Blockchain tracker Lookonchain discovers that a trader using the decentralized exchange (DEX) GMX made more than $1 million by accurately predicting the price action of Ethereum (ETH) over the past few weeks.

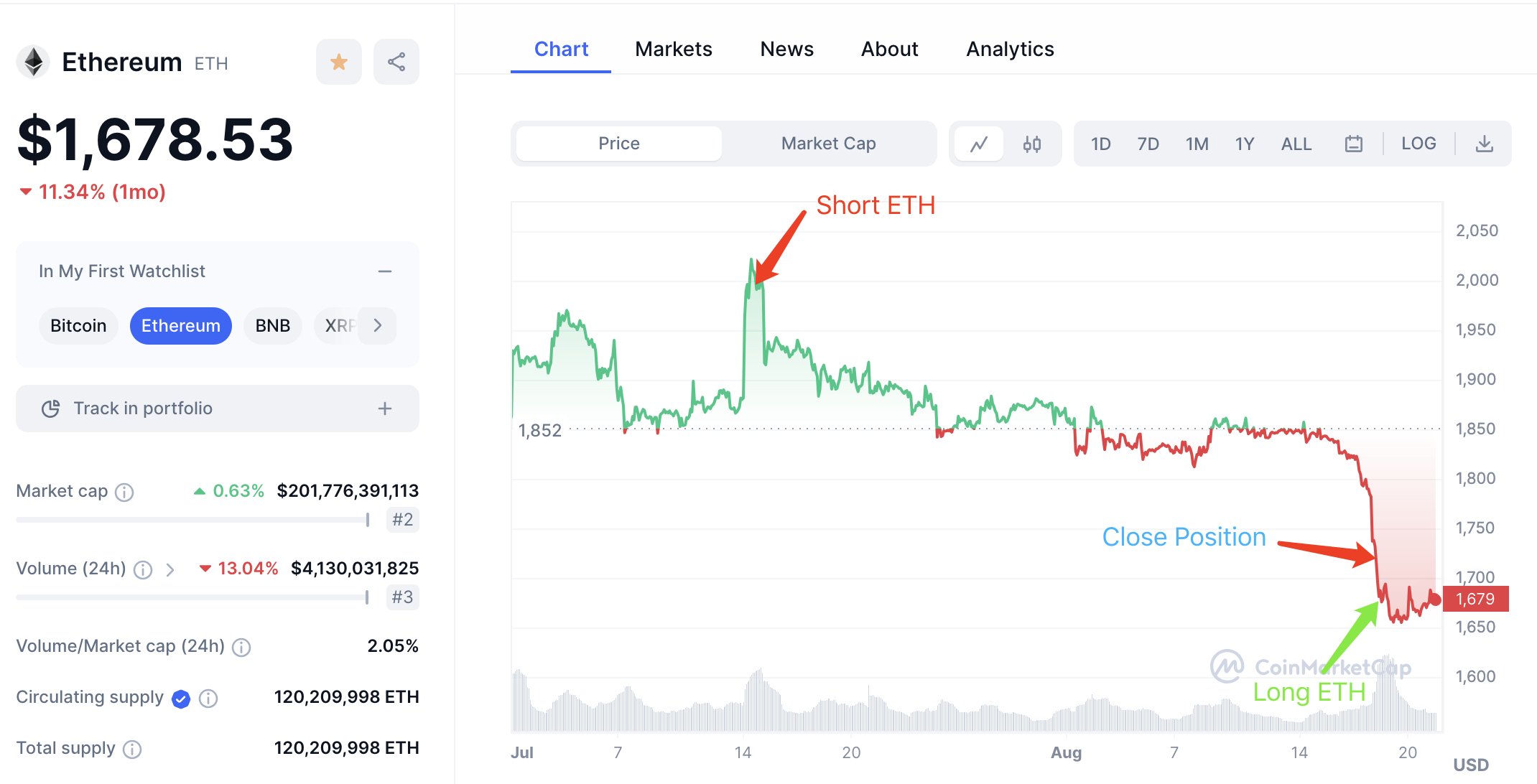

Look at chain notes the trader shorted ETH on July 14, when it was trading near a recent high of around $2,000, and then the trader closed the position after the market crashed last Thursday, making nearly $1 million.

The trader then went long on Ethereum with an entry price of $1,624 and is to make a profit of $145,721 on that position at the time of writing.

ETH is trading at $1,667 at the time of writing. The second-ranked crypto asset by market capitalization is down 0.75% in the past 24 hours and more than 9.6% in the past seven days.

GMX specializes in perpetual futures and aims to provide low swap fees and impact trades at low prices, according to the website.

The DEX is currently live on the Ethereum scaling solution Arbitrum (ARB) and the smart contract platform Avalanche (AVAX).

According to Lookonchain, not all GMX traders were as successful as the ones mentioned above. Another trader went long on Bitcoin (BTC) before the market crashed last week and had lost about $1.07 million at the time of writing. Data from GMX shows that the trader is still holding the underwater position.

Don’t Miss Out – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey