- Ethereum is having its second biggest buying day, with the number of long-term holders increasing significantly.

- Market indicators are showing mixed signals, with the decline in open interest rates and foreign exchange reserves reaching eight-year lows.

Ethereum [ETH]the second largest cryptocurrency by market capitalization, has seen some interesting market moves recently.

Despite dropping 8% over the past week, Ethereum saw a slight increase of 0.3% over the past 24 hours, bringing its current trading price to $3,519.

This small increase comes during a period of general market uncertainty, especially following the adoption of spot Ethereum ETFs by the U.S. Securities and Exchange Commission in May.

Long-term holders benefit from market declines

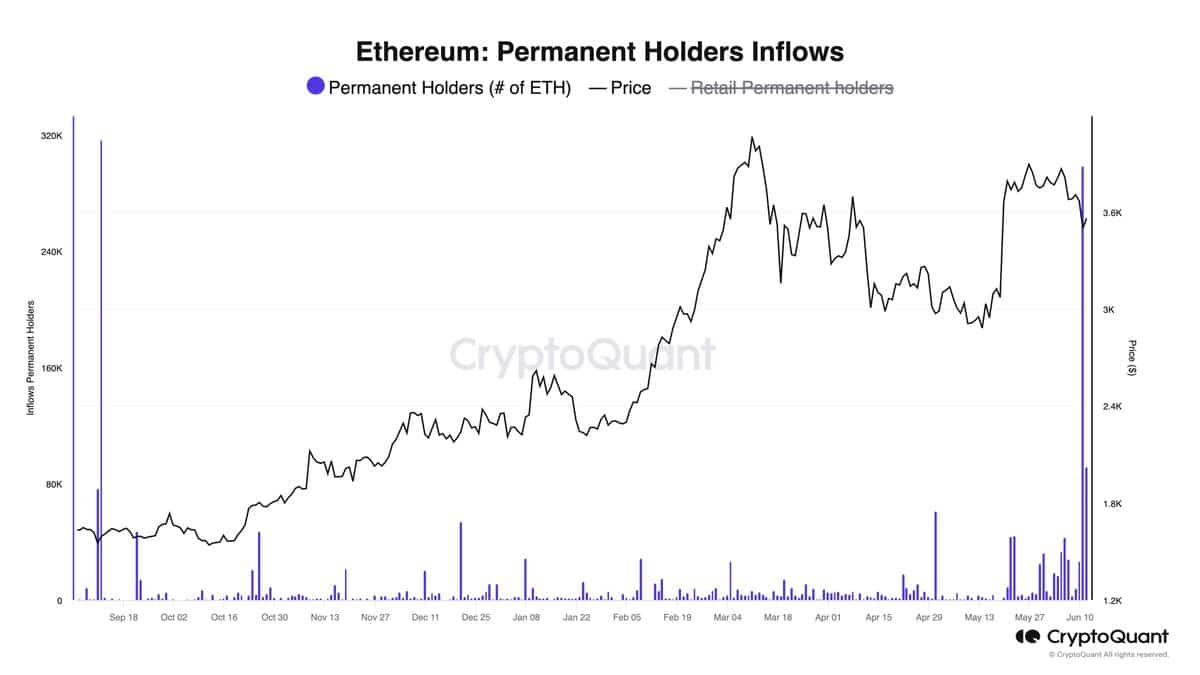

