- A symmetrical triangle and an ascending trendline indicate an upcoming bullish rebound for Ethereum.

- Ethereum’s leverage ratio and open interest are showing important trends that could soon influence price movements.

Ethereum [ETH] closely reflects overall market dynamics and has recently experienced a notable price increase.

Following Bitcoin [BTC] moves, Ethereum is gradually recovering from a week-long dip that saw its assets fall 7.2%, pushing its price below the $2,400 mark.

At the time of writing, ETH has managed to regain some ground, trading at $2,451 with a modest gain of 1.1% over the past 24 hours.

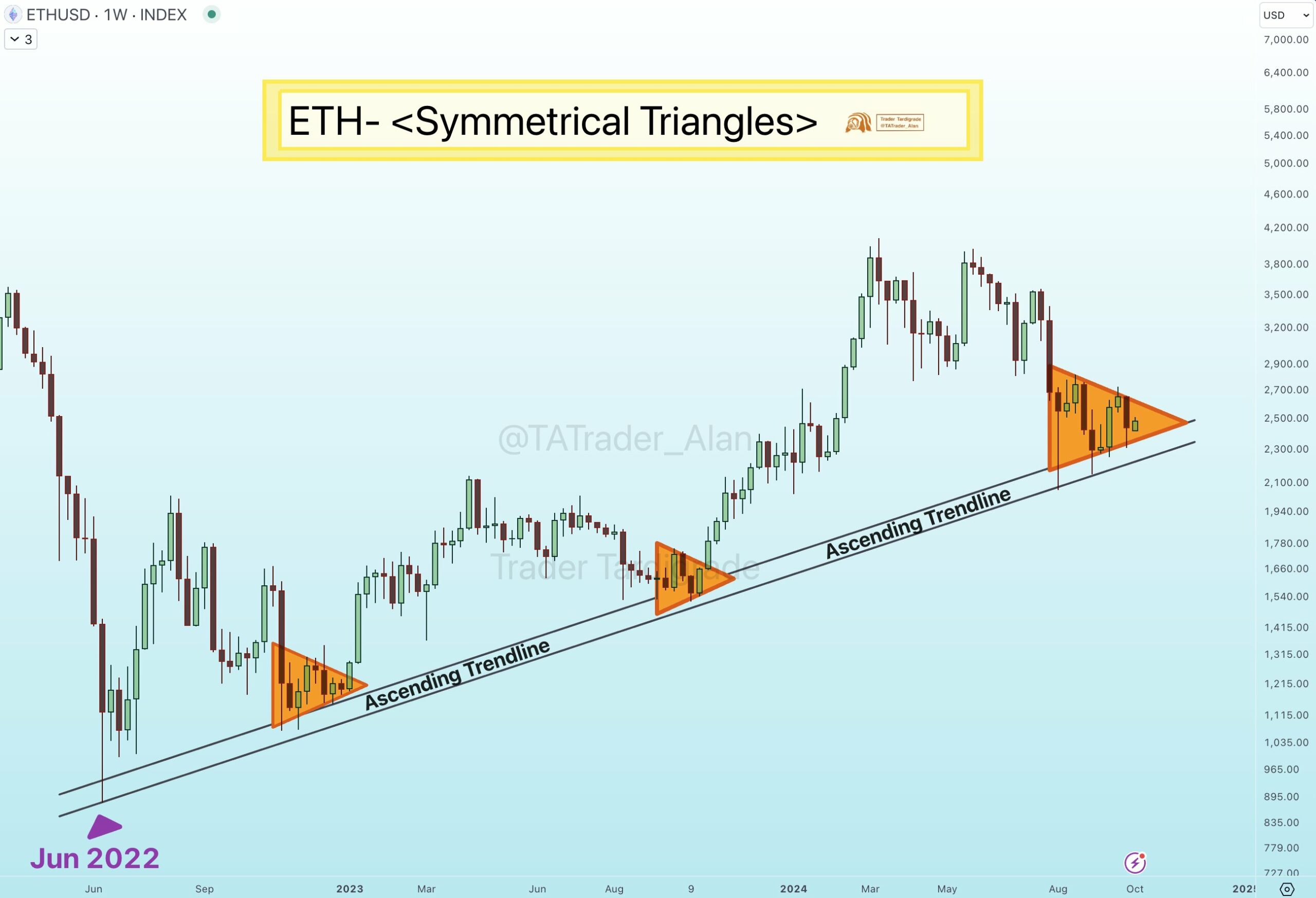

Amid this price recovery, a well-known crypto analyst recently mentioned the name Trader Tardigrade shared insights on the Ethereum price chart.

The analyst pointed out that ETH has been following an upward trendline since June 2022 and has been showing a consistent pattern.

Ethereum recovering soon?

According to the analyst, every time Ethereum approached this trendline, the price action formed a so-called symmetrical triangle pattern before bouncing higher.

Current market activity shows the formation of a new symmetrical triangle just above this trendline, indicating the possibility of an impending recovery for Ethereum.

Tardigrade’s analysis suggests that ETH is approaching a crucial support zone, with this triangle formation potentially providing the momentum needed for an upside breakout in the coming days.

Source: Trader Tardigrade on X

In technical analysis, an ascending trendline is a straight line drawn to connect at least two or more price lows.

It indicates an upward movement, with each low being higher than the previous one, indicating bullish market momentum over time.

A symmetrical triangle, on the other hand, is a chart pattern characterized by converging trend lines, which indicate a period of consolidation before a breakout.

This pattern usually occurs when the market is indecisive, but a breakout in either direction often follows once the consolidation phase is over.

The repeated appearance of these symmetrical triangles on Ethereum’s price chart, coupled with its positioning above the rising trendline, implies that a potential bullish breakout is on the horizon.

