In a recent remark which has caught the attention of both traditional financial markets and the Bitcoin community, Goldman Sachs economists, including the famous Jan Hatzius and David Mericle, have made a major prediction regarding the monetary policy of the Federal Reserve. The note suggests that the Federal Reserve could begin a series of interest rate cuts by the end of June 2024.

“The reductions in our forecasts are motivated by a desire to normalize fund rates from a restrictive level once inflation moves closer to target,” the Goldman economists wrote. This statement underscores the bank’s belief that the Federal Reserve’s current stance on interest rates may be too restrictive, especially if inflation rates continue to move toward the central bank’s target.

The note further elaborates: “Normalization is not a particularly urgent motivation for austerity, which is why we also see a significant risk that the FOMC will instead remain stable.” This cautious tone suggests that while Goldman Sachs is predicting a rate cut, it also recognizes the unpredictability of the Federal Reserve’s decisions.

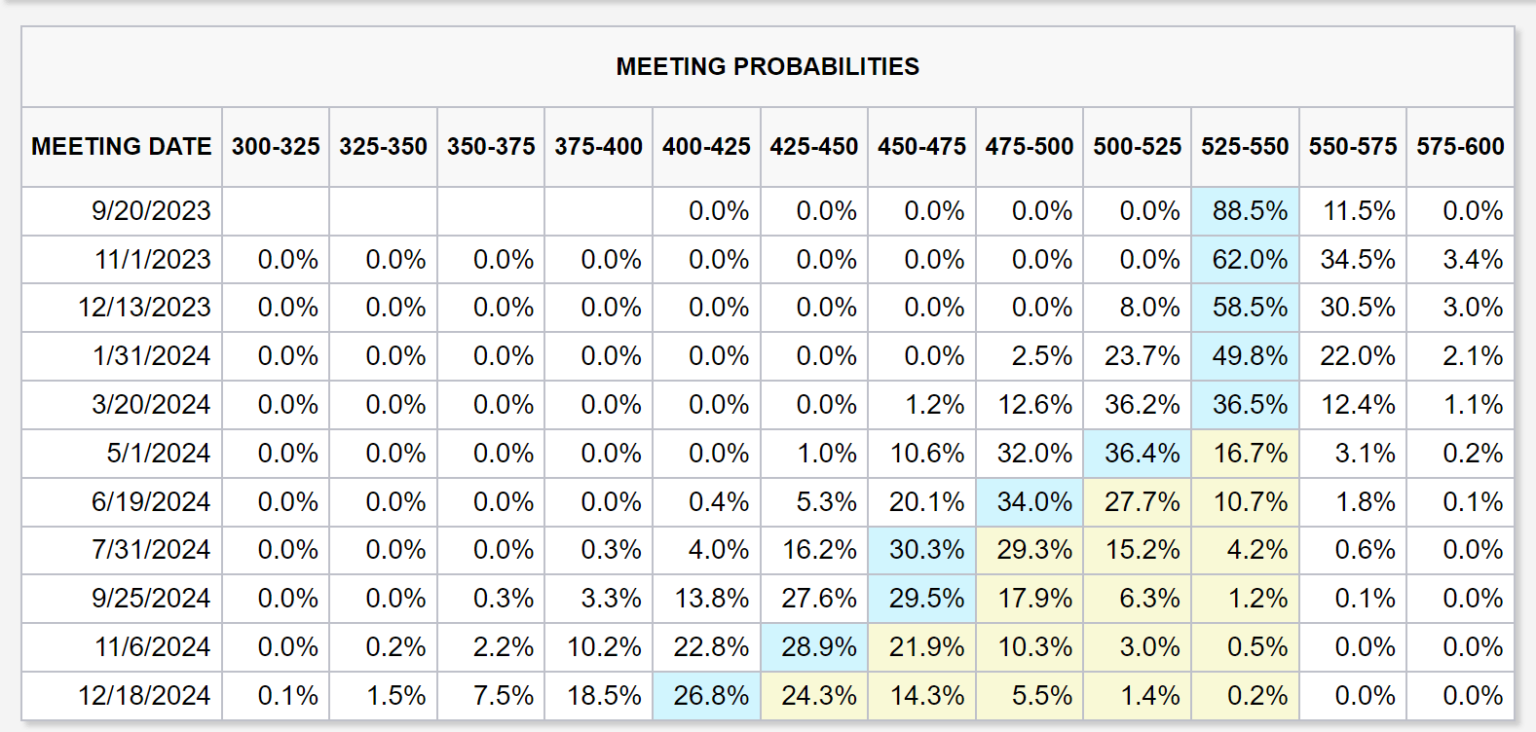

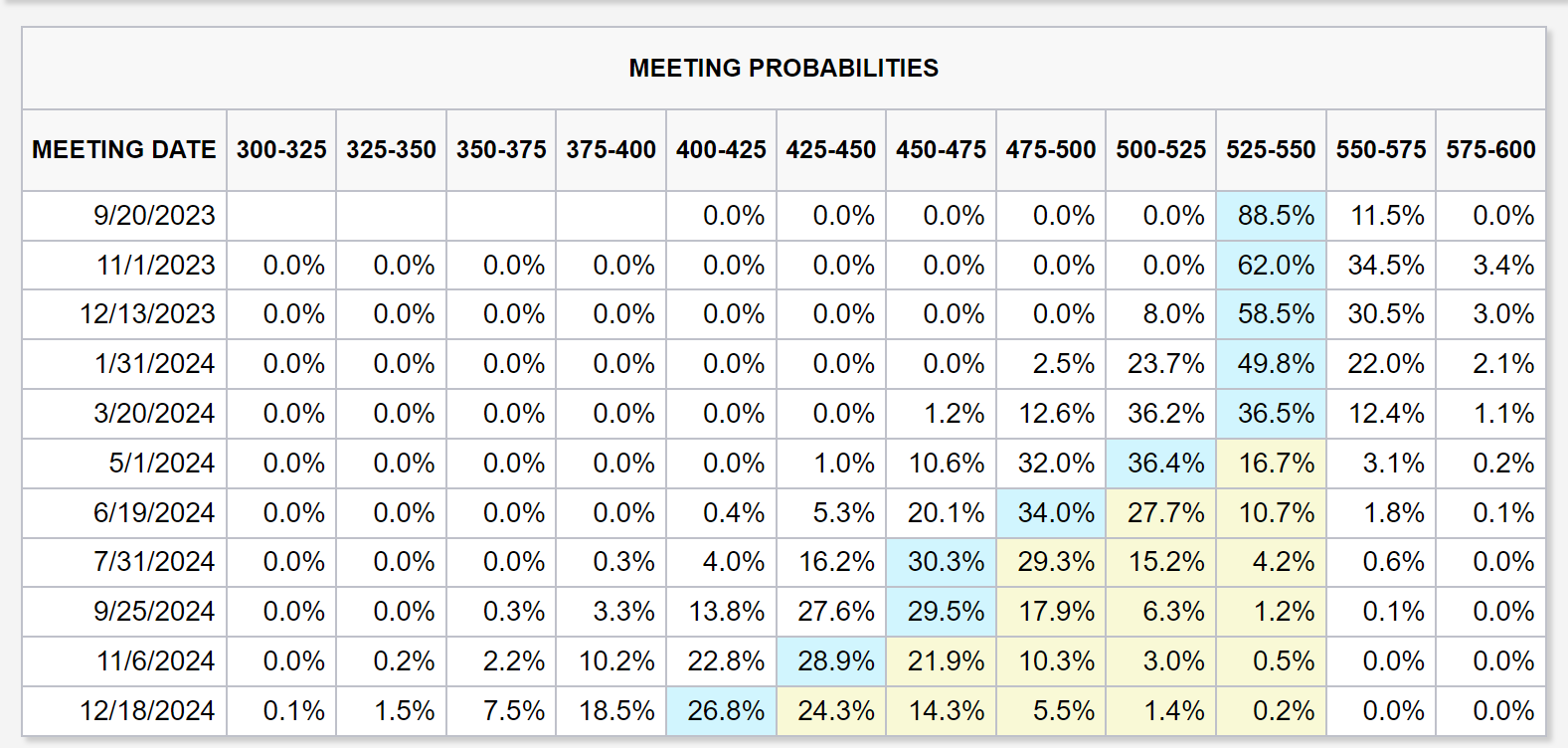

Recent data, which showed that inflation in the US grew at a slower than expected pace of 3.2%, with a core consumer price index of 4.7% year on year, further complicates the picture. With the Fed’s reference rate currently hovering between 5.25% and 5.5%, Goldman Sachs expects it to stabilize around 3 to 3.25%.

What does this mean for the price of Bitcoin?

Expectations of a rate cut from Goldman Sachs are in line with market expectations, according to the CME FedWatch Tool. In May 2024, 68% already expect a rate cut of at least 25 basis points (bps).

