- Bitcoin miners face uncertainties amid price increases ahead of the fourth halving.

- Strategic decisions about Bitcoin ownership and regulatory challenges impact mining profitability.

Amid the dynamic landscape of the cryptocurrency market, Bitcoin [BTC] Miners are at a crossroads. The fourth halving saw a deviation from the norm as the price of Bitcoin soared beforehand, leading to speculation within the sector.

With Bitcoin already hitting new all-time highs before the halving, a question arose: is this a blessing or a curse for miners?

Bitcoin’s halving has consequences for miners

Adam Sullivan, the CEO of Core Scientific, one of the largest Bitcoin miners in North America, sheds light on this. conversation with Anthony Pompliano, said:

“I think one of the big questions is the ETF, the mechanism by which Bitcoin can become even more parabolic, in a way where more institutional investors and more retail investors get access to the market.”

He drew parallels with the previous cycles and added:

“So as we look ahead, we are looking at a point where many miners will be marginally profitable and stay online for three to six months. So I think we will see a much longer process as opposed to 2022.”

This underlines that the post-halving adjustment period could be longer, with miners staying online longer despite marginal profitability.

This could therefore lead to a slower consolidation process and possible failures within the mining sector, potentially extending into 2025.

Strategy for Bitcoin Miners

Furthermore, when talking about the strategy regarding Bitcoin ownership for mining operations, the only prominent question that arises is whether one should hold or sell mined Bitcoins amid market volatility.

In response, Sullivan said:

“We currently sell our Bitcoin daily.”

With his comments, he emphasized on minimizing opportunity costs and maximizing shareholder value rather than accumulating Bitcoin for personal interest.

