- FLOKI has a strong bearish outlook for the short term

- There seemed to be no buying pressure and market participants feared more volatility

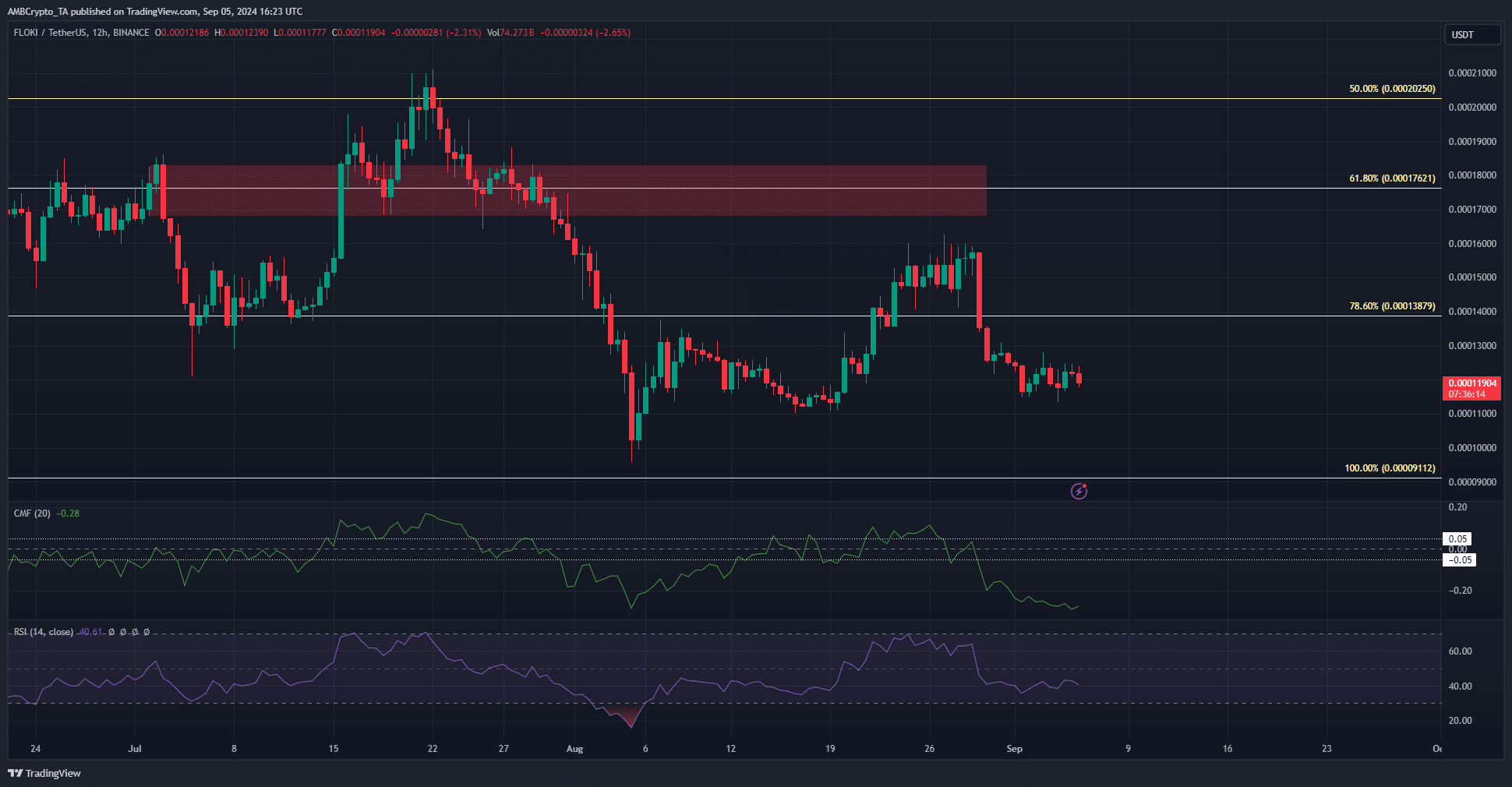

FLOKI bulls had failed to regain the $0.000176 zone. They were not strong enough to retest the resistance zone and fell short of their target at the $0.00016 level.

Source: FLOKI/USDT on TradingView

The CMF fell well below -0.05, indicating that significant capital flows have disappeared from the market in recent days. The RSI on the 4-hour chart was also in bearish territory, and more losses seemed likely for the memecoin.

Hence the question: do the on-chain metrics match these findings?

