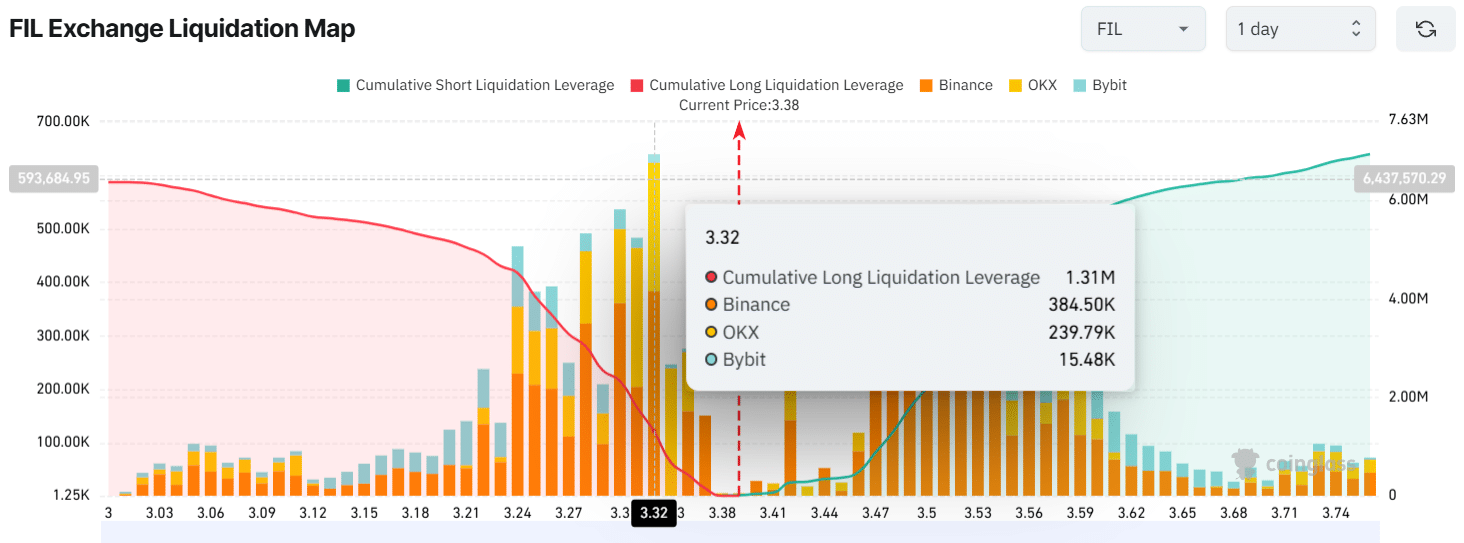

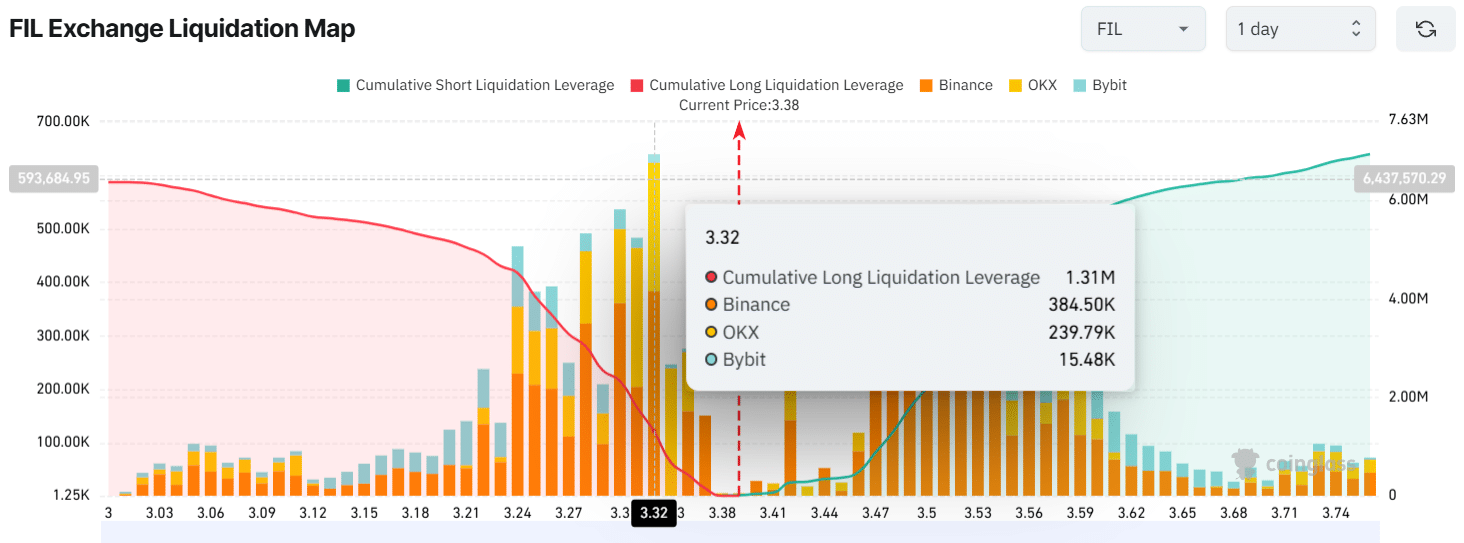

- Intraday traders were delivered too much at the level of $ 3.32 at the bottom and the $ 3.42 at the top.

- On-chain statistics revealed that exchanges have witnessed an outflow of Fil-Tokens worth $ 1.30 million.

In the midst of continuous market uncertainty, large cryptocurrencies experienced a remarkable price decrease that influence the market sentiment.

In this environment, the Top Decentralized Physical Infrastructure (Depin) Crypto project, Filecoin [FIL]Has reached a crucial level of support and is ready for a considerably upward momentum.

Current price momentum

Filecoin acted nearly $ 3.37 at the time of the press and registered a modest price win of 0.50% in the last 24 hours.

In the same period, however, trade volume increased by 16%. The increase indicates a growing interest rate from traders and investors because of the formation of bullish price action.

