Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum trades under the level of $ 1,900 and is confronted with continuous sales pressure as the wider crypto market continues to weaken. After a sharp rejection of the $ 2,500 marking at the end of February, Bulls did not succeed in getting the momentum back and ETH has steadily fallen – many investors disappointing who have discussed high expectations for a bullish trend. The loss of important support levels has further damaged sentiment and the price action of Ethereum remains Beerarish in the short term.

Related lecture

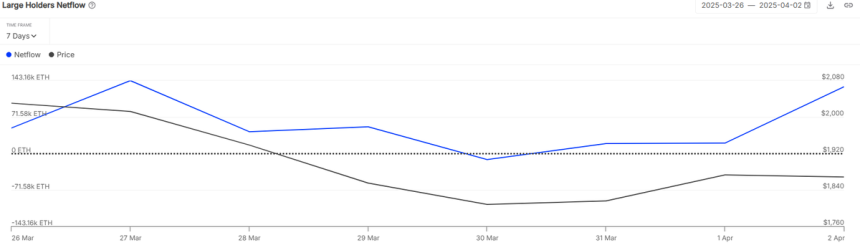

Despite the negative prospects, there are signs of accumulation under the surface. According to data from Intothelock, Ethereumwalvissen buy the dip. The largest ETH portfolios yesterday added more than 130,000 ETH to their participations-a movement that suggests the trust of players in the long term, even while the retail sentiment is faltering.

This accumulation can indicate a shift in Momentum if it is maintained, especially if whales continue to absorb the delivery while the prices remain low. For every real recovery, however, Ethereum must recover critical resistance levels and show a stronger buying activity across the board. For now the market remains under pressure, but whale behavior can offer a hint of what is coming as soon as the current Neerwaartse trend starts to illuminate.

Ethereum Great players buy in the midst of market insecurity

Ethereum currently drops 55% compared to his high in December, which reflects the wider pain in the cryptomarkt. Sale is largely fed by the increasing macro -economic uncertainty, with the aggressive trade policy of US President Donald Trump and unpredictable rate announcements that contribute to global financial instability. While traditional markets have difficulty finding foot, a risky assets such as Ethereum are the most difficult.

Bulls have a hard time defending the most important support levels, and price action suggests that the downward trend can take place in the short term. With Ethereum who acts far below $ 1,900 and no clear signs of Bullish Momentum, the outlook remains vulnerable.

Yet not all signals are Bearish. According to Data from IntotheblockEthereumwalfissen seem to gather. In one day, the largest ETH portfolios added more than 130,000 ETH to their participations – a movement that suggests a calm trust among large players. This level of accumulation, especially during periods of fear and weakness, often refers to a long -term bullish look.

Although the price remains lower trends, the behavior of these large holders contributes to the speculative environment, indicating that some investors may position early for a possible increase. If macro conditions begin to stabilize or shift sentiment, Ethereum could benefit from this quiet battery phase – but for now the market remains in correction mode.

Related lecture

Technical analysis: ETH Bulls defend critical support

Ethereum is traded at $ 1,830 after a wave of heavy sales pressure that pushes the price strongly below the most important level of $ 2,000. Panic sales has seized the market, with bulls that have difficulty recovering control in the midst of a wider decline over the crypto space. The breakdown under $ 2,000 marked a significant shift in sentiment, so that what was once seen as a consolidation phase converted into a deeper correction.

At this stage, Bulls must contain the support level of $ 1,800 – a critical threshold that, if lost, could lead to a further decrease to $ 1,750 or lower. Holding above $ 1,800 would make stabilization possible and the chance of building a basis for recovery. To identify a meaningful reversal, however, Ethereum must reclaim the level of $ 2,100, which now acts as a resistance in the short term.

Related lecture

Only a decisive push above would confirm renewed force and possibly restore bullish momentum. Until then, ETH remains vulnerable for further disadvantage. With broader market conditions still uncertain, the next step from Ethereum around these support levels will be crucial to determine whether it can recover in the short term or can slide deeper into a correction area.

Featured image of Dall-E, graph of TradingView