- APT’s fate heavily depends on whether the bulls can successfully defend the $10.35 support

- Traders should watch for a possible rebound, one that could target $13.75, or a breakdown

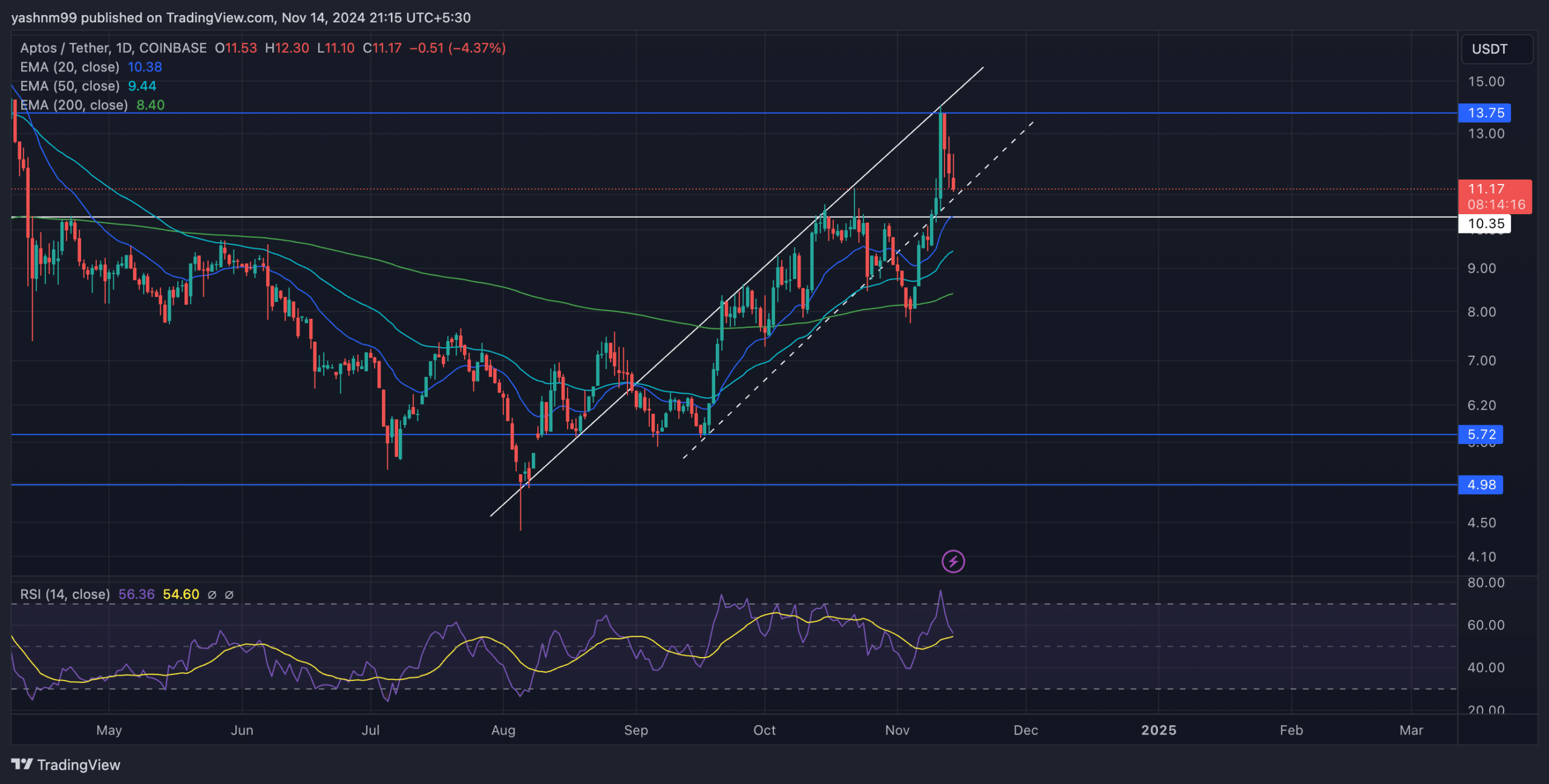

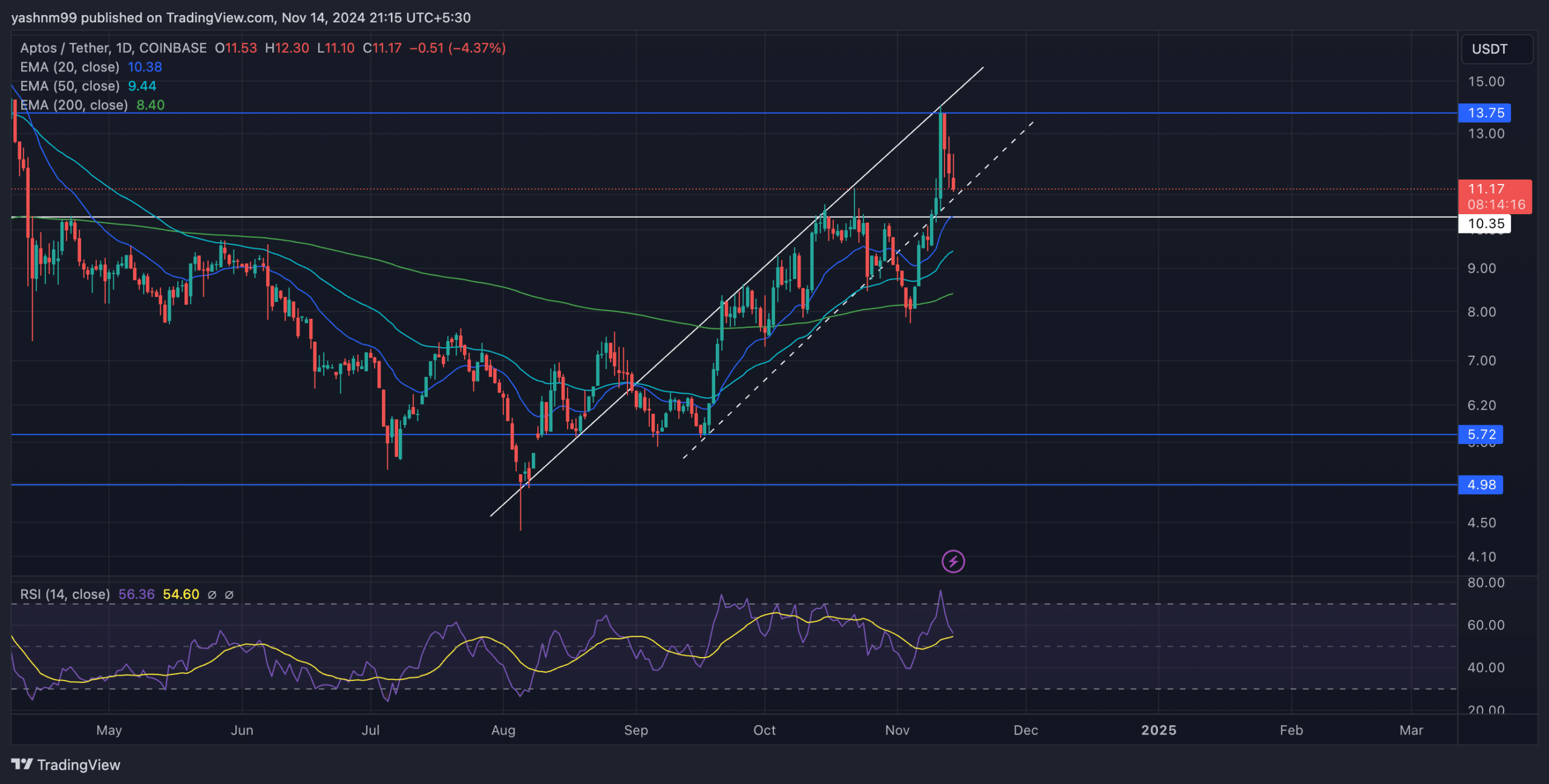

Aptus [APT] continued its strong rise for three months before reaching a seven-month high of $13.75 on November 11.

However, the recent rejection of trendline resistance has left APT in a critical position, with bulls looking to defend a confluence of key support levels.

APT could move THIS way from the immediate support level

Source: TradingView, APT/USDT

At the time of writing, Aptos was trading around $11.11, having fallen nearly 8.7%. The price once again tested a confluence of supports near the $10.35 zone, including the horizontal support, the ascending trendline, and the 20-day EMA. The outcome of this retest could determine the coming trend direction of APT.

If APT bounces off the $10.35 level, buyers could look for a quick retest of the $13.75 resistance, which coincides with the upper trendline of the ascending channel. A successful close above this level could push APT to a potential upside target near $15, reinforcing the bullish bias.

However, if the price breaks below the support confluence, APT could see a consolidation phase near the 50-day EMA ($9.43) and the 200-day EMA ($8.40). This would indicate a lack of momentum among buyers. Failure to hold the $10.35 support could open the possibility of a move towards the $8 zone.

The Relative Strength Index (RSI) stood at around 56, reflecting indecisiveness among traders. A definitive move below 50 could indicate renewed bearish momentum, while a jump below 60 could create more upside.