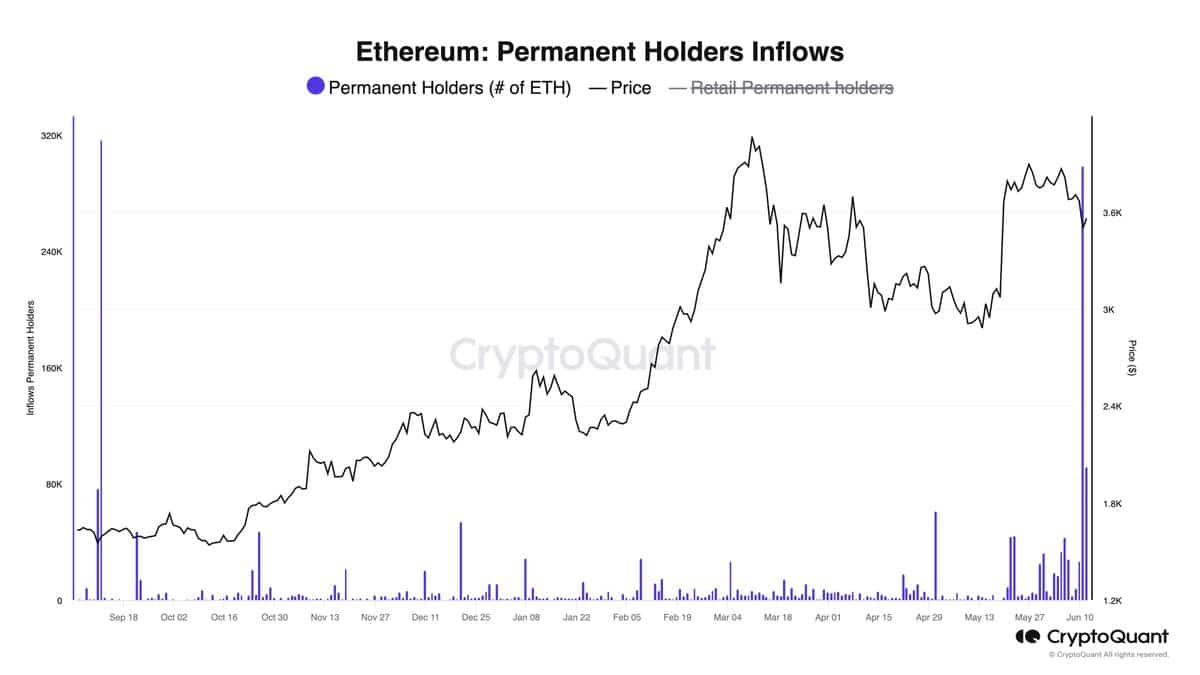

Amid these price adjustments, Ethereum has done just that experienced a significant increase in long-term holder accumulation. According to Julio Moreno, head of research at CryptoQuant, Ethereum just witnessed the second largest buying day among long-term holders.

On June 12, approximately 298,000 Ethereum tokens, worth approximately $1.34 billion, were purchased by these steadfast investors, benefiting from a slight 2% price decline within the same 24-hour period.

Source: CryptoQuant

This remarkable accumulation was not far off the record set on September 11, 2023, when 317,000 Ether tokens were acquired as prices fell below $1,600.

This pattern of strategic buying during price declines highlights the confidence that long-term investors have in Ethereum’s value.

