- Bitcoin ETF volumes continued to grow despite market volatility.

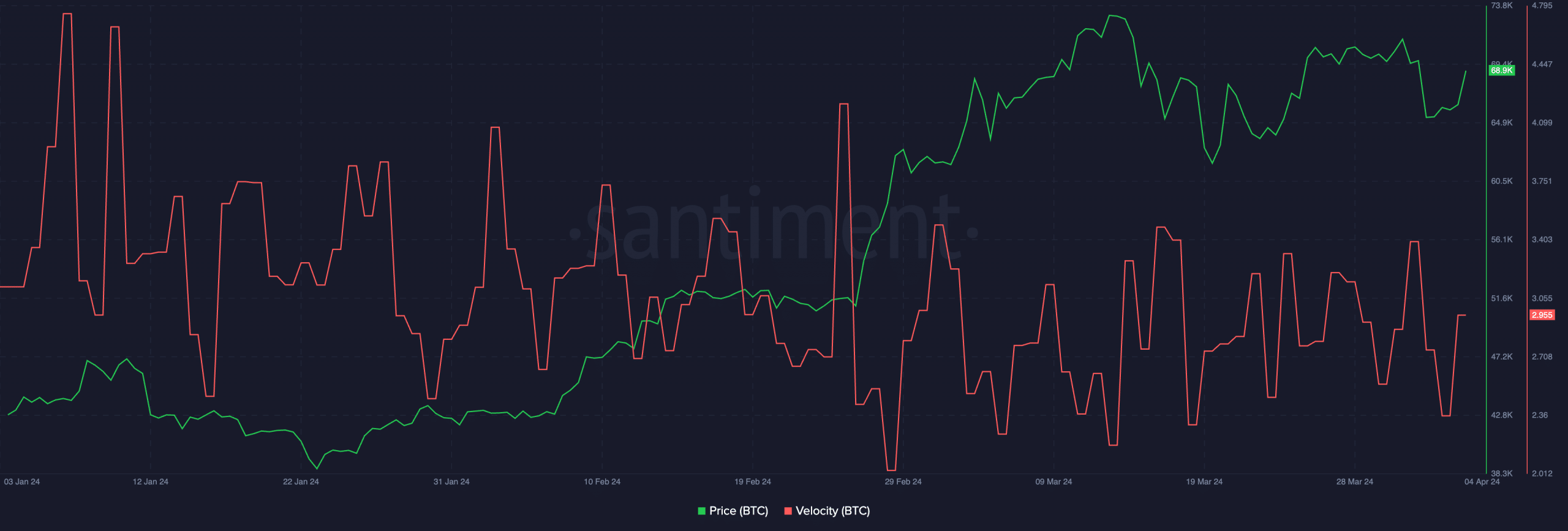

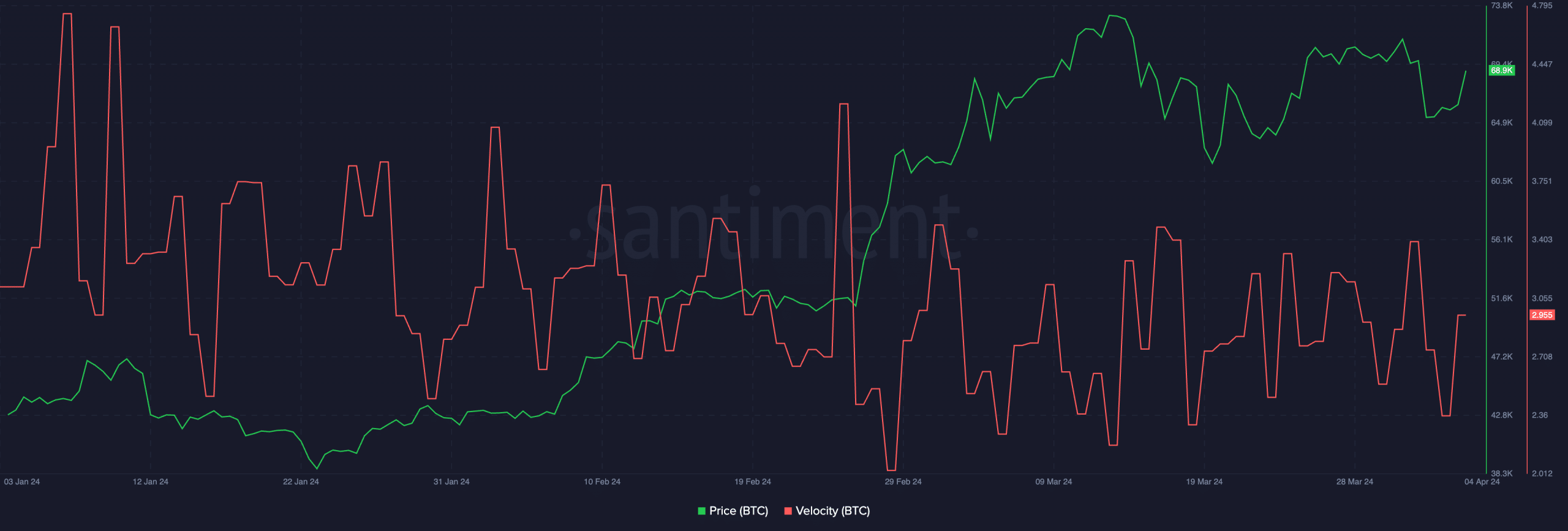

- The price of BTC increased along with the speed.

Following Bitcoin [BTC] reached the $70,000 mark, speculation about an impending correction intensified.

Despite the ongoing battle between Bitcoin bulls and bears in the cryptocurrency space, sentiment in traditional financial markets remained evident.

