- FIL broke out of a falling wedge, signaling a bullish reversal

- Market sentiment remains cautious as technical indicators showed mixed signals of strength

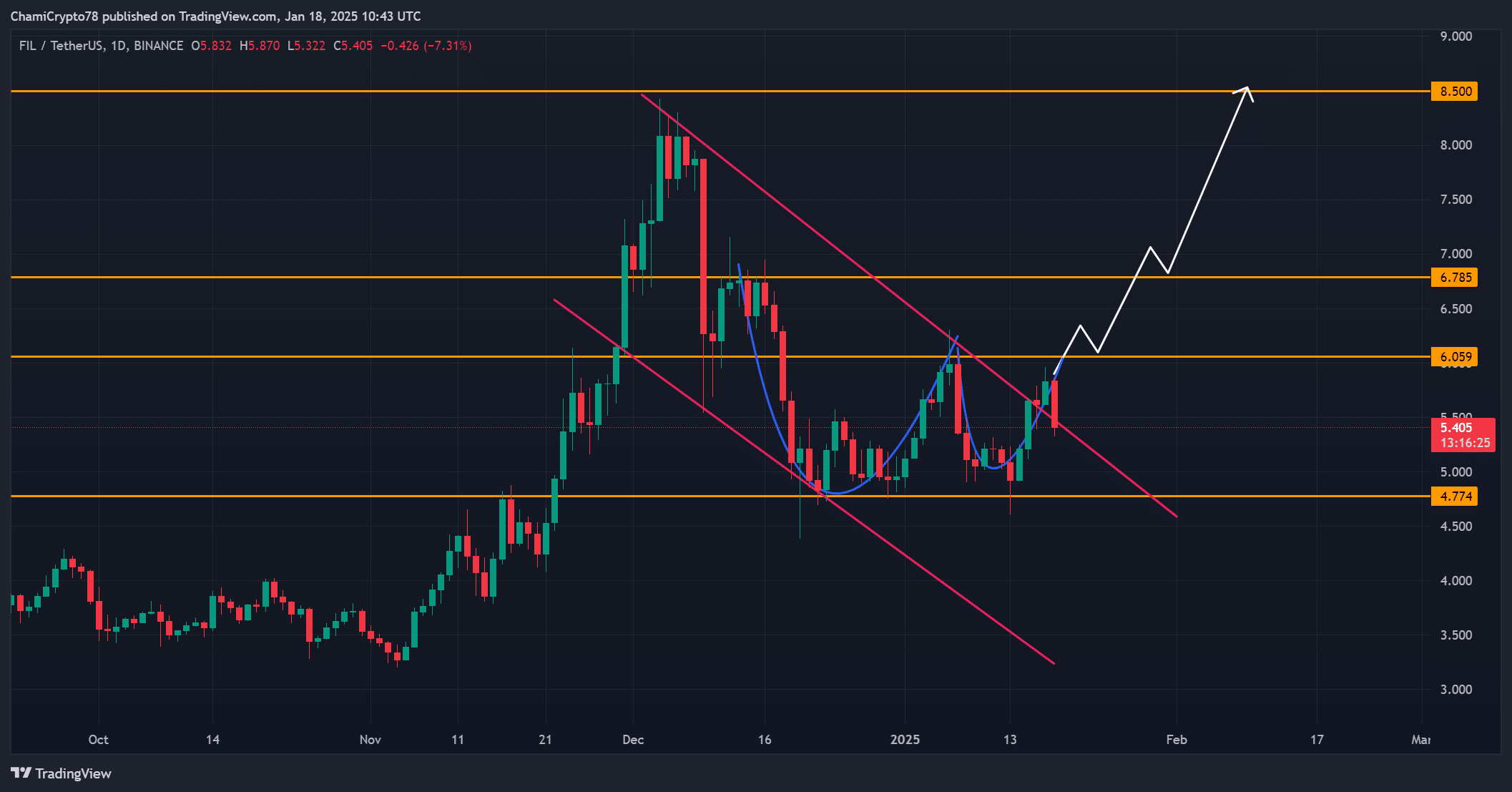

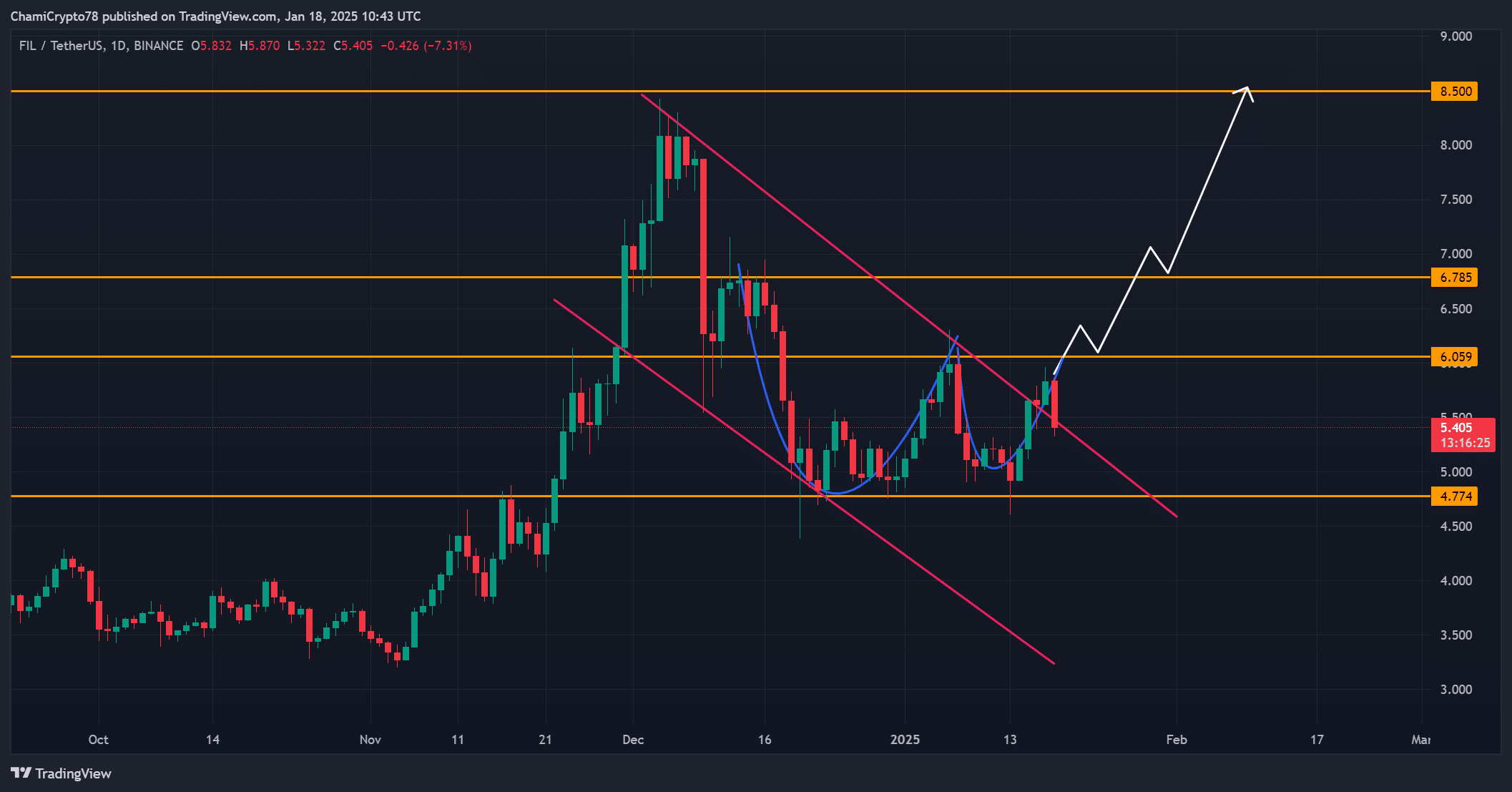

Filecoin [FIL]at the time of writing, that seemed to be the case have broken out of the falling wedge pattern on the 8-hour chart, signaling a possible shift in momentum.

However, despite this breakout, FIL had a press-time price of $5.40, with the crypto down 7.37%. This raises concerns about whether this bullish move can sustain. Can the market regain confidence and push FIL higher?

Will FIL bounce back after breaking the falling wedge?

FIL’s price action showed a significant technical breakout from the falling wedge pattern, which typically signals a bullish reversal. However, after reaching $5.87, the price returned to $5.40 – a sign of hesitation among traders.