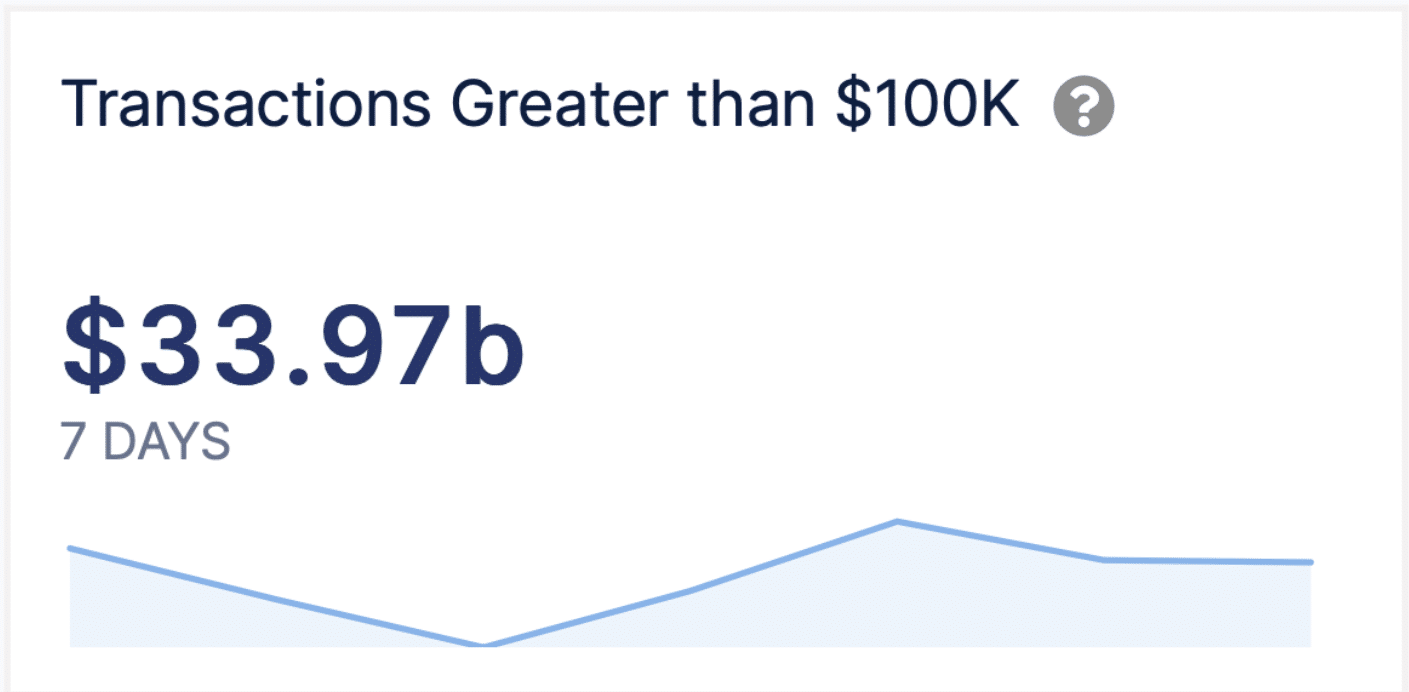

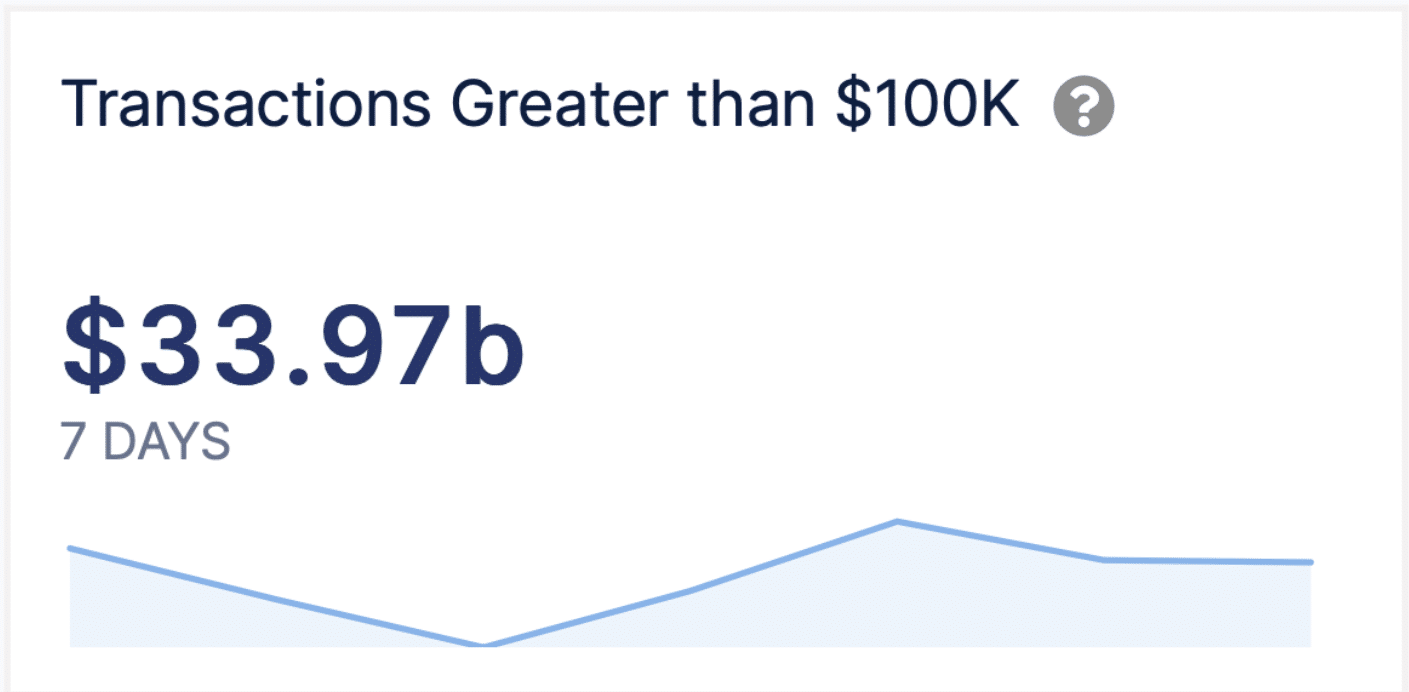

Furthermore, this trend corresponds to an increase in large transactions above $100,000, as shown by IntoTheBlock factswhere such transactions rose from less than 4,000 earlier this week to more than 6,000

This indicates active accumulation by whales regardless of prevailing market conditions.

