- The FET remained flat in October, but the bulls caused rates to consolidate.

- Now it’s primed for an outbreak if the right conditions arise.

The market was buzzing with post-election hype as investors diversified to limit risks. This has driven Bitcoin[BTC] to a new all-time high of $77,000. AI tokens also reaped rewards, posting impressive weekly gains, with many seeing double-digit increases.

However, Artificial Superintelligence Alliance [FET] remained consolidated despite a 15% gain this week. At the time of writing, it was trading at $1.42, still below the $2 target.

Typically, a bull rally like the current one would position FET for a breakout from the four-month slump. However, its lagging performance has caught the attention of AMBCrypto.

Is FET ready for a rebound?

Interestingly, the FET has been on a downward trend since October. Despite Bitcoin’s 5% rise, which closed the month around $72,000, it had little to no impact on FET’s price movement.

One factor that has contributed to this is the memecoin-led ‘supercycle’, which has seen heavy liquidity flow into meme-based tokens. For example, DOGE posted an impressive daily gain of 11%.

Unlike previous cycles, this one is characterized by a more balanced capital allocation. Small-cap tokens are also showing double-digit gains, a trend that FET bulls may want to capitalize on, according to data from CoinMarketCap.

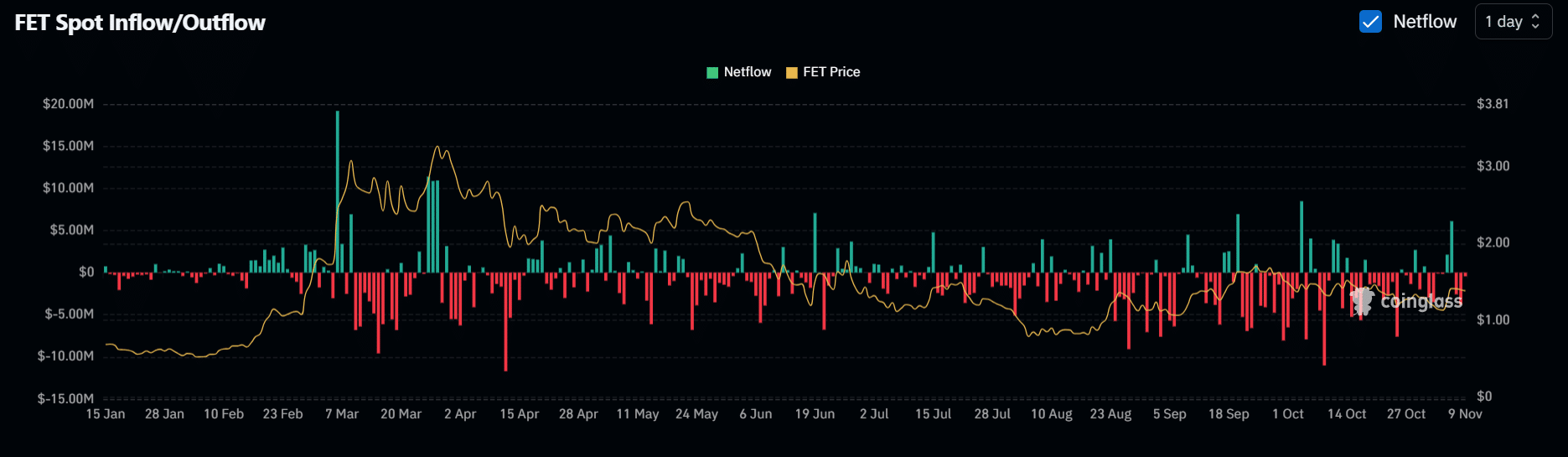

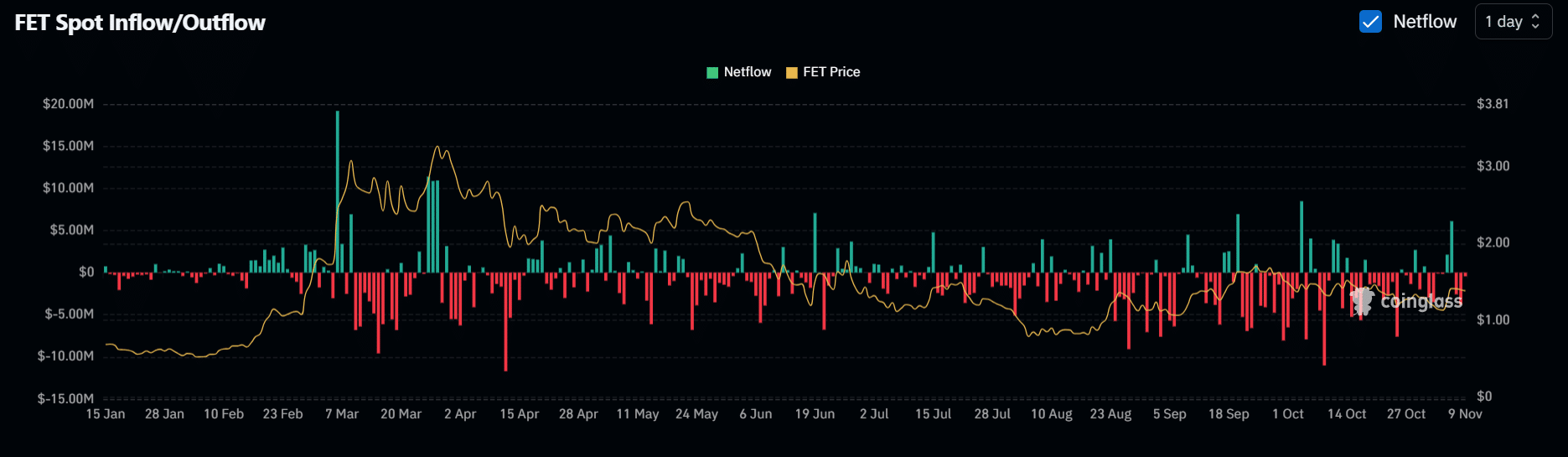

Source: Coinglass

Since mid-June, FET bulls have made four attempts to break the $0.17 resistance, entering an accumulation phase, as shown by on-chain data.

About a month ago, investors withdrew about $11 million worth of FET tokens from the exchanges. This helped keep the FET in a stable range and mitigate potential pullbacks.

However, despite these aggressive buyouts, the expected impact on FET’s price has yet to materialize – pointing to a possible thirdparty influence that can counteract the bullish momentum.