Filecoin price promotion and upcoming levels

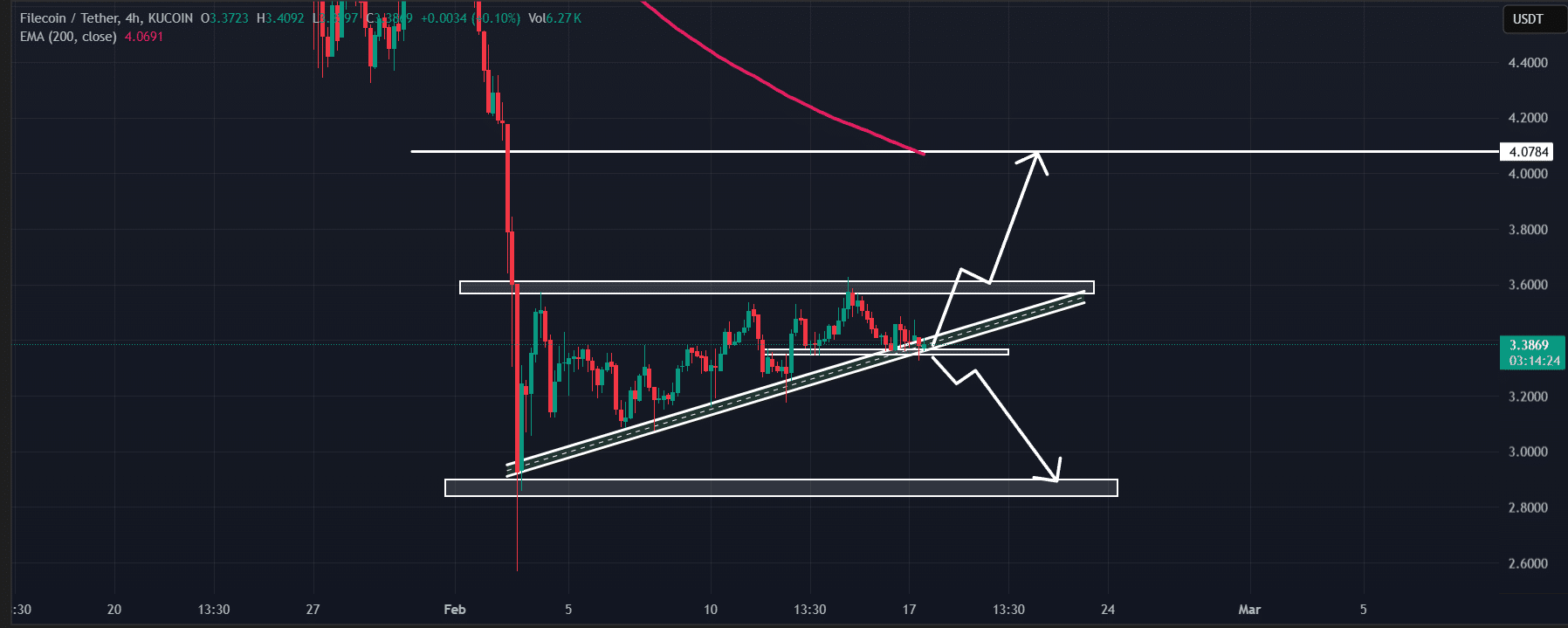

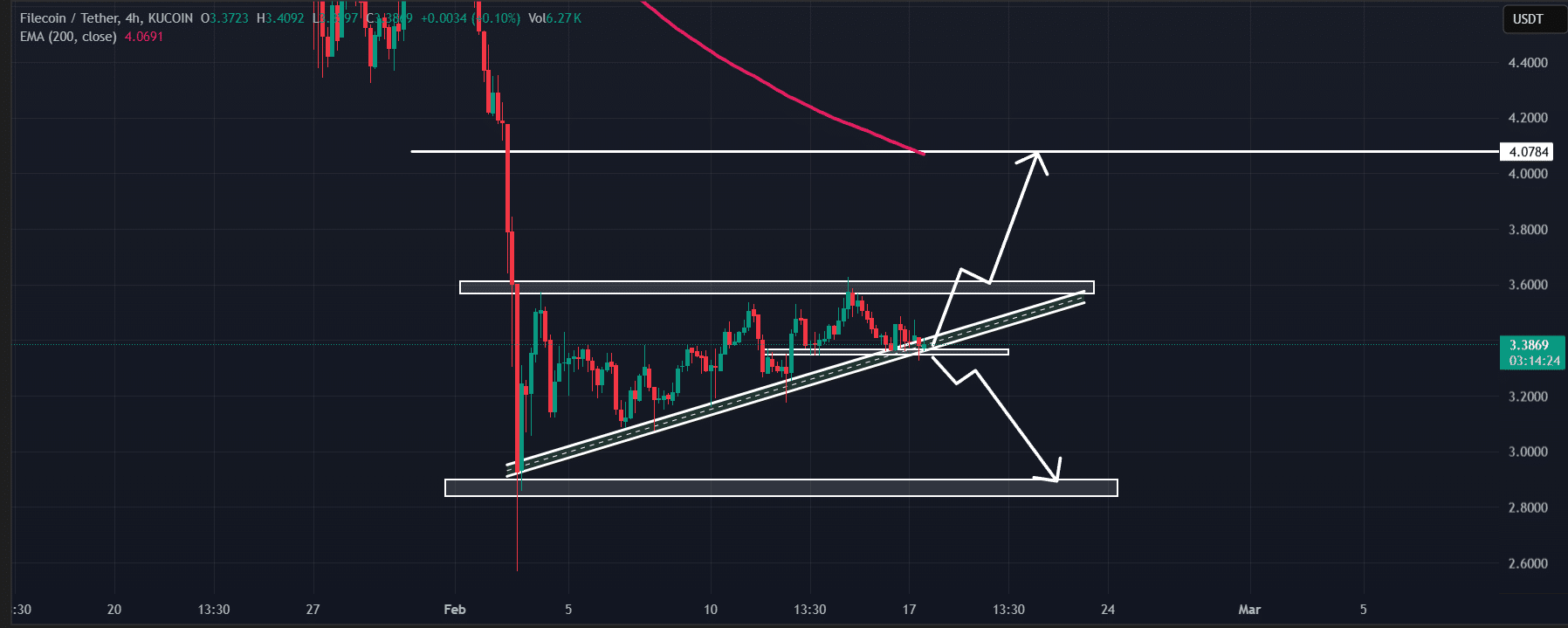

According to the technical analysis of Ambcrypto, Filecoin was an increasing triangular pattern in the four -hour period.

In the midst of the recent fall in price, however, the price of the actual has reached the rising trendline support. The trend made this a pattern in textbook style, creating a make-or-break situation for the active creation.

Source: TradingView

Based on recent price promotion, if FIL $ 3.38 applies, it can rise by 20% to reach $ 4.05. However, if Fil does not hold this level and closes a four -hour candle under $ 3.30, it can fall by 14% to reach $ 2.92.

At the time of writing, Fil traded under the 200-day exponential advancing average (EMA), which indicates a downward trend.

Bullish on-chain statistics

Despite the critical situation, intraday traders gambled in the long positions of Filecoin, as reported by the on-chain analysis company Coinglass.

Data showed that intraday traders who were long positions with over huts at the level of $ 3.32, a total of $ 1.31 million in long positions. In the meantime, traders who bet on short positions were too much supplied at $ 3.42, with $ 268,620 in short positions.

These livered positions indicate that bulls are currently actively dominating despite negative market trends.

Source: Coinglass

In addition to the participation of intraday traders, long-term tokens holders collect. Data from Spot -entry/outflow showed that stock markets witnessed an outflow of Fil -Tokens worth $ 1.30 million in the last 24 hours.

This suggests accumulation by investors and long -term holders.

Given the current market sentiment, such outcomes of trade fairs can cause purchasing pressure and further stimulate upwards momentum.