Real Vision’s most important digital assets analyst Jamie Coutts says that an important metric indicates that the crypto market bull’s bull cycle is not nearly over.

Couts tells Are 34,500 followers on the social media platform X that are based on the historical relationship between cryptocurrencies and the Global Money Supply (M2) Metriek More Rallies are coming.

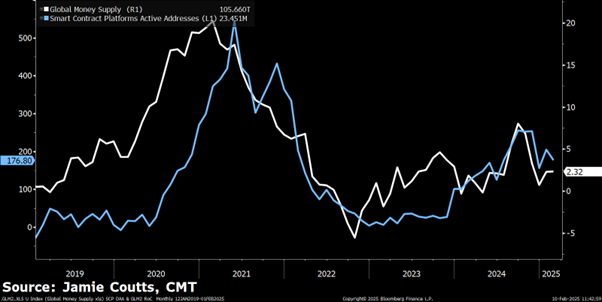

“We know that global liquidity stimulates prices for assets. We also know that network activity (aka adoption) supports prices. So what happens if we map out the global liquidity versus blockchain active addresses? They tell the same story: crypto is a high-beta game about liquidity and a structural growth assets. Zoom out. This still has a way to go. ‘

Coutts shares a graph that suggests that active crypto addresses follow the trend of M2.

He too out That global liquidity is in a rebellion and will soon be able to exceed the high last year.

“Worldwide liquidity bullish momentum signal driven by a weaker dollar. Rand closer to interventions in the central bank. Looking for a break over mid -2024 High to confirm a new regime. “

Finally, he to predict That more governments will acquire Bitcoin (BTC) this year.

“The largest sovereign wealth fund in the world stacks Satoshis. Although that is huge new, let’s not forget that most developing countries with a domestic Bitcoin operation are probably gathering the Activum for more than a year through their sovereign wealth fund or a assistance, and this trend will only rise. “

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Follow us on X” Facebook And Telegram

Surf the Daily Hodl -Mix

Generated image: midjourney