- BTC has fallen by more than 4.5% in the past 24 hours.

- Market indicators and benchmarks pointed to a continued price decline.

The wait is coming to an end when Bitcoin [BTC] will undergo its fourth halving in a few hours.

The importance of this process has given rise to multiple speculations about how the price of the king of crypto might react in the short term.

To understand what to expect from BTC after the halving, AMBCrypto analyzed BTC’s on-chain data.

The Bitcoin halving is happening soon

The halving is one of the biggest events in the crypto world as it affects the supply of Bitcoin. After the process is completed, BTC miner rewards will be reduced by half.

While enthusiasts waited eagerly, BTC bears continued to dominate the market.

According to Coin market capitalization, BTC fell by more than 13% last week. In the last 24 hours alone, the value of the coin has fallen by almost 4%.

At the time of writing, it was trading at $60,995 with a market cap of over $1.2 trillion.

The halving may also not have an immediate positive effect on the price of the coin.

Michael van de Poppe, a popular crypto analyst, recently posted one tweet This highlights that investors may see a few calmer days before momentum returns.

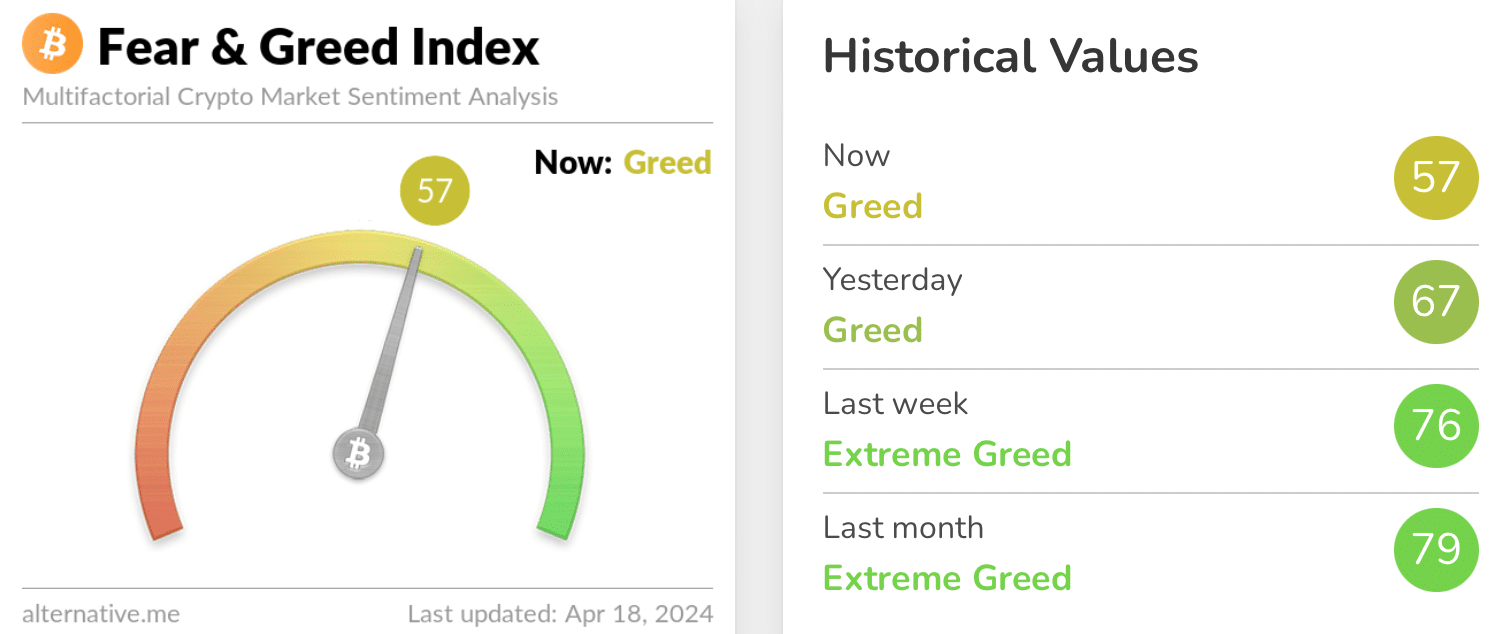

The value of Bitcoin’s Fear and Greed Index also fell as it got closer to the neural frontier. This also indicated a few slow-moving days. At the time of writing, the indicator had a value of 57.

