- Fantom has outlined the Sonic upgrade and governance proposals.

- Sonic upgrade to boost Fantom in the long run, as the indicators say.

Phantom [FTM]renamed Sonic Labs, has geared up for its biggest upgrade with the launch of Sonic Testnet. This upgrade introduces a new high-throughput layer 1 blockchain and a native layer 2 bridge to Ethereum [ETH].

Sonic aims to combine the low cost, scalability and speed of L2 with the security of L1, with the target being 10,000 TPS and already achieving 2,000 TPS on the testnet. The full launch is expected at the end of Q4 2024.

Messari Q2 2024 report marked the most important developments within Sonic Labs, including four crucial governance proposals.

Source:

In addition to approving a 190.5 MS token airdrop to reward users, Sonic Labs has also approved 1:1 compatibility between the FTM and S tokens and a revamped rewards system for validators and builders, as detailed in a wire on X,

The wire welded,

“This proposal authorized the minting of 190,500,000 $S for airdrops that users of Opera and #Sonic.”

These proposals aim to build a community-approved Sonic network and foster innovation through the Sonic bounty program.

This offers rewards for developing apps across industries such as lending, NFTs, payments, and AI.

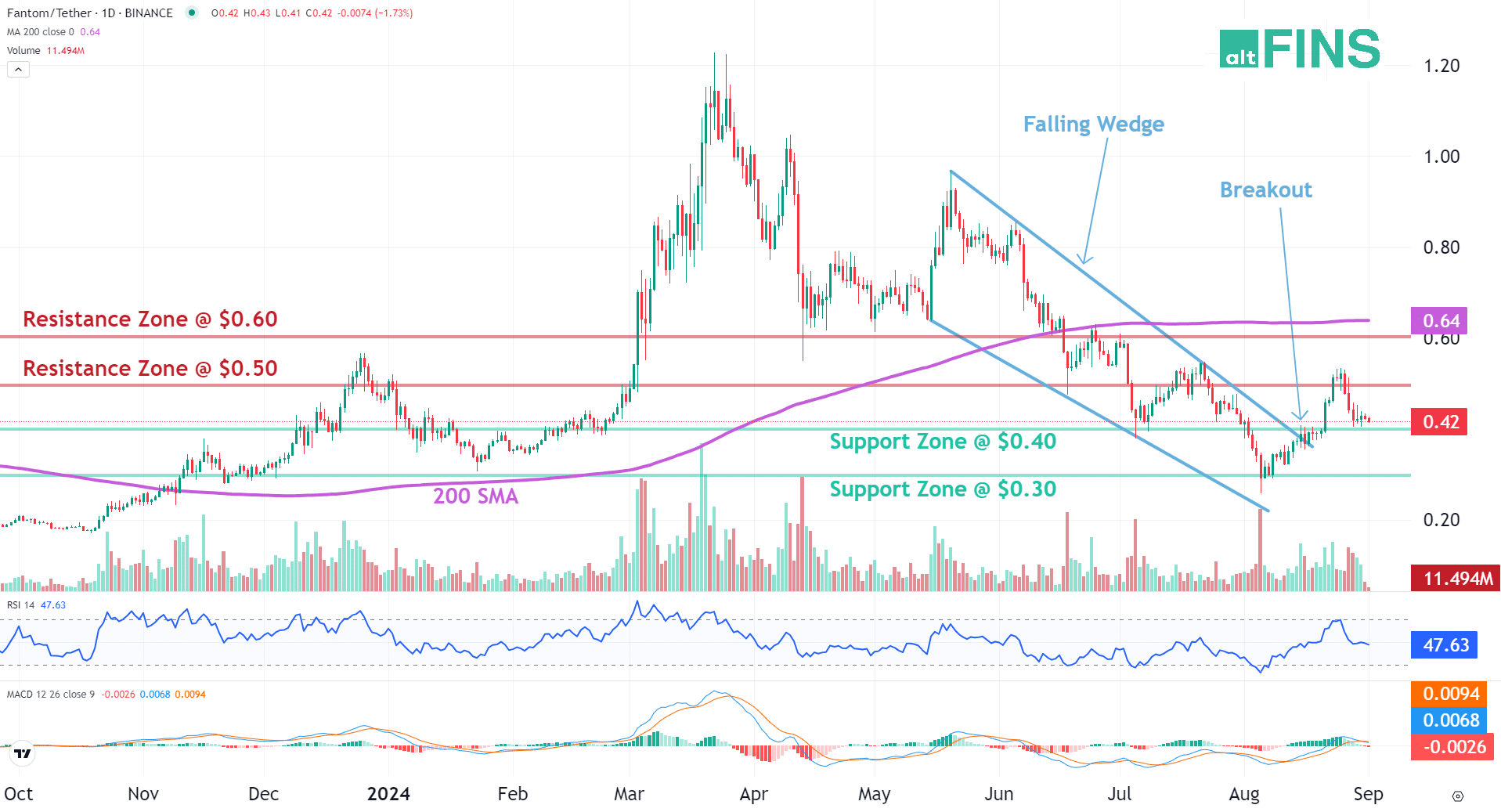

Breakout of FTM falling wedge pattern

Phantom [FTM] was in a downtrend but broke out of a bearish wedge pattern on the daily time frame. It then reached the $0.50 price level before retreating to around $0.40, a crucial support zone.

