Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Matt Hougan, Chief Investment Officer (CIO) of Bitwise Asset Management, provided a striking long -term prediction for Bitcoin in the latest episode of the Coinestories Podcast. Speaking with host Nathalie Brunell, Hougan sketched why he believes that BTC will not only disrupt gold, but will also climb as high as $ 1 million per coin in 2029. He attributed this bullish prediction to fast institutional acceptance, emerging regulatory clarity and persistent long -term demand for the new supply.

Why Bitcoin could reach $ 1 million by 2029

During the interviewHougan pointed to the dramatic impact of Bitcoin-Bitcoin-treated funds (ETFs) as a primary factor behind institutional intake. He described the increase in new capital after the ETFs had been launched in January 2024, so much larger than most analysts had expected. “Before the Bitcoin ETFs were launched, the most successful ETF of all time collected $ 5 billion dollars in the first year,” he said. “This [Bitcoin] ETFs did thirty -seven billion. “

He added that this amazing pace of the intake could continue, largely because “less than half of all financial advisers in the US can even have a proactive conversation” about investing in Bitcoin at the moment. As soon as restrictions have been canceled and more advisers are allowed to recommend Bitcoin to their customers, he expects an even greater inflow of assets.

Related lecture

When demanding competition between top ETF providers, Hougan emphasized that BlackRock’s access to space ultimately benefits the entire industry by stimulating overall participation. He emphasized how his company Bitwise focuses on meeting the needs of both institutional investors and crypto specialists who want a ‘crypto -native’ manager.

Although the place of Bitwise Bitcoin ETF was launched alongside various other prominent players, Hougan said that he sees the fierce competition as constructive for investors, because it has driven costs to have ‘rockbottom’. He noted that the management costs of his company are lower than those of many traditional raw materials and concluded: “It is an incredible deal for the investor.”

Apart from these large -scale shifts in institutional financing, Hougan also drawn attention to the rapid expansion of Stablecoins. He called them a ‘murderer app’, referring to global appetite for cheaper, faster transaction rails and to explain that Stablecoins, which settle on blockchains, can improve cross-border money flows.

He anticipates a Stablecoin market measured in the trillions in the coming years, mainly as supportive regulatory frameworks. Although he acknowledged that the United States can determine the legislation that forms or Stablecoin issuers have short or long-term treasure chest, he expressed the hope that the market would remain free enough to promote continuous competition and innovation.

The conversation was also affected by the increasing business interest, of which Hougan said they are being confronted with obstacles such as ‘weird accounting rules’, but has proven to be robust. He pointed out how companies “bought hundreds of thousands of Bitcoin last year” and believes that these early movers mean a larger wave that should come once the accounting and due diligence considerations have been smoothed out.

Related lecture

The private surveys of his company, he said, reveal a striking gap between the personal enthusiasm of advisers for Bitcoin – where “more than 50%” already contains it – and the approximately 15-20% that can formally assign it on behalf of customer portfolios. That number, he predicts, will continue to rise if internal committees advisers grant green light and as more institutions realize that “if you have a zero percent allocation to crypto, you are effectively short.”

Regulatory shifts and the Washington factor

During the interview, Hougan repeatedly underlined that the market ‘can suppress the change in Washington’. He remembered how banks were not prepared until recently to take deposits of crypto companies and how several subpoenas, lawsuits and the risk of ‘debit’ had a horrifying effect on the growth of industry.

Hougan believes that “unless you have worked in Crypto for the past four years, you cannot imagine how challenging it was”, and that the softer position of the government is now removing a huge obstacle to capital inflow. He also sees dual support for the Stablecoin legislation as a powerful sign of regulatory clarity on the horizon.

In addition to regulation, Hougan suggested that Bitcoin is ready to bloom in a macro -economic climate full of uncertainty. He referred to the runaway inflation or a sudden deflatory bust as scenarios that people are afraid of, and claims that “if you look at the market, it is more volatile or open or insecure than in the past.”

From his perspective, even a small allocation to Bitcoin offers a non-sovereign hedge against potential monetary or tax turbulence. He said that many of the major customers of Bitwise are investigating methods for generating yields on their bitcoin – either by derivatives or institutional loans – so that they can maintain exposure without selling the assets themselves. He reflects such interest in the strong beliefs that tend to characterize the crypto community.