Immediate resistance was at $6,059 – a key level to cross for further gains. On the other hand, $4,774 seemed to serve as a solid support level, one that could prevent a deeper correction.

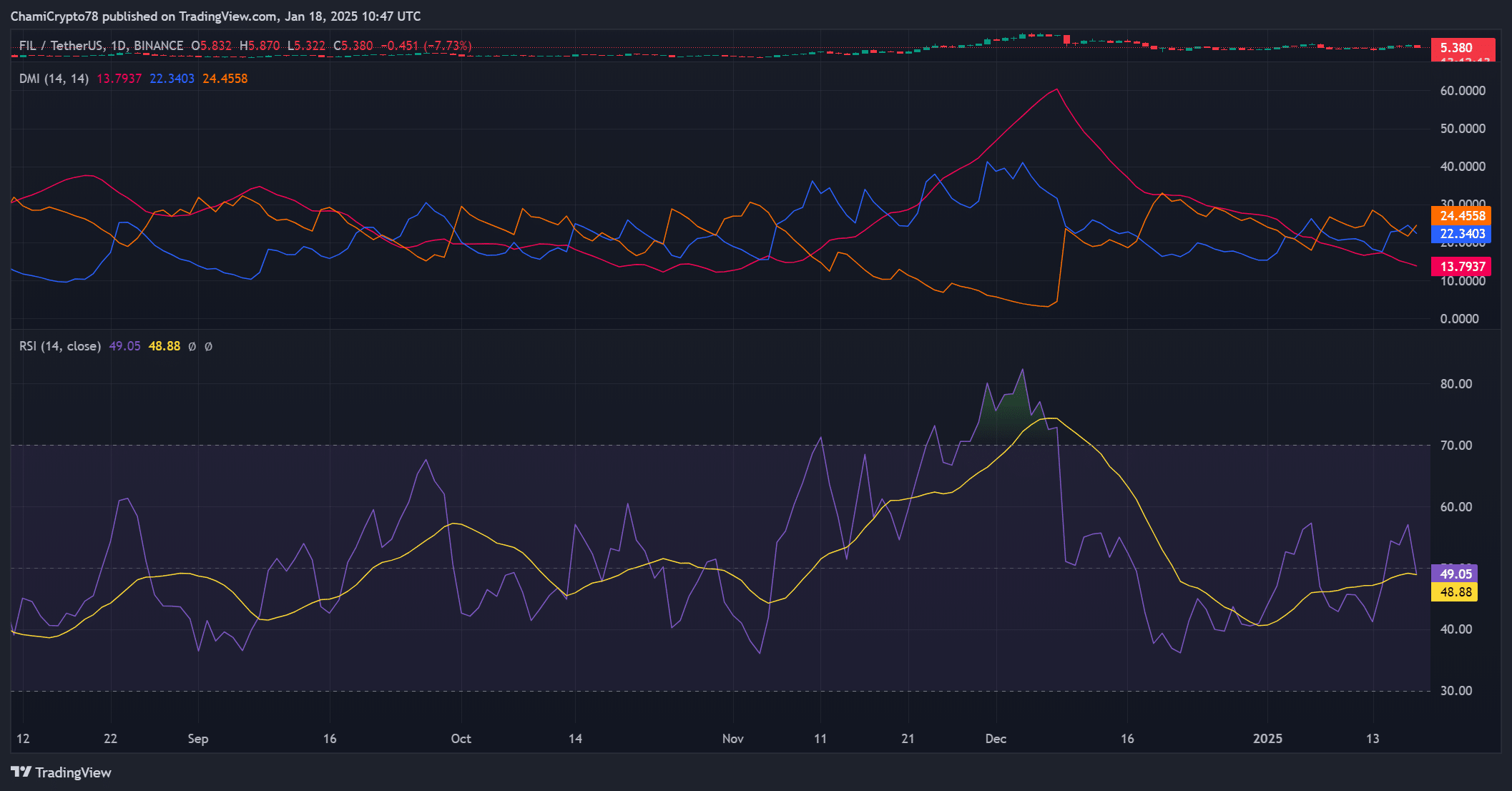

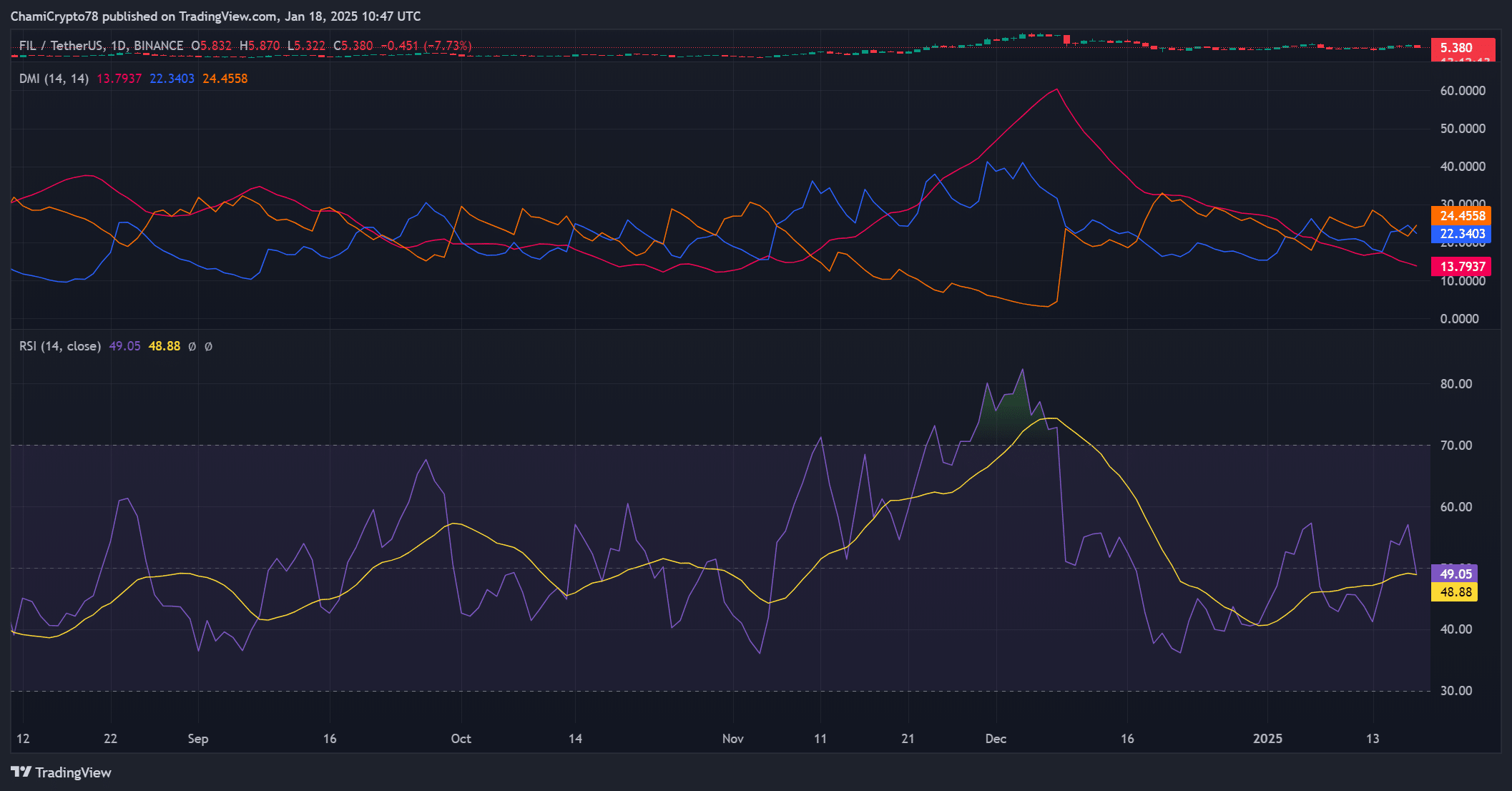

Source: TradingView

How do Binance funding rates determine sentiment?

