- The price of Ethereum has fallen by more than 3% in the past 24 hours.

- A key indicator suggested that ETH had almost reached its market bottom.

Ethereum [ETH] bears continued to dominate the market as the token’s weekly chart remained red.

However, the whole situation may change as the latest data shows that this may be the final phase of the accumulation phase for altcoins.

Since Ethereum is the largest altcoin in the world, there seemed a good chance that ETH would gain bullish momentum.

Last chance to buy ETH

CoinMarketCaps facts revealed that the price of ETH has fallen by more than 3% in the past seven days. At the time of writing, the king of altcoins was trading at $3,553.33 with a market cap of over $426 billion.

Meanwhile, Milkybull, a popular crypto analyst, posted one tweet highlighting how altcoins followed the trend of 2020, which then resulted in a huge altcoin season.

In 2020, the market cap of altcoins broke out of the pennant pattern, marking the beginning of a bull rally. A similar pattern has emerged again, indicating that this may be the last chance to buy alts, including Ethereum, at a lower price.

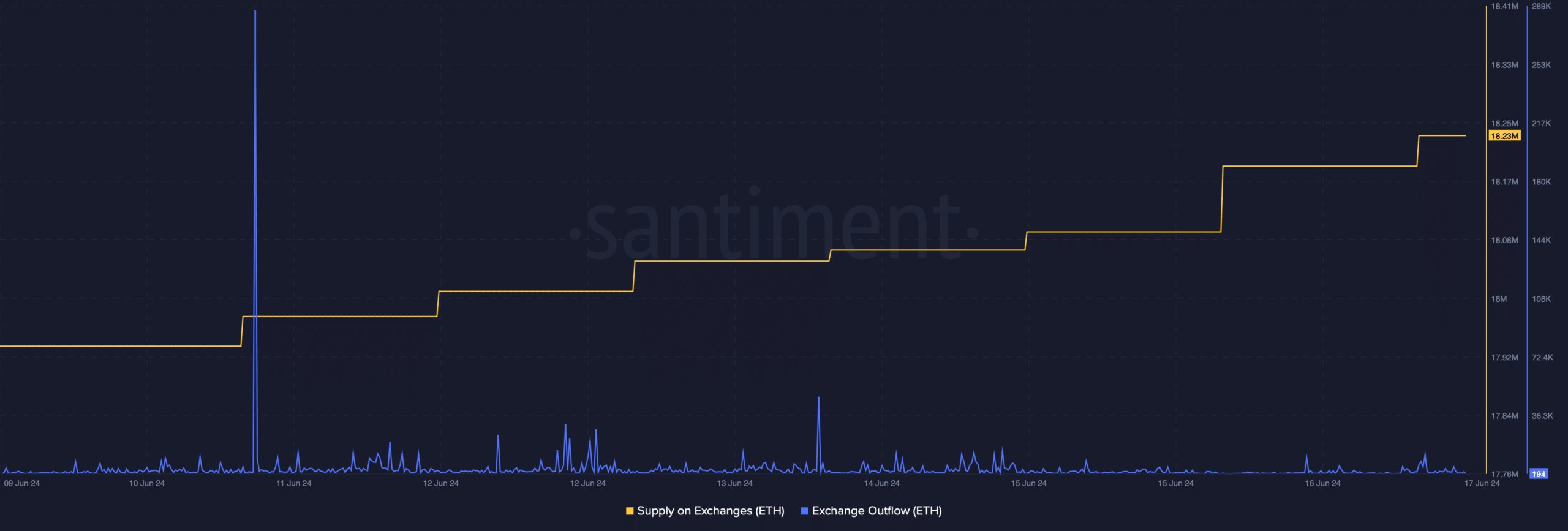

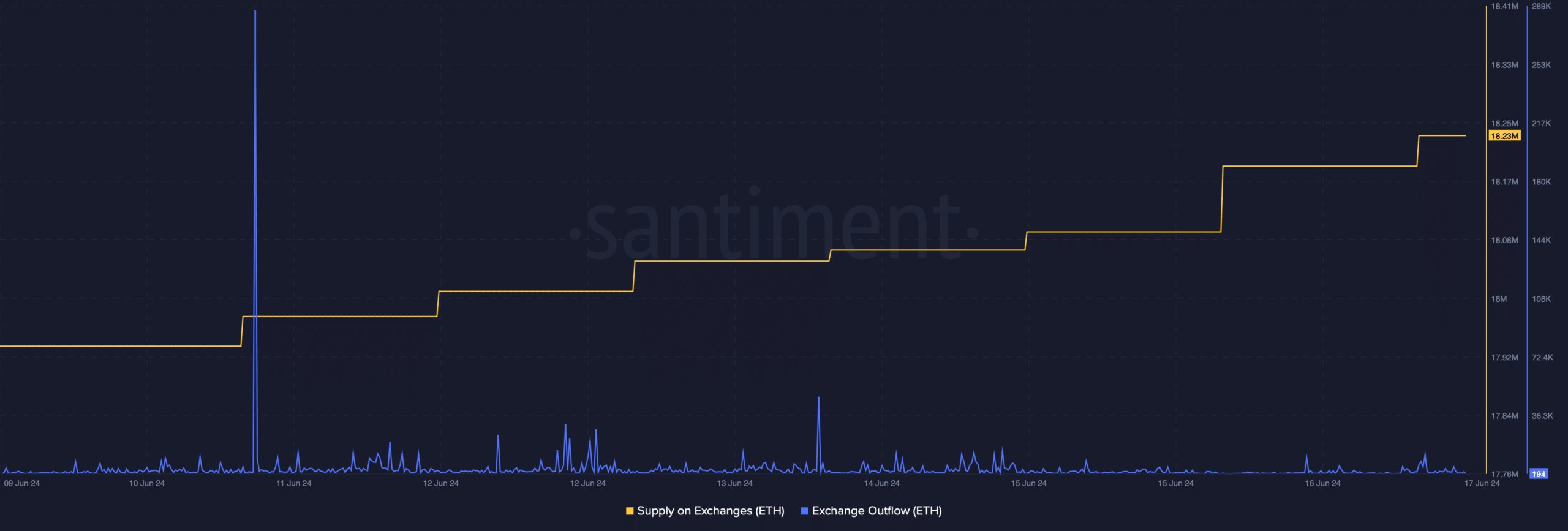

However, AMBCrypto’s analysis of Santiment’s data showed that investors are not taking advantage of this opportunity.

We found that ETH outflows have decreased over the past week. Moreover, the supply on the exchange also increased, meaning that the selling pressure on the token was high.

Source: Santiment

Is Ethereum waiting for a rally?

Since Milklybull’s analysis indicated a bull rally, AMBCrypto then analyzed ETH’s on-chain data to see if it supported the possibility of a price increase.