Source: Alternative.me

A price drop is likely

AMBCrypto then checked other data sets to see if bears would apply more pressure.

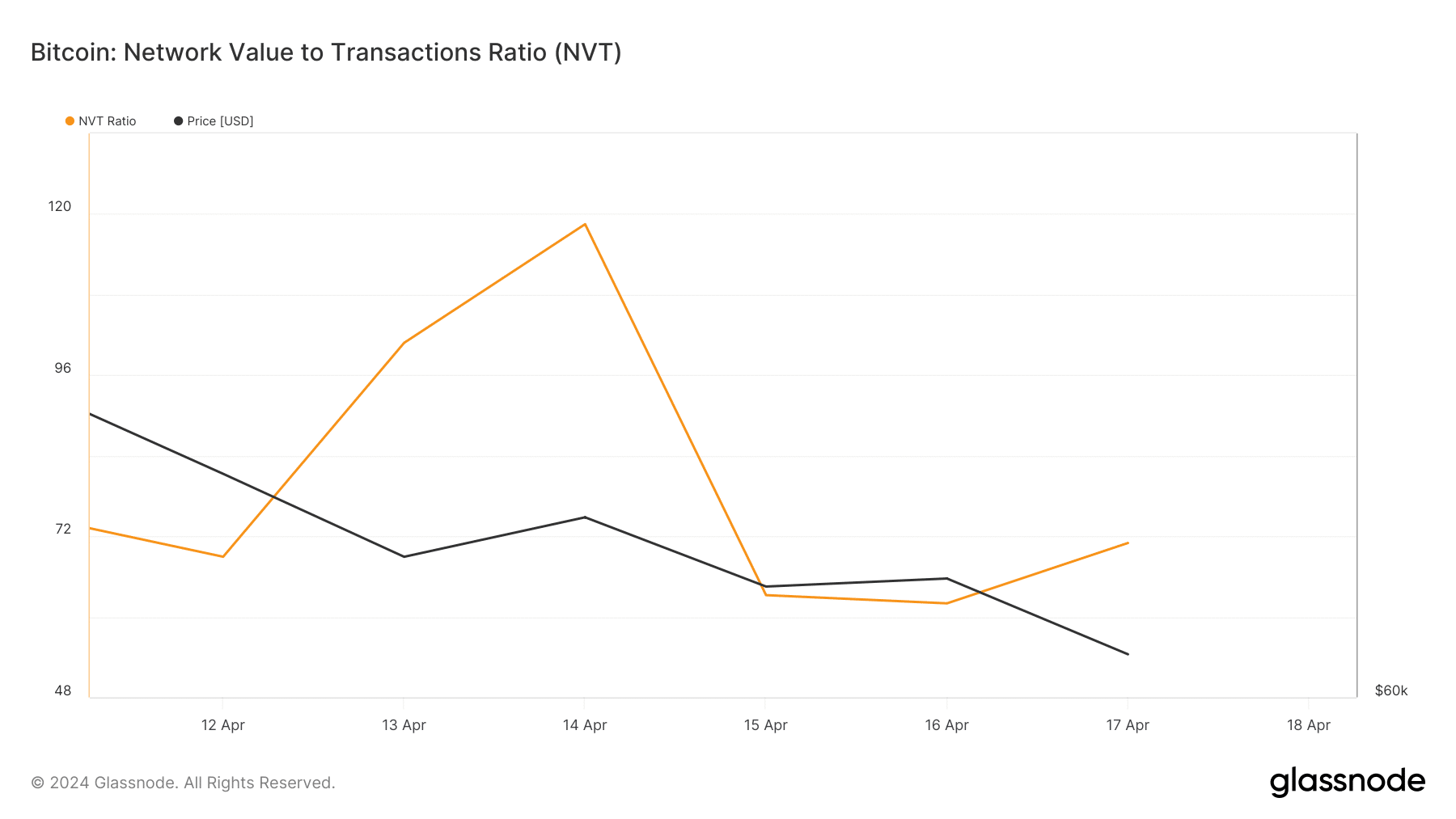

Our analysis of Glassnode’s data showed that, after a sharp decline on April 15, BTC’s network value ratio (NVT) registered an increase.

