- Google has removed the Bitcoin price chart from SERP.

- The king coin has made a strong comeback as it surged past $64,000.

In an interesting development, Google has removed Bitcoins [BTC] price and graph from the results of the main search page. This change affected both desktop and mobile users and generated some interesting responses from the community.

A user on

“They are deliberately trying to suppress crypto. They only keep quiet about things they are afraid of.”

Source: Google

However, upon closer inspection, AMBCrypto discovered that the BTC price chart had not been deleted. Instead, it was moved to the Finance section.

This subtle shift has raised questions about Google’s intentions, with many opposing the change.

Is Uptober finally starting?

Against this backdrop, Bitcoin’s performance suggested that “To‘ can finally take shape. The King Coin started the week strong, successfully breaching the critical $64,000 mark and reaching as high as $64,500.

At the time of writing, the stock was down slightly, trading at $63,928, but the bullish sentiment remained intact. This price increase caused the market capitalization to rise by more than 1.63% in the past 24 hours. CoinMarketCap.

HODLing sentiment remains strong

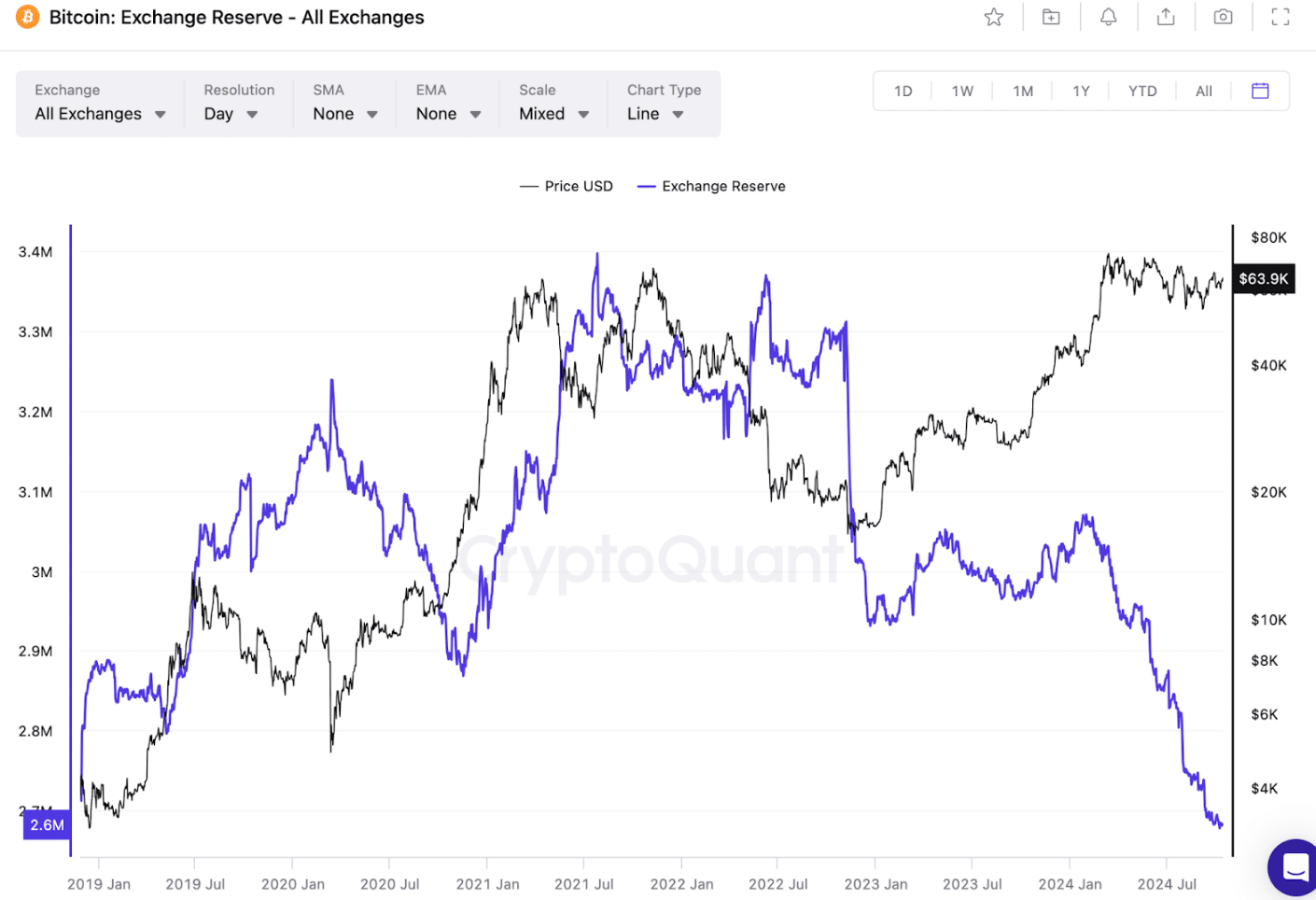

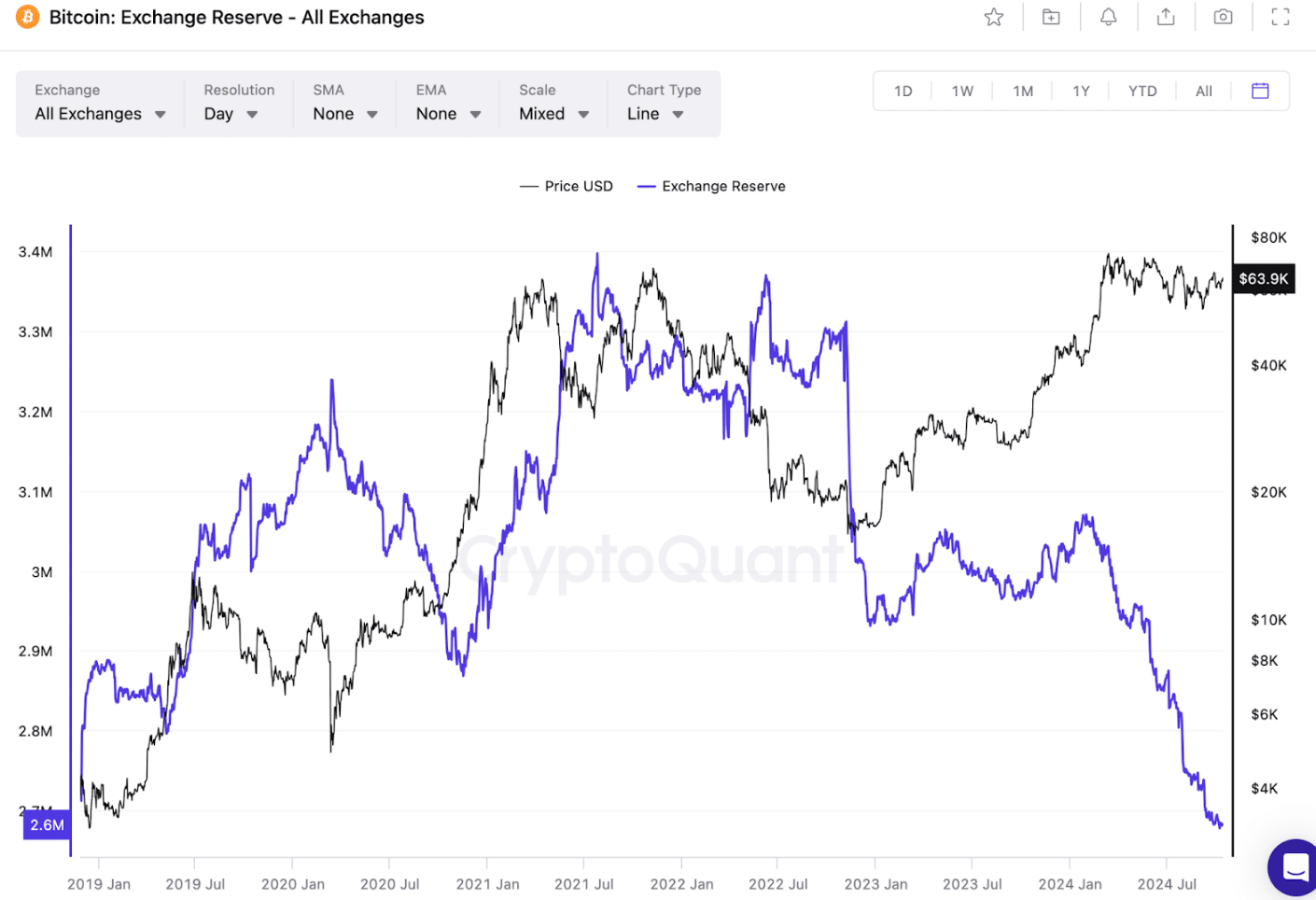

After the recent volatility, this price increase brought new optimism to the market. Notably, the increase comes at a time when Bitcoin exchange reserves are at their lowest level since late 2018 CryptoQuant.