The fundamental view of ETH

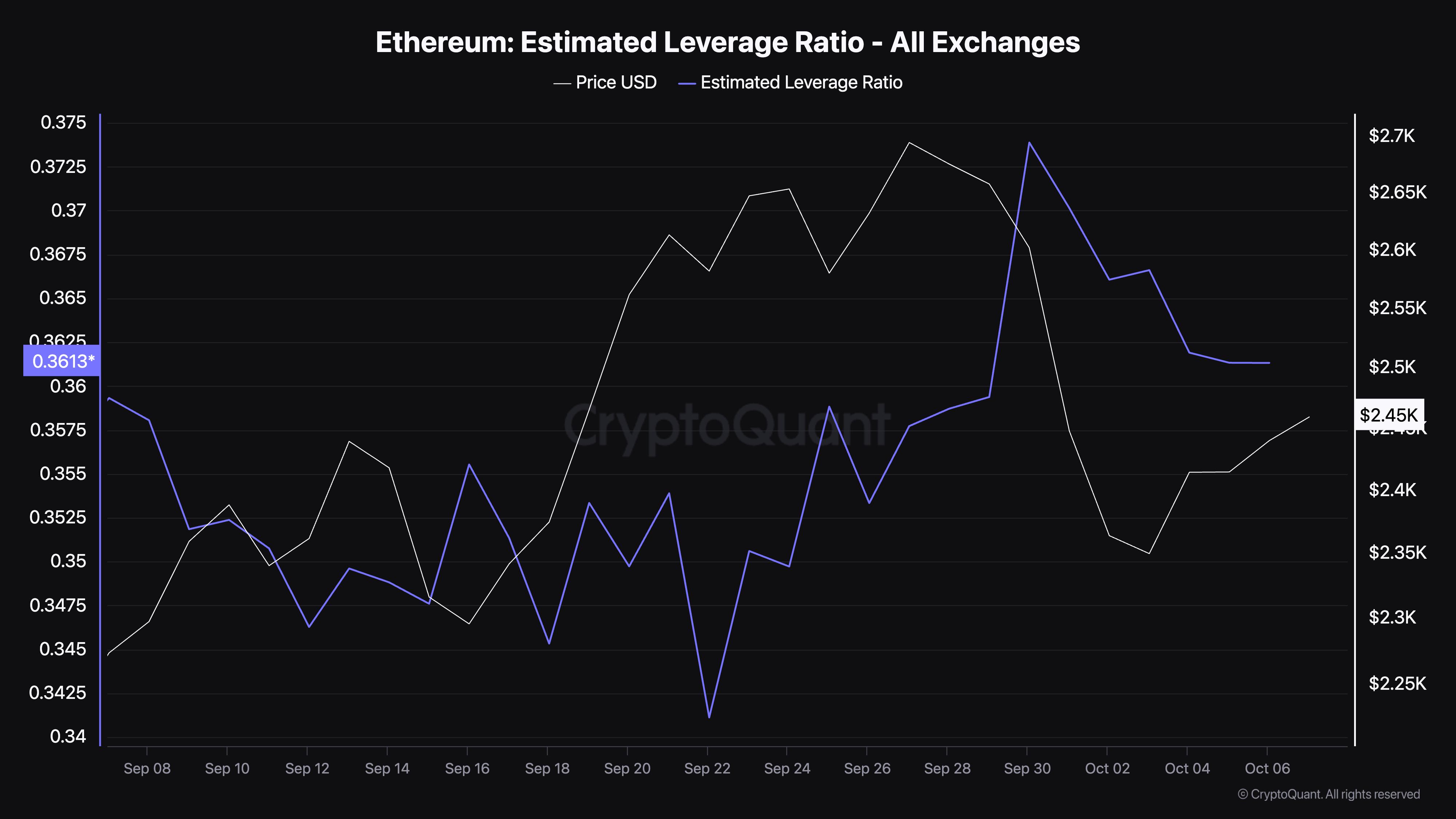

In addition to the technical indicators, Ethereum’s fundamental metrics also provide valuable insights into its potential trajectory.

According to facts from CryptoQuant, Ethereum’s estimated leverage ratio has increased over the past month, with the figure currently standing at 0.361.

This ratio represents the amount of leverage traders use, calculated as Open Interest divided by currency reserves.

Source: CryptoQuant

An increase in this ratio implies that more leverage is being applied, which often means higher expectations for price volatility.

While this can lead to higher profits if the price moves in the expected direction, it also increases the risk of liquidation if the price shifts unfavorably.