A rise in the measure suggests that an asset is overvalued, indicating a price correction.

Source: Glassnode

CryptoQuant’s facts revealed that BTC’s net unrealized gain and loss (NUPL) rose. This meant that investors were in a ‘faith phase’, where they were currently in a state of high, unrealized gains.

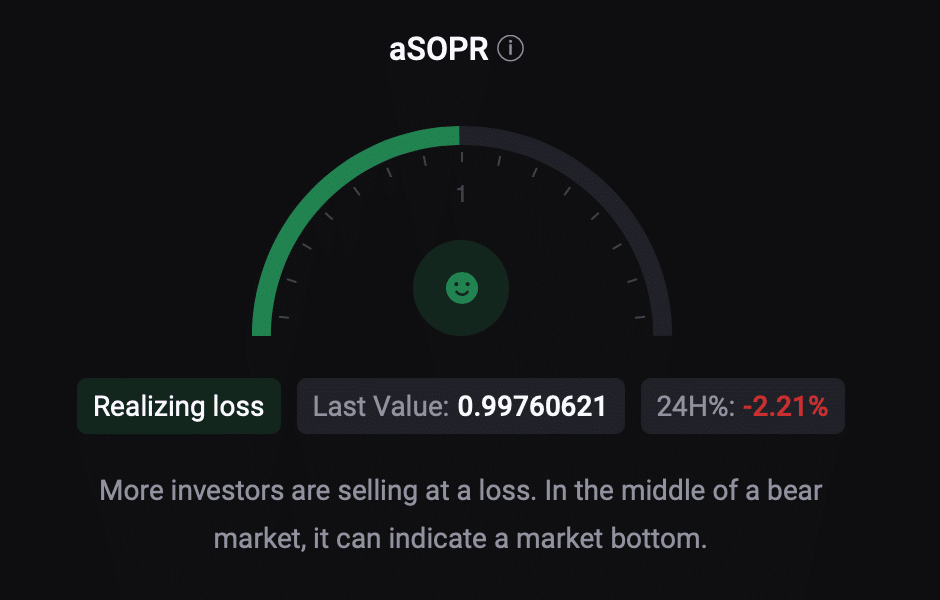

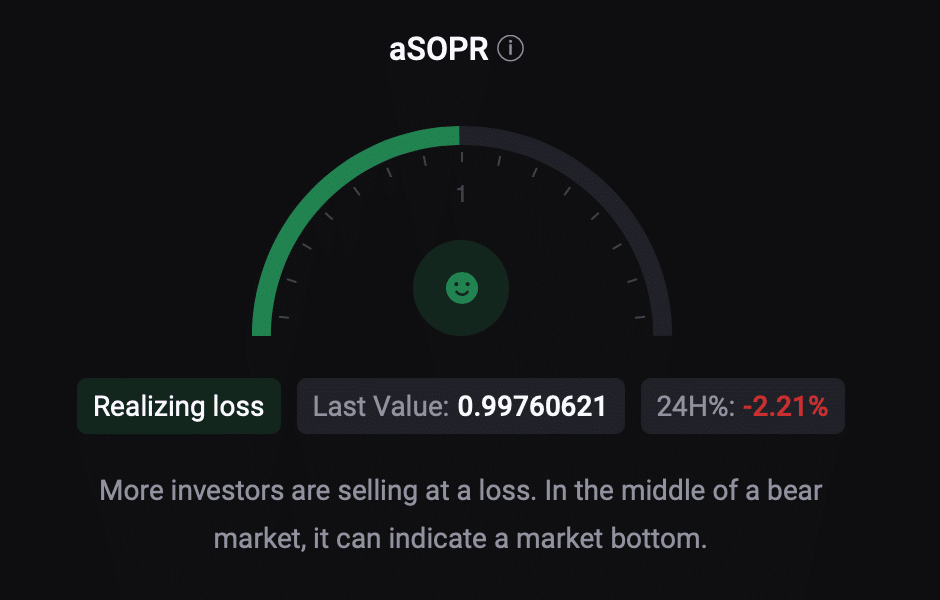

Nevertheless, the aSORP appeared optimistic as it indicated more investors were selling at a loss. In the middle of a bear market, this could indicate a market bottom.