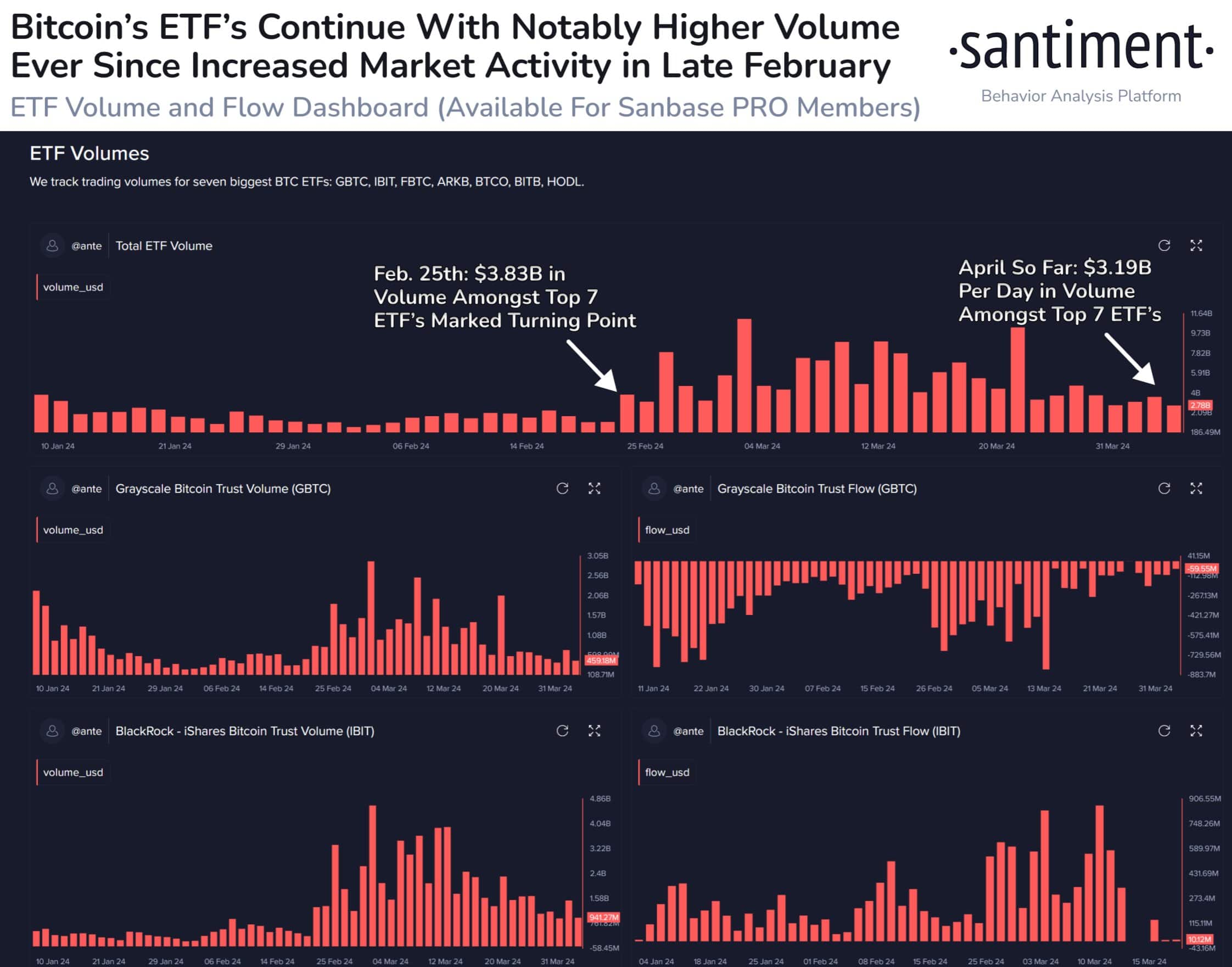

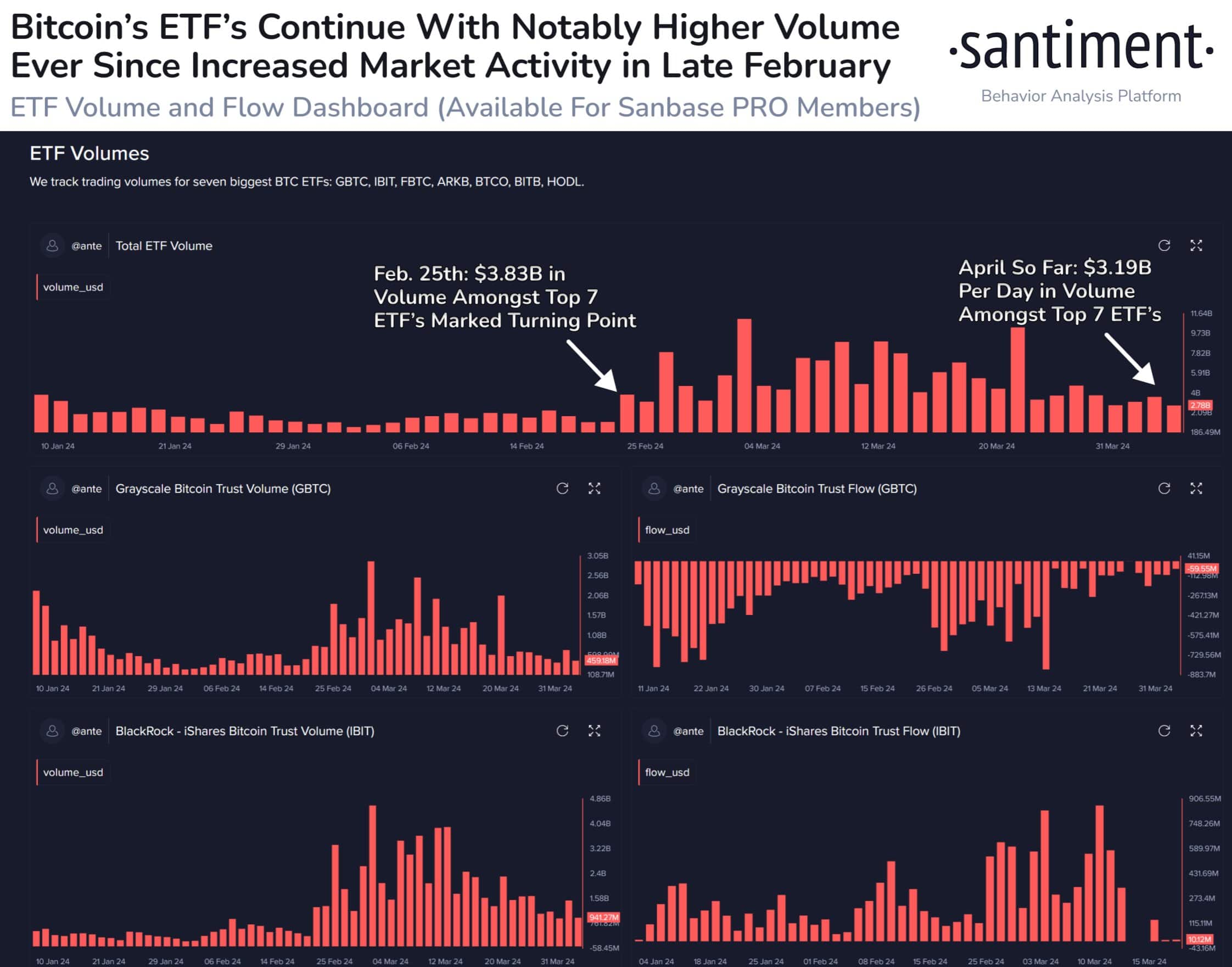

ETF volumes are rising

Based on Santiment’s data, Bitcoin ETF volumes show no signs of slowing down, even four weeks after BTC hit its all-time high.

For assets such as GBTC, IBIT, FBTC, ARKB, BTCO, BITB and HODL, trading activity remained high compared to the turning point observed in late February, following a surge in individual trading activity that has continued since then.

It is highly likely that this increased activity will continue leading up to the April halving. This continued interest, even after Bitcoin’s all-time high, signals strong investor interest.

This translated into increased demand for Bitcoin, as ETFs hold actual Bitcoin to back their stocks. But while this could potentially drive up Bitcoin’s price, it is not without risks.

High volume can also lead to significant price fluctuations if there are sudden changes in investor sentiment in the ETF market.

On the plus side, the popularity of Bitcoin ETFs could bring Bitcoin to a wider audience and further legitimize it within the traditional financial world.

