Este Artículo También Está Disponible and Español.

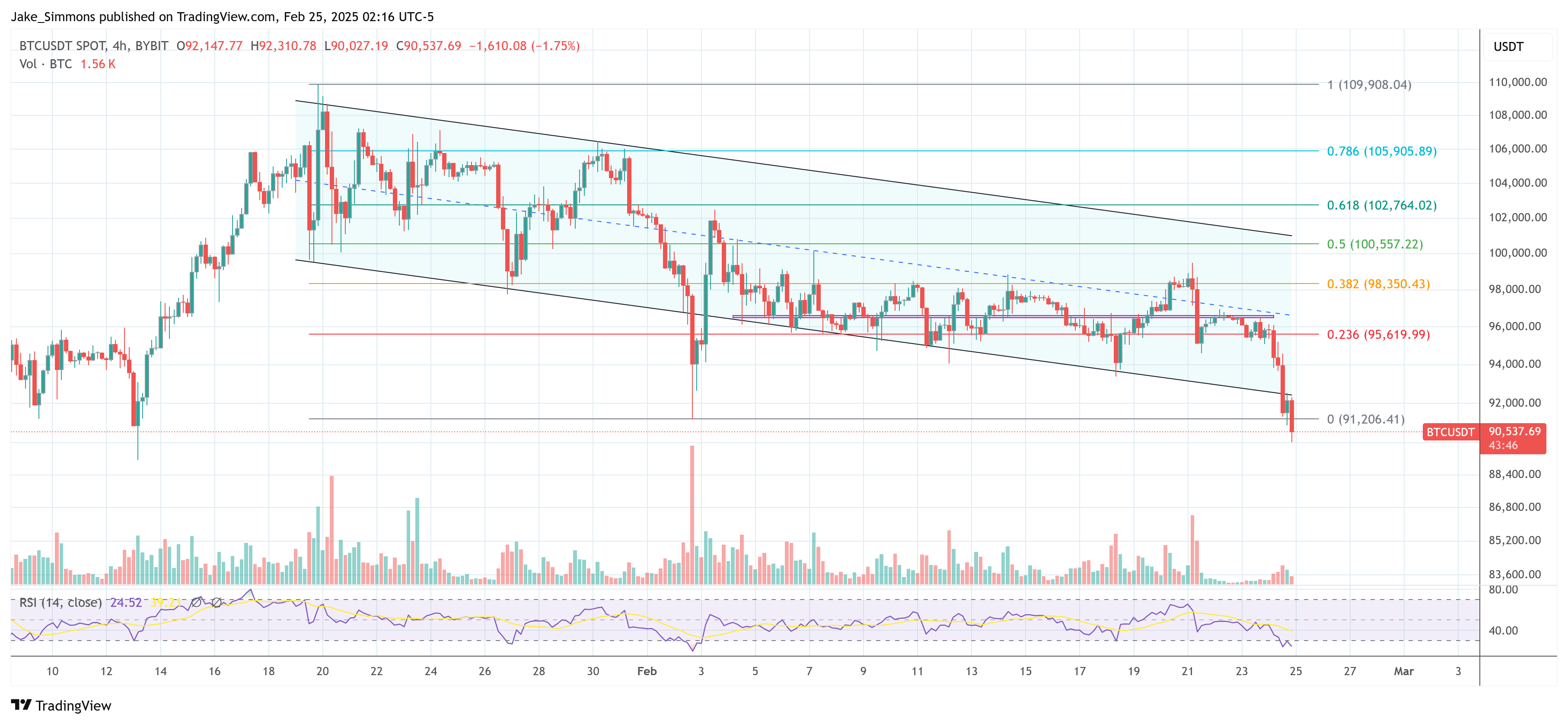

The Bitcoin price has fallen more than -8.8% since Friday when Bybit the largest crypto -hack in history suffered. The Digital Asset flagship reached a peak of $ 99,493 at the end of last week, only to withdraw to around $ 91,500 at the time of the press, which a decrease of a -5.5% marked since Monday. This decline not only crushes Bitcoin’s attempt to keep more than $ 95,000, but it also places it about to lose its critical 97-day trading range between $ 91,000 and $ 102,000. In particular, the price of Bitcoin is broken under the falling trend channel that has been in the game since 20 January.

What is the next step for Bitcoin?

Ari Paul, co-founder and Chief Investment Officer of Blocktower Capital, offered a broad picture of the Bitcoin process and the wider macro-economic environment. In one after At X, Paul got the potential for persistent stock market weakness and the knock-on effect on digital assets: “My market is: shares for 4-15 months of pain (I guess 9 months) bound to deflatoiral government (rates and massive dismissals usually ). Then it is a political question – ‘capitulate’ Trump admin and will it be seriously inflationary? In the vast majority of the similar cases in history, the answer was yes, but only a low trust guess me at the moment. “

Related lecture

Paul shifts the focus to crypto and emphasized that although cryptocurrencies can still show short -term correlations with shares, they are inherent in different cyclical rhythms: “What does that mean for crypto? I keep thinking that crypto and shares are on different cycles rhythms, but that does not deny a shorter term correlation. Alts probably follow at least in the beginning (but they are already so much, even versus 2021 prices, they can do well before shares under the bottom.) “

Speaking on Bitcoin, Paul predicts that the leading cryptocurrency “will be worn as a mix of gold and S&P 500”, adding to it: “If gold stays strong, it would suggest that Bitcoin would surpass then losing shares, but perhaps not much. A retreat to ~ $ 73k $ 77k seems likely, I would probably add there. “

Despite the short -term volatility, Paul remains optimistic: “I do not stay over to crypto bullmarkt, but this looks more and more different than earlier cycles, perhaps considerably slower and longer. My basicase is that crypto will lead the general macro inflation, so perhaps Crypto Bull Run CV is in 6 months and shares will appear in 9. The given dates are only instructions of my gambling substances. I do not place a weight on the exact timetables. “

BitMex founder Arthur Hayes also went to X to warn From an imminent downward push. He pointed to the mechanics of Bitcoin-exchange-related funds (ETFs) and Futures market arbitrage as potential factors of increased sales pressure.

“Incoming Bitcoin Goblin Town: Many Ibit holders are hedge funds that have gone Long ETF short CME to achieve a yield that is greater than where they finance, short -term American treasury. If that basis falls if BTC falls, these funds will sell Ibit and buy back Cme Futures. These funds are in profit, and the basis is close to UST revenues that they will relax during the American hours and realize their profit. $ 70,000 I see your mofo, “he writes.

Related lecture

In particular research agency 10x research published An analysis on Monday that indicates that although Bitcoin ETFs – led by the IBIT product of BlackRock – have collected $ 38.6 billion since their launch of January 2024, much of this capital cannot represent any simple bets on rising BTC prices, in in Line with Hayes’ statement.

“Although Bitcoin ETFs have attracted $ 38.6 billion since their launch of January 2024, our analysis suggests that only $ 17.5 billion (44%) represents real long-all-purchasing. The majority -56% -is probably bound by arbitration strategies, in which short bitcoin -Futures -positions compensate for the inflow, ”the company noted.

