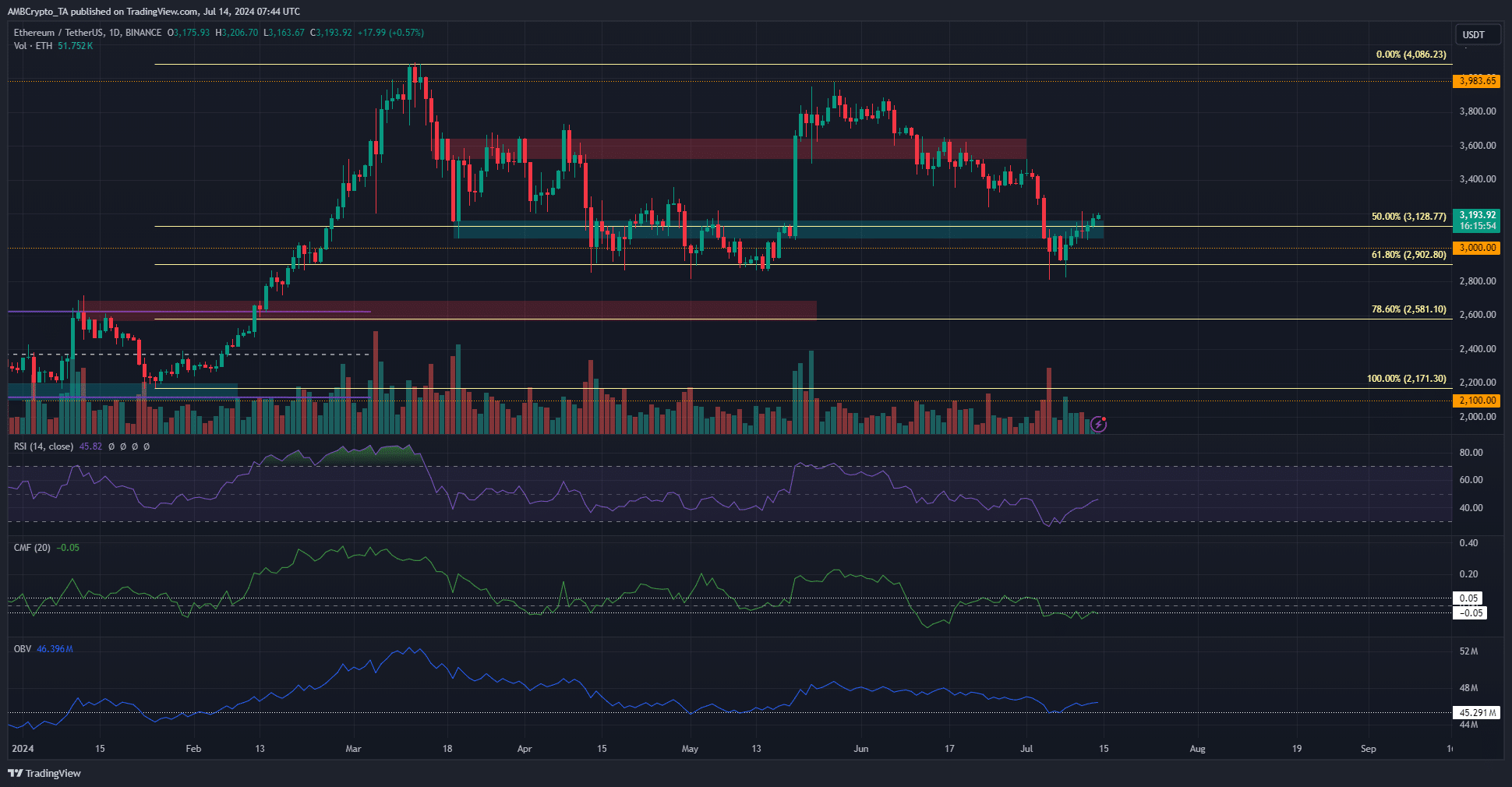

- Ethereum has a bearish market structure on the daily chart, but is still targeting the next major resistance zone.

- Volume has been sub-par in recent days, so a retracement next week is possible.

Ethereum [ETH] climbed back above the $3k level, and in an interesting turn of events for the bulls, the former $3.1k resistance zone reversed to support.

The balancing act between whale deposits and foreign exchange reserves showed that the recent deposits were small compared to the outflows of the past two months.

Ethereum network gas fees hit May lows, a sign of reduced network activity. This was not a positive sign and reflected reduced demand in the chain and slow growth.