The $0.4 area previously pushed the price up 37.48%, presenting a potential opportunity for traders to enter the market and retarget at $0.50.

With the Sonic upgrade on the horizon, FTM price could see a rally, either immediately or after more fundamental factors come into play.

Source: TradingView

Will the Sonic upgrade reverse FTM’s weekly losses?

Fantoms [FTM] its market capitalization was approximately $1.14 billion, with a trading volume of $62 million, giving a volume-to-market ratio of 5.53%. This indicated that FTM’s market stability was due to just enough liquidity.

According to CoinMarketCapThe FTM price has fluctuated by 17.83% over the past seven days, as at the time of writing, but the upcoming Sonic upgrade could cause a reversal of these losses as the circulating supply stands at 2.8 billion at a total of 3.2 billion.

Source: CoinMarketCap

Market sentiment and upside potential

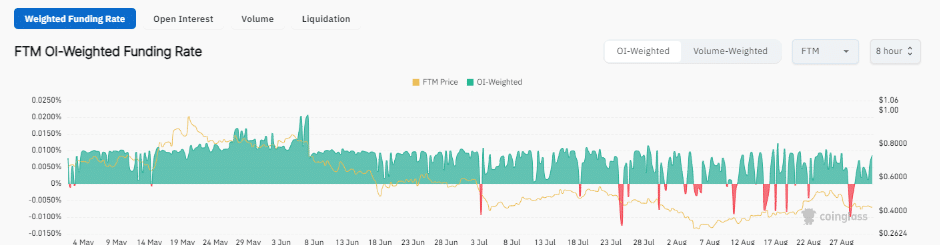

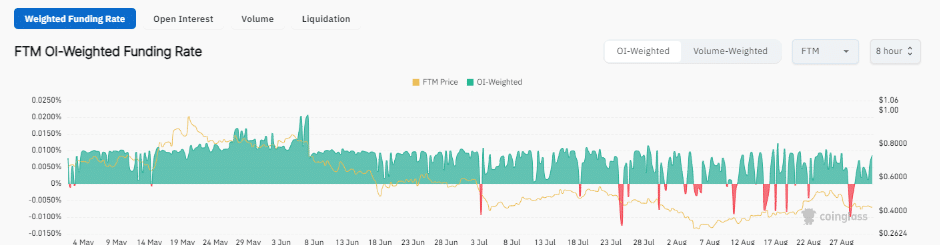

Additionally, FTM’s Open Interest fell 3.57% to $112.87 million. However, the combination of Open Interest and Funding Rates, resulting in an OI-weighted Funding Rate of 0.0065%, indicated slightly bullish sentiment.

The FTM chart has consistently shown strength in the OI-weighted funding rate over time, again providing an important confluence of the expected bullish breakout bias for FTM.

Source: Coinglass

Read Fantom’s [FTM] Price forecast 2024–2025

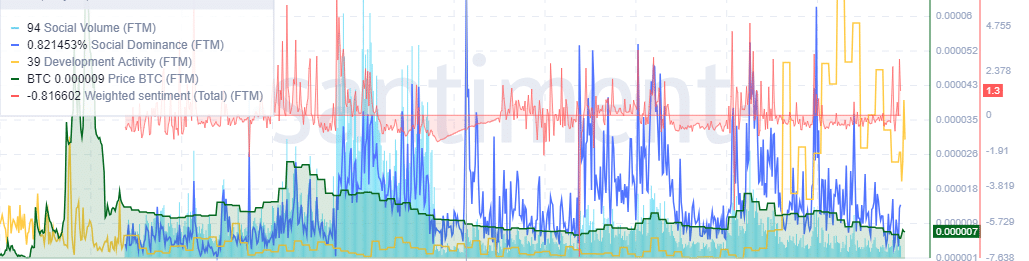

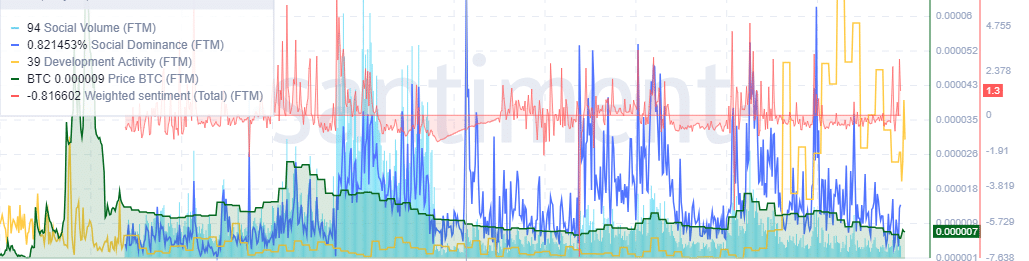

Finally, the combination of the OI-Wighted Funding Rate with the recent social dominance and volume increases related to the Sonic upgrade suggested that FTM could be poised for an upward move.

Source: Santiment

These development activities and the Weighted Sentiment further support the potential for FTM price increases. And then the timing will largely depend on how quickly the Sonic upgrade impacts market fundamentals.