Analyzing APT derivatives data

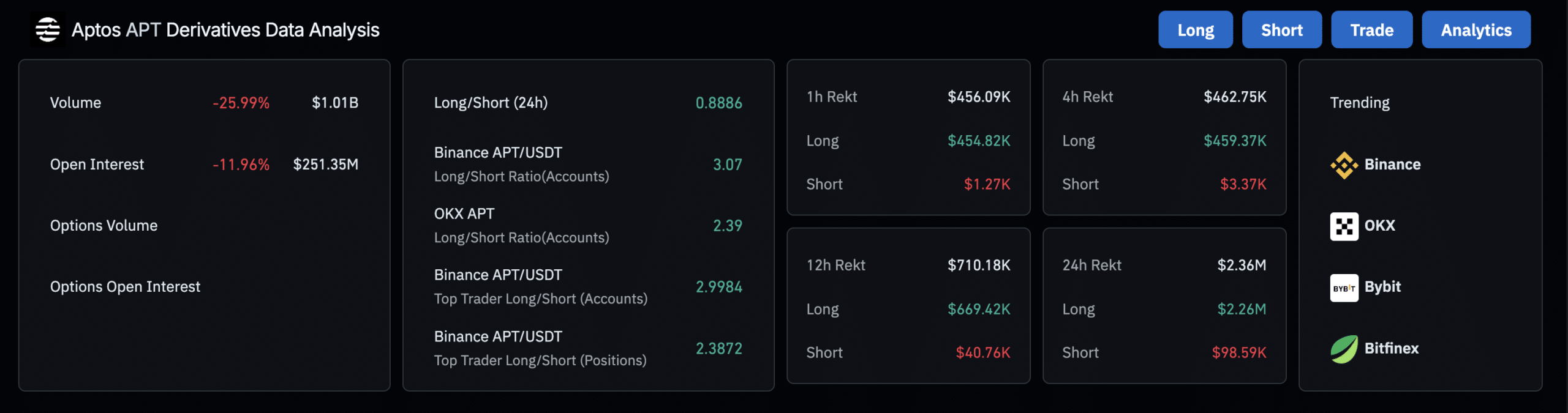

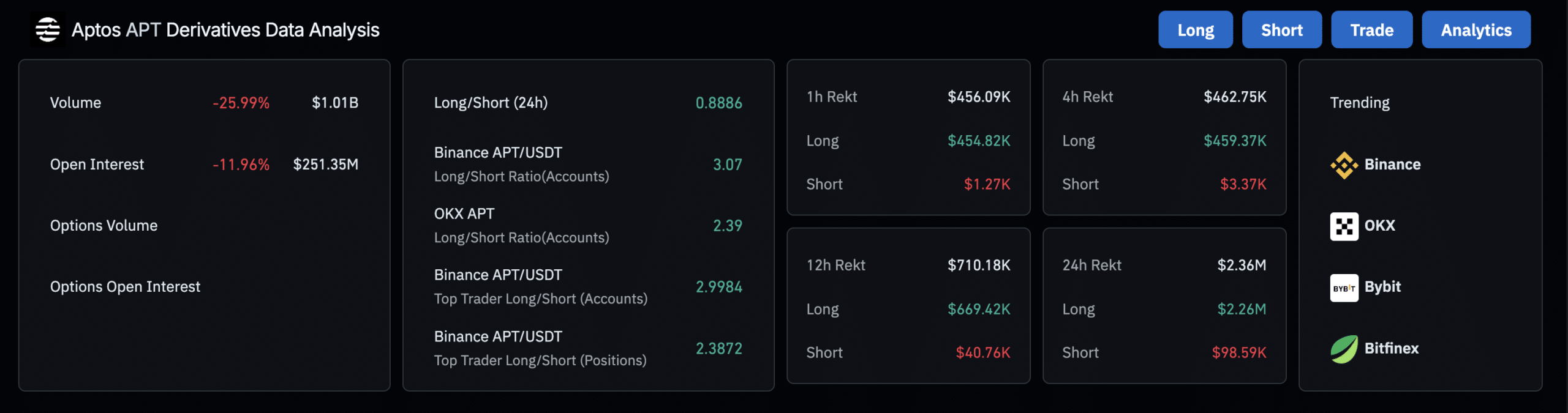

Source: Coinglass

APT’s derivatives data revealed mixed sentiment in the market. Open Interest fell 11.96% to $251.35 million, indicating traders have closed their positions, possibly due to uncertainty about APT’s next move. Similarly, trading volume fell by 25.99% – a sign of reduced trader participation.

Interestingly, Binance’s long/short ratio was 3.07, while OKX had a ratio of 2.39. This indicates an optimistic bias among traders on these major platforms. However, the 24-hour long/short ratio was 0.8886, implying that slightly more traders were leaning toward short positions.

In the liquidation data, longs dominated, with about $2.36 million in liquidations, indicating a continued attempt by bulls to maintain their positions amid the recent decline.

Given the current mixed sentiment and key indicators pointing to indecision, it is important to consider Bitcoin’s movement and broader market trends before making any moves on APT.