- One analyst expects ETH to outperform BTC in January.

- A shift in ETF flows and seasonal data supported this outlook.

Ethereum [ETH] could surpass Bitcoin [BTC] in January if the market shift of the past two days continues.

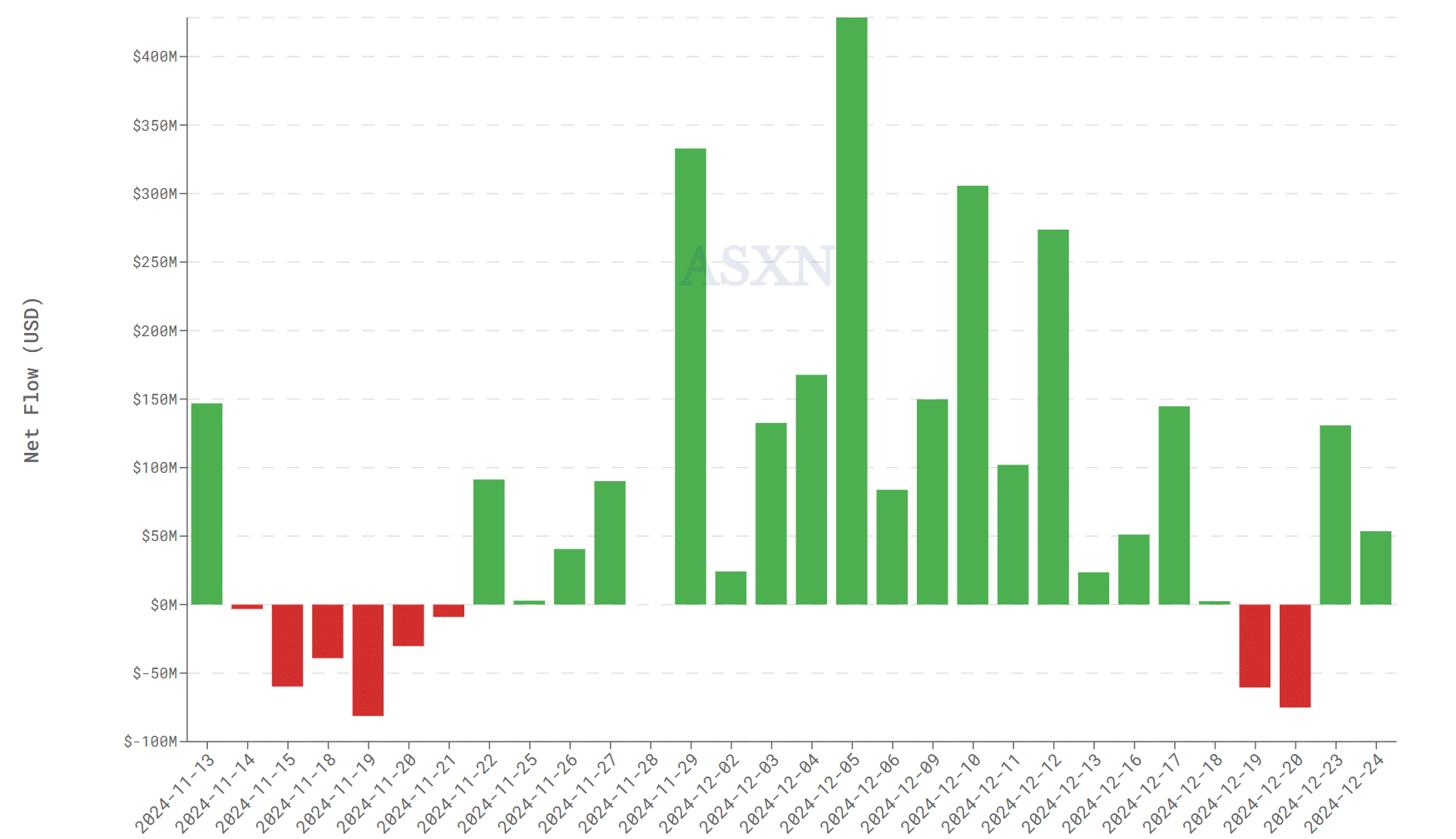

According to crypto analyst and investor Michael van de Poppe, ETH’s outperformance could likely be due to outflows into US spot BTC ETFs, while ETH recorded inflows.

For context, BTC ETFs have seen four consecutive daily outflows, unlike ETH, which saw positive inflows worth $183 million over the past two days.

This could be considered a positive outlook for ETH versus BTC in the short term.

ETH to outperform BTC?

Poppe added that the ETH/BTC ratio, which tracks the relative price performance of ETH versus BTC, could exceed 0.04 in January.

At the time of writing, the ratio stood at 0.033, so a move to 0.04, as predicted by Poppe, would translate into ETH collect compared to BTC by 20%.

Source: ETH/BTC, TradingView

However, the 0.04 has been a short-term resistance since November. The earlier recovery, which also fueled the altcoin season’s momentum, was stopped at the roadblock.

However, breaking the hurdle could accelerate ETH’s outperformance against trendline resistance.

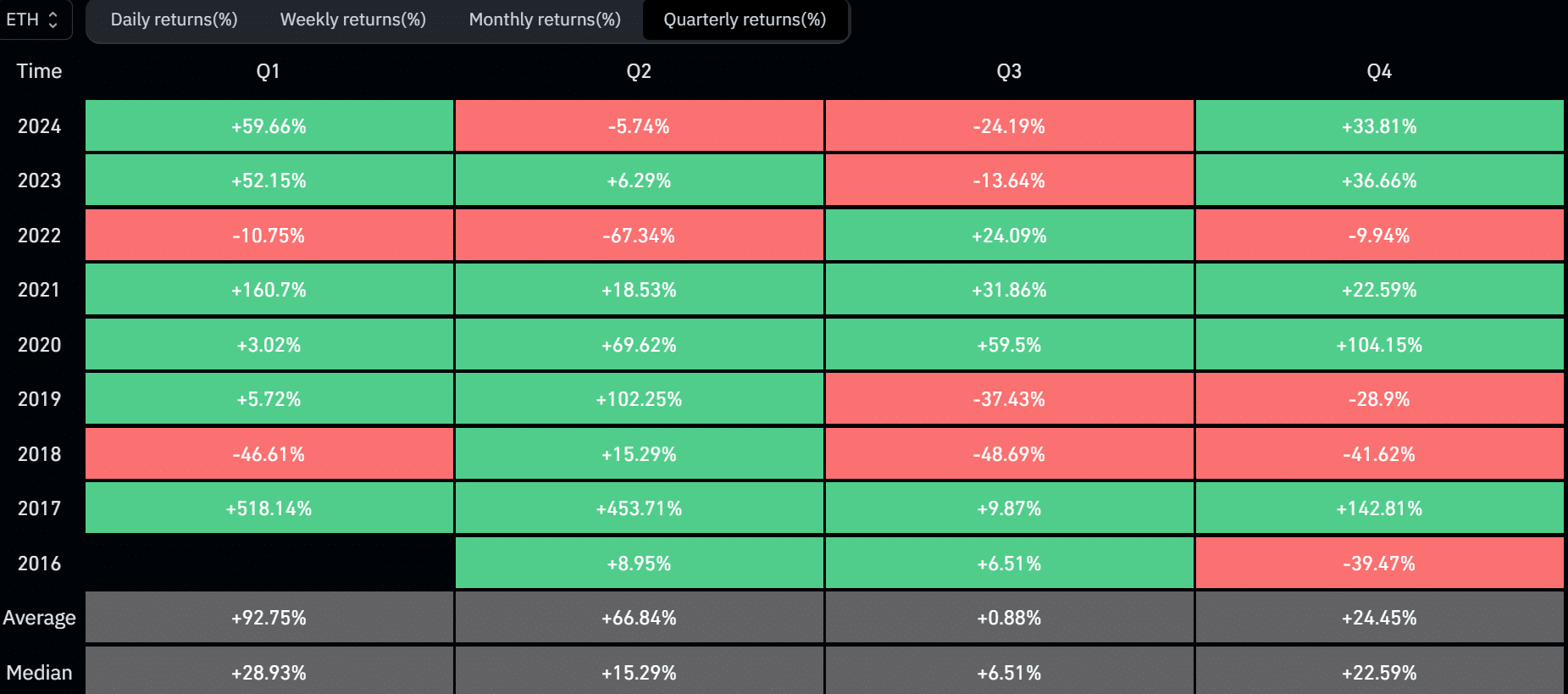

While the two-day ETF flow data may not be enough to correctly predict a mean shift, the seasonal data trended toward the Poppe projection.