A short bias could derail the rally

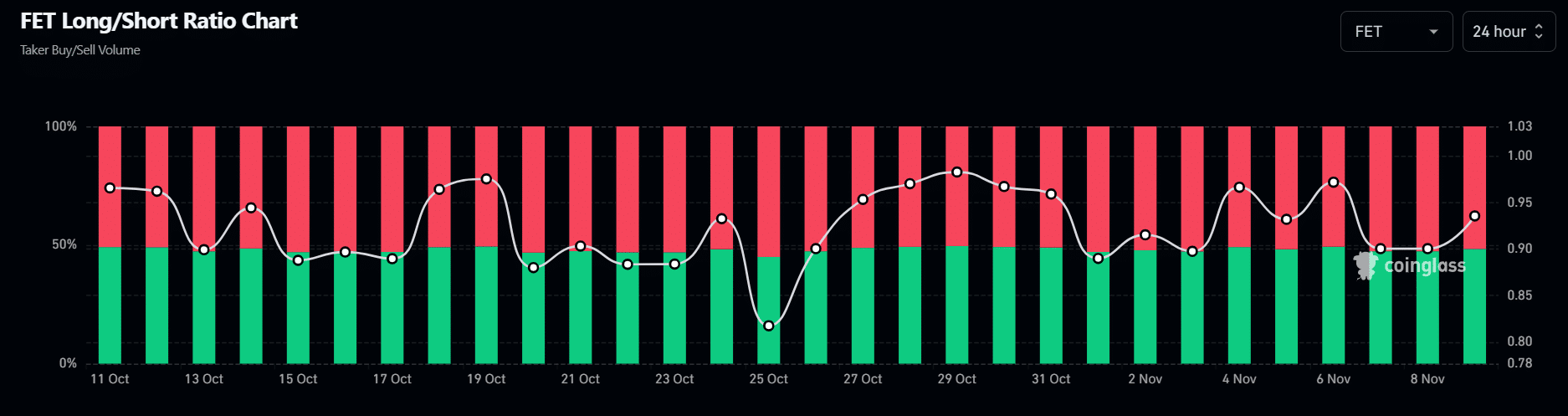

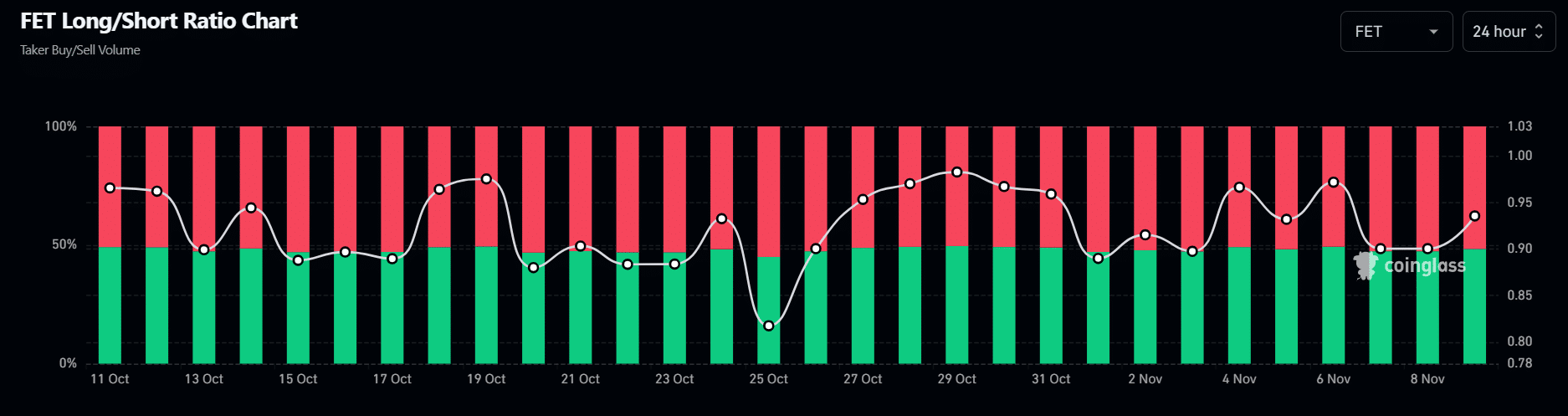

In addition to inconsistent order book activity from large investors, FET’s breakthrough largely depends on the derivatives market, where there is a clear bias towards shorts.

Since October, short sellers have dominated the FET futures market, acting as a major source of resistance.

There’s a twist, though: a large number of short positions could quickly reverse if market momentum turns against them. And there is no better time than now.

Source: Coinglass

As previously mentioned, investors were diversifying their portfolios, with many focusing on small-cap tokens. This trend is notable, especially as BTC approaches a risk zone.

Read the Artificial Superintelligence Alliance’s [FET] Price forecast 2024–2025

While spot traders targeting the dip is a bullish sign, it may not be enough to trigger a breakout. For that to happen, large holders must avoid losing their positions.

As a result, strong buying interest could trigger a short squeeze and pave the way for a bullish recovery.

In other words, FET has the right ingredients for a potential breakout. With the RSI in a neutral phase, a few conditions could push the FET above its resistance at $0.17 and put it on course towards a $2 target.