In a recent series of tweets, Vetle Lunde, Senior Analyst at K33 Research, took a deep dive into the potential impact of the US Bitcoin (BTC) spot ETFs. Lunde’s analysis suggests that the broader market may be significantly underestimating the transformative power of these financial instruments.

Lunde’s claim is rooted in five cores reasons. He opened with a bold statement: “The market is wrong — dramatically underestimating the impact of US BTC ETFs (and ETH futures-based ETFs).”

Why the market is wrong about Bitcoin

First, Lunde believes the current climate is ripe for the adoption of US spot ETFs, suggesting that the odds have never been better. As NewsBTC reported, Bloomberg experts Eric Balchunas and James Seyffart recently increased their Bitcoin spot ETF approval chances following the Grayscale verdict to 75% this year, and 95% by the end of 2024.

Second, Lunde pointed out that the price of BTC has returned to pre-BlackRock levels. The third reason revolves around the potential competition and the simultaneous launch of multiple US spot ETFs. Lunde expects that, if approved, these could lead to robust inflows, potentially exceeding both BITO and Purpose’s initial trading days.

For context, he emphasized that Purpose saw an inflow of 11,141 BTC, and in the wake of that, subsequent ETF launches in Canada resulted in a whopping 58,000 BTC in inflows in just four months. Given the size of the US market compared to Canada, the inflow potential is significantly higher.

The fourth reason presented by Lunde is based on historical data from the past four years. He highlighted a noticeable correlation between the strong inflow of BTC investment vehicles and rising BTC prices. This relationship becomes even more apparent during periods of extreme inflows, which have historically contributed to significant market upturns.

The last crucial point for Lunde is that the market got rid of excess debt on August 17, as NewsBTC reported.