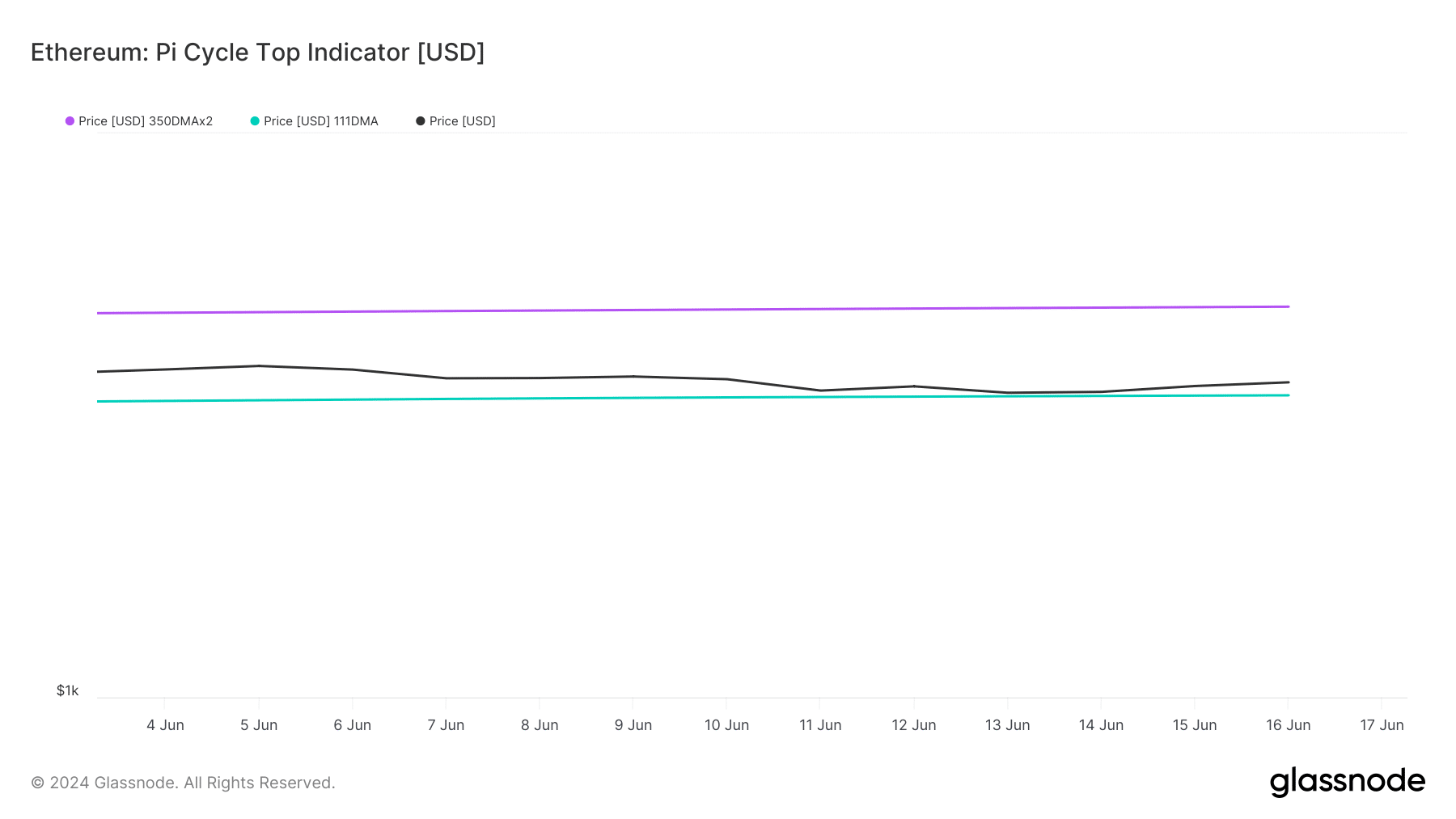

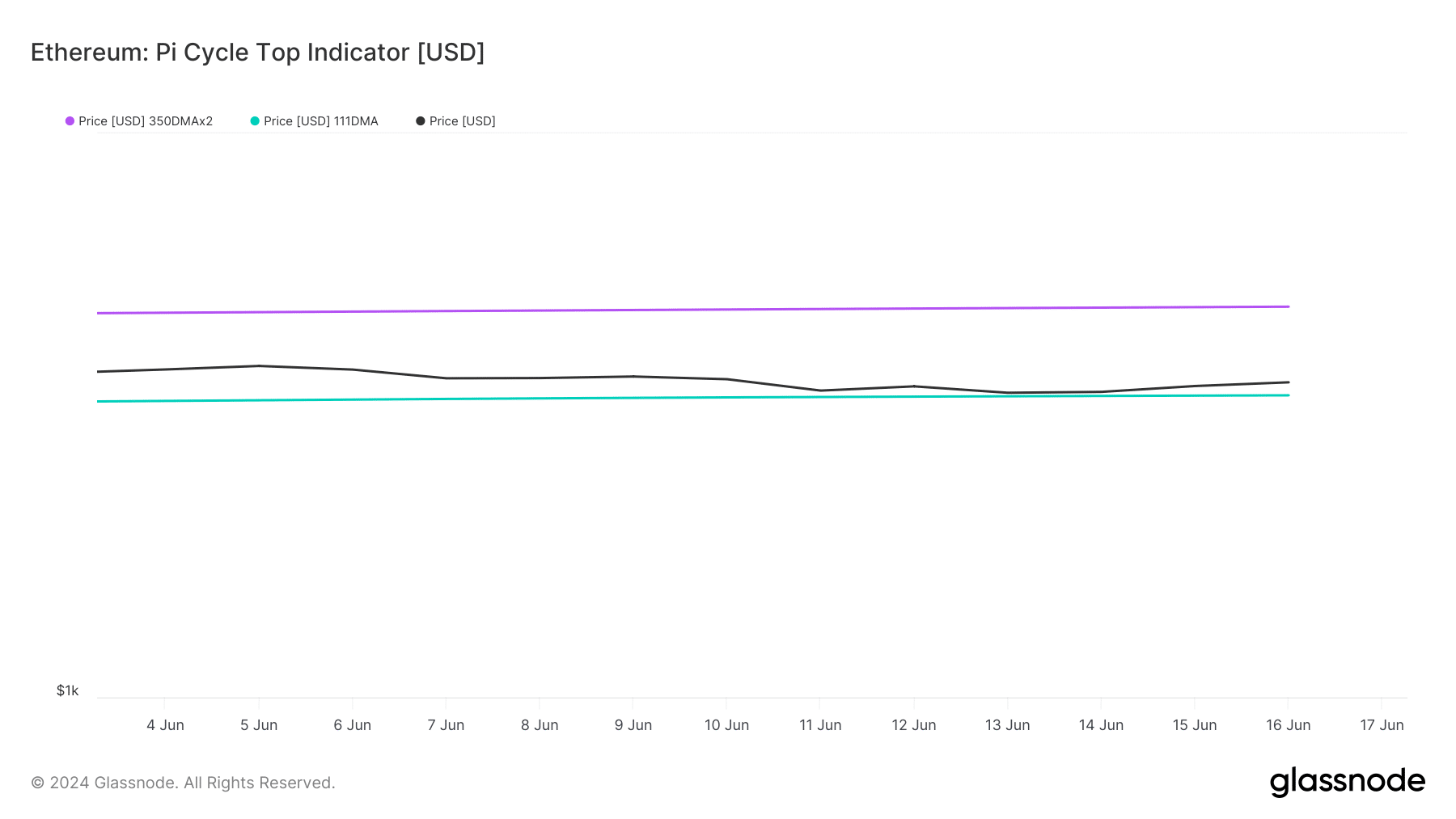

Ethereum’s Pi Cycle Top indicator revealed that ETH was near a market bottom, indicating a price increase.

If that happens, ETH could soon reach $4.92k. To start, the Pi Cycle indicators are composed of the 111-day moving average and a 2x multiple of the 350-day moving average of Ethereum’s price.

Source: Glassnode

The possibility of ETH gaining bullish momentum seemed high, as it did at press time fear and greed index had a value of 38%, meaning the market was in a “fear phase”.