Source: CryptoQuant

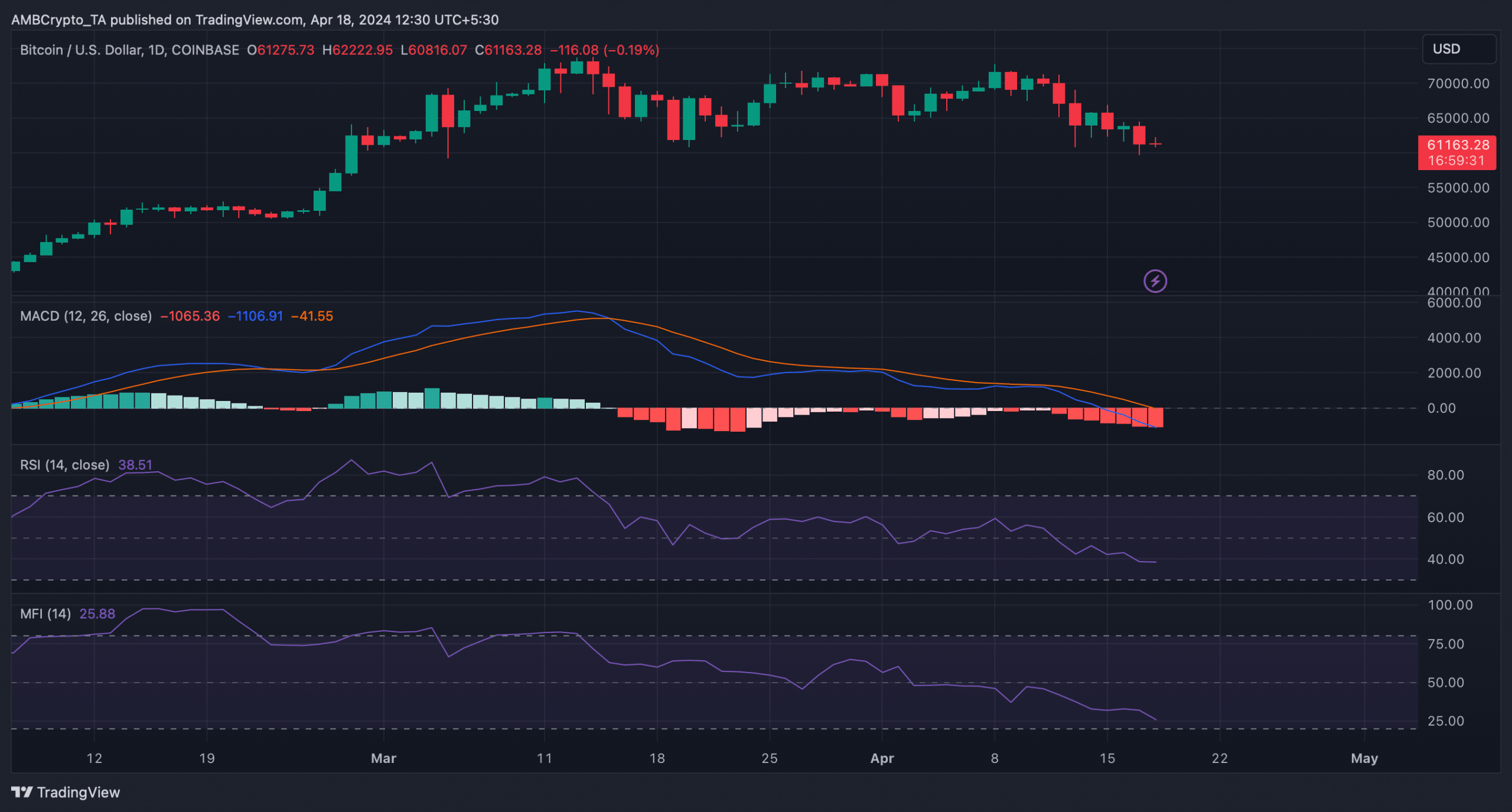

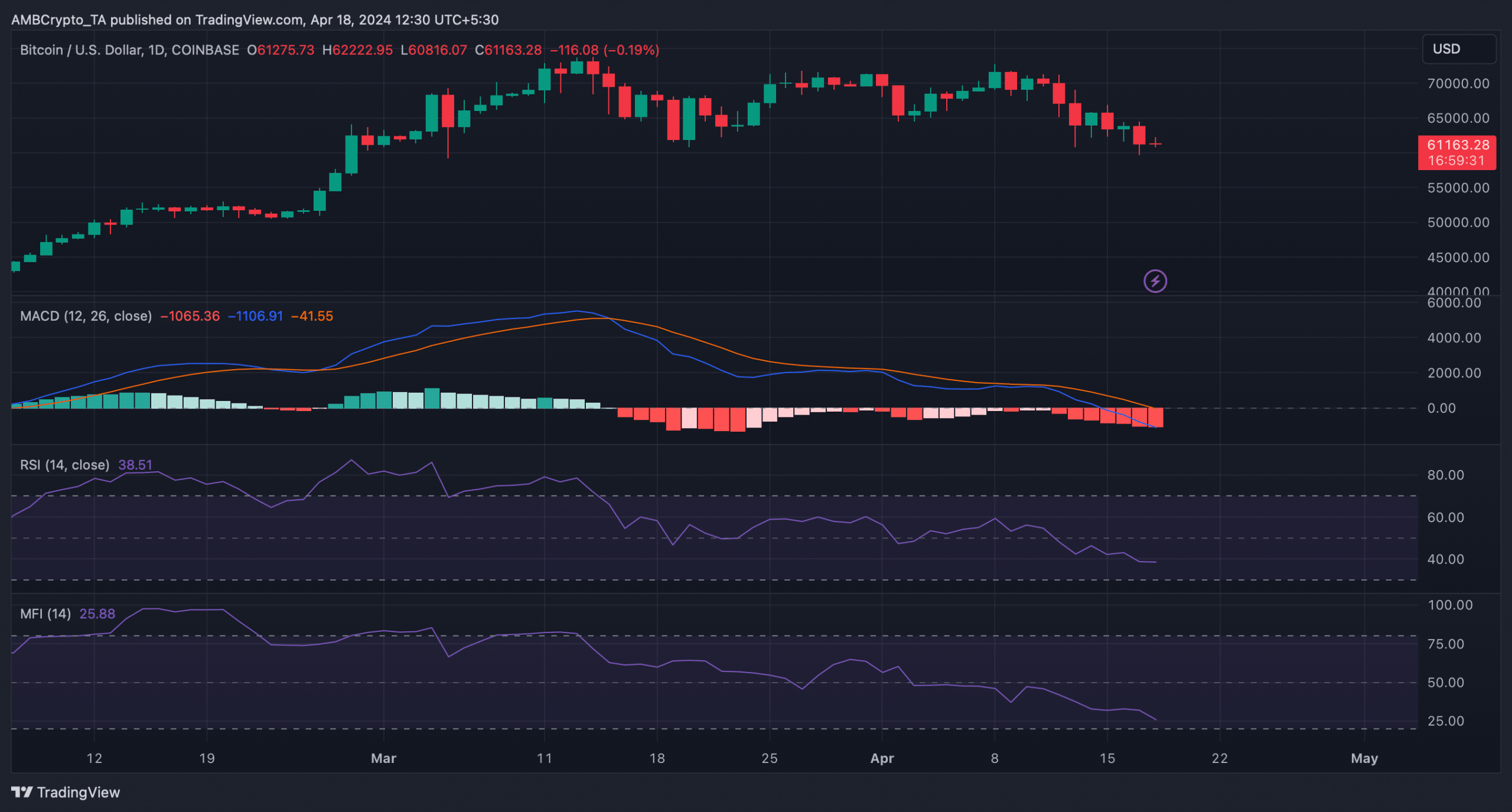

However, technical indicators remained bearish. For example, both BTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) registered a decline.

The MACD showed a clear bearish upper hand on the market, indicating a further price decline.

