- A huge spike in LINK’s Age Consumed helped the token bounce.

- The price could drop to $17.50 because it was overbought.

Chainlink’s [LINK] The price is up 17% over the past 24 hours, making the cryptocurrency the best performing altcoin within the period. But AMBCrypto’s research showed that the increase was not without reason.

Instead, there were some behind-the-scenes events that fueled the altcoin rally. Based on our findings, we confirmed that the inflow of LINK tokens into the network circulation was one of the catalysts.

The dormant wallets are awake

Santiment noted in a Feb. 1 post that about 5.38 billion coins in dormant wallets came to life. The rise of the wallets implied that the Age Consumed metric soared.

🔗📈 #Chain link has jumped ahead of the #altcoin pack after a number of previously dormant wallets created the highest spike in age consumption (5.38 billion, calculated by multiplying the coins moved by the number of days these coins had been inactive). This influx of $LINK back in the

(Continued) 👇 pic.twitter.com/eHVpeJz2HW

— Santiment (@santimentfeed) February 1, 2024

Furthermore, the spike in Age Consumed reflects how there was a short-term behavioral change among long-term owners. Furthermore, it typically precedes market bottoms and leads to an upswing.

However, that was not the only reason. Data on the chain also showed that some addresses have liquidated their LINK holdings. Usually this means that there was some level of fear, uncertainty and doubt (FUD) surrounding the project. But FUD isn’t always a bad thing, suggesting the action has boosted the Chainlink token price.

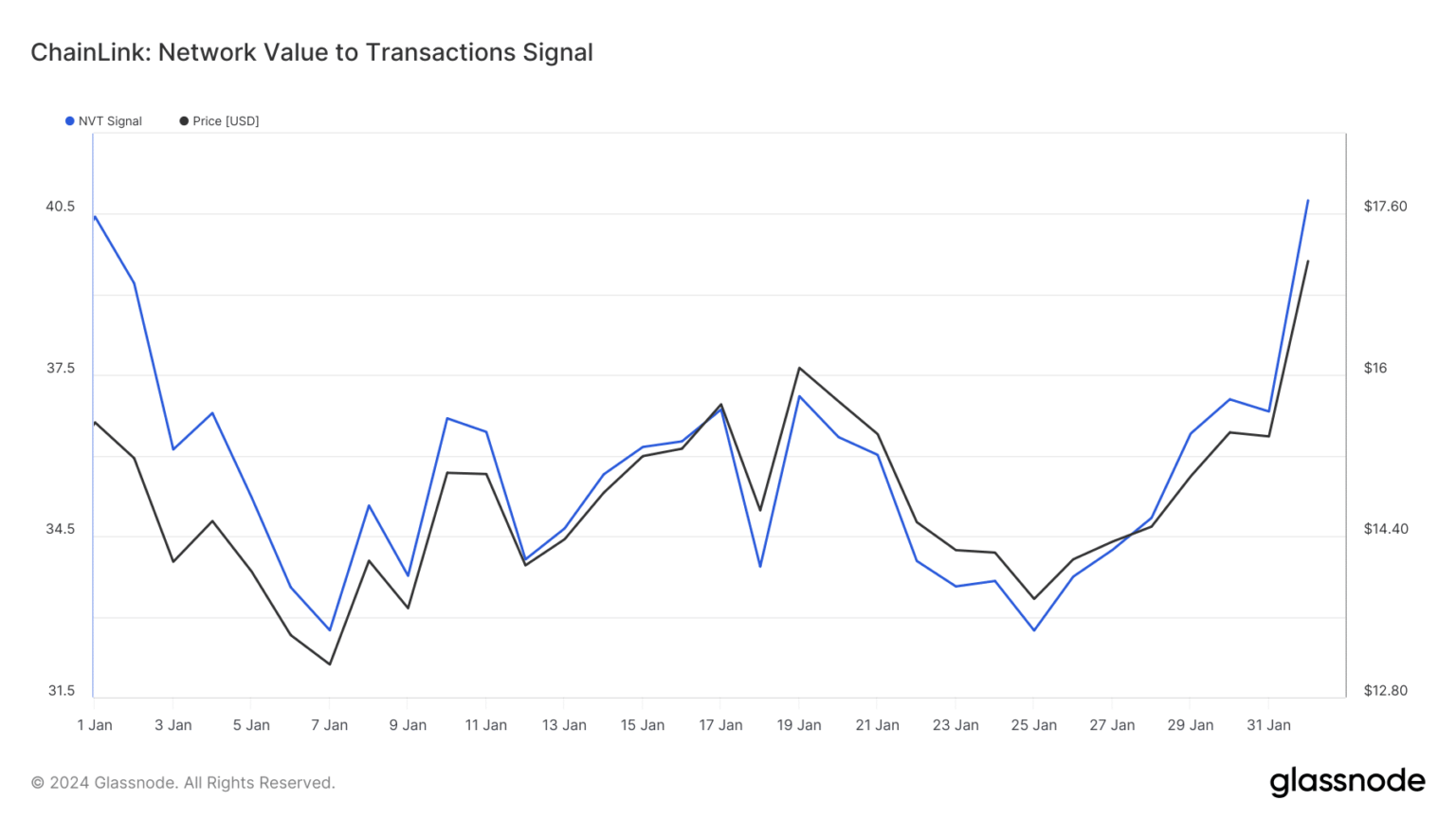

LINK’s price at the time of writing was $18.03, marking its highest value in almost six weeks. Despite the increase, the Network Value to Transactions (NVT) signal showed that the price could recover quickly.

According to AMBCryptos analysis Based on Glassnode data, Chainlink’s NVT signal had risen to 40.75. The measure uses a 90-day moving average (MA) to determine when investors are applying a premium or otherwise.

Historically, low NVT signals serve as periods to acquire tokens, and these usually coincide with market bottoms.

Source: Glassnode

But when an NVT signal is high, it means it may be time to distribute and the market may have reached a local top. In the case of Chainlink, there is a chance that the price will slow down. If this happens, LINK could fall below $18.

LINK aims to cool down for a while

AMBCrypto’s analysis of the LINK/USD 4-hour chart showed bulls taking advantage of the support at $15. With the increased buying pressure, the cryptocurrency was able to rise past the USD 16 resistance.

However, indications from the Bollinger Bands (BB) showed that LINK may have been overbought. This was because the upper band of the BB reached the price of LINK at $18. Although volatility increased, LINK started to retreat as the price fell to $17.75.

The Relative Strength Index (RSI) also confirmed the sentiment with a reading of 77.01. Values of the RSI above 70 suggest that a token is overbought and could portend a retracement.

Source: TradingView

Is your portfolio green? View the LINK Profit Calculator

Had it been below 30, it would have been classified as oversold and could have led to a recovery.

For now, LINK may drop to $17.50. But a move below $17 seemed unlikely as buying pressure could see the price take another look at $18.