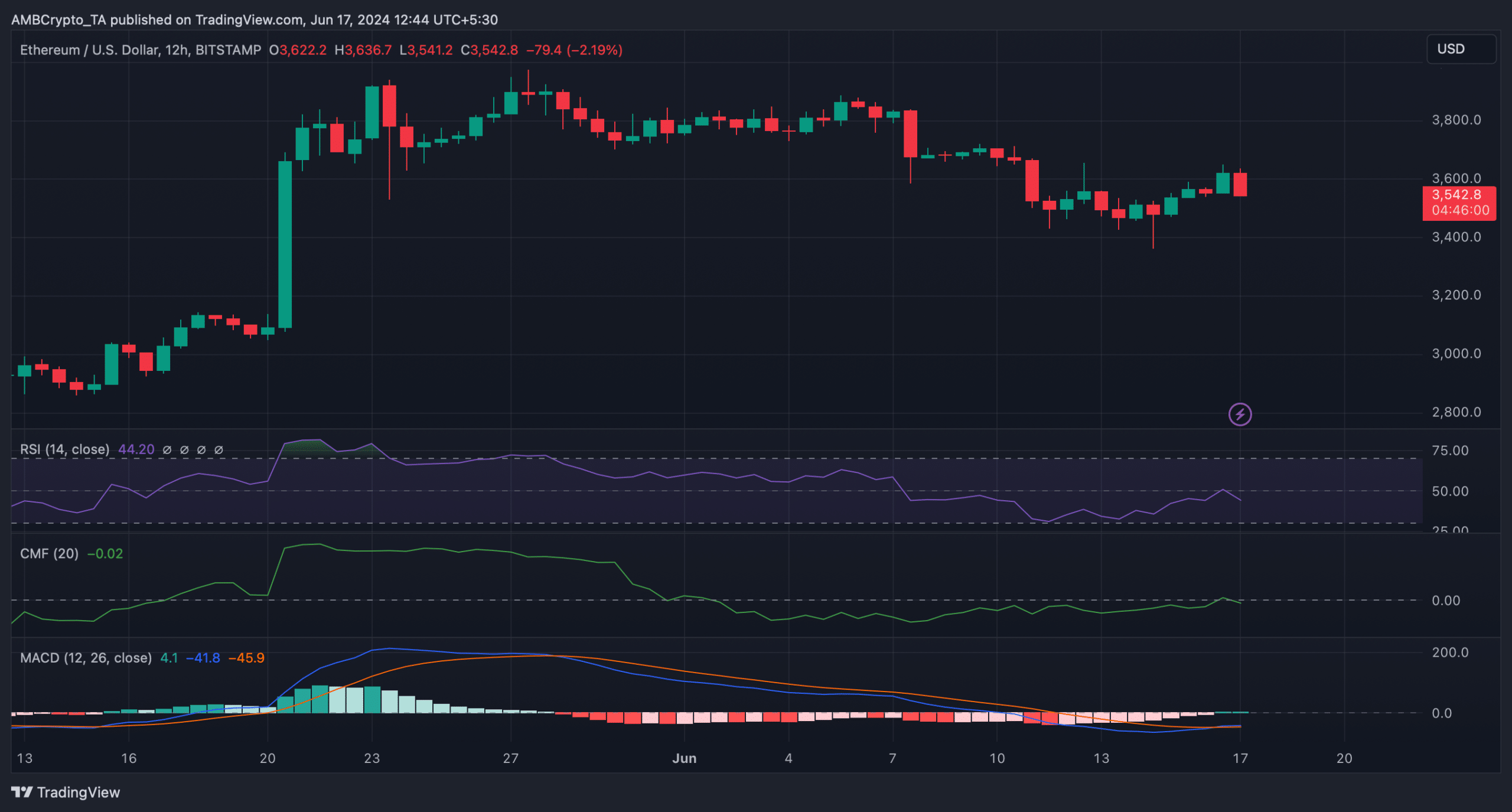

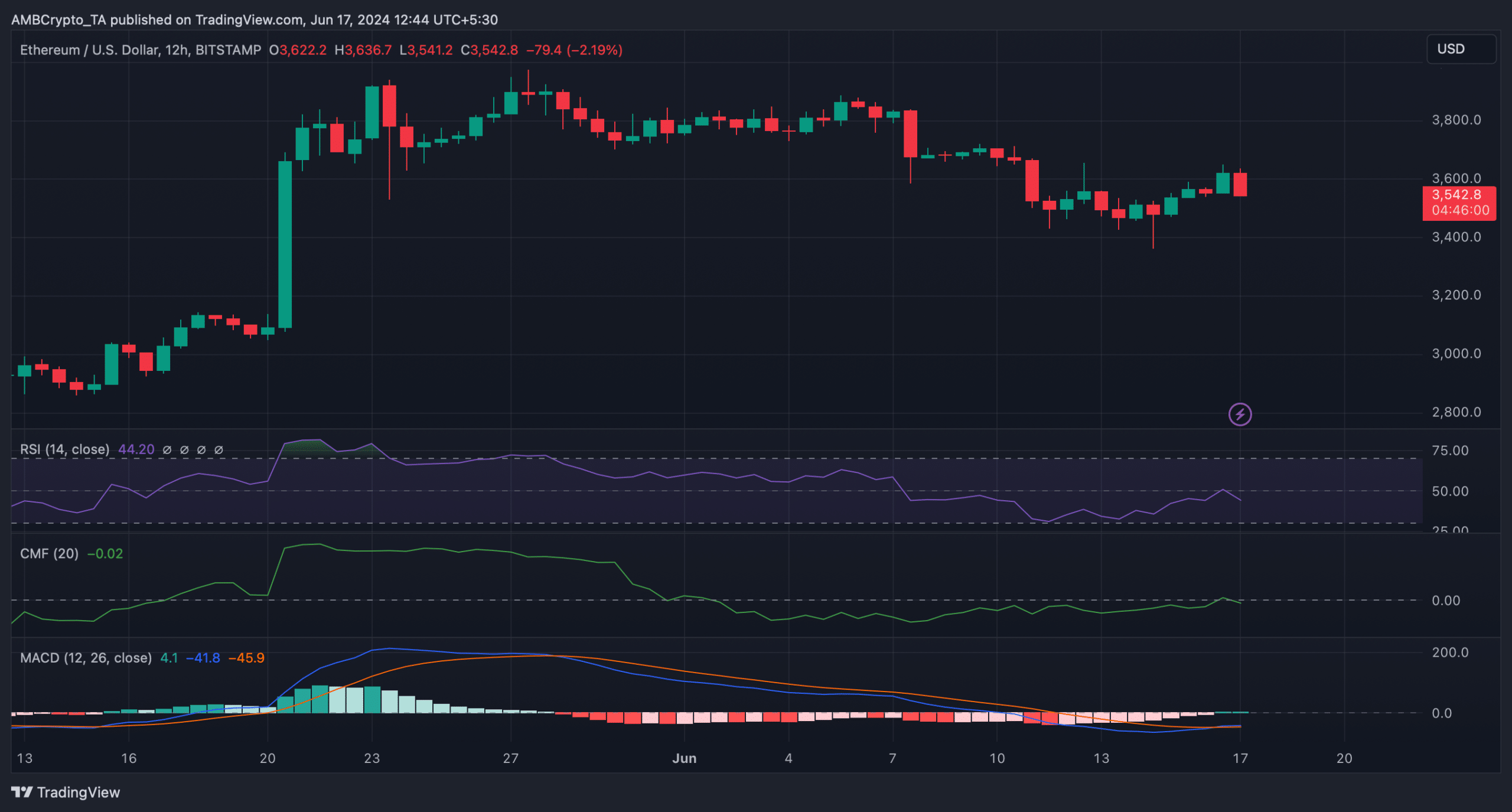

When the measure reaches that level, it indicates that the likelihood of a bull rally is high. We then took a look at ETH’s 12-hour chart to better understand what to expect from the king of altcoins.

The technical indicator MACD showed a bullish crossover.

Read Ethereums [ETH] Price prediction 2024-2025

However, the rest of the indicators appeared bearish. For example, the Relative Strength Index (RSI) registered a decline.

The Chaikin Money Flow (CMF) also followed a similar downtrend, suggesting that it could take a little longer for ETH to start a bull rally.

Source: TradingView