- Outflows from crypto funds rose to a three-month high last week.

- While BTC recorded significant outflows, inflows into ETH-backed products exceeded $10 million.

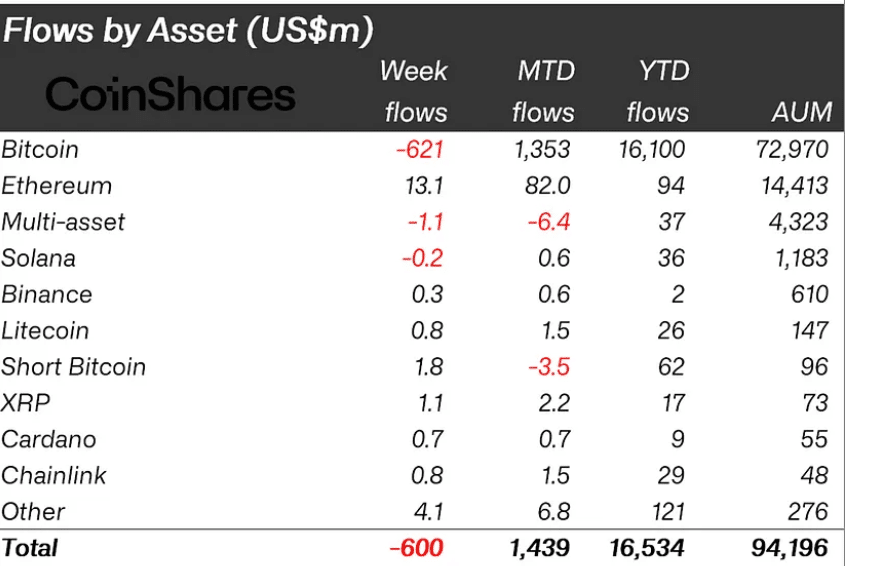

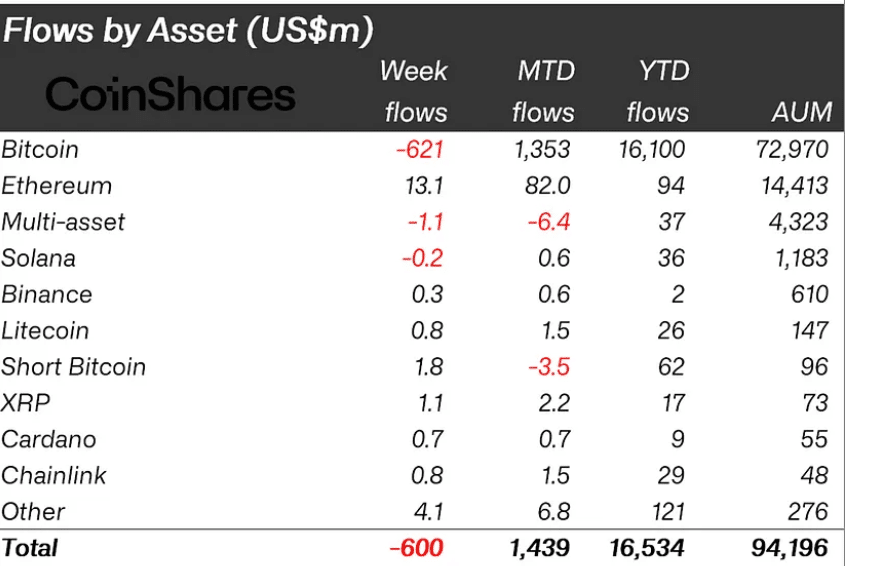

Digital asset investment products recorded outflows totaling $600 million last week, investment firm CoinShares found in its new report.

According to the report, last week’s figures represent the largest weekly outflow from cryptocurrency funds since March 22.

Source: CoinShares

This was due to “a more aggressive than expected FOMC meeting, which prompted investors to reduce their exposure to fixed assets,” CoinShares noted.

AMBCrypto before reported that after a two-day meeting, the members of the Federal Open Market Committee decided to keep interest rates between 5.25% and 5.50% for the seventh time in a row.

At the end of the period observed by CoinShares, total assets under management (AUM) for crypto-related investment products stood at $94 billion. This marked a 6% decline from the $100 billion recorded last week.

Trading volumes also declined due to the decline in trading activity during the reporting week.

CoinShares discovered that:

“Trading volumes remain lower this week at $11 billion, down from this year’s weekly average of $22 billion, but well above last year’s $2 billion per week.”

Regionally, most of last week’s crypto fund outflows came from the United States. Outflows from that region totaled $565 million, representing 94% of all amounts withdrawn from digital asset products during the period.

How did Bitcoin and Ethereum fare?

Last week, Bitcoin-backed investment products saw a recorded outflow of $621 million. This strong increase in outflows led to a decline in the year-to-date (YTD) flows of the major currencies.

At $16.1 billion at the end of the reporting period, BTC YTD flows were down 4% from the previous week.

As for short Bitcoin products, they registered inflows during that period.

CoinShares stated:

“The bearishness also resulted in $1.8 million inflows into short Bitcoin.”

Interestingly, the altcoin market fared significantly better. As noted in the report, the leading altcoin is Ethereum [ETH]recorded inflows totaling $13 million during the week under review, bringing the coin’s YTD flows to $94 million.

Other altcoins such as LDO, XRP, LINK and BNB recorded inflows of $2 million, $1 million, $800,000 and $300,000.