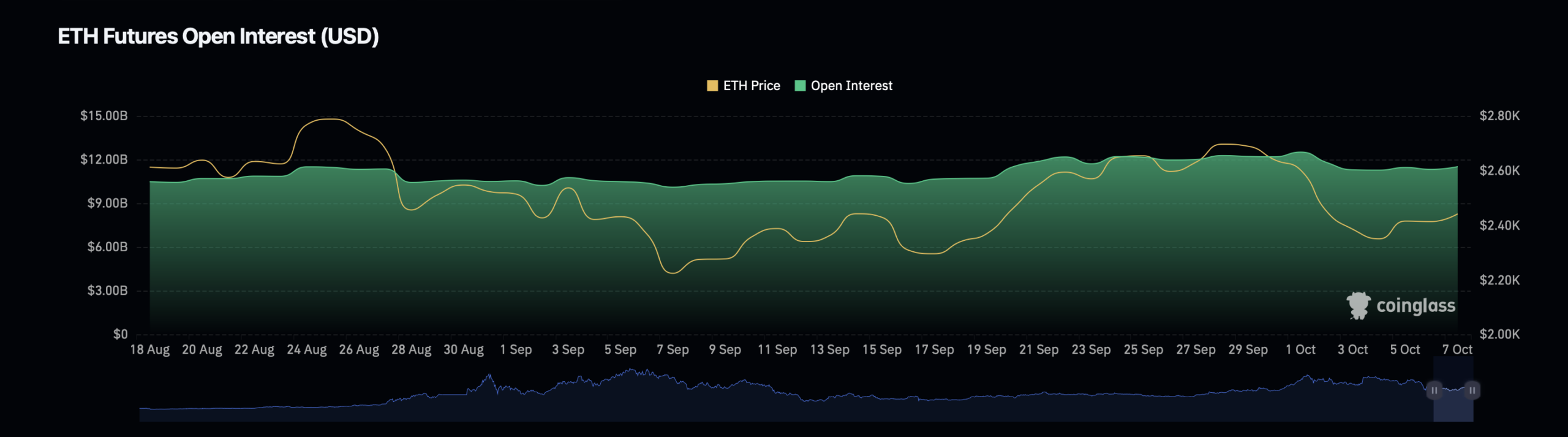

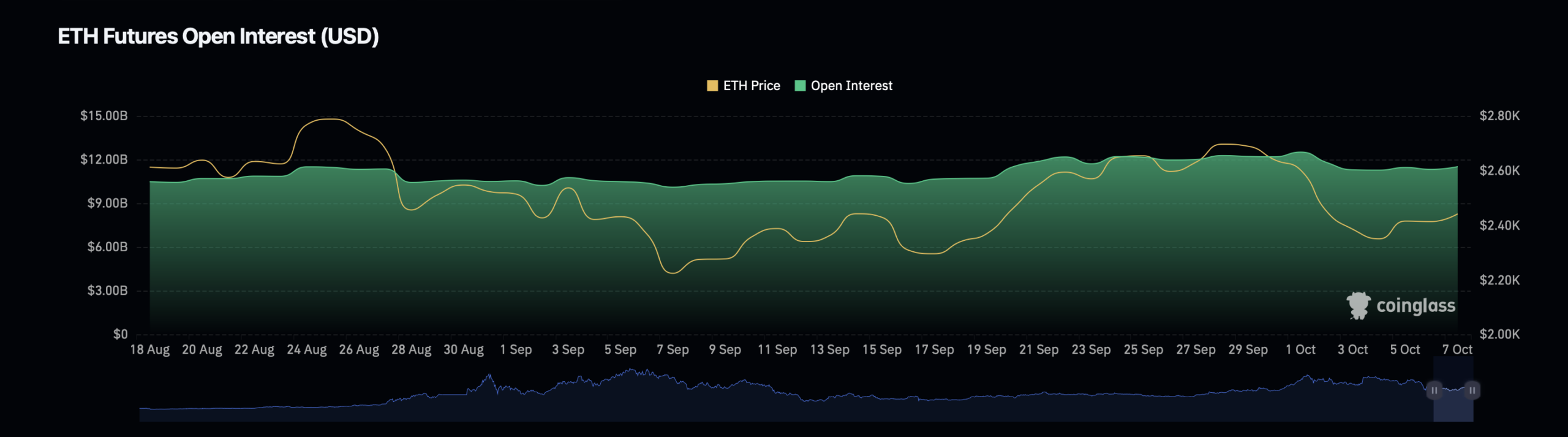

To further assess Ethereum’s market health, a look at the open interest reveals mixed indicators.

Open Interest, which represents the total number of active derivatives contracts, has experienced a slight decline of 0.21% and stands at a valuation of $11.38 billion according to Mint glass.

However, Ethereum’s Open Interest volume has increased by an impressive 120% and is now valued at $18.38 billion.

Source: Coinglass

This difference indicates that while the number of open contracts has decreased, the trading volume and activity around these contracts has increased significantly.

The decline in Open Interest could indicate a phase of reduced speculative activity, which often occurs when traders close their positions to avoid greater market uncertainty.

Read Ethereum’s [ETH] Price forecast 2024–2025

Conversely, the increase in volume could indicate that traders are actively participating in the market and possibly positioning themselves for Ethereum’s next big price move.

This mix of reduced speculative positions but increased volume activity implies that market participants are consolidating their positions, likely in anticipation of more decisive price action in the near future.