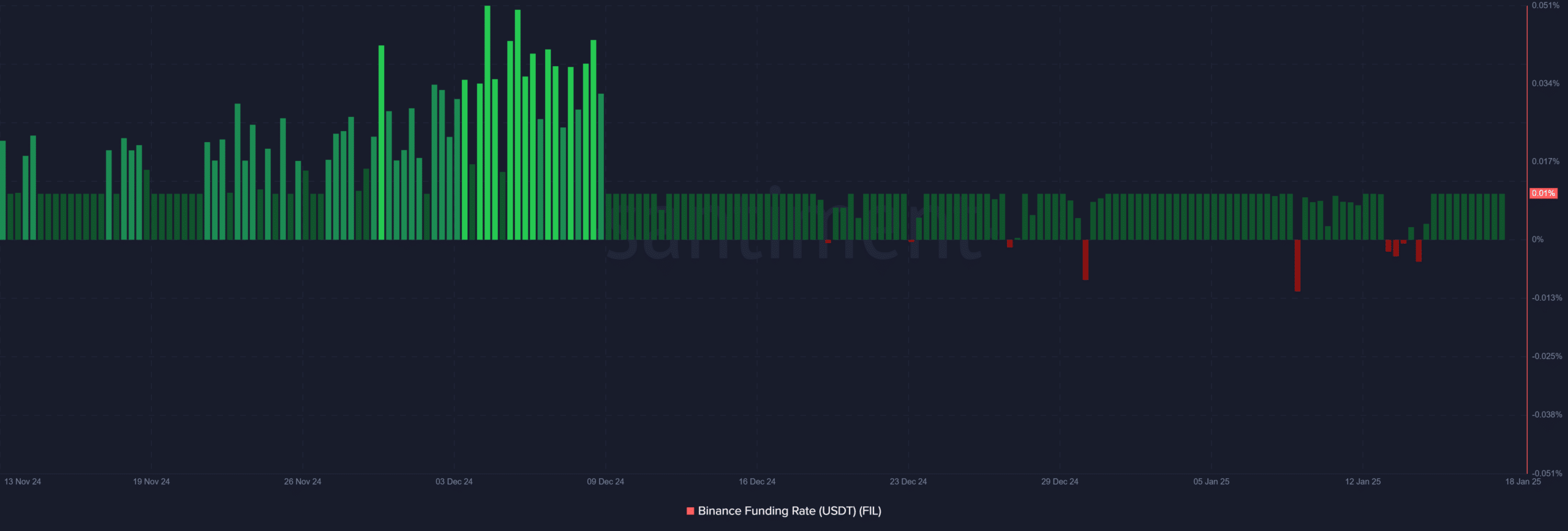

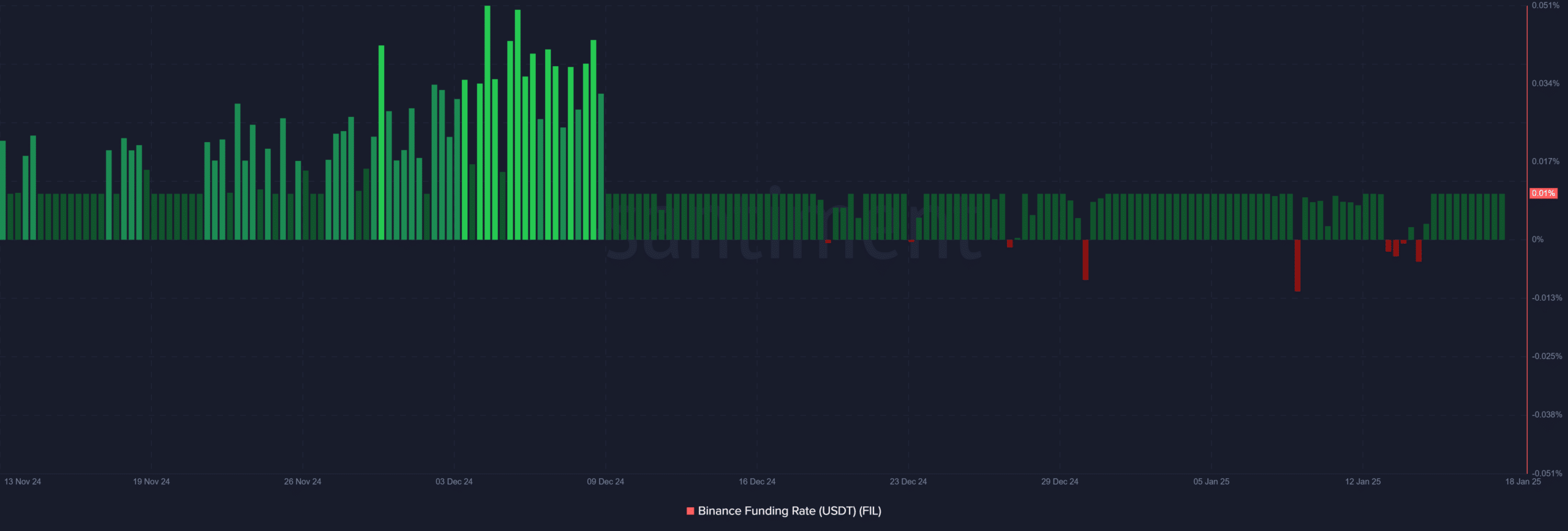

Binance funding rates for FIL were slightly positive at 0.01%, reflecting cautious optimism in the market. While this indicated that traders were slightly more bullish than bearish, the absence of significant interest rate spikes also indicated a lack of conviction.

Therefore, for FIL to rise meaningfully, financing rates need to rise higher to reflect increasing demand. Otherwise, the market could remain stagnant in the short term.

