- ETH’s supply crisis intensified as staking demand increased and foreign exchange reserves fell

- ETH fundamentals remained strong despite weak market sentiment

Ethereum[ETH]The supply crunch in the US continues to intensify and could be a harbinger of a possible strong recovery for the world’s largest altcoin.

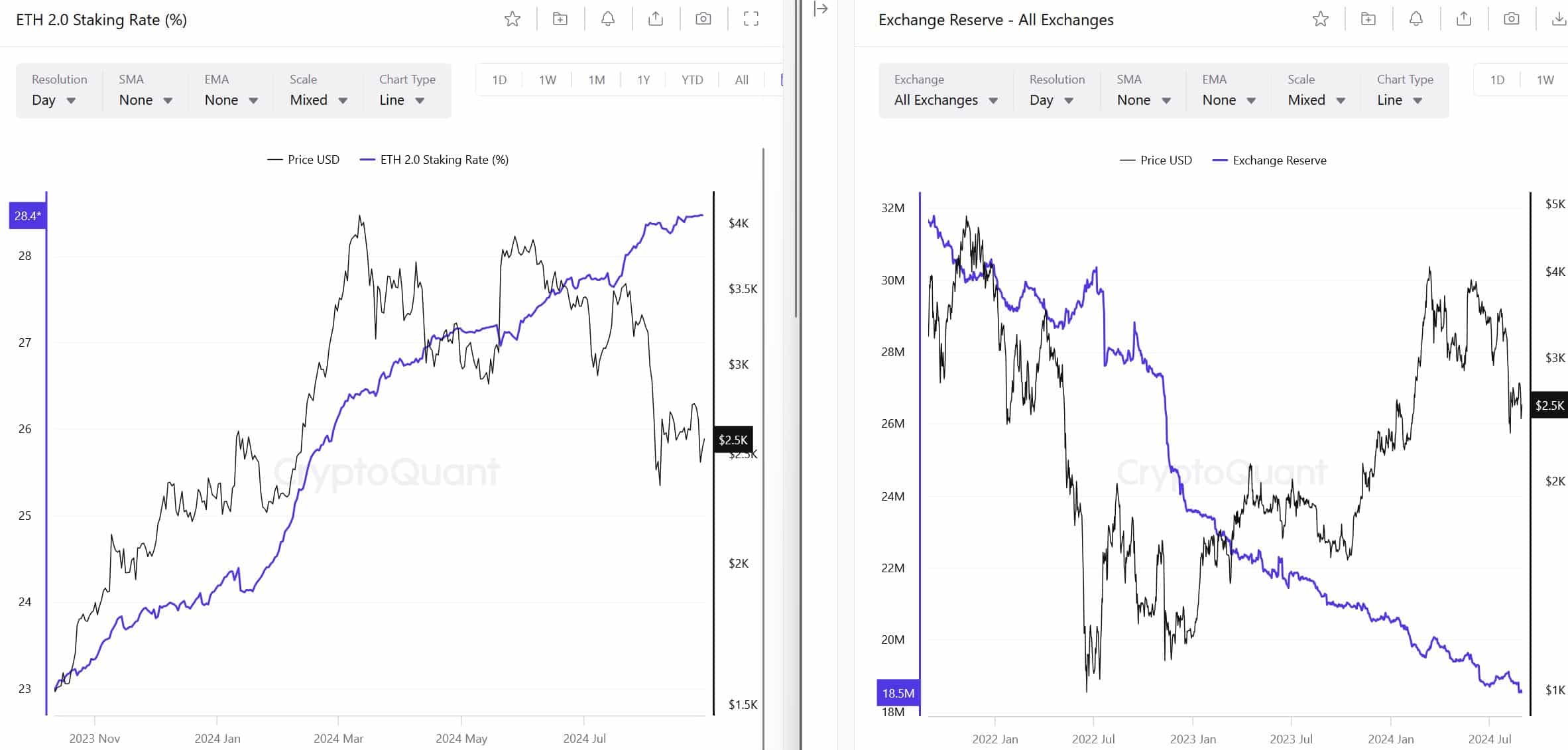

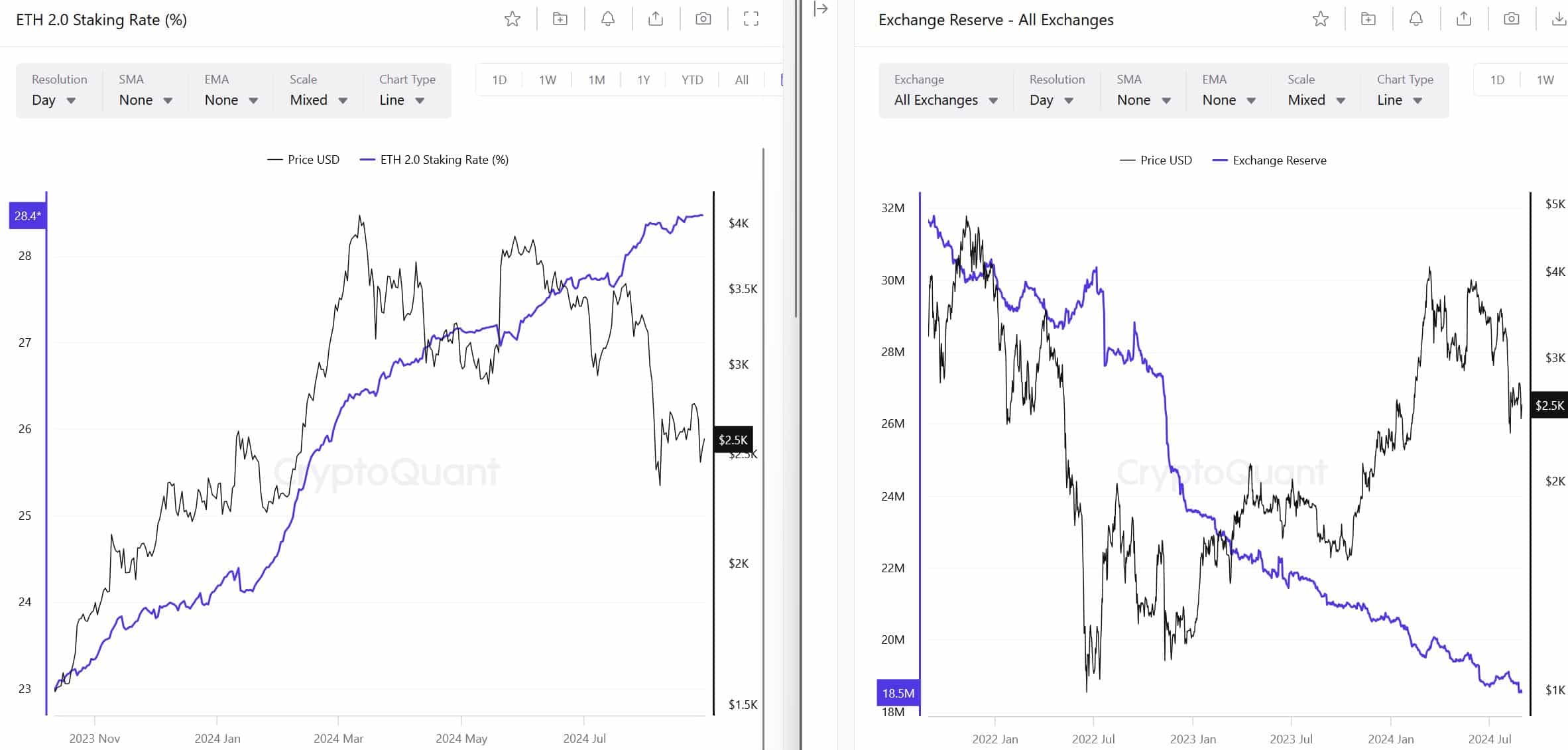

According to on-chain analyst Leon Waidmann, ETH’s supply crisis has been even worsened by dwindling foreign exchange reserves and growing investor interest in staking ETH. He projected that ETH could ‘fly’ amid the supply crisis.

