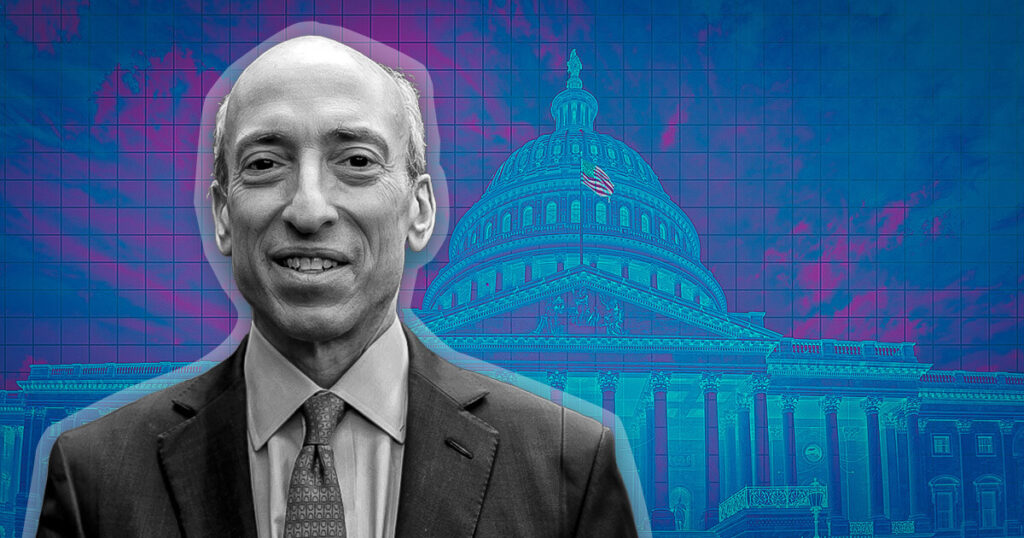

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler defended the agency’s record of regulation, enforcement and regulatory authority during a contentious hearing before the Senate Committee on Banking, Housing and Urban Affairs on Tuesday, 12 September.

The hearing highlighted the tension between the SEC’s extensive regulation under Gensler’s tenure and those who believe it exceeds Congress’ mandate.

Gensler, disparagingly labeled an “unelected bureaucrat” by Montana Sen. Steve Daines, was tasked with justifying the SEC’s approach to cryptocurrency regulation and its broader regulatory authority amid numerous criticisms. The Chairman responded that the SEC has appropriately followed the facts and law in its supervision of cryptocurrencies. This comes in the wake of a slew of enforcement actions against the cryptocurrency space and its largest participants, including Binance, Coinbase and more.

When asked about a recent court ruling criticizing the SEC for blocking a spot Bitcoin (BTC) exchange-traded fund, Gensler stated that the agency is still reviewing the ruling and several similar documents.

Limits on authority

Gensler’s extensive regulatory activities drew criticism from multiple Republicans who claimed it exceeded the SEC’s congressional mandate and risked damaging consequences for companies and investors. Nevertheless, Gensler remained steadfast, citing precedents in defending the scope of the regulations and claiming that it aligns with the actions of previous presidents. He emphasized input from all types of investors on the proposed rules.

Senator Elizabeth Warren (D-MA) criticized Gensler for not implementing stronger regulation of private equity funds quickly enough. Gensler pointed to a recently completed rule requiring additional disclosures as an indication of progress.

Gensler’s stance on cryptocurrency regulation has consistently emphasized the need for greater oversight. Despite the presence of good faith actors within the industry, he has persistently argued that the crypto environment is “rife with fraud” and does not provide comprehensive investor protection.

He has repeatedly argued that the crypto space is “rife with fraud,” does not provide comprehensive protections for investors, and can be effectively regulated under current law. “I’ve been in finance for about 44 years now,” Gensler said today of the crypto industry, “and I’ve never seen a field so full of misconduct… It’s disheartening.”