Hougan’s conclusion circled back to the power of the limited supply and the deepening of Bitcoin’s institutional demand. He stated that Bitcoin’s finite issue scheme, in combination with new buyers who will surpass the number of new Bitcoin in the course of time, will probably continue to push the price over time. “I think Bitcoin is well on my way to disturb gold,” he said. “We think it will cross a million dollars by 2029.” Although he emphasized that the daily price fluctuations can be dramatic, he is convinced that the foundations remain inviolable in the long term.

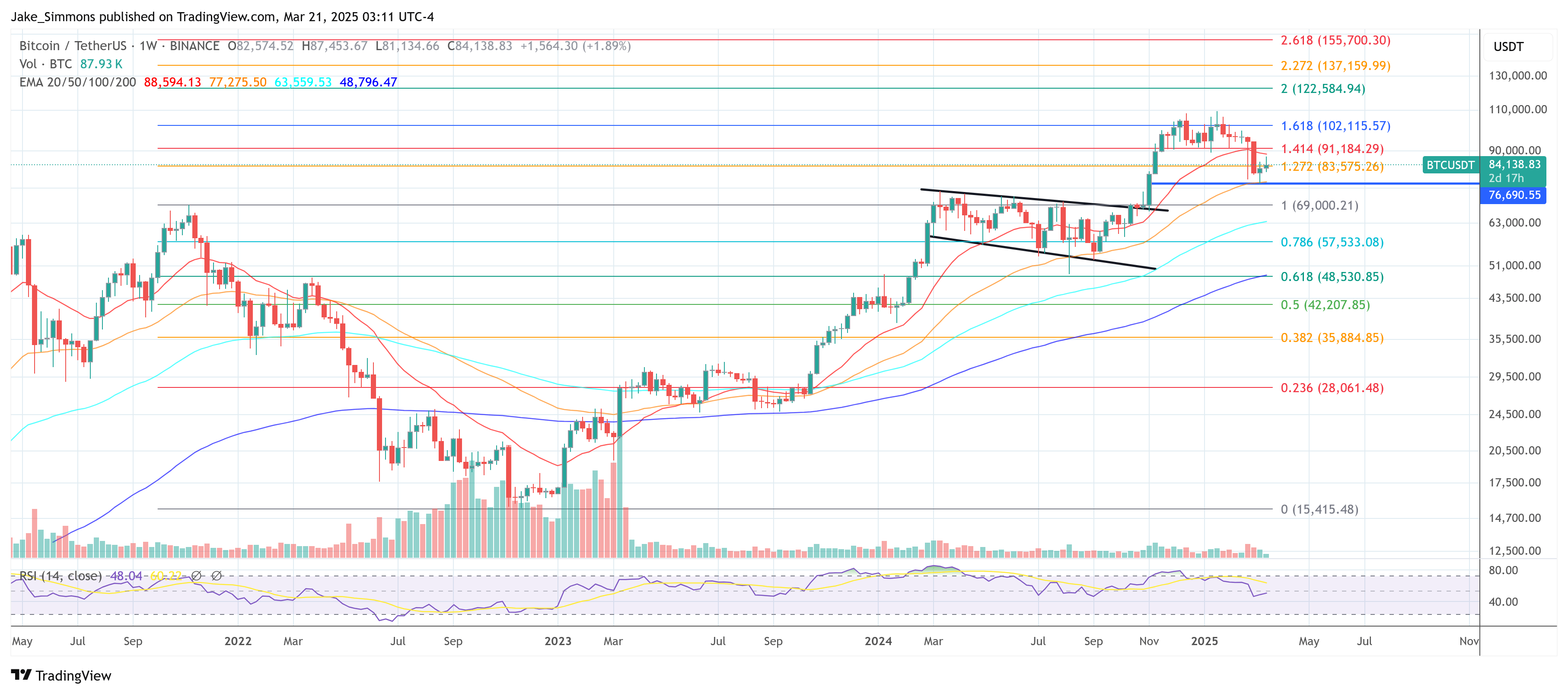

At the time of the press, BTC traded at $ 84,138.

Featured image made with dall.e, graph of tradingview.com