Friend Tech (FT), the web3 social token platform that recently saw a resurgence in user activity, has seen a rise in ‘sniper bots’, which have caused significant shifts in stock prices.

According to a detailed analysis carried out by X-user @unexployed_ of Castle Capital, these bots, beyond their normally expected functionality, use a technique of ‘sniping’ to gain control of valuable profile shares.

In the case of DappRadar’s recent registration on FT, Unexployed revealed that share prices started at an unusually high point of 0.26 ETH. This was not caused by a registered account, but apparently by a sniper address interacting directly with the smart contracts, demonstrating the influence of these bots on the market.

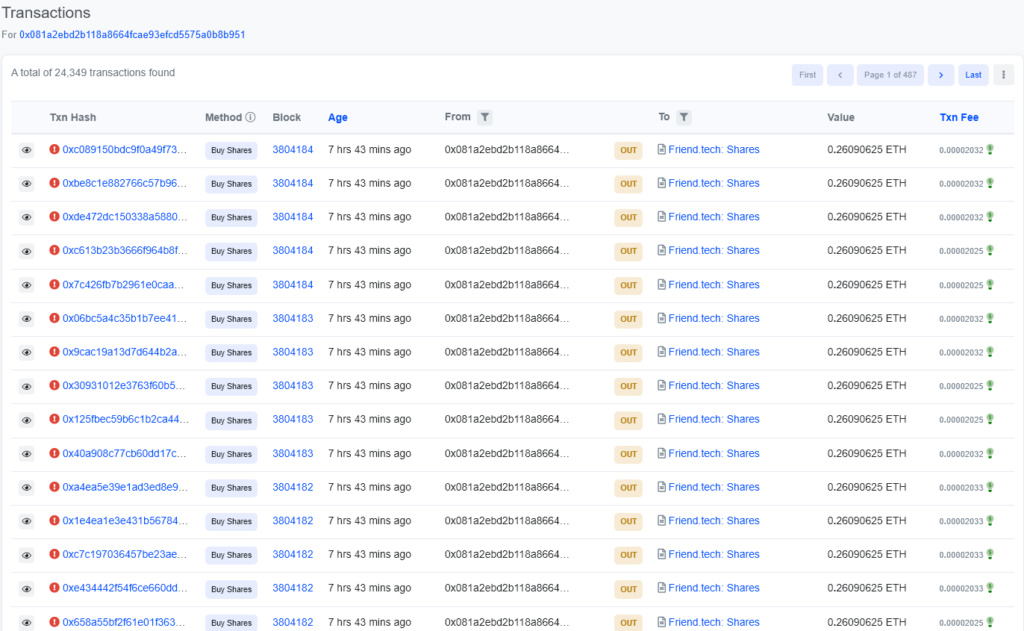

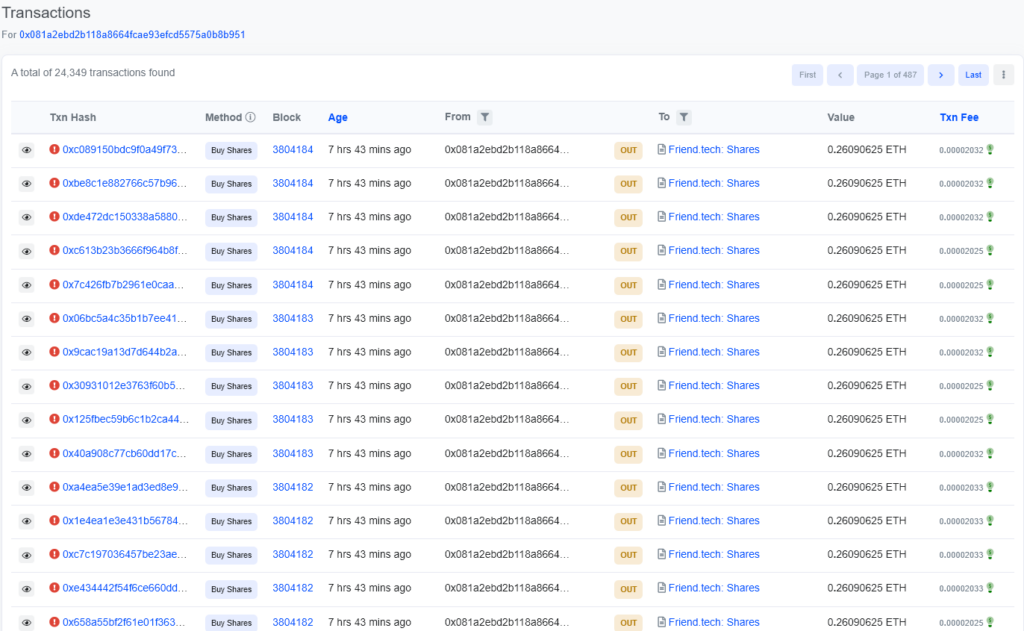

By digging deeper into basescan.org, Unexployed was able to trace the chronological order of buyers and sellers. Within the first four blocks, there were already 65 shares on the market. And DappRadar wasn’t the only one. Other entities, such as Moonshilla and Rektdiomedes, also faced a similar situation where snipers gained immediate control over their FT offering.

The primary sniper, identified as 0x081…951, made more than 20,000 trades to acquire the shares. The first 46 transactions failed with the error message ‘Failed with error ‘Insufficient payment’ and were reversed according to Basescan.

a CryptoSlate Analysis of the transactions showed that the account attempted to purchase the shares before the account owner had purchased the first share (an FT requirement.) The transaction log shows Fail with the error: ‘Only the shares’; subject can buy the first share”

Such spam behavior was already visible during the first week of FT. According to Bert Miller of Flashbots, chain spamming and mempool leaks are key factors leading to this phenomenon.

The sniper’s massive control over the supply allowed them to make a profit of 1.84 ETH by selling their shares. However, the bot’s actions led to a significant reduction in supply, and another sniper suffered a loss of 0.5 ETH, illustrating the competitive nature of these bots.

In the wake of these revelations, there are concerns about the platform’s fairness for individual users and high-quality profiles. Unexployed suggests that FT should consider solutions such as allowing creators to buy more of their shares upon registration to mitigate the effects of these bots.

FT revival of user activity.

It’s clear that despite the drastic drop in initial hype and challenges with ‘sniper bots’, the platform is making significant progress. Revenue rose to $5.6 million on September 9, marking a 30-day high for the blockchain-based social network.

The sales spike was driven by consistent usage growth over the past two weeks, which is an encouraging sign in light of the substantial decline in initial excitement that followed the launch.

The platform’s number of daily active users reached 9,000, with 2,000 new signups on September 9. The same day witnessed a trading volume of $12.3 million, positioning it as the third highest trading day since its inception. Additionally, FT collected fees worth $1.23 million, making it one of the highest fee days for any dApp in the crypto market.

However, the rise of ‘sniper bots’ has led to significant shifts in stock prices, the impact of which has not yet been identified.

It’s worth noting that FT’s beta version made quite a splash when it debuted on Coinbase’s layer-2 Base on August 11. Within ten days, the platform’s fees skyrocketed – surpassing Uniswap and the Bitcoin network. Despite this short-lived success, FT clearly shows resilience and adaptability in the face of challenges.

As the phenomenon of the increasing number of bots on FT unfolds, it remains to be seen how it will respond to the bot activity.