However, it remains to be seen whether macro events will affect Bitcoin price again. Over the past few months, BTC has increasingly decoupled from macro events as the stock market soared to an all-time high and stagnated around $30,000.

Interestingly, the timing could be very positive for the Bitcoin market. On the one hand, March 15, 2024 is the latest deadline for spot Bitcoin ETF deposits from BlackRock, Fidelity, Investco, VanEck, and WisdomTree; on the other hand, Bitcoin’s halving is coming at the end of April (currently expected on April 26).

The high expectations for these two events, coupled with loose monetary policy from the Federal Reserve, could be a huge catalyst for the Bitcoin price.

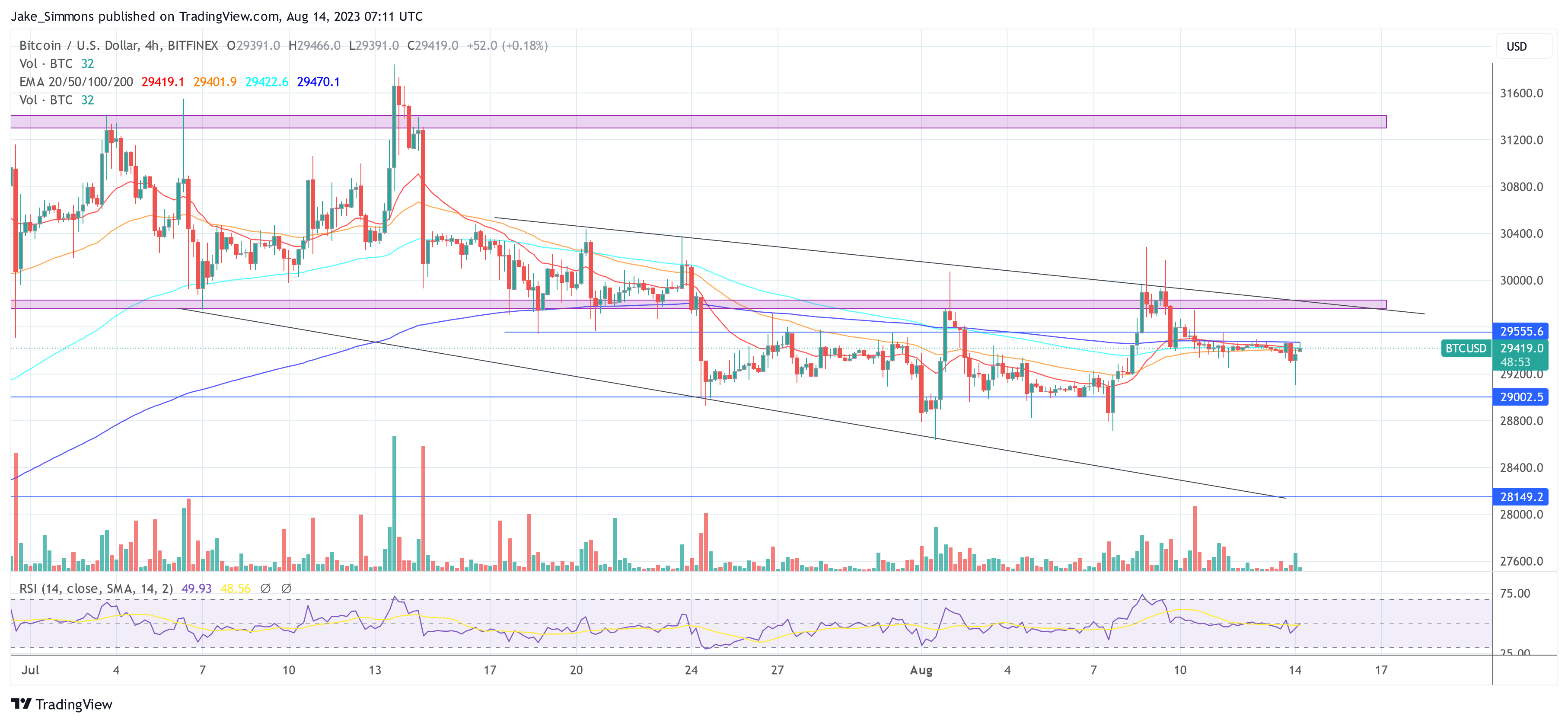

At the time of writing, BTC was trading at $29,426 and saw another quiet weekend amid the liquidity summer drought. A break above USD 29,550 is key to establishing bullish momentum to initiate a fresh push towards USD 30,000.

Featured image from iStock, chart from TradingView.com