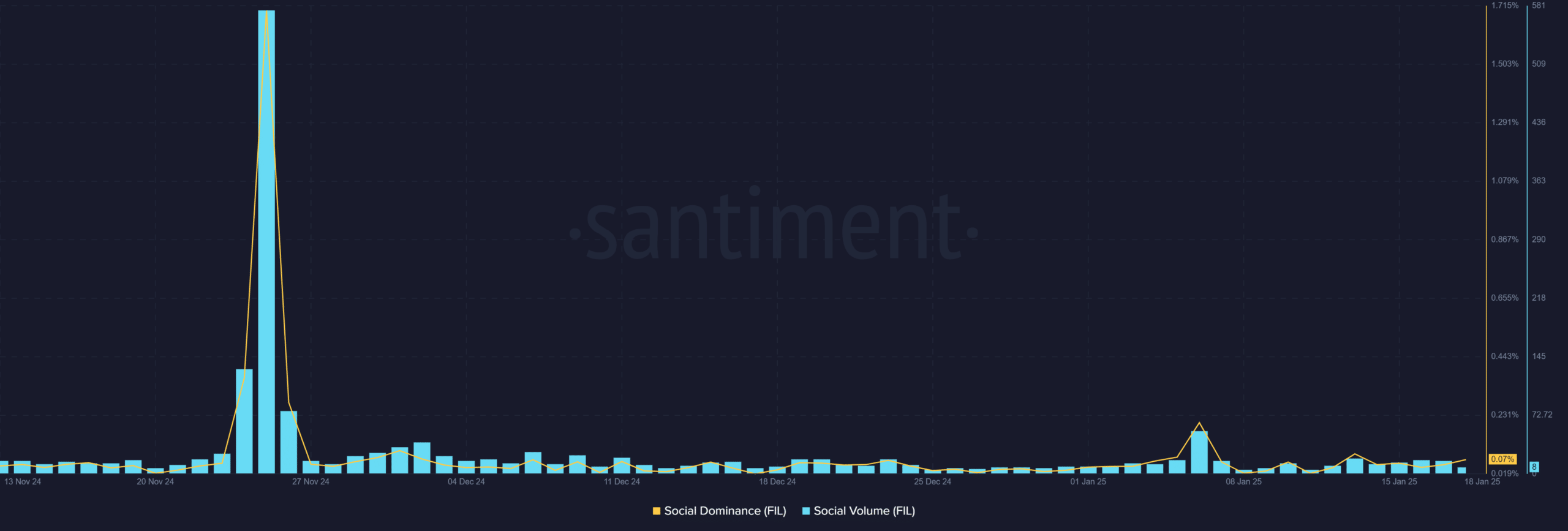

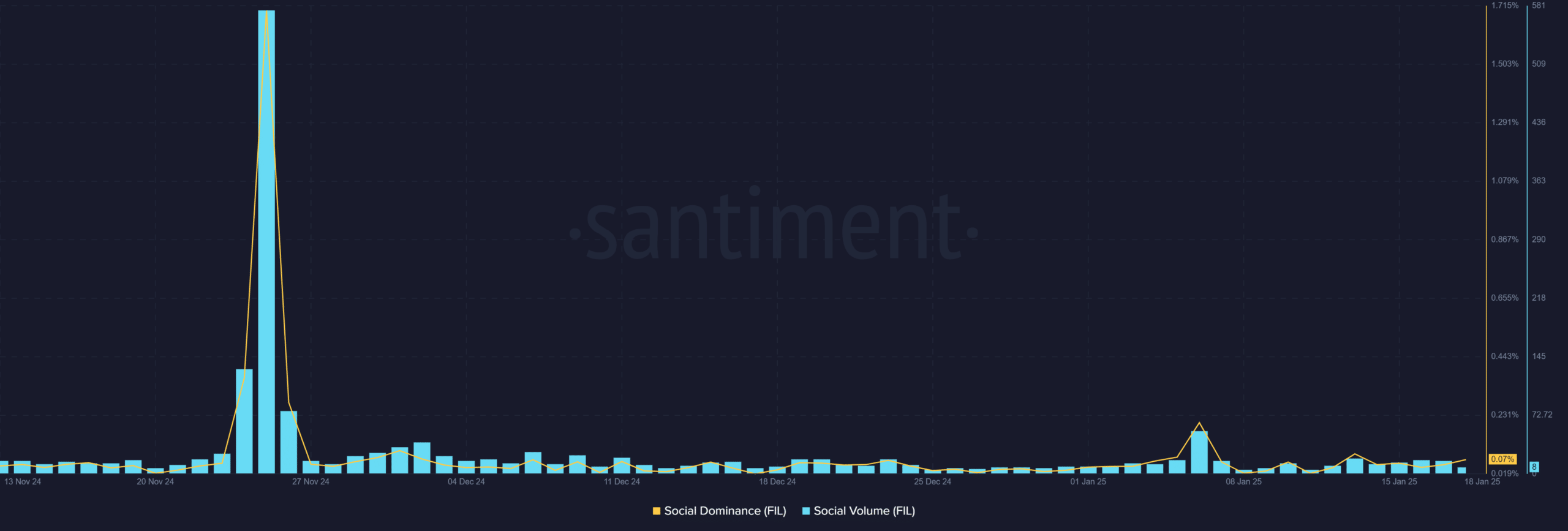

Source: Santiment

FIL’s social metrics lack momentum

However, despite the outbreak, FIL’s social volume and dominance remain surprisingly low, with only eight mentions recorded. This muted social activity highlighted the limited involvement of retailers, which often fuels market upturns.

Furthermore, the low social dominance suggested that FIL is not yet on the radar of the broader crypto community. For continued bullish momentum, social metrics need to improve to draw broader attention to FIL’s potential.

Source: Santiment

Technical indicators point to market hesitation

FIL’s technical indicators showed a mixed picture. The DMI showed -D at 24.45 and surpassed +D at 22.34 – indicating slight bearish dominance. Moreover, the ADX at 13.79 highlighted a weak trend, while the RSI at 49.05 indicated neutral momentum.

Therefore, Filecoin needs stronger buying pressure to establish a clear bullish trajectory and regain investor confidence.

