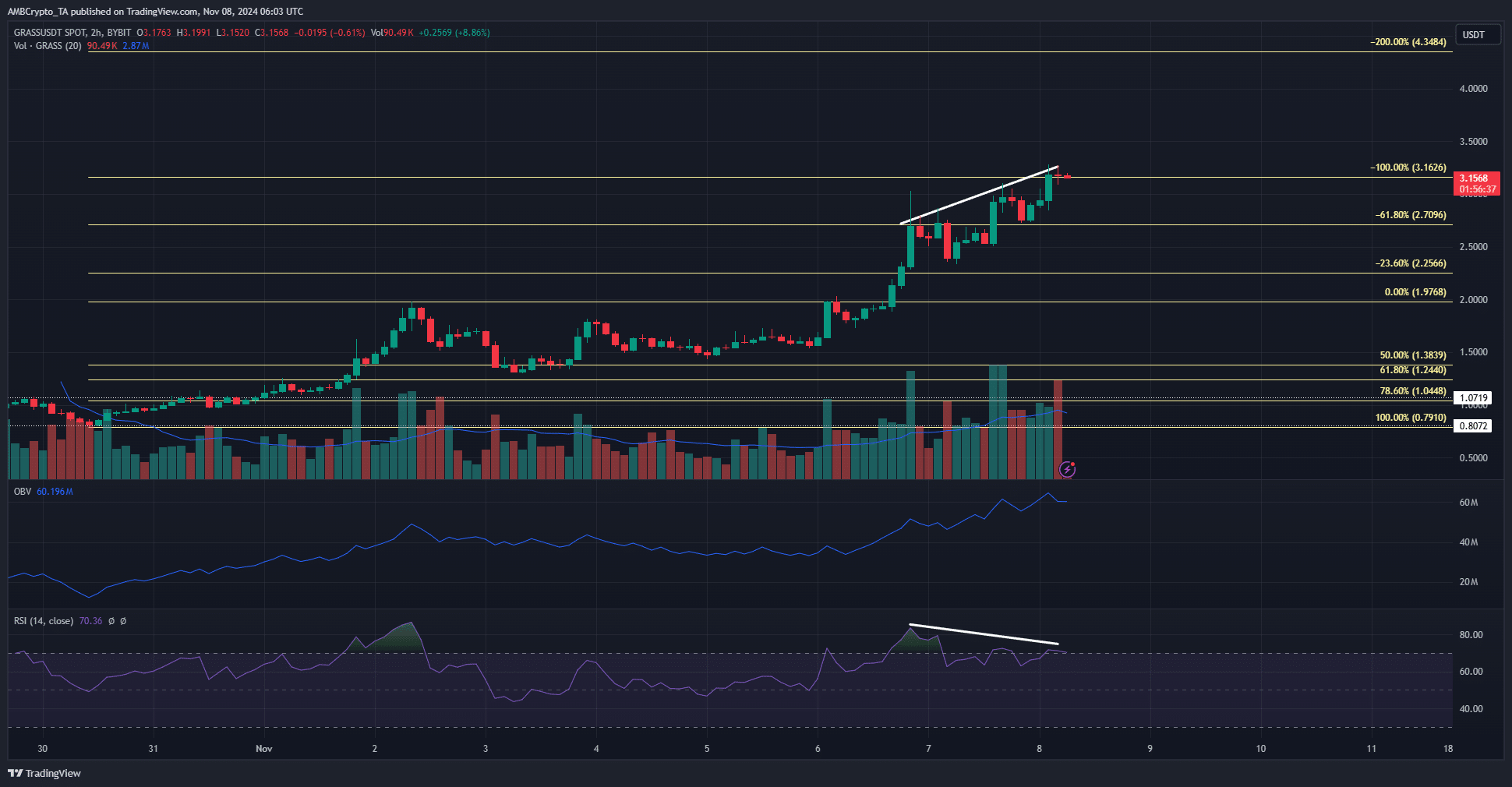

Source: GRASS/USDT on TradingView

Since November 5, trading volume has been on an upward trend. The OBV also rose steadily, showing that buying pressure was high and GRASS gains were driven by real demand.

The RSI on the 4-hour chart has been above the neutral 50 for the past three days, showing that momentum has been strongly bullish but has formed a bearish divergence for the past two days.

The RSI formed lower highs while the price moved higher to reach higher highs. This divergence does not guarantee a trend reversal. Instead, it’s a sign that the market is likely to experience a small pullback.