Source: Santiment

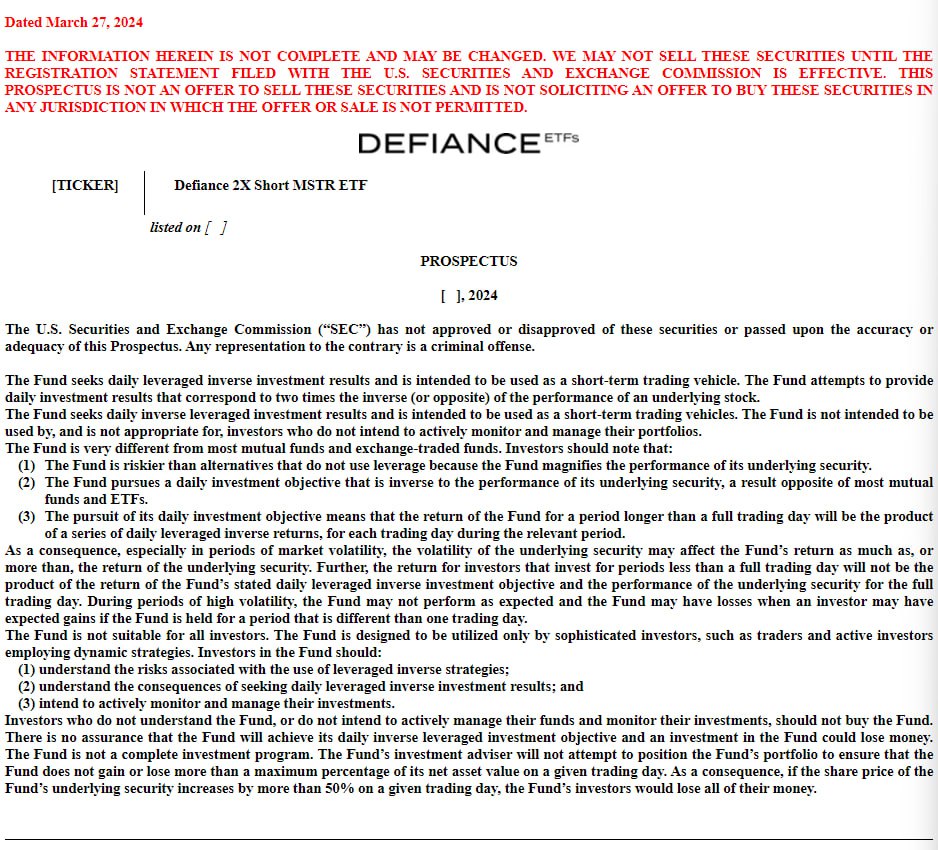

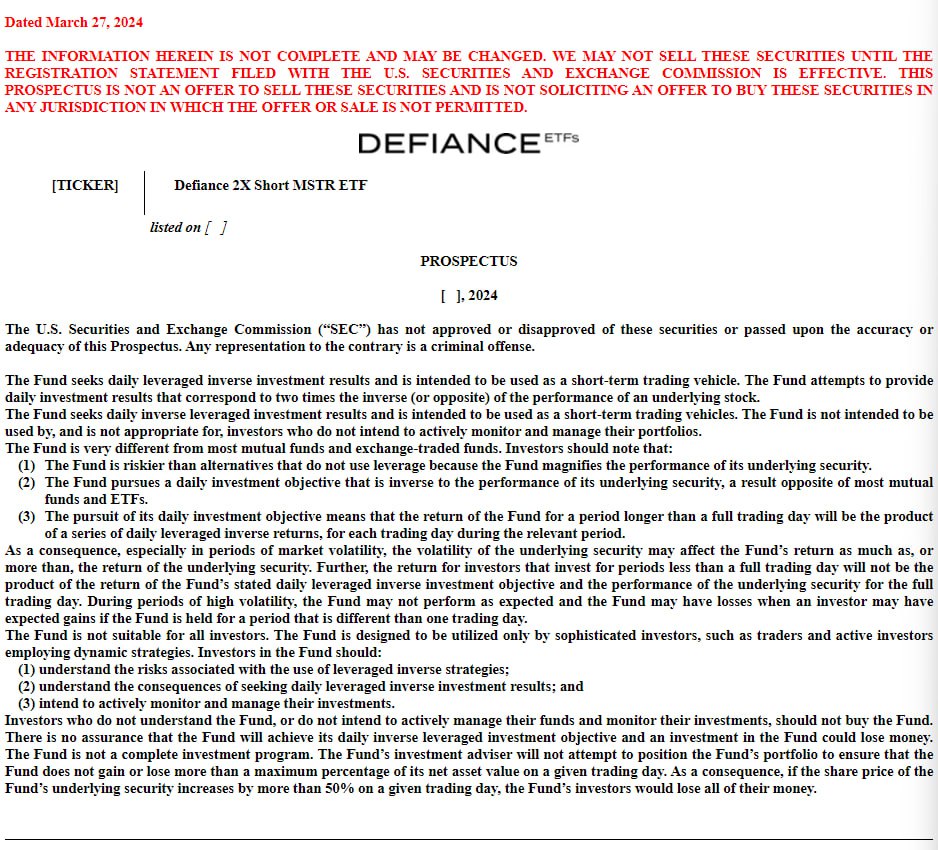

However, it wasn’t all bullish news for BTC. Defiance recently filed for an ETF that is 2x short on MicroStrategy.

MicroStrategy, the company led by Michael Saylor, is known for being extremely bullish on BTC. The company has accumulated Bitcoin at different price levels in different market cycles.

The creation of this ETF suggests that not everyone on Wall Street shares the same positive view of BTC.