Source: TradingView

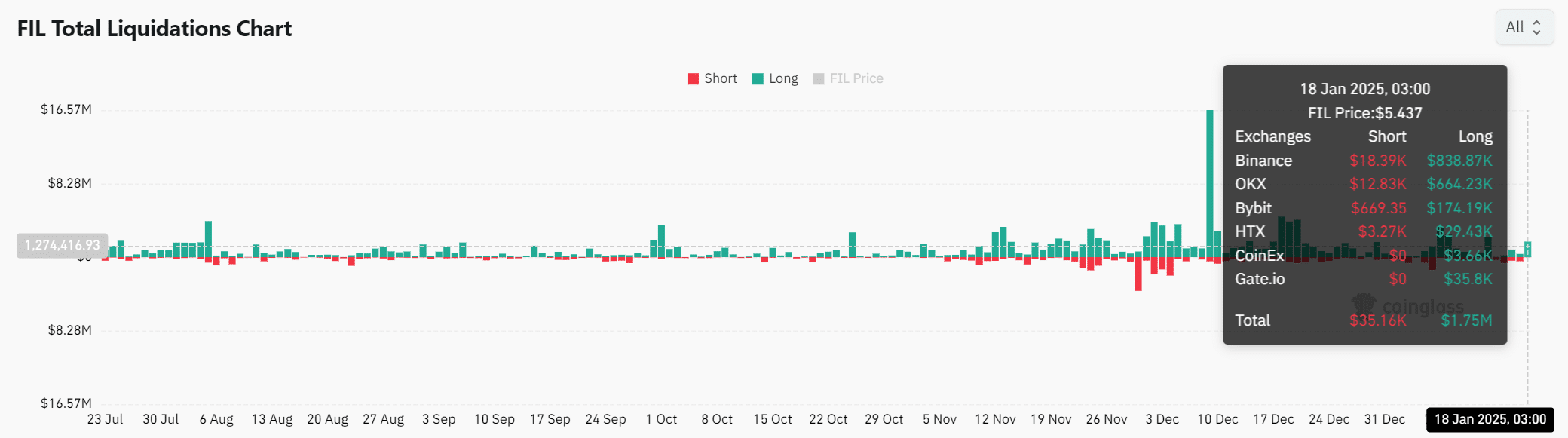

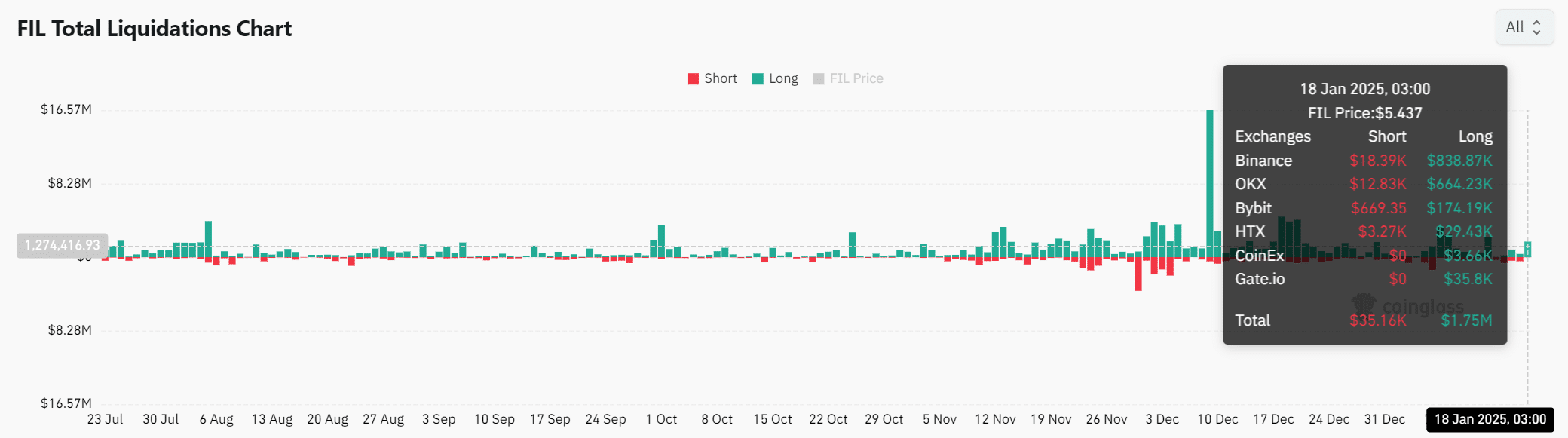

Market sentiment reflects cautious positioning

Finally, Filecoin Open Interest fell 5.79% to $324.7 million, indicating declining leverage. Moreover, total liquidations amounted to $1.75 million, which favored longs, underscoring traders’ lack of confidence.

While declining Open Interest indicated reduced market activity, a reversal here could spark renewed interest in Filecoin’s potential upside.

Source: Coinglass

Read Filecoin’s [FIL] Price forecast 2024–2025

Can FIL rally further?

Filecoin’s breakout is encouraging, but its ability to recover depends on breaking the critical resistance at $6,059 and gaining stronger market participation.

Without higher funding rates, better social metrics and more open interest, FIL could struggle to maintain its bullish momentum. So, while the breakout is promising, further upside potential will depend on renewed buying pressure and market enthusiasm.

![Filecoins [FIL] a falling wedge breakout could push the altcoin THIS way!](https://bitcoinplatform.com/wp-content/uploads/2025/01/Erastus-53-min-1000x600.png)