- The price of Bitcoin has fallen by almost 5% in the past seven days.

- Most benchmarks and market indicators pointed to a continued price decline.

Bitcoin [BTC] Bulls are struggling to take control of the market as the king of cryptos’ weekly chart remained red.

However, BTC may have a trick up its sleeve. Taking into account the latest data, BTC has been quietly moving within a bullish pattern, which could push it to new highs.

Bitcoin is targeting $127,000

CoinMarketCaps facts revealed that the price of BTC had fallen by almost 5% over the past seven days. At the time of writing, BTC was trading below $67,000 at $66,147.26 with a market cap of over $1.3 trillion.

Meanwhile, Gert van Lagen, a popular crypto analyst, posted one tweet to draw attention to an interesting development.

According to the tweet, the recent price drop could be due to BTC consolidating within a bullish flag pattern.

The tweet also mentioned that BTC had successfully tested support. If true, BTC could soon initiate a bull rally, which could lead to BTC reaching $127,000 in the coming weeks or months.

BTC’s next step

Since the possibility of BTC reaching $127,000 soon seemed like a gamble, AMBCrypto then reviewed the king of cryptos’ stats to find out what to expect in the near term.

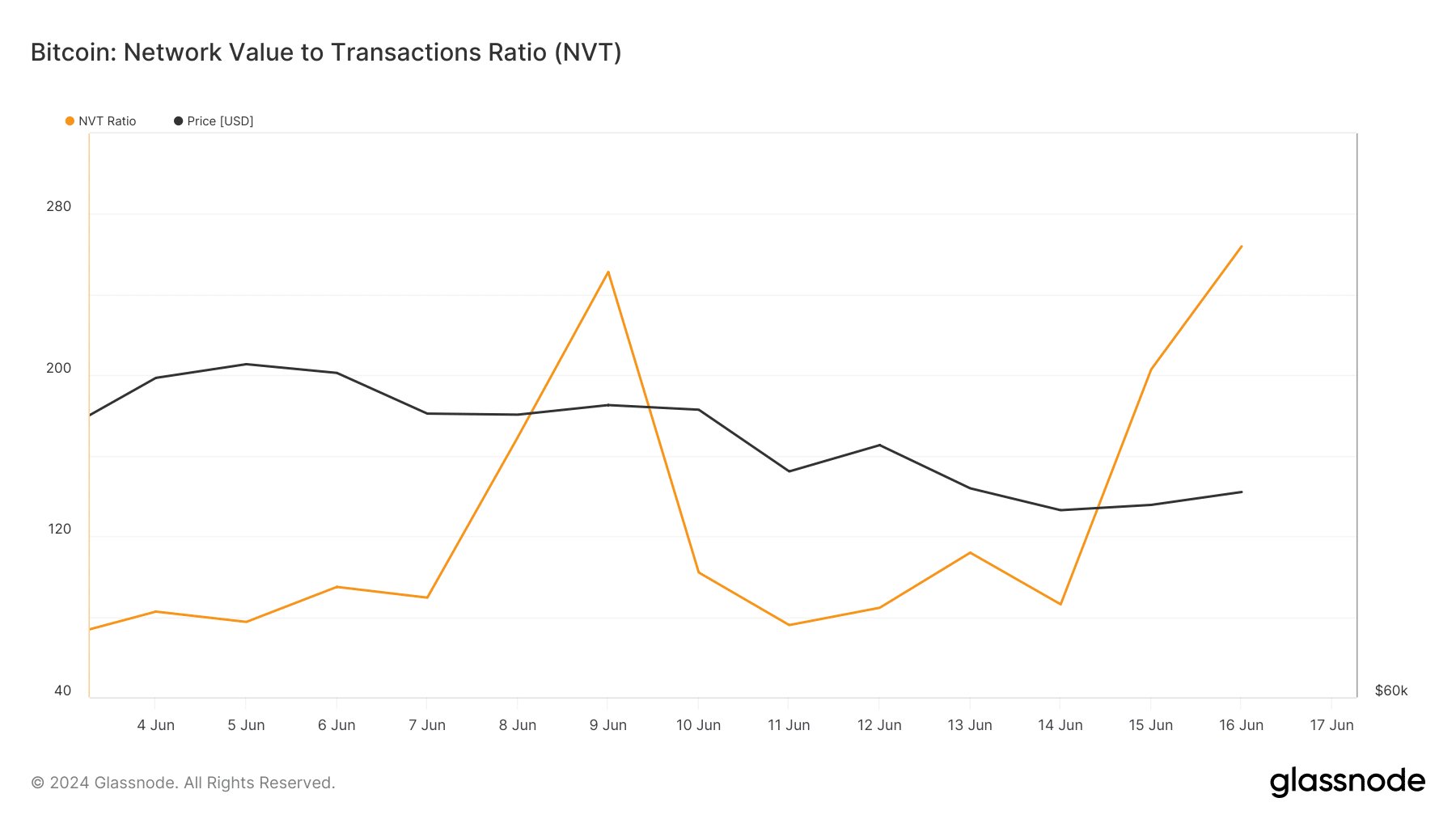

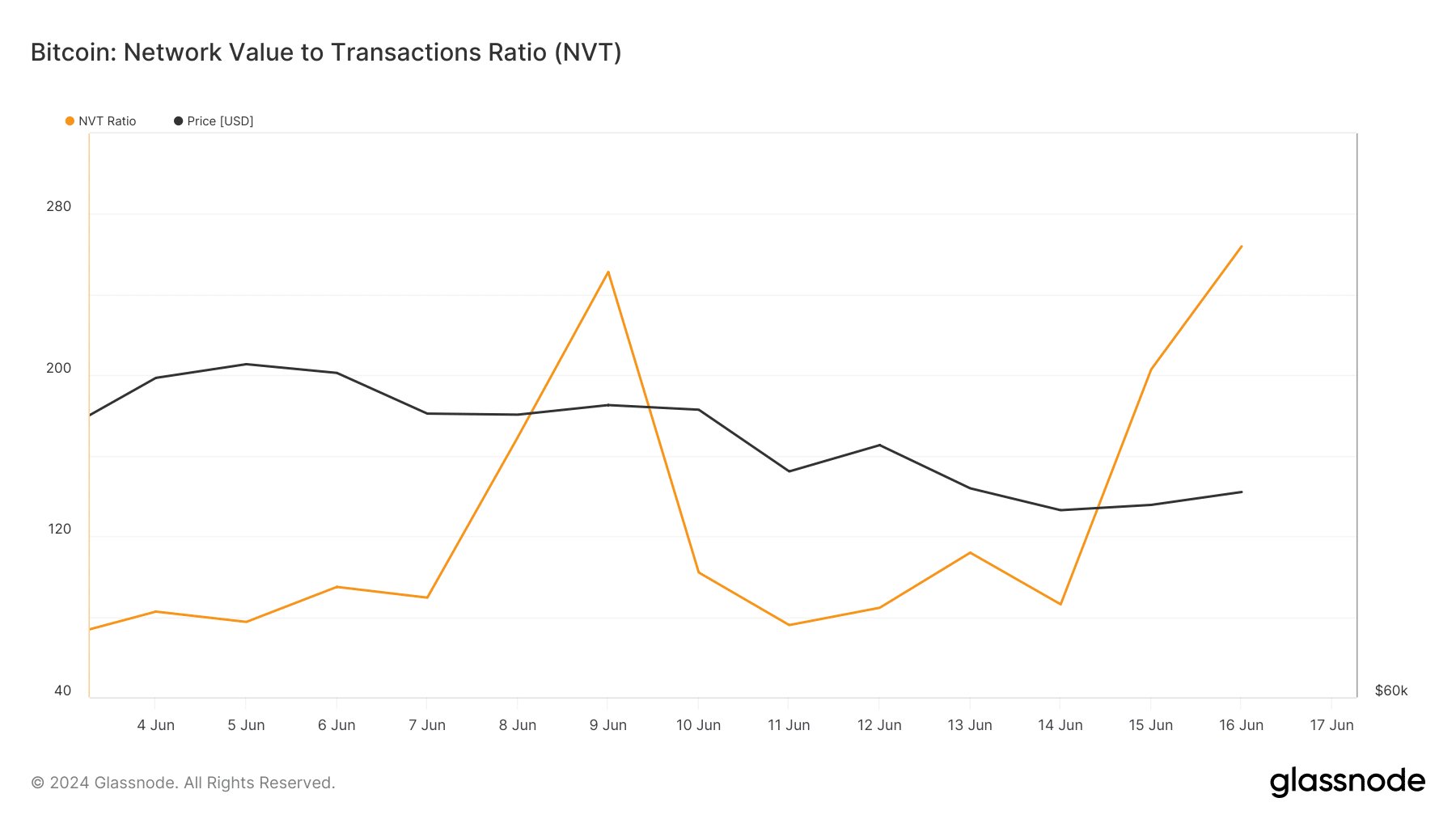

Our analysis of Glassnode’s data showed that BTC’s NVT ratio rose sharply. A rise in the measure means an asset is overvalued, indicating a possible price decline in the coming days.

Source: Glassnode

Next, we looked at CryptoQuant’s data. We found that the net deposits of BTC on the exchanges were higher compared to the average of the last seven days, meaning that the selling pressure on BTC was high.

BTC’s aSORP was red. This means more investors are selling at a profit. In the middle of a bull market, this could indicate a market top.