By the numbers

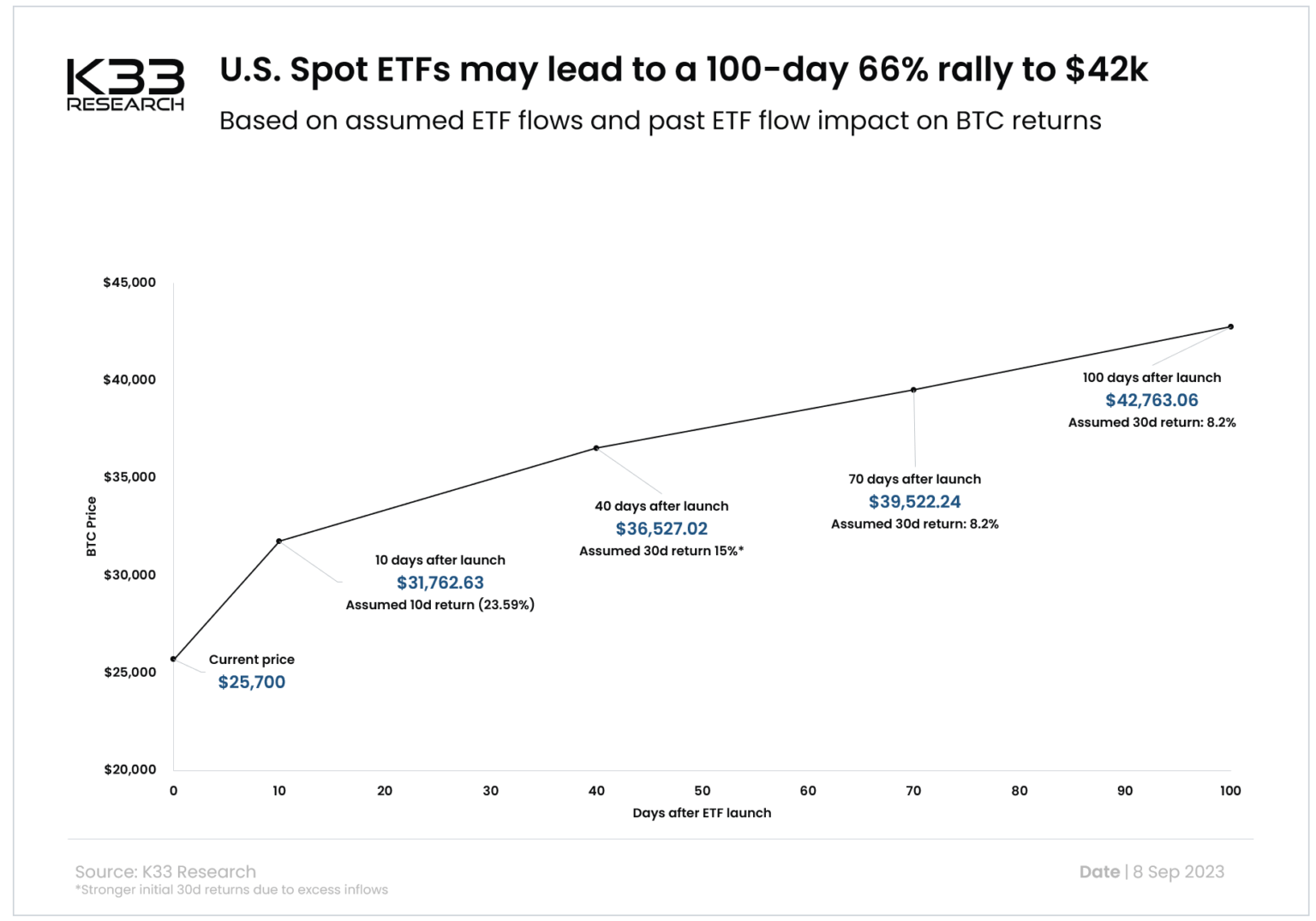

In conclusion, the research firm states that US BTC spot ETFs could see an inflow of at least 30,000 BTC in the first ten days. Over a four-month timeframe, combined inflows into BTC investment vehicles could range from 70,000 to 100,000 BTC, driven by US spot ETFs and growing inflows to ETPs in other countries.

Based on these power assumptions and data from the past four years, Lunde suggests a potential BTC rally of 66%, targeting a price of $42,000. However, he also cautioned that this projection is based on a “naive assumption” and does not take into account other market-moving events.

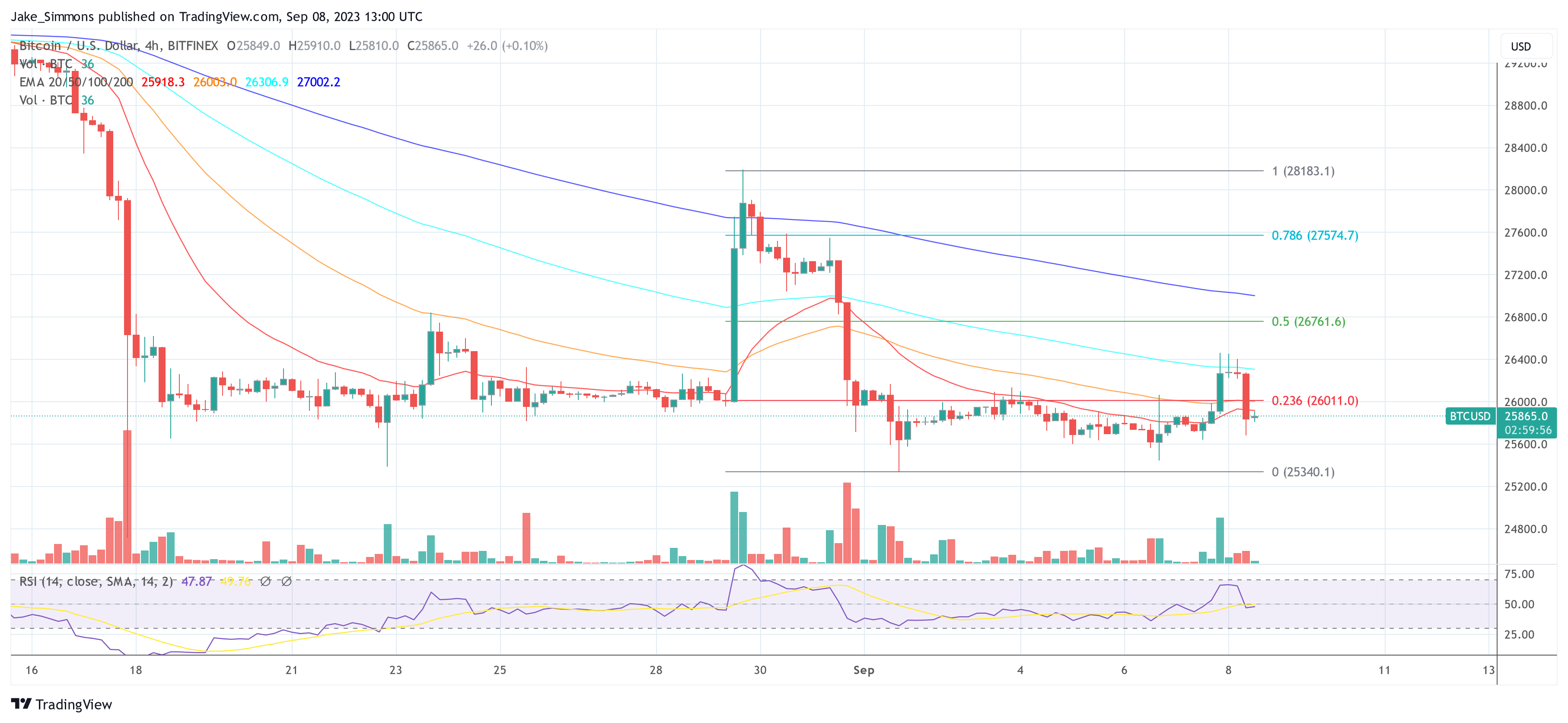

At the time of writing, BTC was trading at $25,865.

Featured image from iStock, chart from TradingView.com