“The #ETHEREUM SUPPLY CRISIS is getting MORE SEVERE by the day. With betting rates rising and currency reserves plummeting, #ETH will fly once sellers are exhausted and demand increases!📈”

Source: CryptoQuant

Here it is worth pointing out that ETH exchange reserves have hit a new low of 18.5 million in the past 24 hours. This is down from a peak of 35 million recorded in 2020.

ETH fundamentals were strong, but…

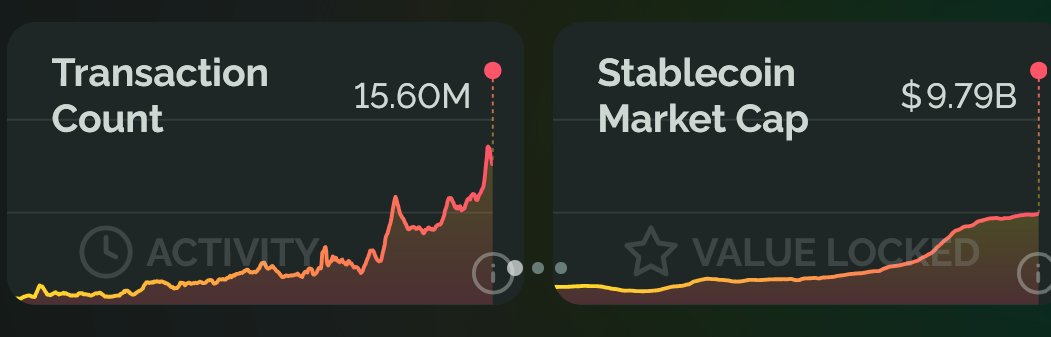

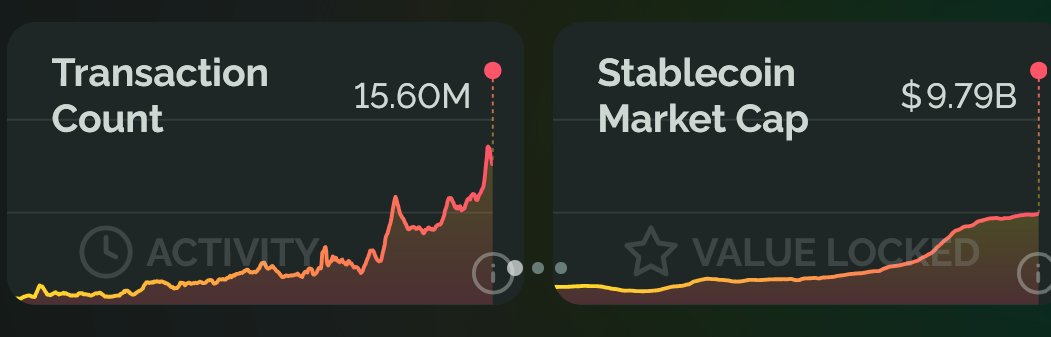

In addition, the analyst marked the strong fundamentals of the ETH ecosystem, citing record high stablecoin and transaction numbers.

“Number of transactions: ALL-TIME HIGH at 15.60 million. Stablecoin market cap: ALL-TIME HIGH at $9.79 billion. The foundations are stronger than ever!”

Source: Growthepie

This is a sign of strong network growth for ETH, which under normal circumstances could be a positive catalyst for a rebound.

