- BlackRock’s iShares Bitcoin Trust (IBIT) saw inflows of $102.7 million, marking nine days of gains.

- Bitcoin’s RSI at 59 indicated strong bullish sentiment, despite recent negative sentiment trends.

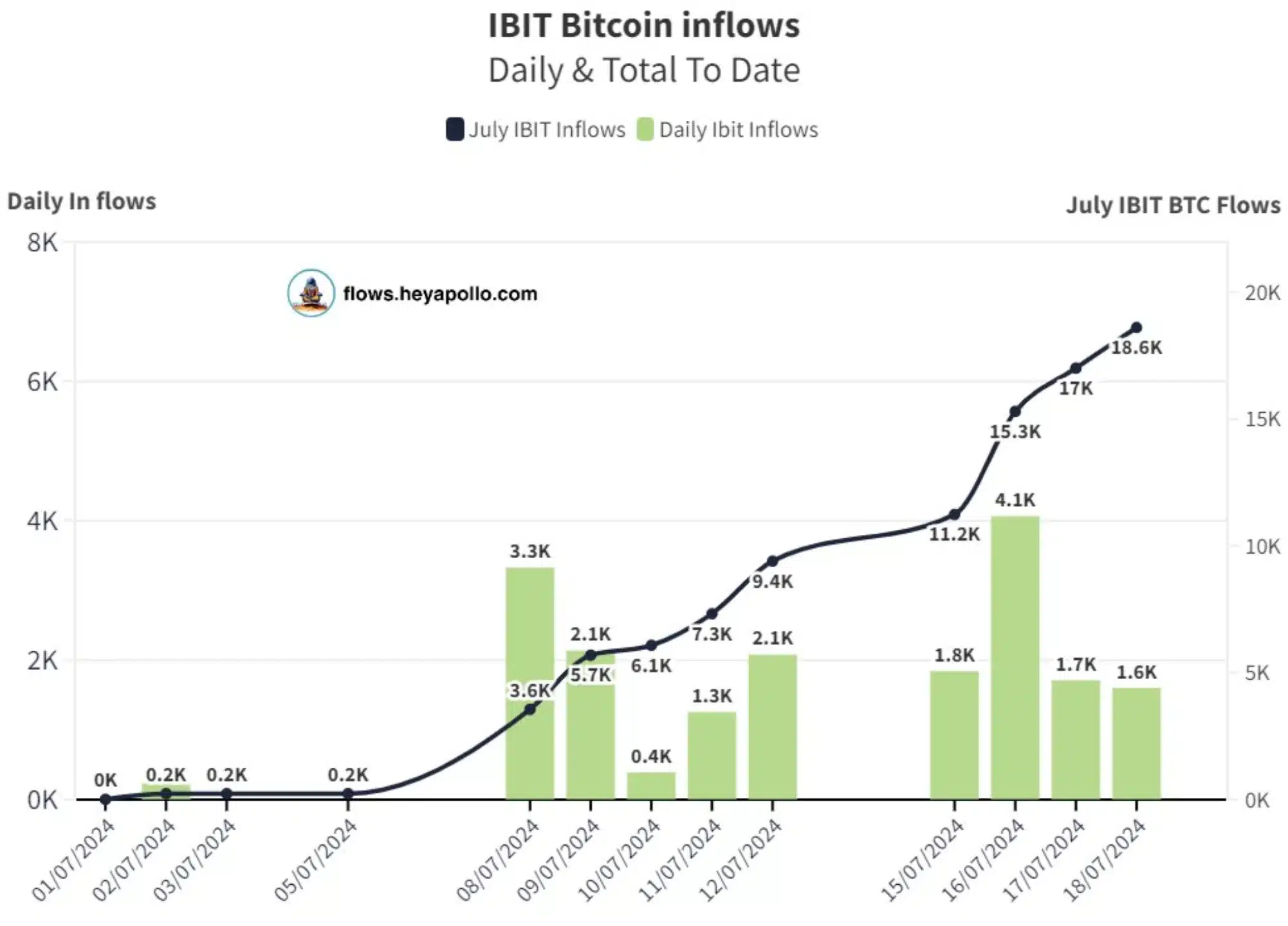

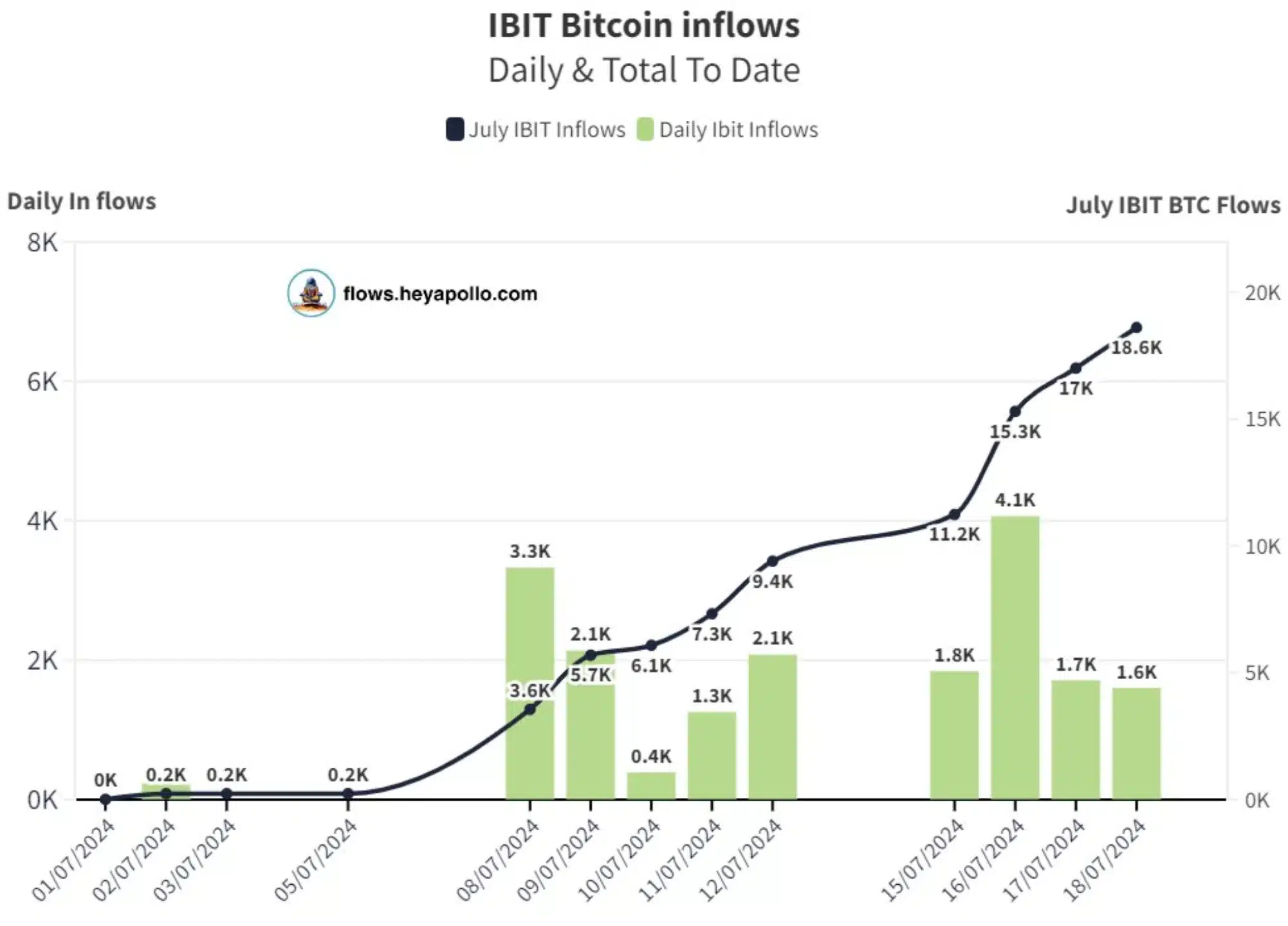

On July 18, BlackRock released the iShares Bitcoin [BTC] Trust (IBIT) saw an impressive inflow of $102.7 million.

This was the ninth straight day of positive inflows, making IBIT the only Exchange Traded Fund (ETF) to achieve such a streak.

BlackRock’s Increasing Adoption of Bitcoin

BlackRock also made headlines for purchasing over $1 billion worth of BTC this month, highlighting Bitcoin’s increasing institutional adoption.

Expansion on the same, Thomas Fahrerco-founder of crypto data platform Apollo, said:

“Blackrock bought over $1 billion worth of #Bitcoin this month – including $107 million today. That’s 18,600 #Bitcoin. This is a total acceleration of the inflow.”