The former resistance zone of $2.7-$2.85 is expected to serve as support in the event of a pullback in the coming days.

Potential 14% pullback for Grass crypto

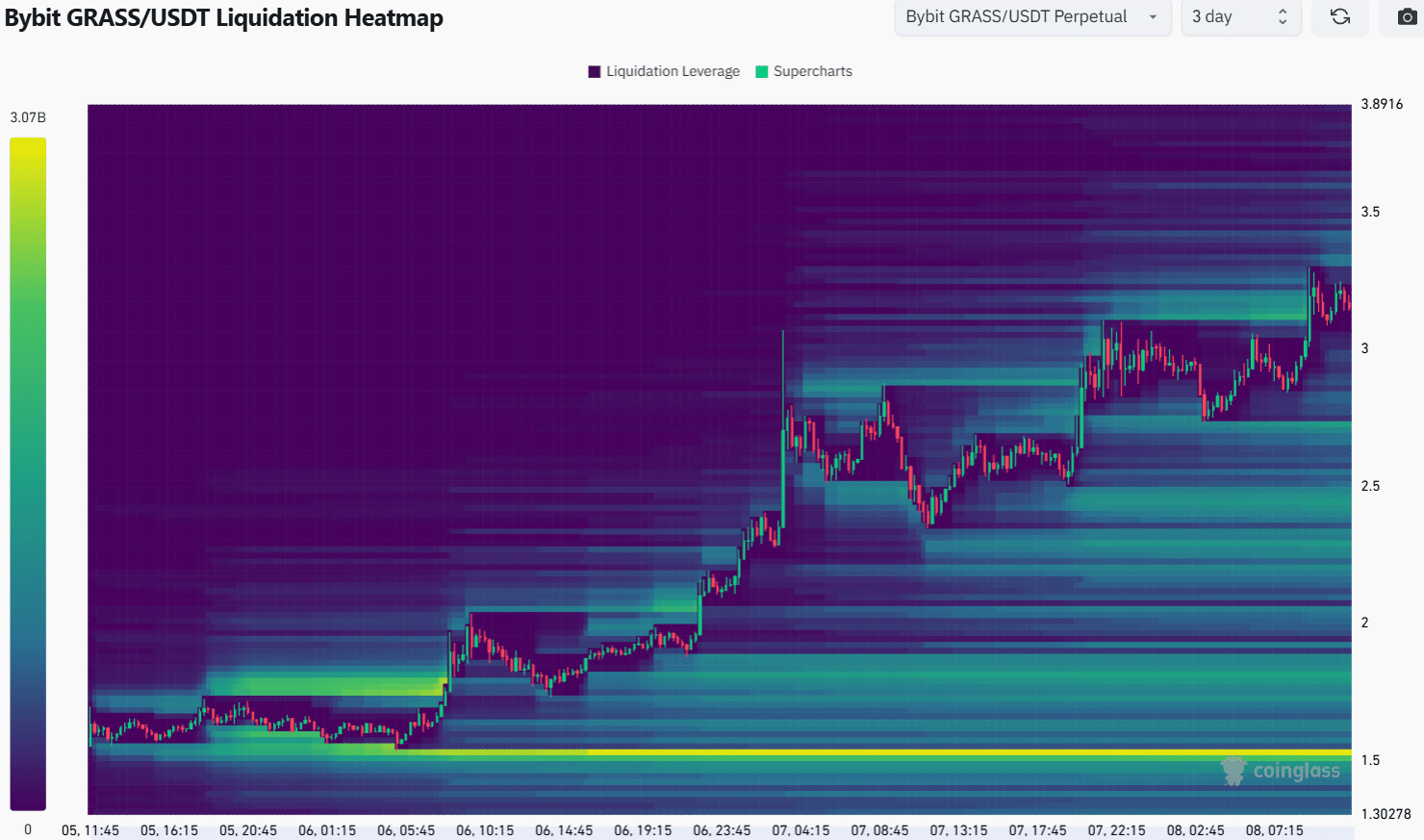

Another indication that the $2.7 area is a demand zone came from the short-term liquidation heatmap. At the previous high at $3.03, a significant amount of liquidity accumulated just above that over the past 24 hours.

Is your portfolio green? View the Grass Profit Calculator

Consequently, the GRASS price became magnetized to it and crossed this zone. It is possible that the token will post more gains.

However, due to the momentum divergence on the H4 chart, a pullback to the nearest liquidity pool of $2.7 is also possible.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer