The expansion ecosystem is growing rapidly, with increasing institutional importance and potentially legal supervision. Everstake, a blockchain rider, protects more than 80 cryptocurrencies and supports some of the leading networks of the industry. In an exclusive interview, Sergey Vasylchuk, Everstake CEO, the origin of the platform, the challenges of setting, regulating developments and the role of governance in blockchain ecosystems discussed.

Balancing growth, security and risk management

Everstake’s journey began as an experimental project, while Vasylchuk built a cryptocurrency exchange. As a software developer with a background in payments and banking, he was focused on making blockchain technology for financial institutions faster and more practical. However, the limitations of early proof-of-work networks, including slow transactions speeds, made him explore solutions for proof-of-stake (POS).

“When I first saw Eos, it was stunning transactions in less than two seconds. Then I realized that we came closer to the speed that financial systems required, “Vasylchuk explained. His team became deeply involved in optimizing blockchain performance and developing techniques to improve network efficiency. The success of these innovations led Everstake to emerged as a validator for several block chains, which evolved into a complete infrastructure provider for more than 80 blockchain projects.

The role of Everstake will set out further than expanding; It acts as a crucial infrastructure layer for block chains, bridges and decentralized applications. “We are not just validators. We support blockchain ecosystems, ensure security and help scale to new networks, “emphasized Vasylchuk.

Because the release is a mainstream function in crypto, validators are confronted with increasing operational and security challenges. Managing thousands of tests and servers requires rigorous risk management processes to prevent expensive errors. Vasylchuk noted that Everstake maintains a uptime of almost 99.9%, proof of his dedication to reliability.

“The biggest challenge is not existing block chains, it is an onboarding new test nets. New networks are supplied with design errors and bugs, and choosing the right emerging blockchain to support requires careful technical evaluation, “he said.

To strengthen institutional trust, Everstake recently protected SOC 2 Type 1 certification, a generally recognized security standard. While retail strikers trust the company on the basis of its long -term reputation, institutional investors require extra verification. “For many institutions it is not about whether they trust us, it is a requirement. Without the certification they simply cannot work with us, “Vasylchuk explained.

Ethereum Strike Growth and Market Preview

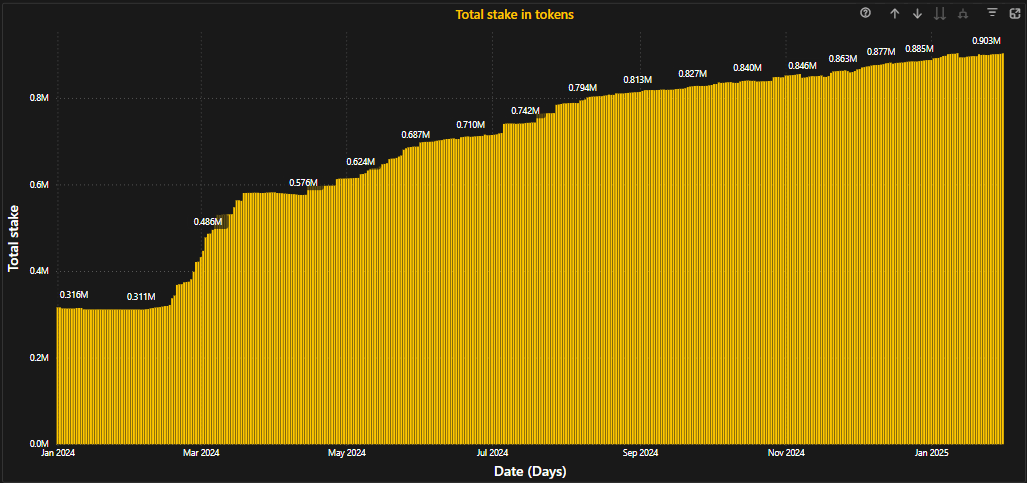

In the past year, Ethereum has seen a steady increase of 4% in the set ETH, which indicates trust in POS networks in the long term. Vasylchuk believes that this growth will continue and compare with Solana, where more than 65% of the tokens are used.

“Using Ethereum is still relatively low at 27%, which means that there is considerable space for growth. Looking at networks such as Solana, we expect that the Ethereum deployment percentage will rise considerably, “he noticed.

In addition to Ethereum and Solana, Vasylchuk sees potentially in newer deploying ecosystems, but believes that long -term success depends on strong management models. “Business is not just about earning rewards, it’s about governance. When you bet, you delegate your voting power. Unfortunately, many users give priority to APR than choosing responsible validators, “he warned.

The role of validators in blockchain -governance

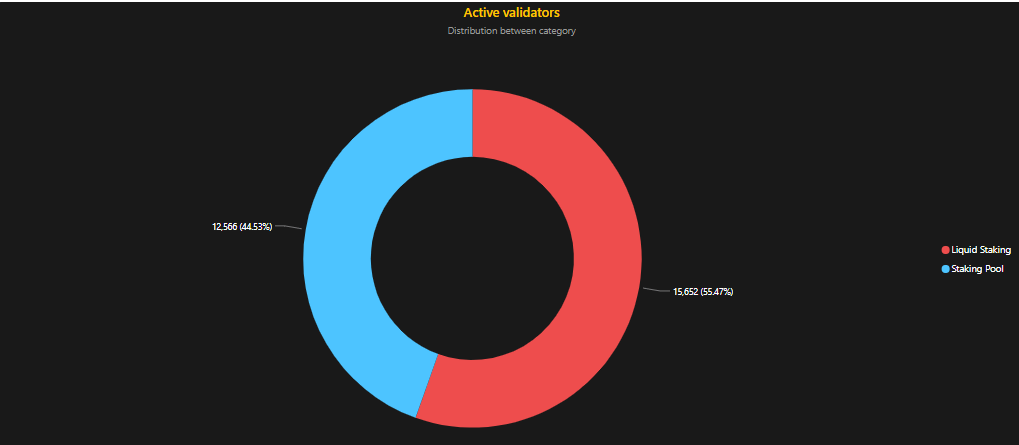

As an important validator in multiple networks, Everstake plays a key role in management decisions. Vasylchuk, however, rejected the concern that great validators are a centralization risk. “Despite the fact that it is one of the largest, our interest in Solana is only 1.4%, in Sui, it is 1.3%. That is far from centralization, “he clarified.

Instead, he pointed out centralized exchanges as a greater threat to blockchain -governance. “Changes the steming funds, but do not allow users to participate in governance. This weakens decentralization and gives them disproportionate influence on networks, “he warned.

Legal uncertainty and institutional approval

With governments that are increasingly focused on cryptocurrency regulation, it comes to turn out, among other things, control. Vasylchuk believes that regulators are still missing a deep understanding of deploying, often incorrectly interpreting as a purely financial instrument instead of a board mechanism.

“When we explain as a voice process, supervisors get confused. They want to regulate it, but they don’t know how, “he said. However, he remains optimistic that clearer regulations under the new American administration can create paths for institutions to fully embrace the expansion.

“If institutions get regulatory clarity, we would see that the release of ETFs or listed income companies are popping up, so that huge new investment flows unlock,” Vasylchuk predicted.

2025 and further: a bullish outlook

Despite regulatory uncertainties, Vasylchuk believes that 2025 will be a strong year for the deportation, powered by a bullish market, institutional access and greater clarity of the regulations. However, the full potential of deportation will only be realized if traditional financial institutions have access to it through regulated investment vehicles.

“A plotting ETF would be a game changer. It is not a matter of whether it is when. With the right risk management and regulations, expanding can become a market for several dollars, “he concluded.

While Everstake continues to expand its role in Blockchain -Governance and Safety, Vasylchuk continues to commit itself to bridging the gap between crypto and traditional finances. Everstake positions his double mission to optimize blockchain infrastructure and at the same time leading regailers as a crucial player in the future of decentralized finances.