Source: Thomas/X

Decline in positive sentiment

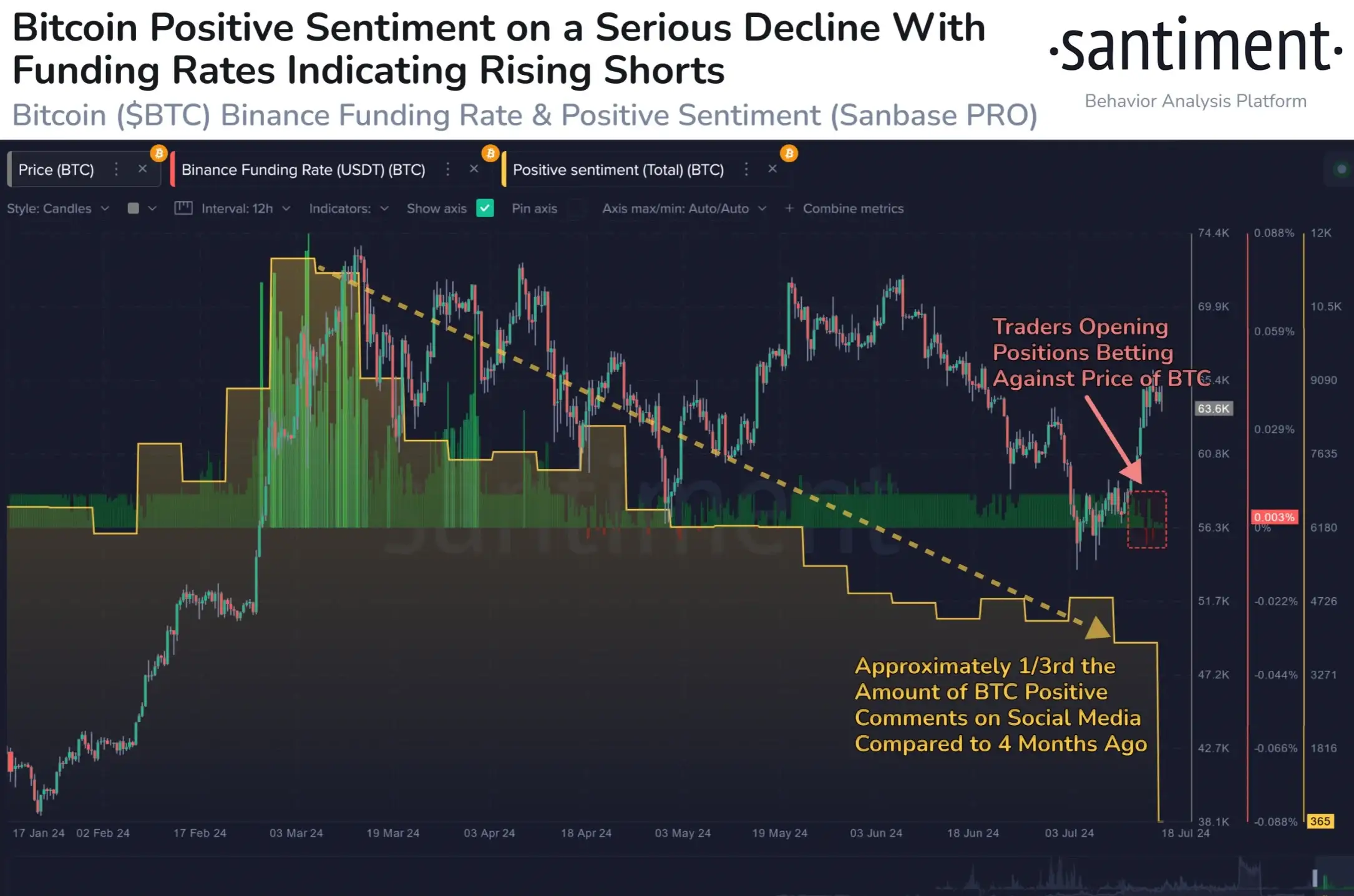

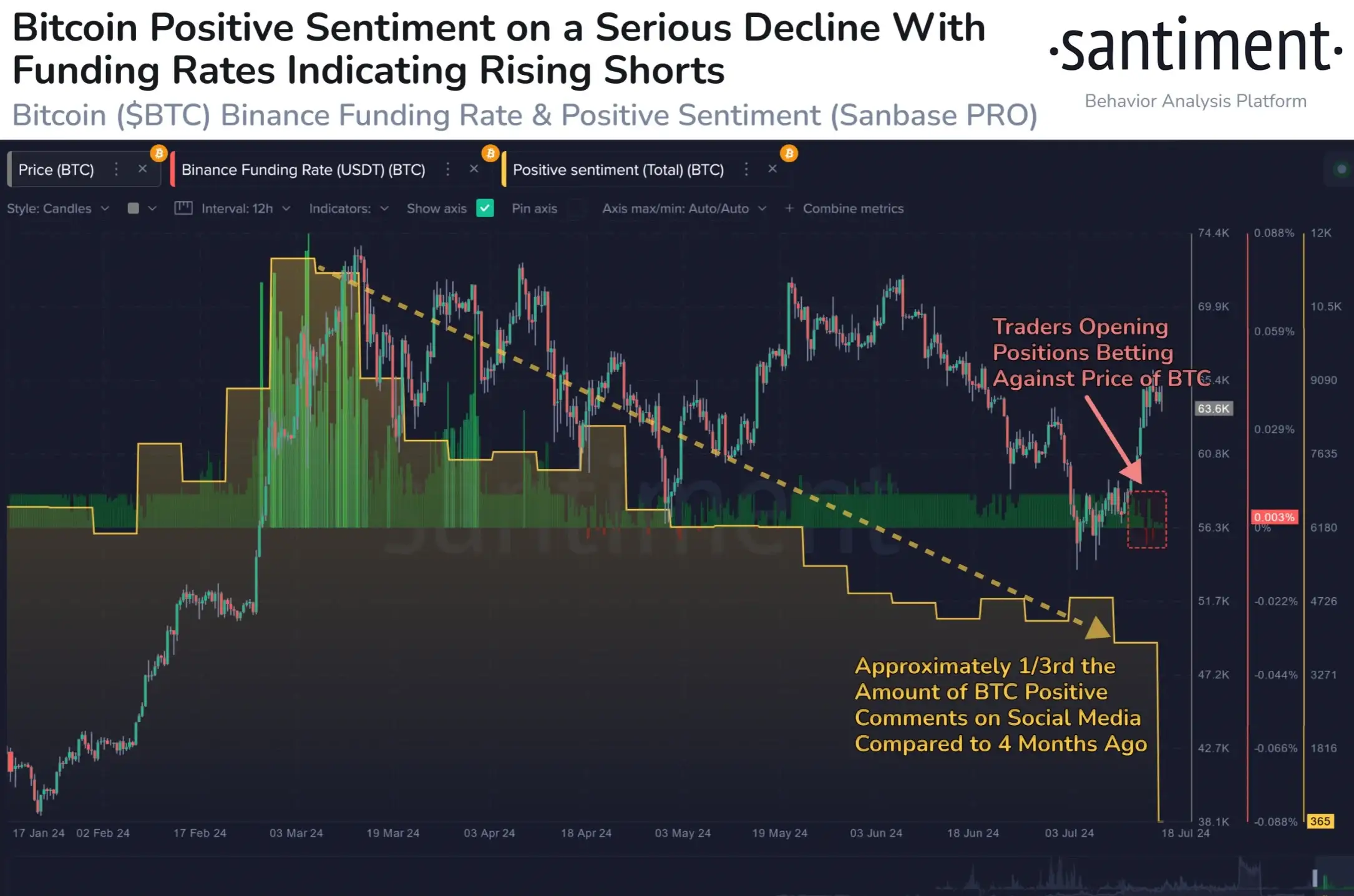

Moreover, a medium-sized crypto market took place this week. However, this has not affected the positive sentiment around BTC, which has fallen sharply compared to March.

This includes sentiments from social media platforms such as Twitter, Reddit, BitcoinTalk and 4chan.

That said, in addition to the decline in positive sentiment, traders are increasingly taking short positions in these assets.

This is reported by the blockchain market information agency Santiment,

“Many traders, especially on @binance, are opening shorts with the expectation that BTC will drop again. Both factors increase the likelihood of a cryptocurrency surge.”

