After witnessing a price drop of 65% in the past two months, the artificial Superintelligence Alliance (FET) seems ready for Start, supported by Bullish Price Action on both weekly and daily time frames. With a constant price recovery, FET -Tokens get considerable attention from traders and investors, which could actively help to return quickly.

Current price momentum

Today, February 21, 2025, FET acts almost $ 0.778 after an increase of more than 9.50% in the last 24 hours. During the same period, trade volume increased by 17%, indicating growing interest rates and traders compared to the previous day.

FET technical analysis and upcoming levels

According to the technical analysis of Coinpedia, Fet Bullish seems and it is ready for a considerably upward momentum, because the technical indicators flash a bullish divergence on the weekly period. Moreover, FET seems to form a bullish price pattern with double bottom and it is currently about to complete its second upward leg.

Based on historical patterns, if it is active above the level of $ 0.70, there is a strong possibility that it could rise by 45% to reach $ 1.10 in the coming days and with 165% in general to to reclaim the $ 2.05 level, which FET lost in December 2024.

Investors Bearish Outlook

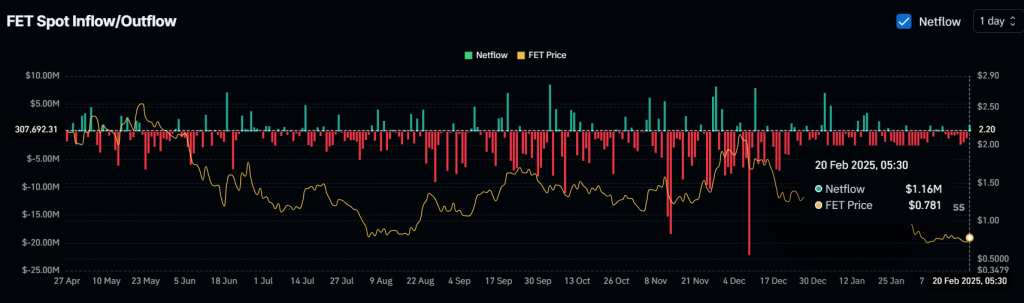

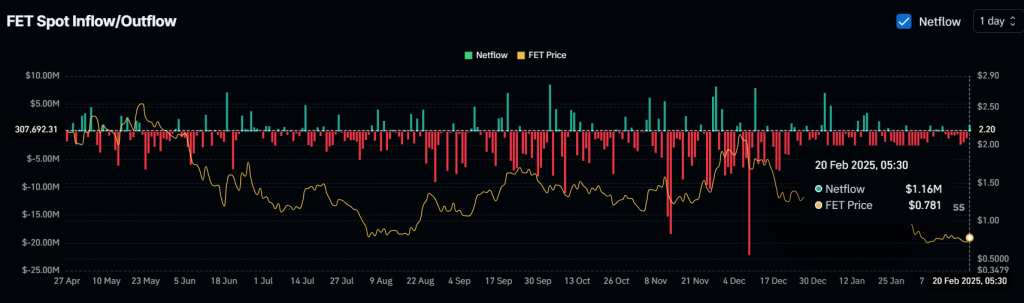

Despite the Bullish Momentum, some investors release fet, as reported by the uncleaning analysis company Coinglass. Data shows that stock markets have witnessed an outflow of around $ 1.50 million in fet -tokens, which suggests that some holders have sold their positions.

Important liquidation levels

In the meantime, traders who bet on the long side are currently active. At the time of the press, the over-livered levels are $ 0.731 at the bottom and $ 0.785 at the top, where traders have built millions of value on long and short positions. Data shows that traders for $ 1.03 million in long positions at the level of $ 0.731 and $ 270,000 at $ 0.785 level.

When combining these statistics on the chain, it seems that some traders benefit from the current market sentiment, while others, driven by fear, are active.