Source: SEC

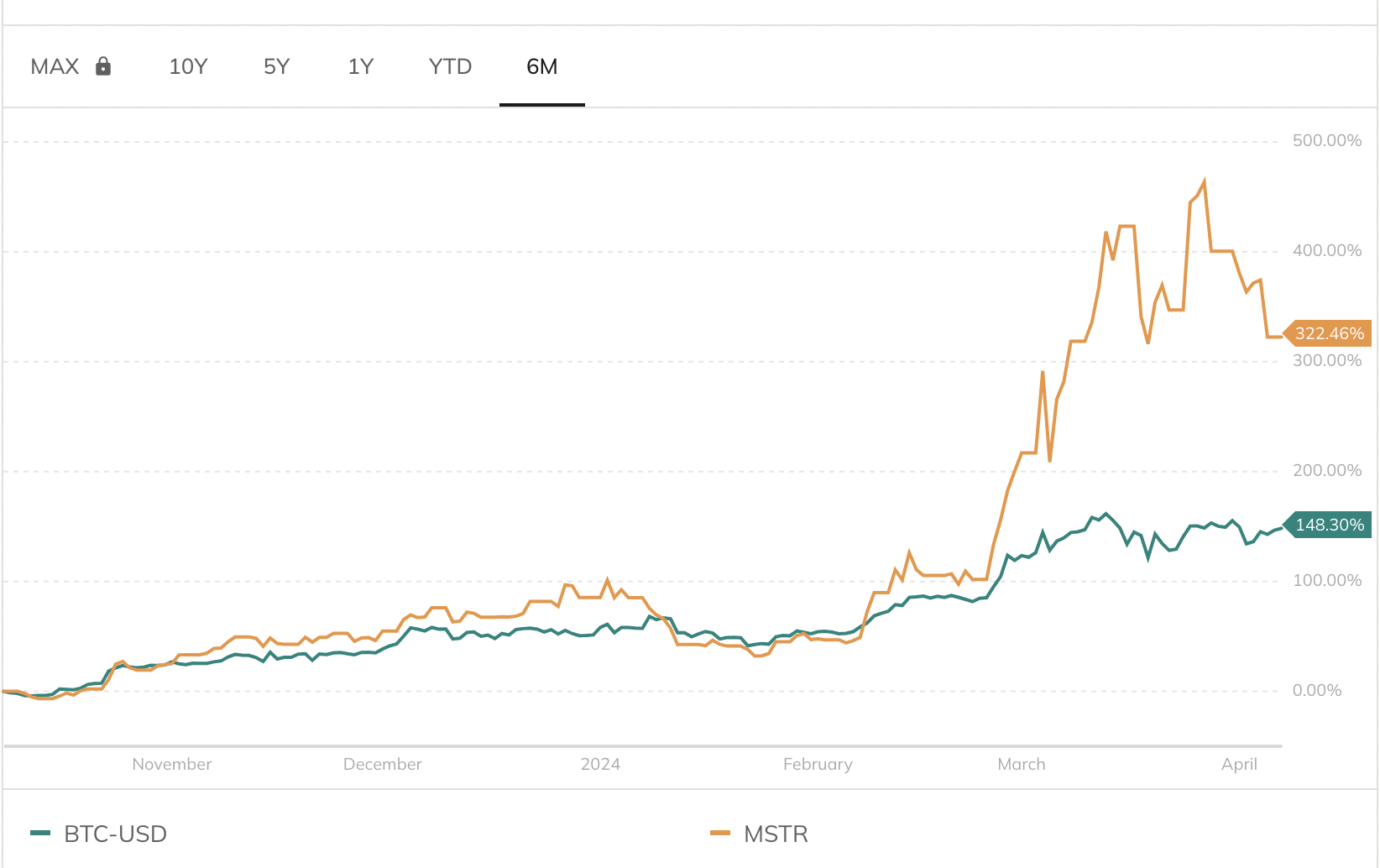

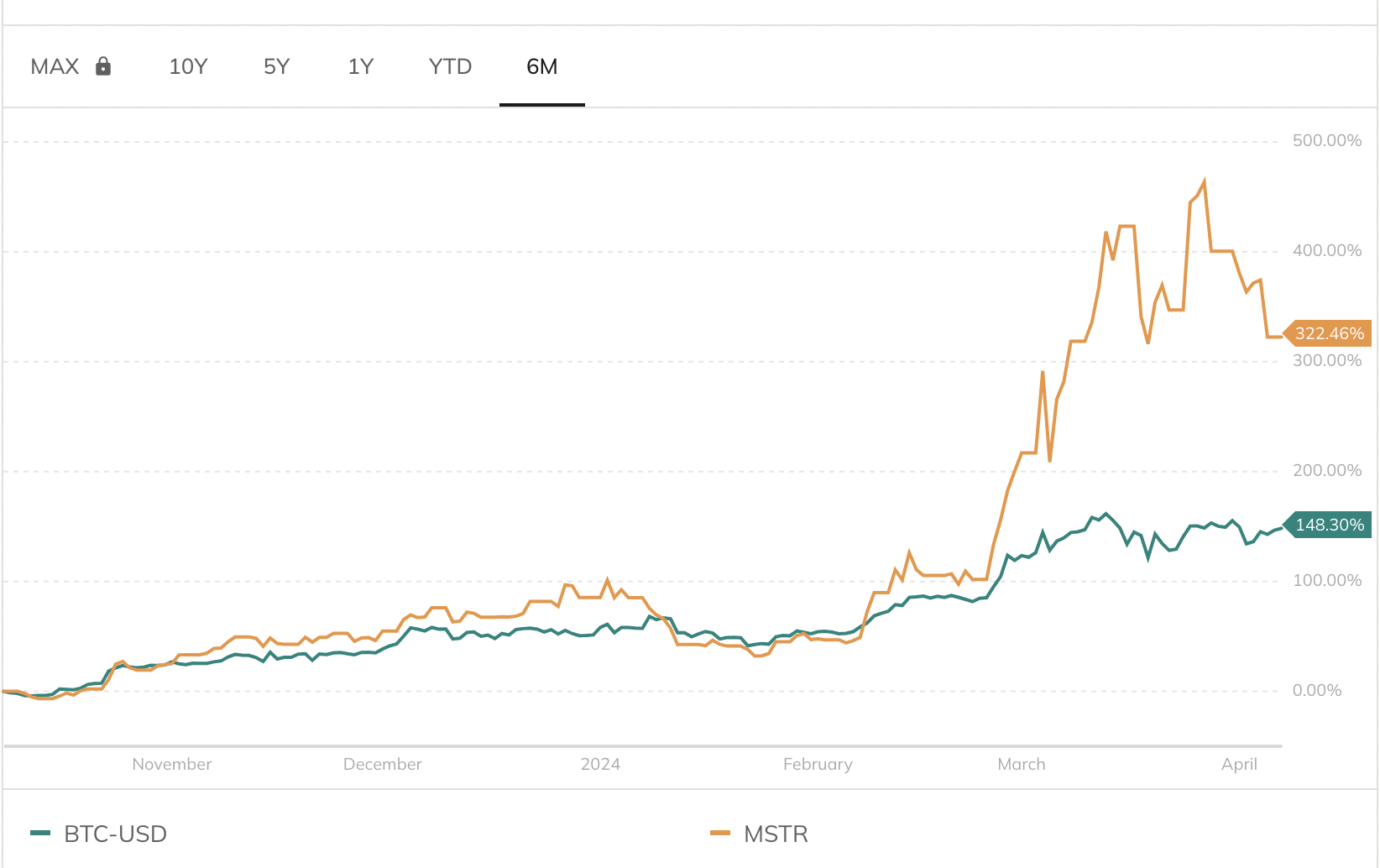

While MSTR has not seen similar growth to BTC, both assets have shown some degree of correlation over the past six months.

Source: Portfolio Lab

Read Bitcoin’s [BTC] Price forecast 2024-25

State of Bitcoin

At the time of writing, BTC was trading at $72,029.22 and the price was up 3.98% over the past 24 hours. The speed at which BTC traded had also increased during this period.

The rising speed of BTC indicated that the frequency with which BTC traded had also grown alongside the price in recent days.

Source: Santiment