Volume indicators are ambivalent despite the outbreak

Source: ETH/USDT on TradingView

On Saturday, July 13, Ethereum closed a daily trading session at $3,201, breaking the resistance zone in the $3.1k area. Despite this performance, the market structure and momentum in the daily time frame were bearish.

Furthermore, the CMF showed a reading of -0.05, indicating significant capital flow from the market. The OBV was unable to start an uptrend as buying volume faltered over the past ten days. This meant that the volume was too weak to be taken as a clear signal of bullish strength.

The daily RSI stood at 45, indicating bearish momentum, but has crept higher over the past week. As things stand now, Ethereum may not be ready for a quick upward move unless more volume enters the market.

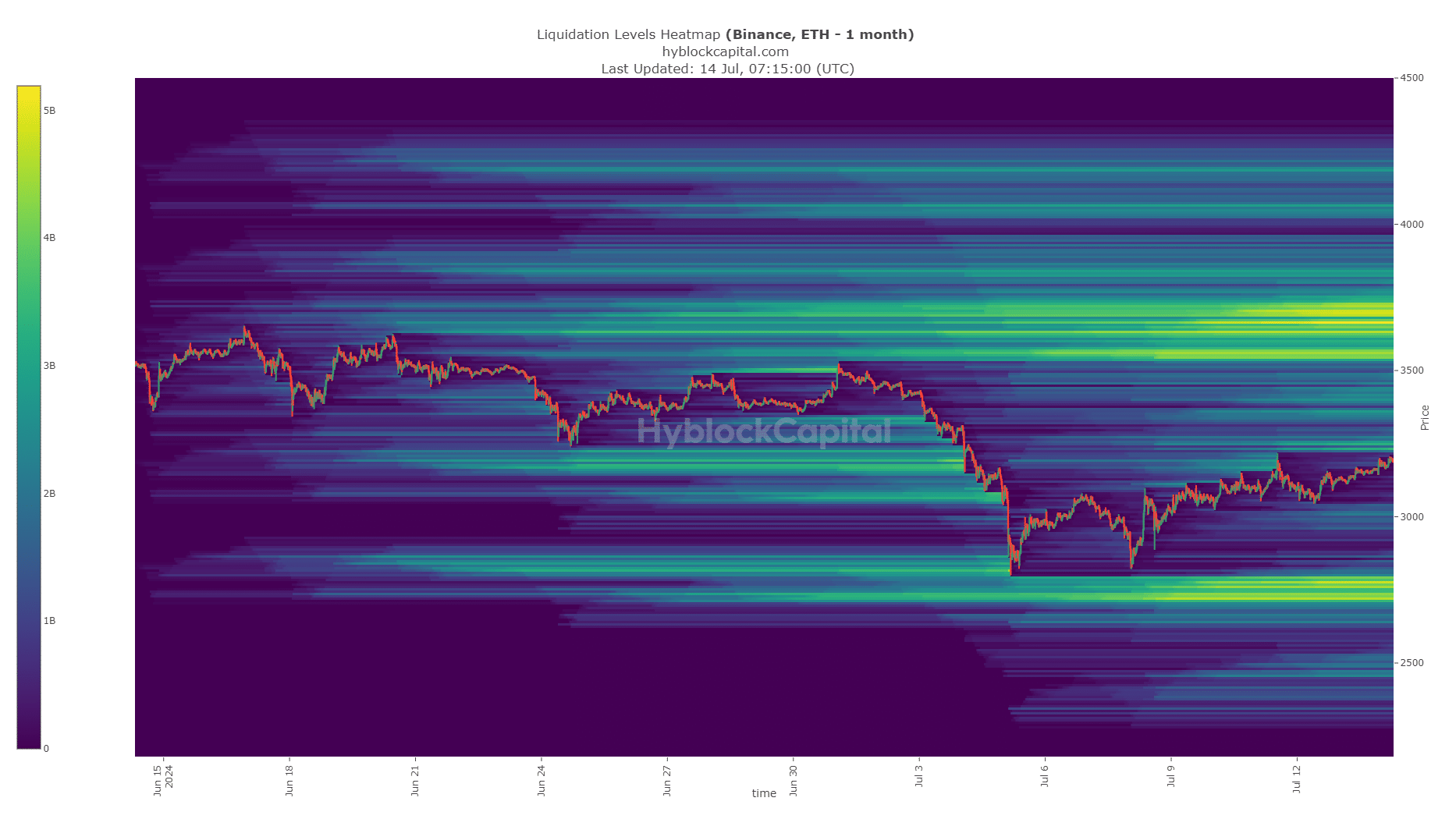

Liquidation heatmap’s directions for the next resistance

The $2.7k-$2.8k zone in the south was an attractive liquidity pool. It was tested in the first week of July, but not completely swept.