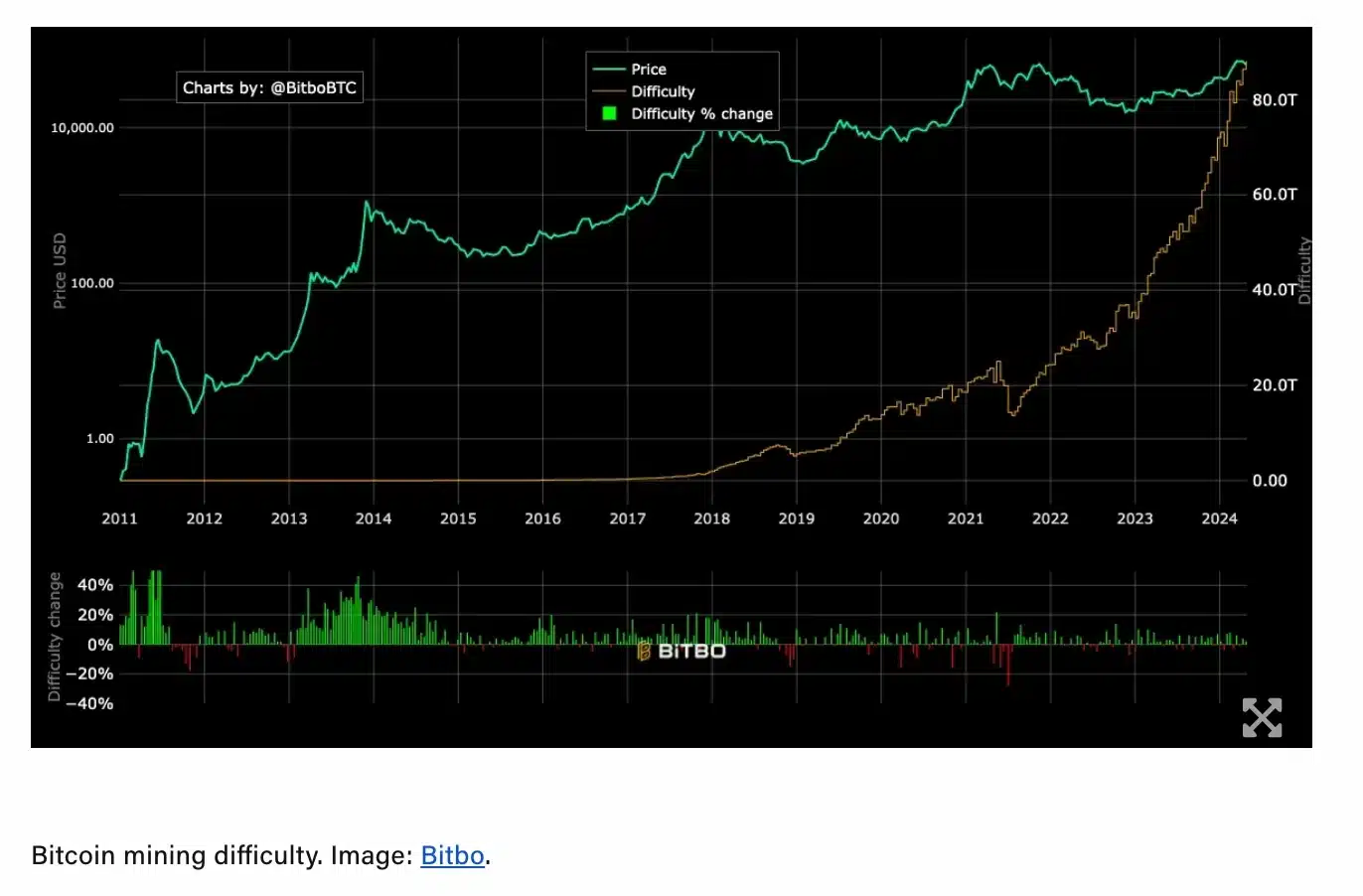

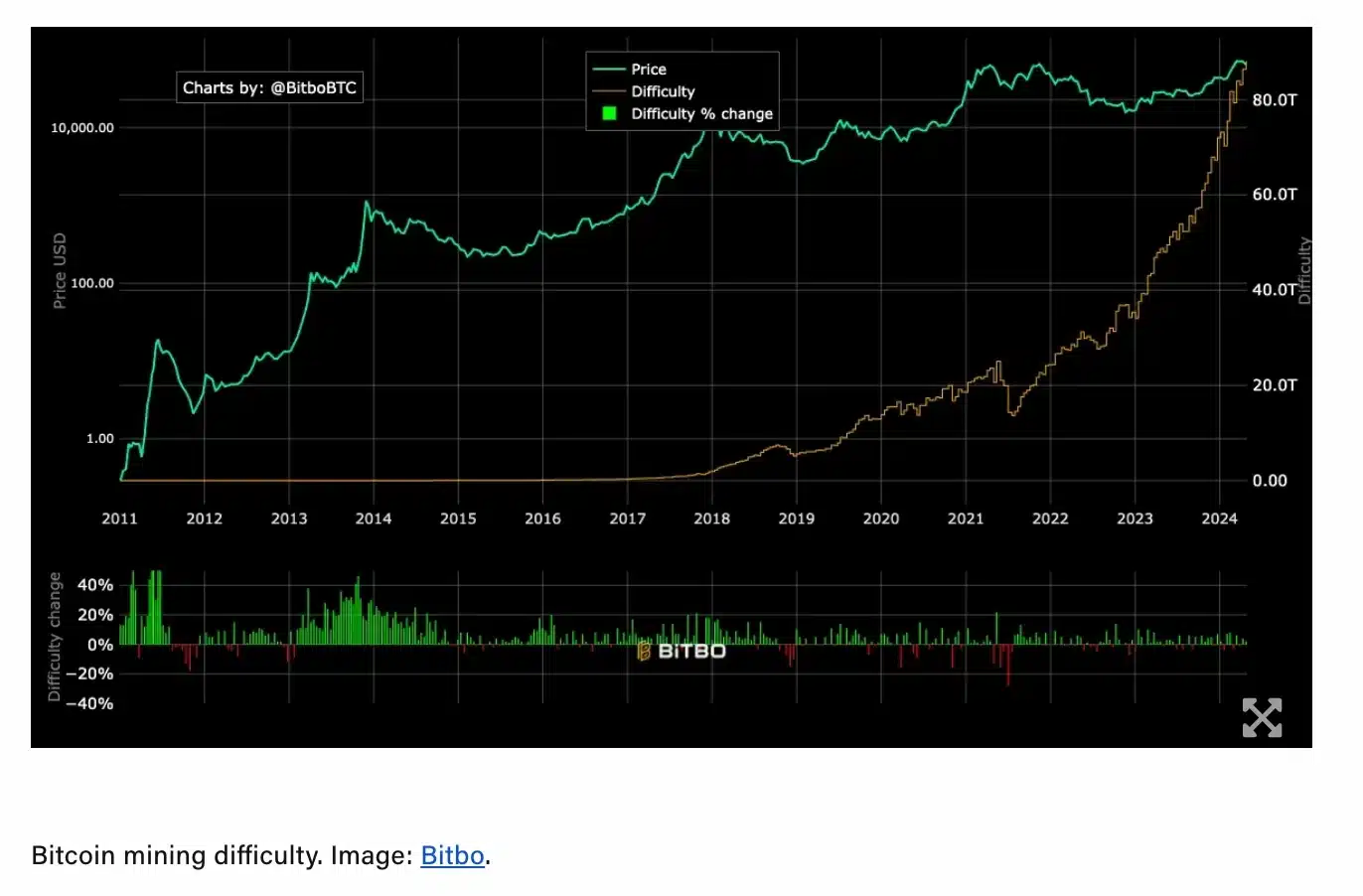

This was further confirmed by data from Bitbo, which highlights a 2% increase in Bitcoin mining problems, reaching a record 88.1 trillion at block height 840,672.