The continued decline in Bitcoin reserves on exchanges since early 2024 indicated that investors were increasingly choosing to hold rather than sell their assets, reinforcing bullish belief in the coin in the long term.

Source: CryptoQuant

What does the derived data indicate?

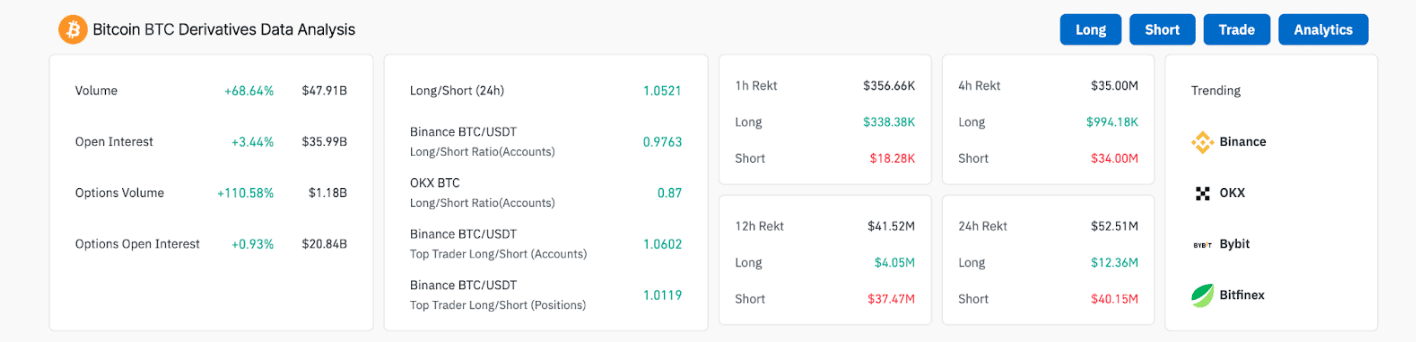

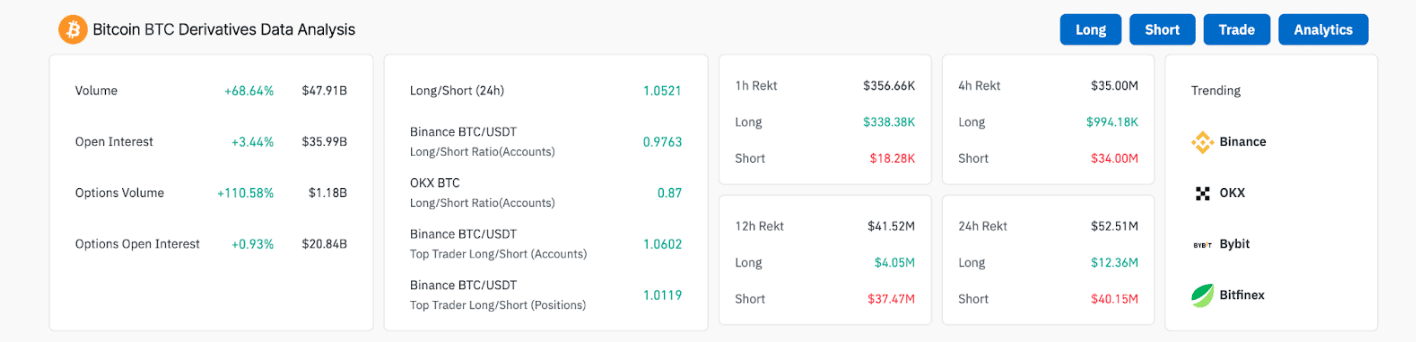

AMBCrypto’s analysis of derivatives data further supports the optimism Mint glass showed a higher number of short liquidations.

It suggested a short squeeze, where the rapid closing of short positions pushes prices higher as traders rush to cover their losses.

Source: Glassnode

This trend could potentially lead to further upward movement if momentum continues as more participants re-enter long positions, expecting profits to continue rising.

Moreover, BTC trading volume increased by more than 68% in the past day, indicating growing market participation.