The subsequent price rise above $3.1k meant that the next liquidity cluster of $3.5k-$3.7k would be the target for bulls.

Is your portfolio green? Check the Ethereum profit calculator

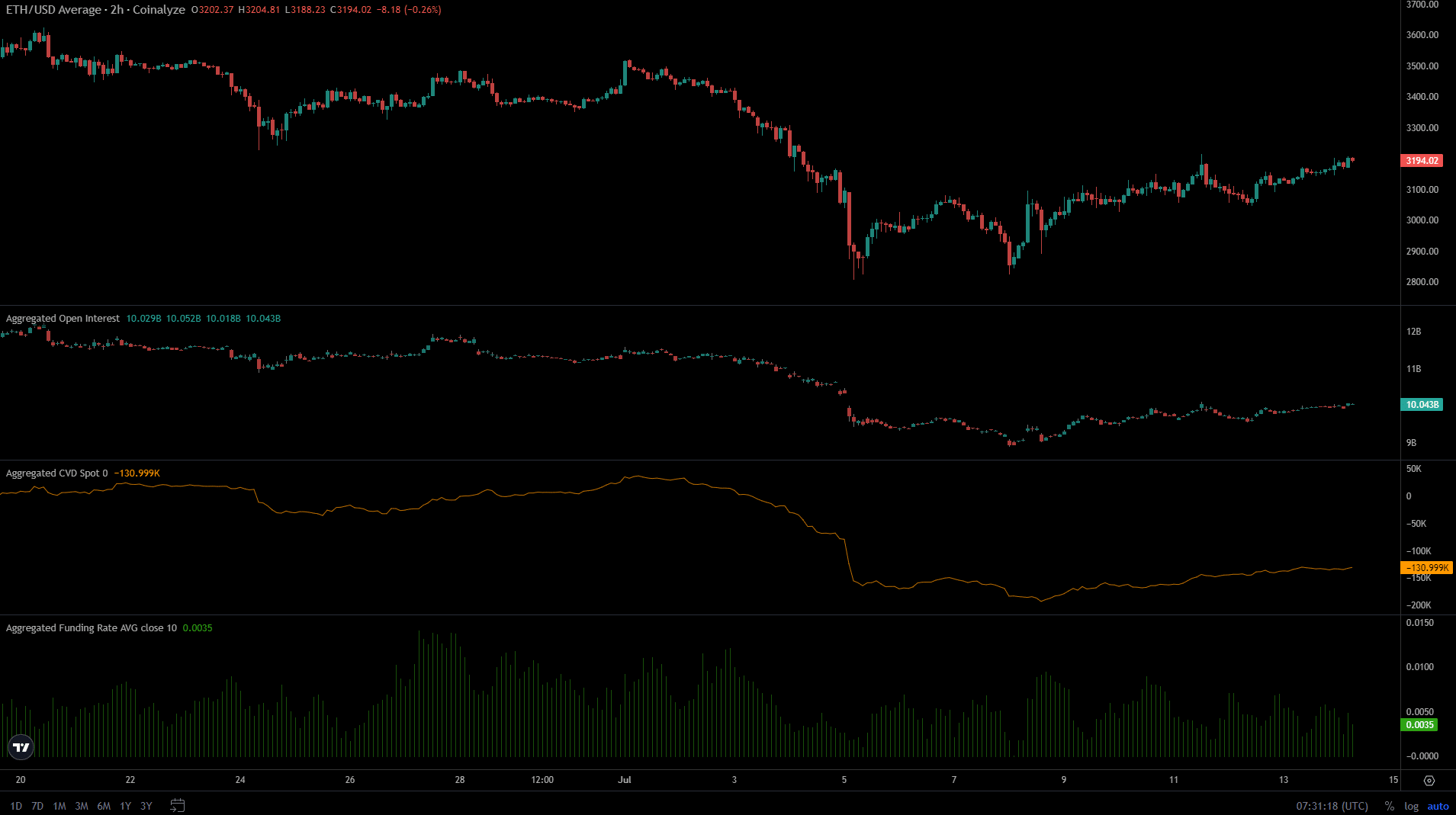

Open Interest increased along with prices and the financing rate was positive. Sentiment was strongly bullish and spot CVD also recovered.

If the trend were to remain intact, the chances of an ETH move towards $3.6k would become healthier.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.