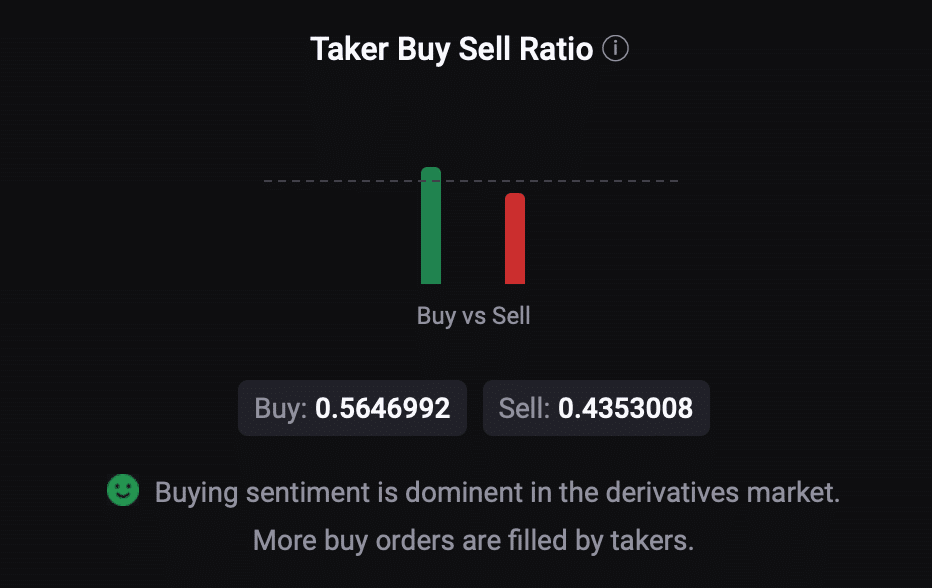

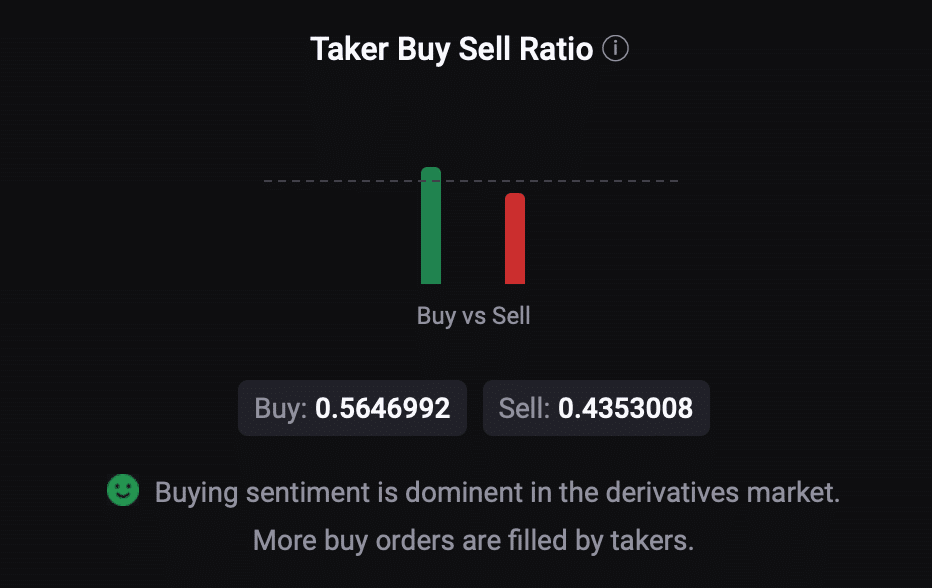

Nevertheless, things looked positive in the derivatives market as the buyer’s buy/sell ratio indicated that buying sentiment was dominant among futures investors.