Source: TradingView

Read Bitcoins [BTC] Price prediction 2024-25

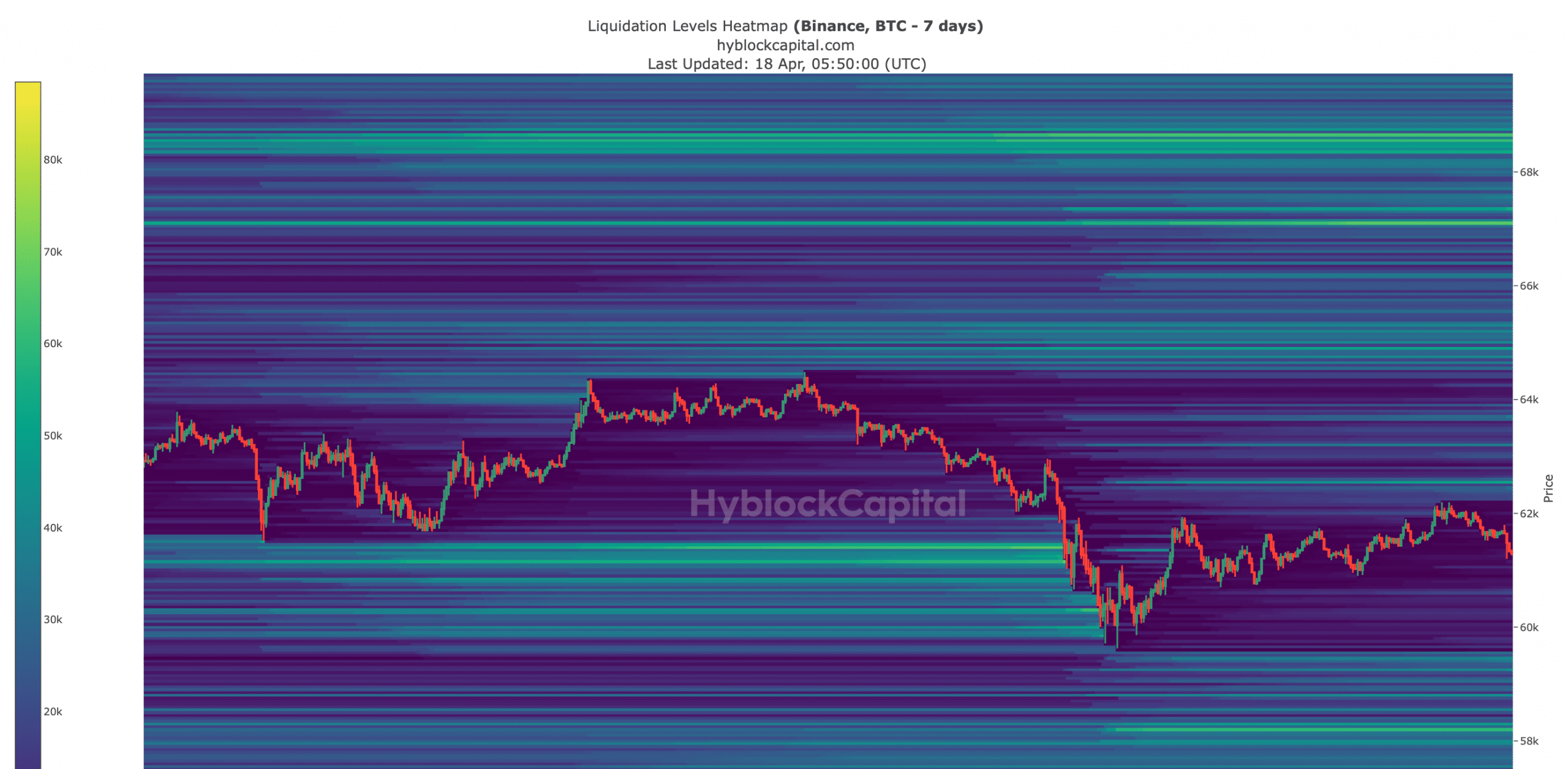

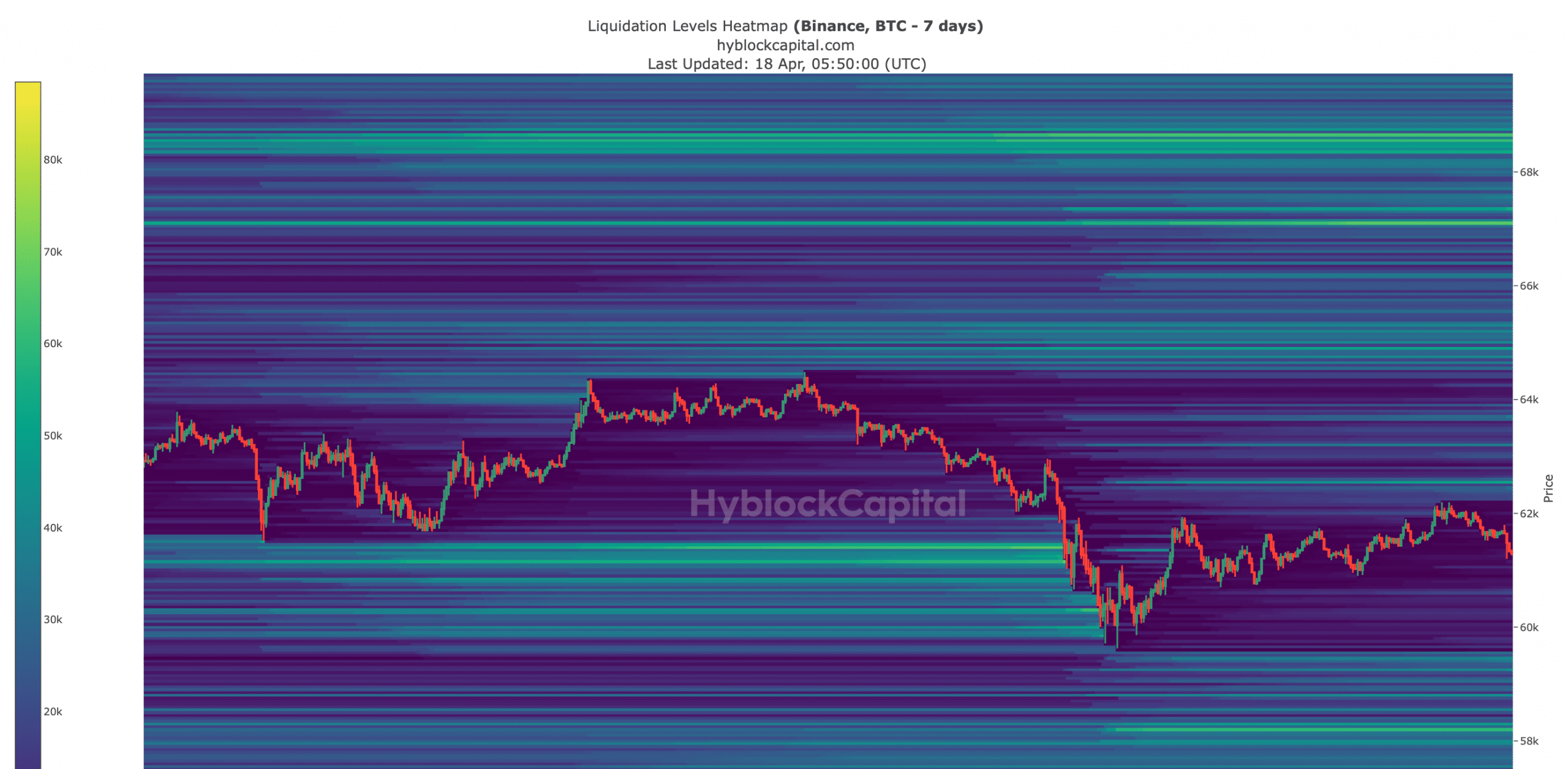

AMBCrypto then checked Hyblock Capital’s data to find the support levels at which BTC could fall beyond the halving if the downtrend continues. According to our analysis, BTC has a support level near $59,950.

A drop below that level could be dangerous as it could drop the price of BTC to almost $58,000, liquidating a significant portion of BTC.

Source: Hyblock Capital