Source: Bitbo

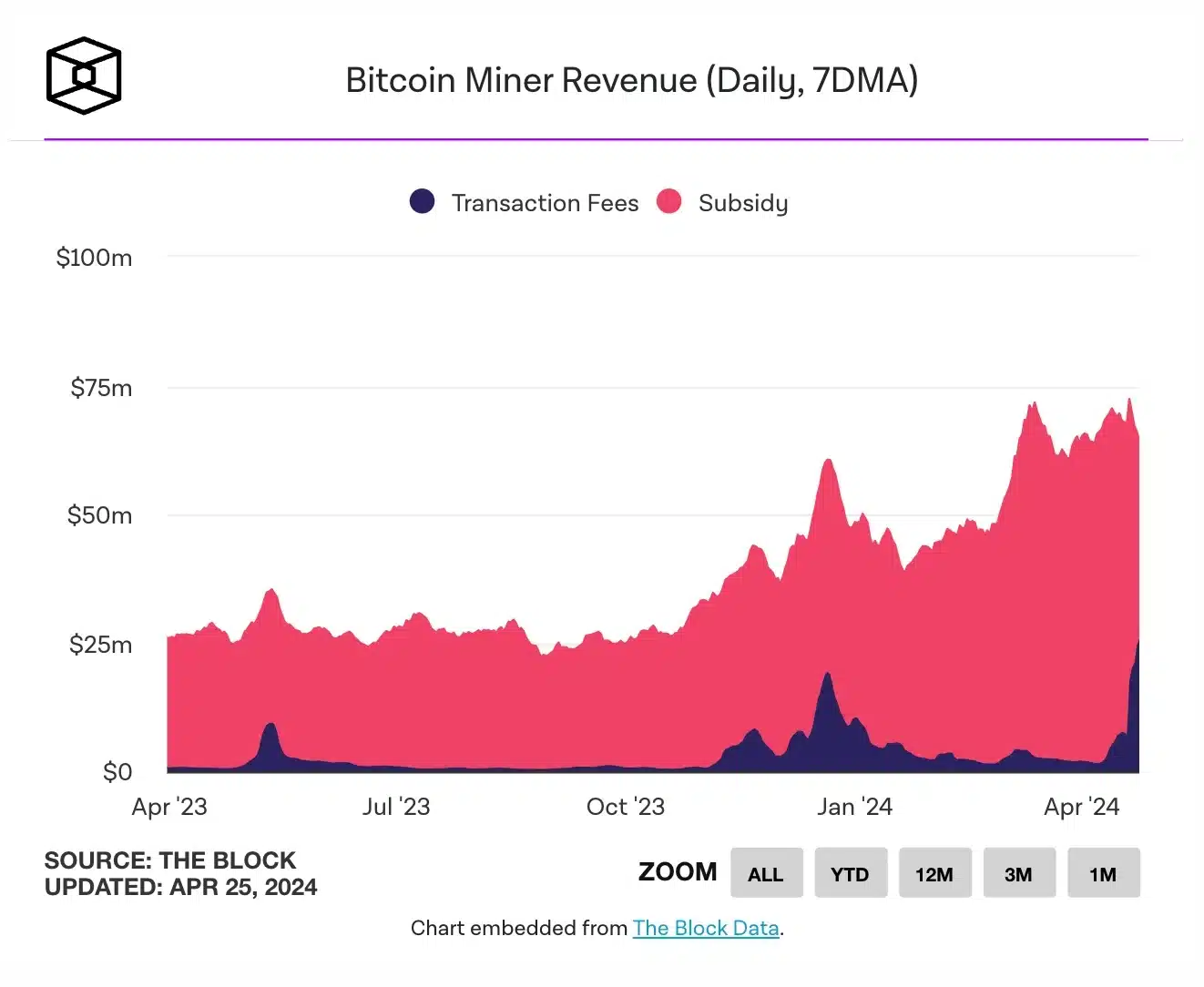

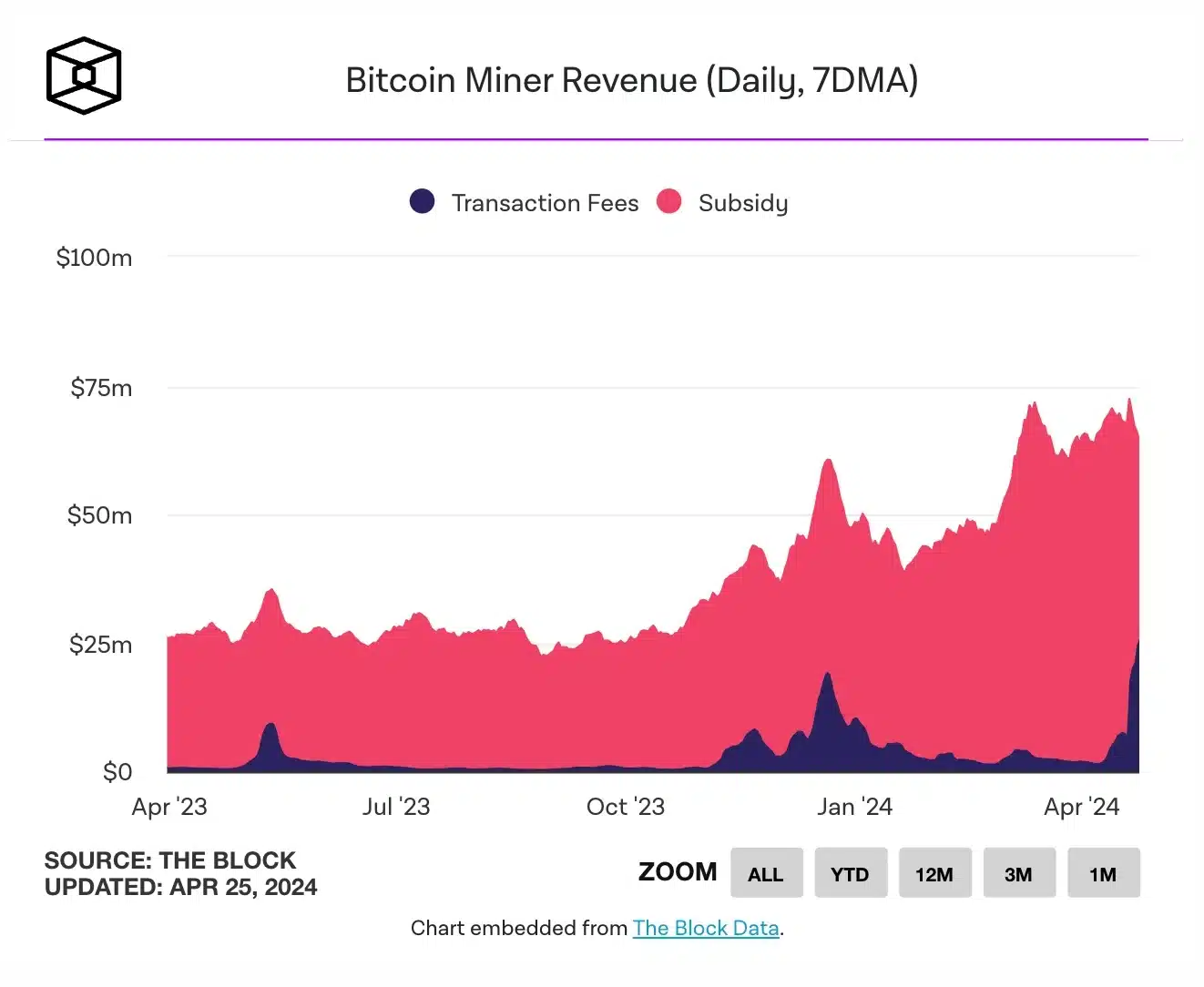

Despite this, The Block’s data indicates that miners are maintaining stable revenue after the halving.

According to the chart, transaction fee rewards now make up 40% of total block rewards, up from 10% before the halving, indicating a significant shift in revenue sources for miners.

Source: Het Blok

Joe Biden’s big move

Interestingly, Joe Biden also imposed a 30% tax on Bitcoin miners, which was further criticized Senator Cynthia Lummis.

“It would be a historic mistake to impose a 30% tax on Bitcoin miners, which is a de facto ban.”

Overall, these developments underscore the complex interplay between market dynamics, regulatory measures, and strategic decision-making within the Bitcoin mining ecosystem.

. Ergo, it would be interesting to see how things will unfold for miners in the coming days, weeks or months.