The signals were bearish, but there was some hope for holders

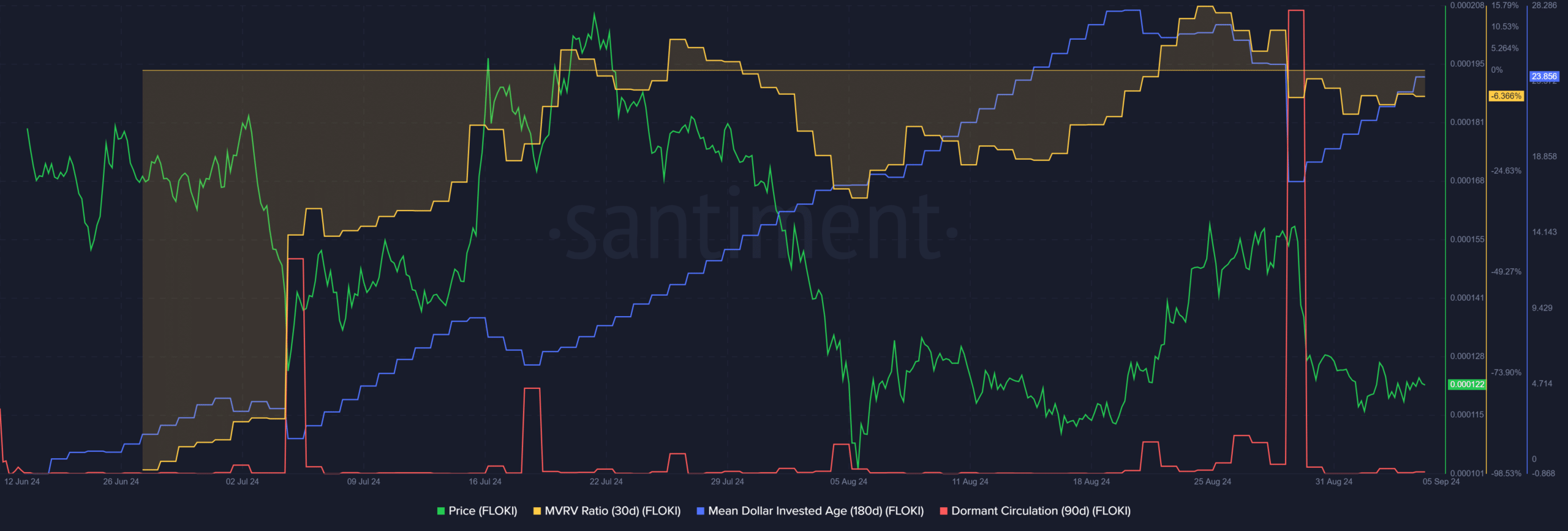

On August 29, dormant circulation experienced a dramatic increase. This signaled a wave of symbolic moves likely for sales purposes. At the same time, the price fell from $0.000157 to $0.000135.

The short-term MVRV, which was in positive territory, was also forced to withdraw. This showed that holders suffered a small loss, with the recent price increase culminating in a major sell-off.

The average invested age of the dollar also saw a decline, indicating that old coins are coming back into circulation. After showing an upward trend for almost three months, this was a good sign. There was room for FLOKI to make profits after the recent reset. As things stand, buying pressure has not yet favored the bulls.

