Raoul Palthe co-founder and Chief Executive Officer (CEO) of Real Vision Group, has predicted that the global crypto market will reach a market capitalization of $100 trillion. The financial expert has maintained a strong bullish position on the future of the sector, outlining several reasons why he believes the market will rise 44x from its current market capitalization.

Related reading

Crypto market reaches $100 trillion market cap

In a recent one YouTube interview on the Blockworks Macro channel, Pal predicted that the total market capitalization of the crypto industry In less than a decade, the economy could grow from $2.5 trillion to $100 trillion. The financial expert revealed that if the market maintains a stable growth rate and continues to develop at a rapid pace, the market capitalization could increase by up to 44x.

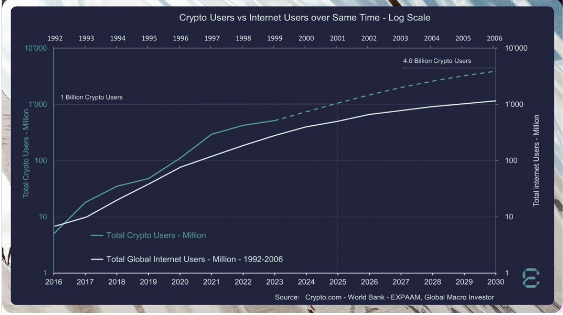

In an earlier message on X (formerly Twitter), Pal revealed that assets such as cryptocurrency and technology are performing exceptionally well during secular adoption-driven trends. He emphasized that this growth rate was twice as high speed of internet adoption when comparing active wallets and IP addresses.

The analyst has based his $100 trillion crypto market cap on the adoption rate of the crypto industry, highlighting that the increasing number of cryptocurrency users will have a huge impact on the value of the market. Moreover, in the interview, Pal advised not to take unnecessarily investment risks when dealing with cryptocurrencies.

He revealed that the goal should be to maximize investment opportunities without getting caught up in tribal or philosophical debates. He emphasized that the cryptocurrency market may be one Market cap of $100 trillionthere is no need to take excessive investment risks. Instead, investors must balance risk and opportunity and use the right portfolio management strategies to effectively capture the majority of the market’s gains.

Market liquidity could continue into 2025

During the YouTube interview, Pal predicted that the current market liquidity cycle could continue until 2025. The CEO of Real Vision revealed that there has been a remarkable cyclicality in the economy since 2008 global liquidity. While delving into the nuances of what he calls ‘The Everything Code’, Pal revealed that the current market cycle is largely driven by the growth of market assets such as equities. cryptocurrency and technology.

He noted that the market was shifting to a “Macro summer”, characterized by liquidity growth and often associated with the “Banana zone.” According to Pal, the banana zone is a period of significant upward price movement when market indicators turn bullish, signaling the start of a new bull run.

Related reading

The financial expert emphasized that the global liquidity cycle generally exhibits a predictable pattern that affects economic activities. He highlighted several factors that could also influence the cryptocurrency market cycle, including the upcoming ones US presidential election and a potential interest rate reduction by the Federal Reserve.

Featured image from Pexels, chart from TradingView