Source: IntoTheBlock

Market caution and technical outlook

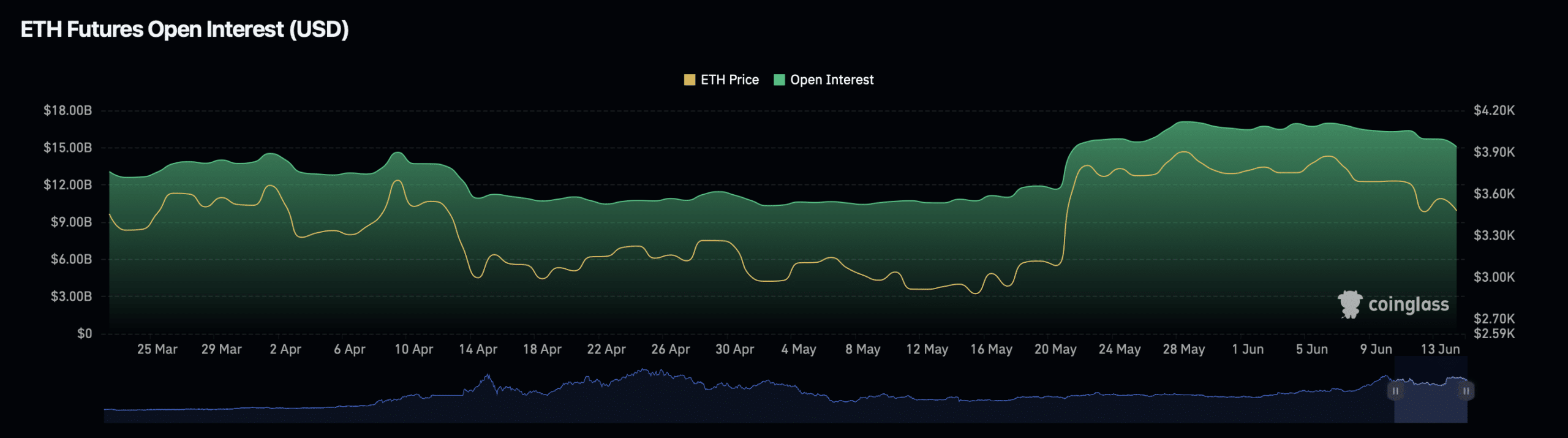

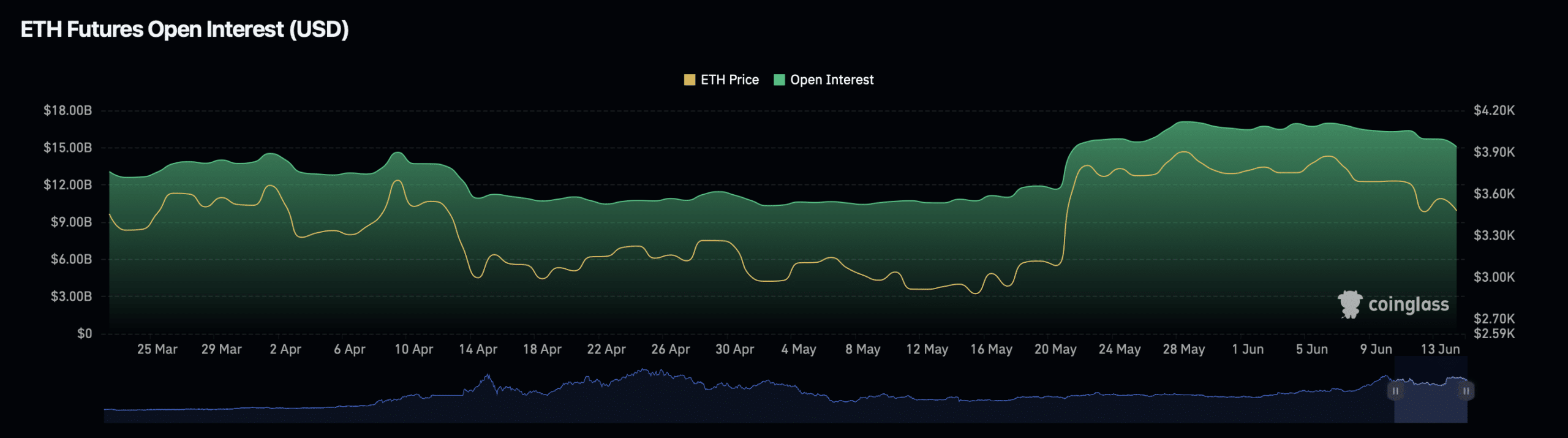

However, in contrast to this bullish accumulation activity, Ethereum market metrics such as open interest and trading volume offer a more muted picture.