Source: Santiment/X

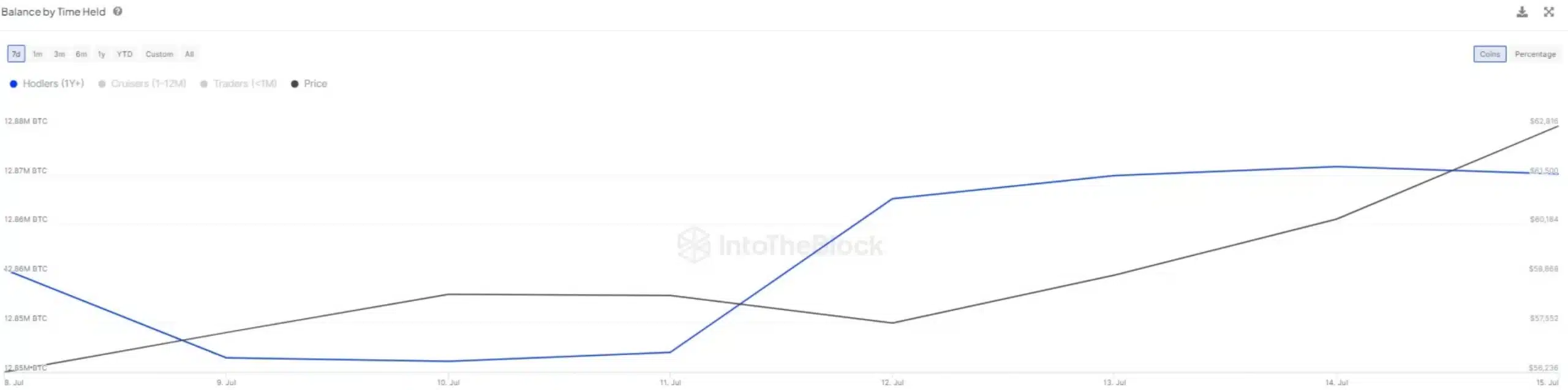

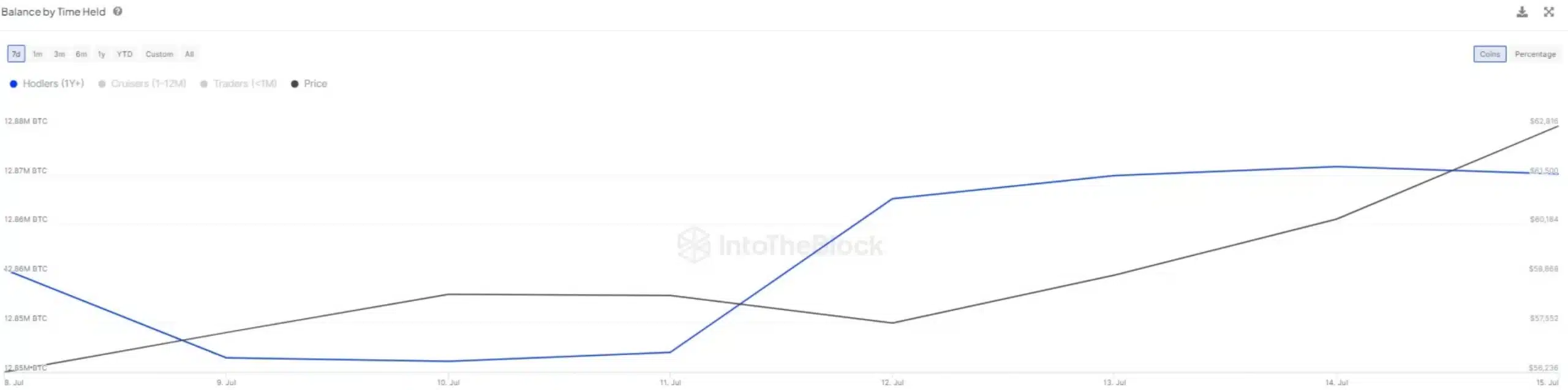

Long-term holders are strong

In fact, at the time of writing, BTC was down 0.84% and was trading at $64,304. However, the Relative Strength Index (RSI) of 59 indicates strong bullish sentiment for the leading cryptocurrency.

Source: TradingView

This highlighted the long-term confidence of Bitcoin holders. On-chain analytics platform, InHetBlok emphasized this best when it noted:

“Long-term Bitcoin holders showed confidence last week, increasing their holdings despite fears over recent transactions involving Mount Gox and the German government.”

Source: IntoTheBlock/X