Source: CryptoQuant

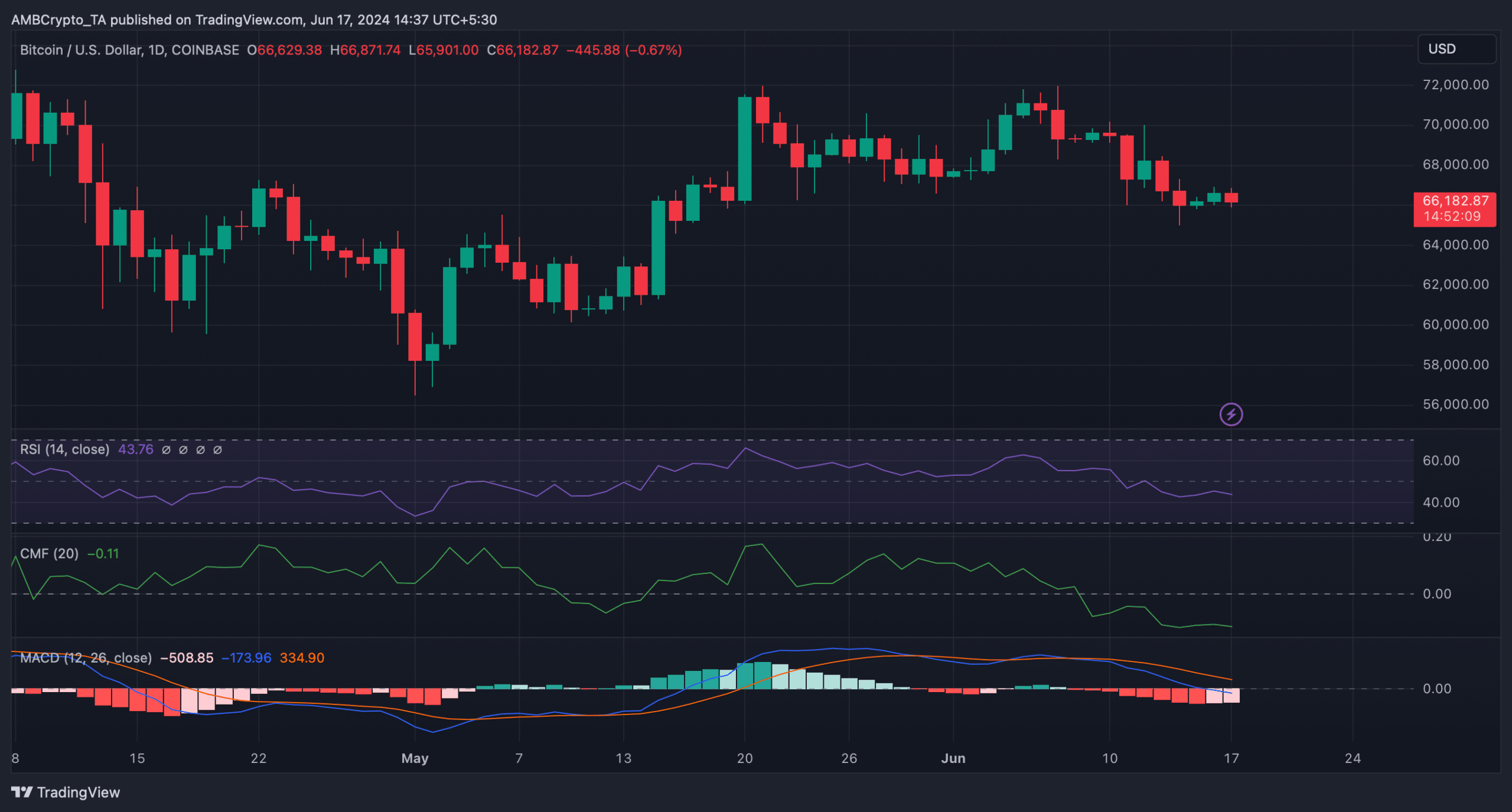

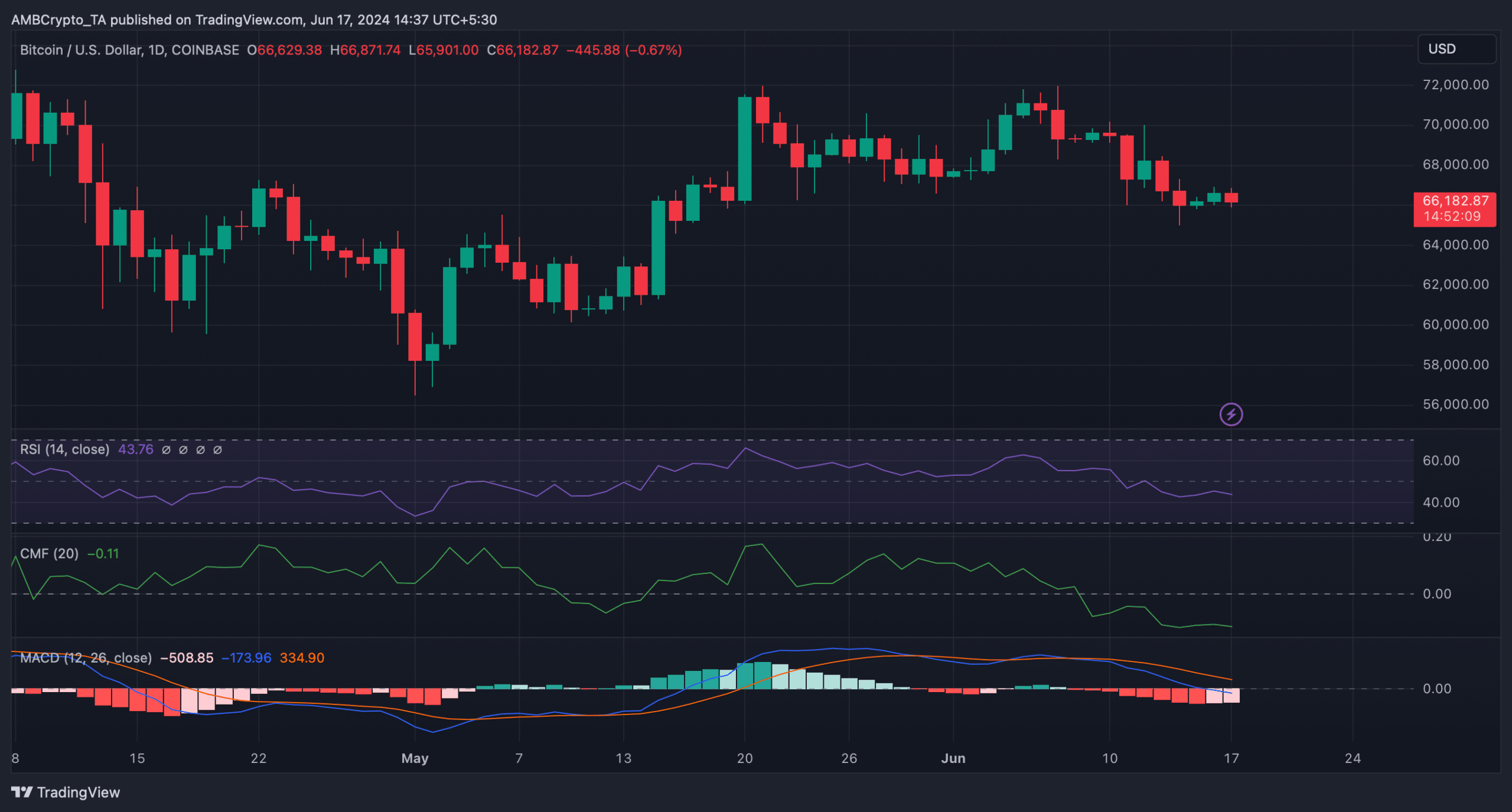

However, market indicators remained bearish on the coin. For example, both BTC’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered a decline and rested below their respective neutral marks.