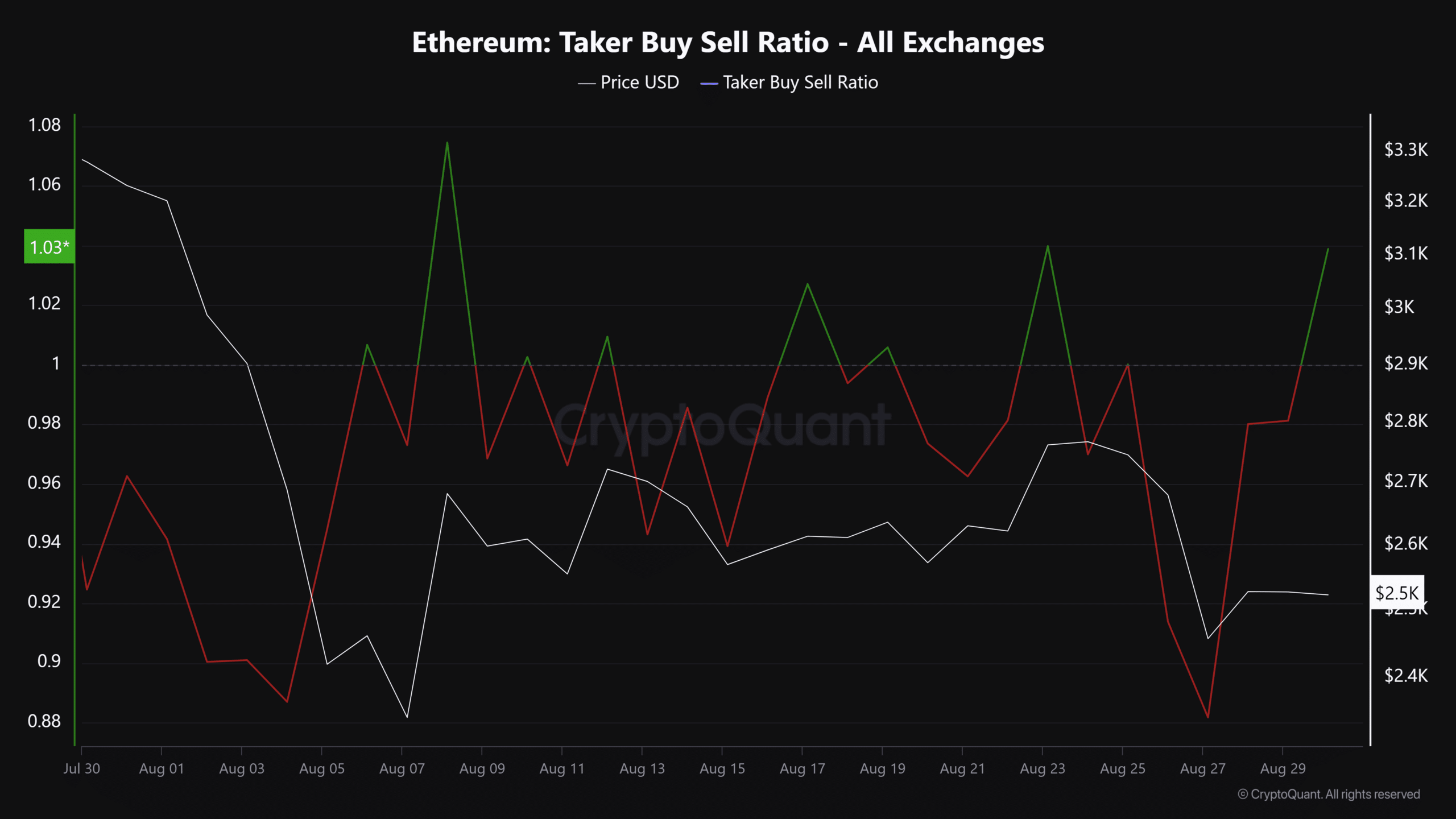

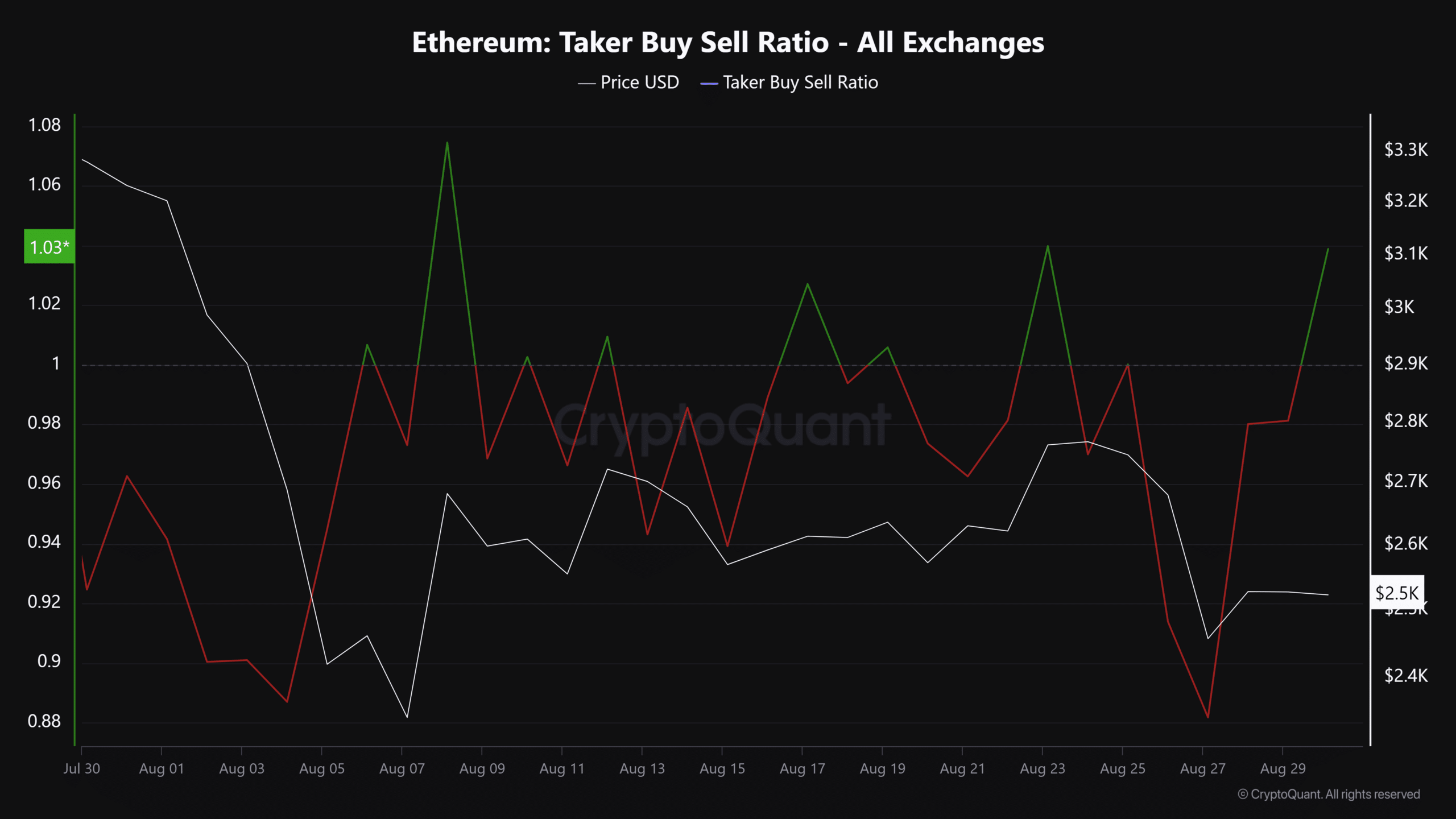

However, the altcoin was plagued by negative market sentiment for most of August, as reflected in its Taker Buyer Sell ratio. This metric tracks the buying versus selling volume of the altcoin in the derivatives market.

The overwhelmingly negative numbers in August indicated that sellers were dominating the market. The negative sentiment on this front may partially explain the altcoin’s muted price action on the charts.

Source: CryptoQuant

So was some of the negative sentiment driven due to perceived low fees and inflation issues in the ecosystem. Especially since the introduction of blobs, which made chain transaction costs cheaper.

According to Ethereum community member Ryan Berckmans statement, Revenues for the chain will improve as blob usage increases.

“The future looks extremely bright for Ethereum L1 revenues.”

He’s not alone either, with another analyst echo the outlook and expects ETH to reach $10,000 just from using blob space.

At the time of writing, ETH was trading at $2.5k, down almost 5% on the weekly charts from a recent high of $2.8k last weekend.