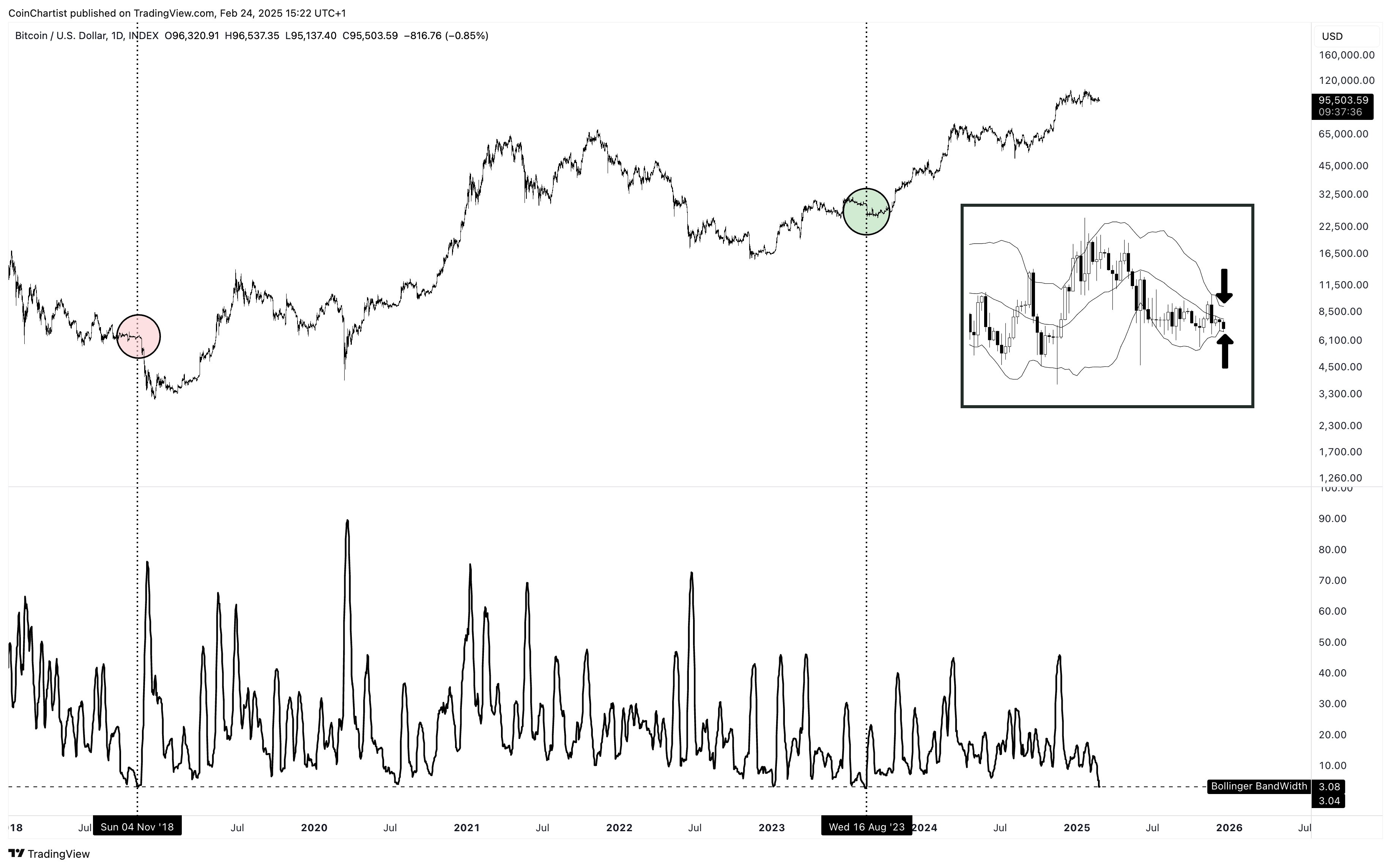

Prior to the current price decrease, market technician Tony “The Bull” Severino, warned of threatening volatility in Bitcoin, and noted that the daily Bollinger tires are tight-tight-a pattern often followed by a significant price fluctuation: “A decision will soon be made in Bitcoin, because the Daily Bollinger bands reach the third tightest reading since 2018 . At the end of 2018, the tightness led to a decrease of 50% in just over a month. In mid -2023, record liability led to a climb of 200% in just over 200 days. Which direction does the volatility give off? “

With Bitcoin, who is staggering just above $ 91,000 and is still faltering the market from the historic hack of Bybit, the market is at a crucial moment. Graph signals, macro -economic uncertainties and the settlement of complex trade strategies together attract a cloudy prospects with a possible expansion of this slump up to the reach of $ 73,000 – $ 77,000 in the coming months.

In the meantime, this does not have to herald the start of the Bear Market. Chris Burniske, partner at Placeholder VC, commentary Via X: “In the middle of 2021: BTC fell 56%, ETH Dreef 61%, Sol fell 67%, many others 70-80%+. You can think of all the reasons why this cycle is different, but the mid-bull reset that we are going through is not unprecedented. Those who call for a completely bloated bear are misleading. ‘

At the time of the press, BTC traded at $ 90,537.

Featured image made with dall.e, graph of tradingview.com