The MACD showed a bearish advantage in the market, indicating a continued price decline.

Source: TradingView

Read Bitcoins [BTC] Price prediction 2024-25

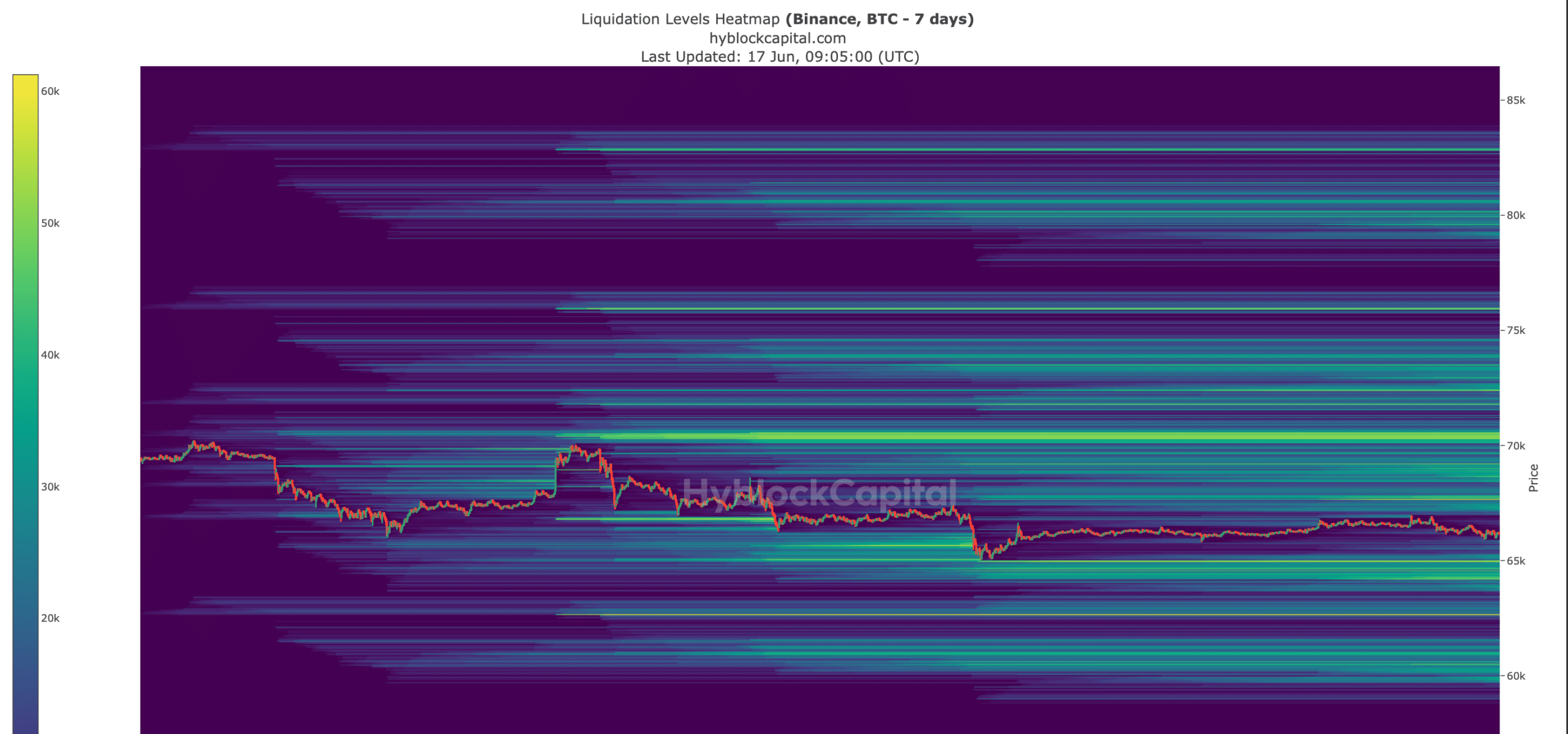

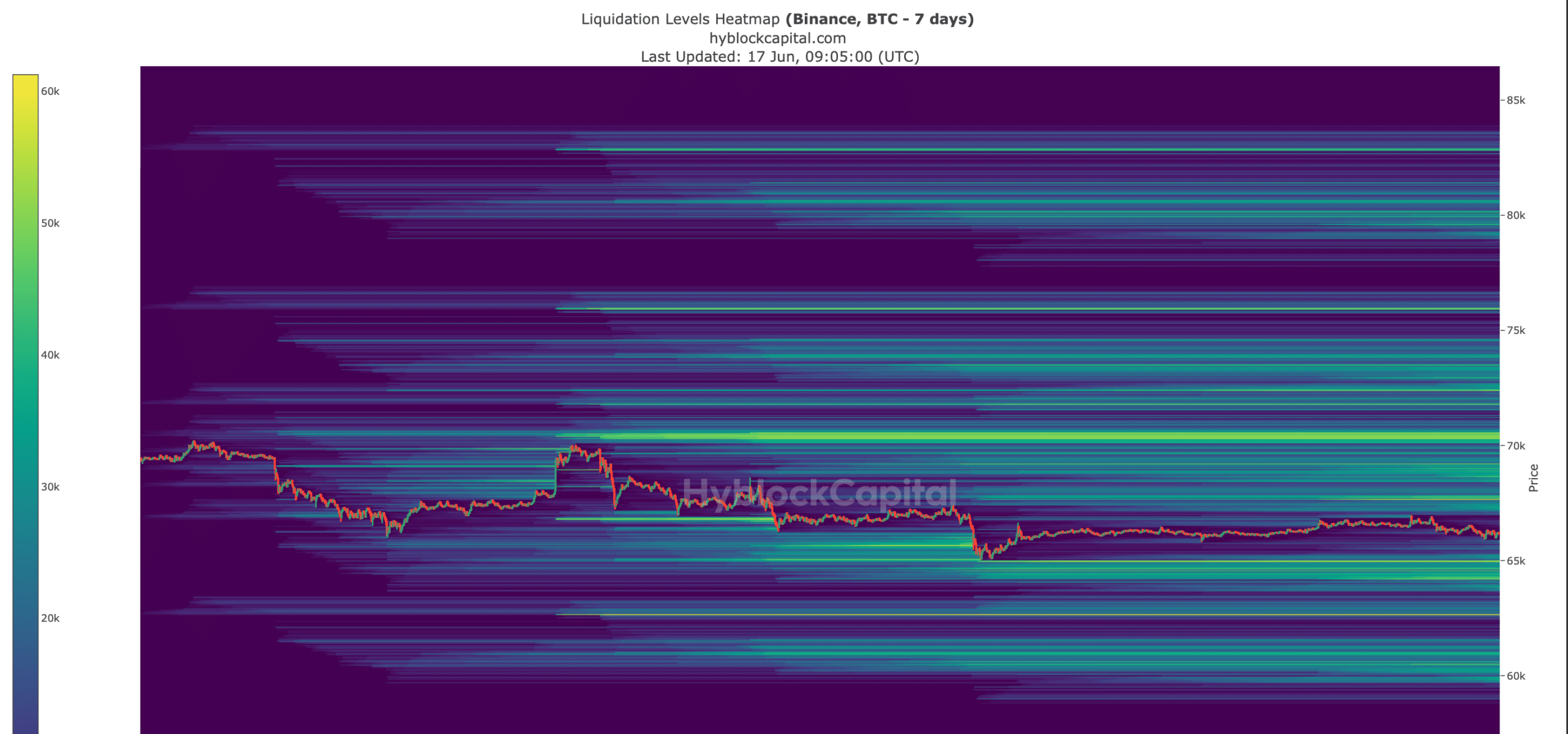

AMBCrypto’s analysis of Hyblock Capital’s data revealed that if BTC remains bearish, investors could witness BTC reaching $65,000 this week.

A drop below that level could see BTC drop to $60,000 in the coming days. On the contrary, if BTC turns bullish, it could reach $67.65k first.

Source: Hyblock Capital