FLOKI sentiment deteriorated after the retracement

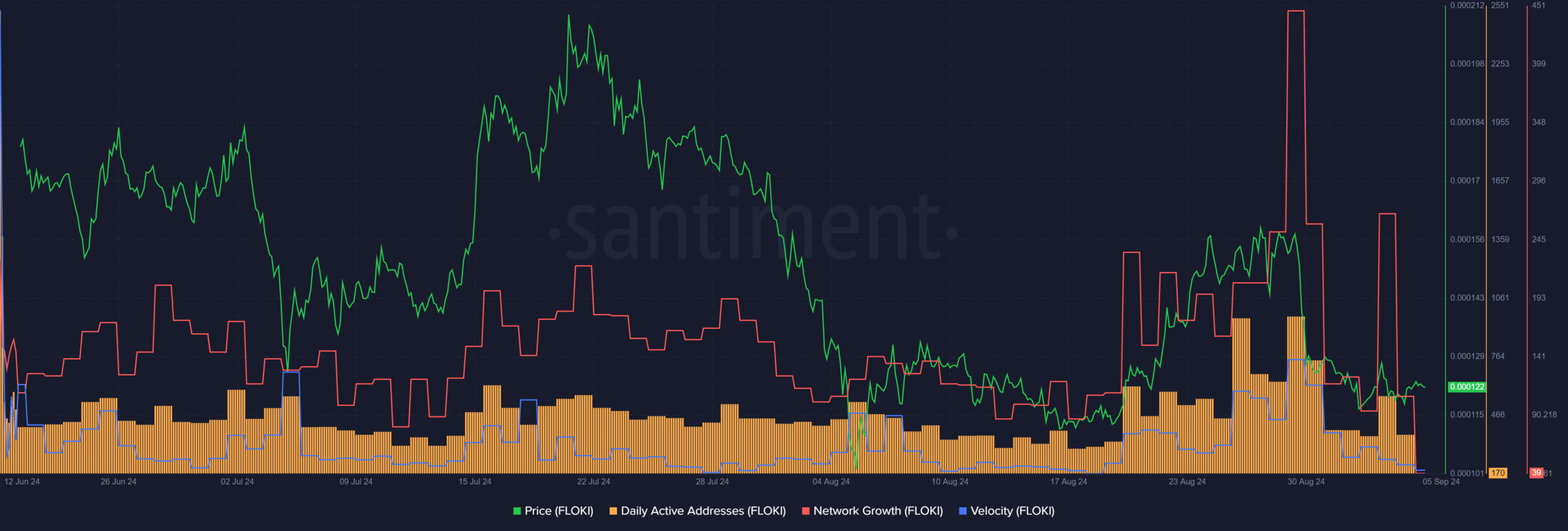

In the last week of August, when FLOKI made strong short-term gains, the value of the number of daily active addresses increased steadily. This meant greater usage and potential demand. Furthermore, token velocity also increased, indicating increased usage in transactions.

This upswing dissipated within the span of a few days as bearish sentiment took over the market and drove participants away. Network growth was not hit as hard.

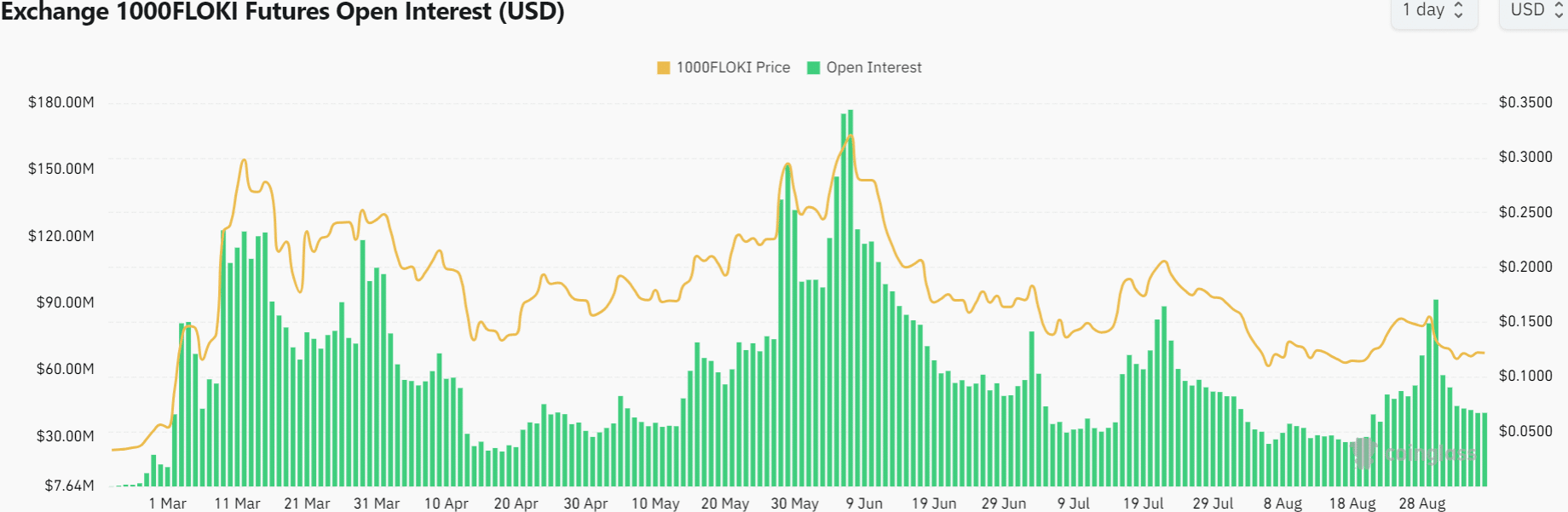

The Open Interest saw a sharp increase even after FLOKI reached a local high and started to retreat. This was a sign of heavy short-selling in the markets.

Realistic or not, here is FLOKI’s market cap in BTC terms

Since then, the OI has fallen, showing that bearish sentiment prevailed.

Overall, the short-term metrics and indicators were in favor of the sellers. The decline in the average age invested in dollars seemed to have only a small positive effect.