Open interest in Ethereum fell almost 2% to $15.41 billion, while trading volume saw a significant drop of 25.77%, now standing at $24.19 billion. These figures indicate a cautious attitude among some market participants, who may anticipate further price adjustments.

Source: Coinglass

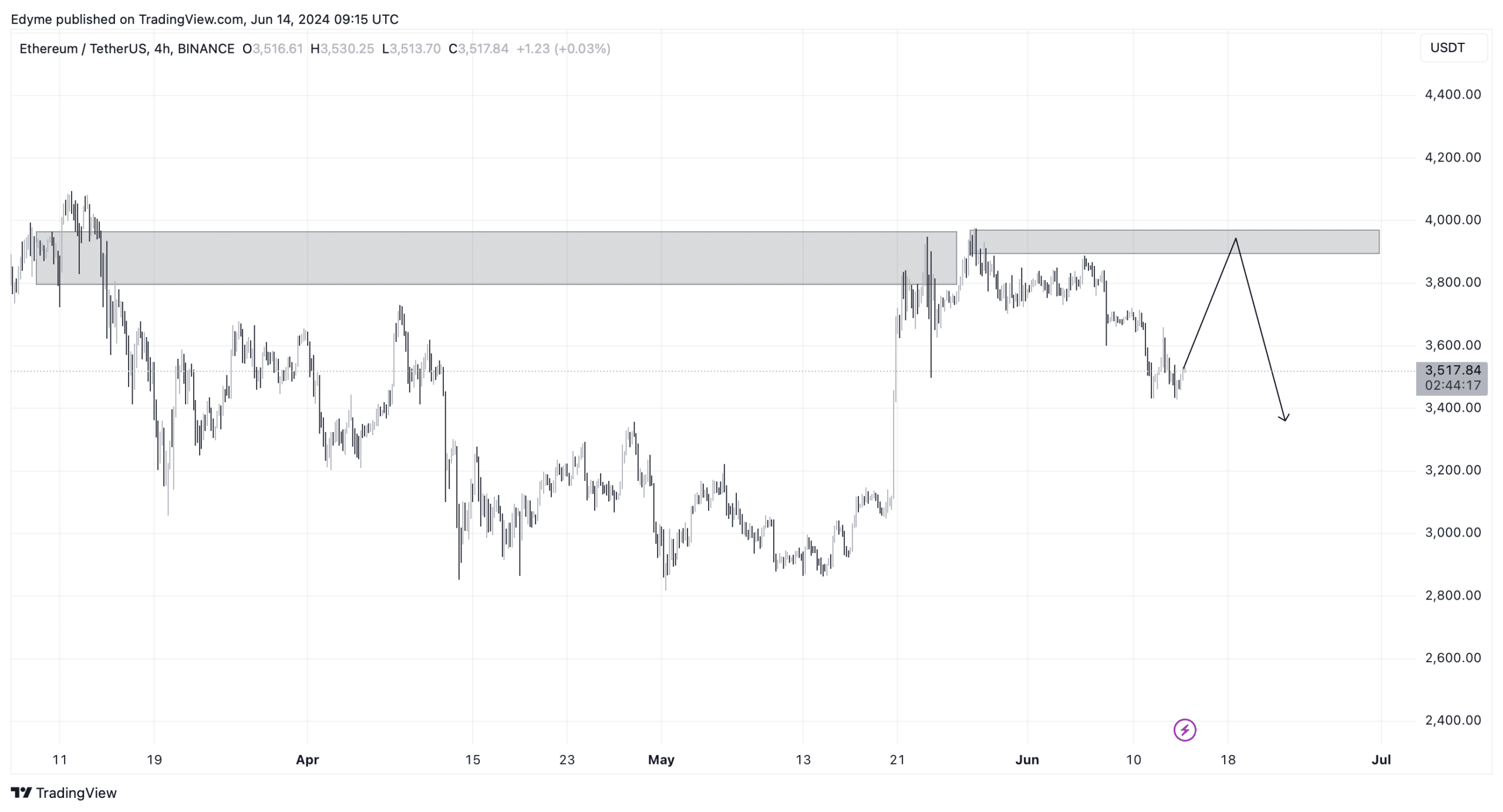

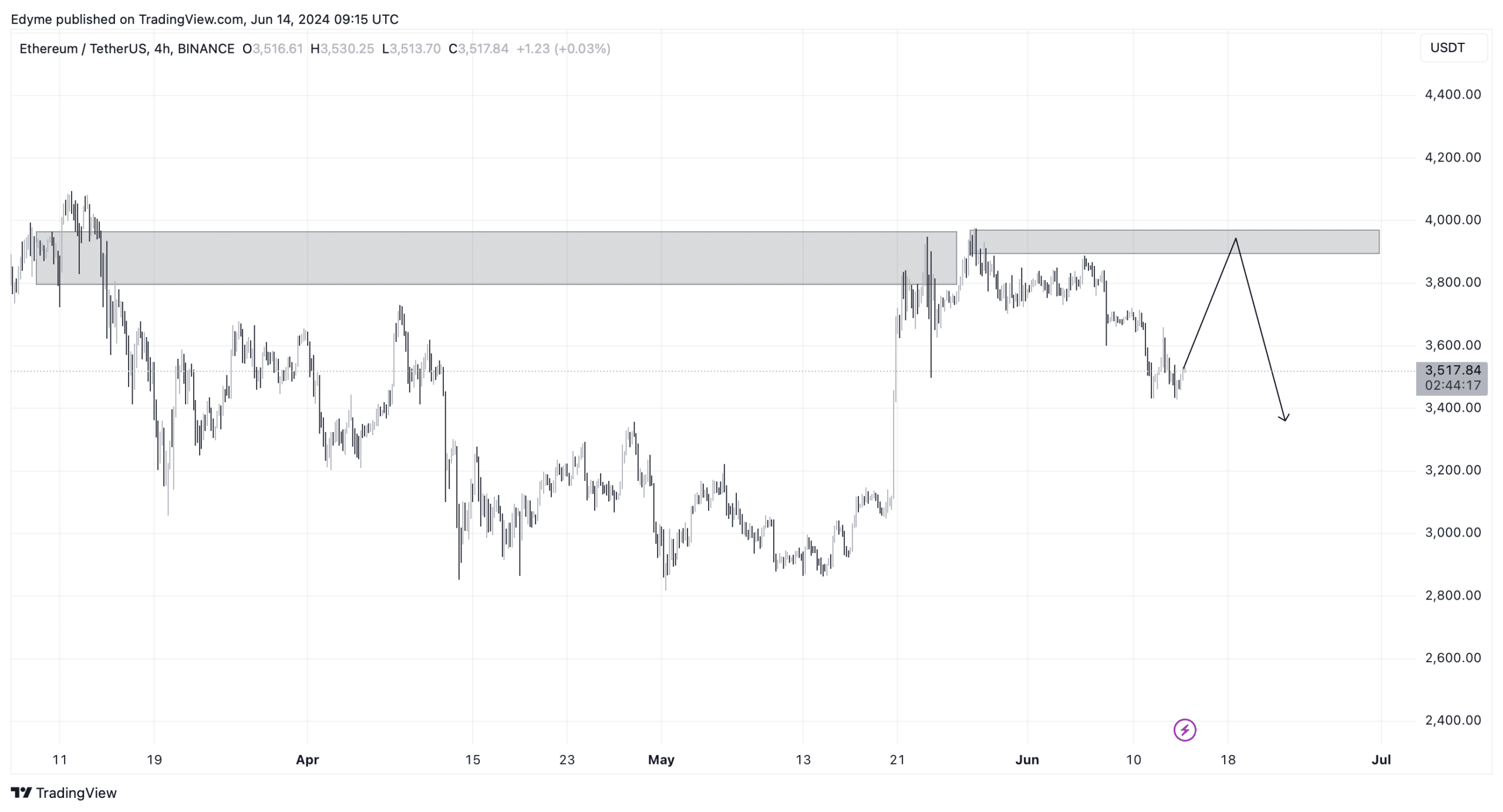

On the technical front, Ethereum’s inability to surpass March highs has triggered a sell-off on the daily chart, indicating possible continued downward pressure.

However, a shorter-term perspective from the 4-hour chart suggests that there could be a temporary rise to around $3,800, potentially providing liquidity for an ongoing downtrend.

Source: TradingView

Read Ethereum’s [ETH] Price forecast 2024-25

In another key aspect of market dynamics, the amount of Ethereum held on exchanges has reached an eight-year low. spotted by AMBCrypto.

This reduction in the number of Ethereum holdings on the exchange, combined with the launch of spot ETFs, could lead to a significant supply shock, which in turn could cause a sharp price increase.