- Base’s “on-chain summer”, along with increasing focus on optimism, caused a dip in ETH burn.

- Projects in the development phase, including zkSync and StarkNet, also contributed to the decline.

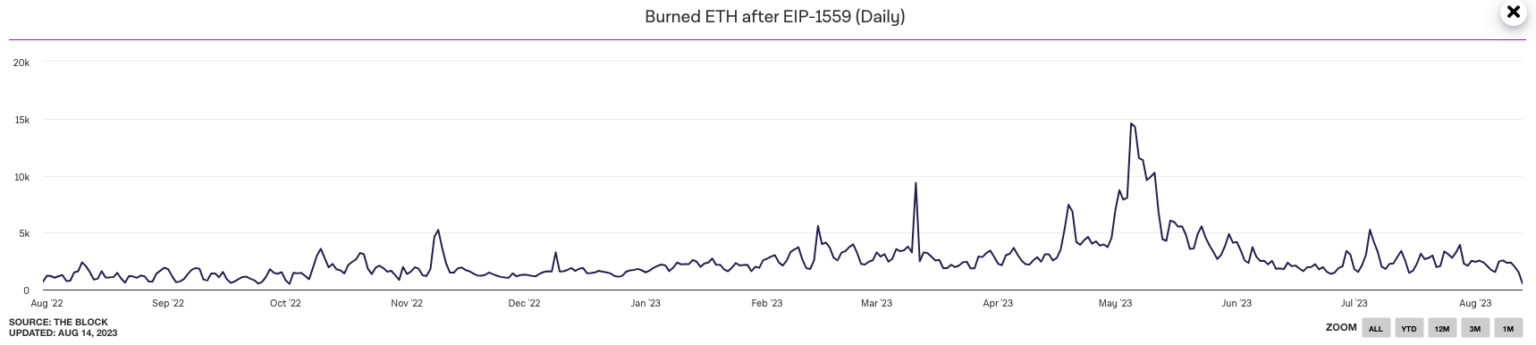

The inability of Ethereum [ETH] Layer One (L1) to scale efficiently has caused the amount of ETH burned to hit a new low since 2023. According to on-chain data from The Block, the amount of ETH burned after EIP-1559 fell to 504.54 ETH on August 12.

Realistic or not, here it is OP’s market cap in ETH terms

The blockchain started the ETH burning mechanism after the London hard fork with the aim of simplifying the transaction fee process. So when a transaction takes place on the Ethereum Maiinet, it will be split in two. This creates a base fee that is burned and prioritized to the miners.

A change in attention

Therefore, the decrease in ETH burned could be attributed to the declining activity on Ethereum L1. And this was because market participants shifted their focus to L2s that offered more scalability.

Source: The Block

Lately, the crypto community has been busy launching Base, the L2 from Coinbase. And since launch, $203.88 million has been bridged to Base, with ETH bookkeeping for $144.54 million of the total.

Source: Dune analysis

Despite the increased activity on Base, it has not yet been matched with other L2s, including Polygon [MATIC] And Optimism [OP] in terms of active addresses. Active addresses are the number of individual addresses that participated in the given transfer of an asset.

As of press time, both Optimism and Polygon have recorded declines in the metric over the past seven days. Optimism was the dominant one, however, as the stat remained at 69,400. Network activity on Polygon was relatively disappointing with active addresses at 9.101.

Source: Sentiment

Participants watch new launches

Two other L2s that seem to have shifted attention away from the Ethereum Mainnet are zkSync And StarkNet. StarkNet is a permissionless decentralized Zero Knowledge (ZK) package aimed at scaling decentralized applications (dApps) on the Ethereum blockchain.

zkSync, on the other hand, also uses ZK technology to enable faster and cheaper transactions on Ethereum. But why have these two projects, which are still in the development phase, received so much hype?

While unconfirmed, the wider crypto community believes that both projects would boost their early adopters when they are officially launched. As a result, StarkNet and zkSync registered an influx of active users on their respective Testnets.

Source: Token Terminal

How many Worth 1,10,100 ETHs today?

At the time of writing, Token Terminal showed that the number of active users of StarkNet has grown by 3524% in the past 180 days.

For zkSync, the Total Value Locked (TVL) has grown incredibly. And at the time of writing, the TVL was $142.68 million. The TVL statusat the time of writing, implying deposits in dApps under the protocol was impressive.