Since 2017, ETH’s strongest price performance has always occurred in the first quarter. Coinglass data showed that ETH averaged a 92% gain in the first quarter. Of the past six years, ETH has only finished two years in the red.

From a monthly perspective, ETH had the best rallies in January, with an average gain of 23%, further strengthening the potential bullish outlook for early 2025.

Read Ethereum [ETH] Price prediction 2024-2025

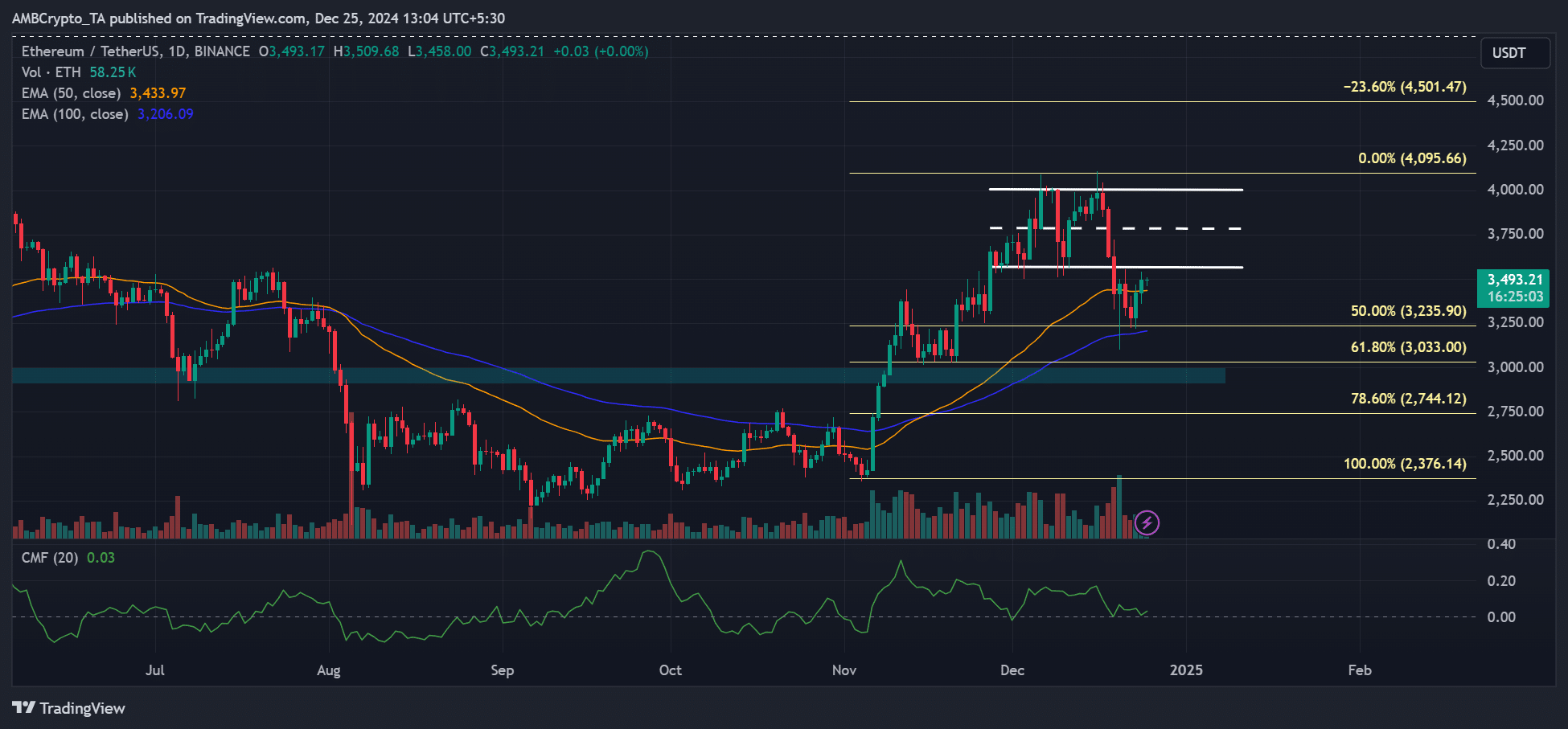

On the price charts, the immediate level that could herald ETH’s bullish reversal was the previous support and lows at $3.5K.

Despite the positive outlook, as evidenced by the price being above the major moving averages, the $3.5K could attract more traders.

Source: ETH/USDT, TradingView