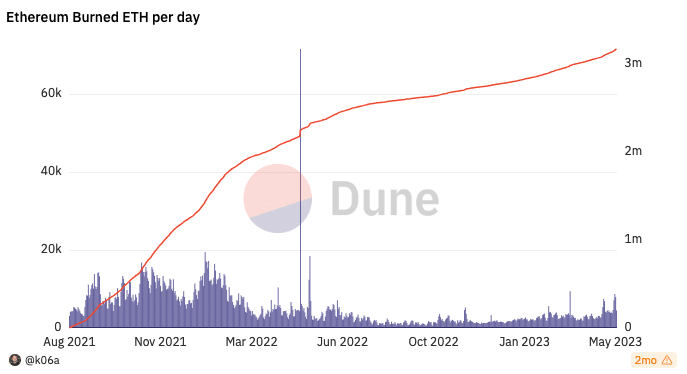

- The value of ETH burned since 2021 approached $10 billion.

- Gas consumption on the Ethereum network fell due to low activity.

Since the implementation of Ethereum Improvement Proposal 1559 (EIP-1559), an upgrade aimed at improving the network’s transaction fee mechanism, Ethereum [ETH] has witnessed the burning of a significant amount of ETH.

Read Ethereum [ETH] Price prediction 2023-2024

The mechanism, which reduces the supply of ETH, has resulted in the burning of nearly $10 billion worth of ETH tokens, Dune analysis revealed.

Source: Dune analysis

Dealing with hope

Implemented in August 2021, the Ethereum team developed EIP-1559 as one of the London Hark Fork Improvement Proposals. This happened alongside EIP-3554, 3198, 3529 and EIP-3541.

All these developments took place in preparation for the transition to Proof-of-Stake (PoS). For EIP-1559, the goal was to get rid of the previous fee market mechanism regarding the main gas fee calculation.

While many users had hoped that development would slow down gas fees on the network it did not. Instead, it provided a discrete base fee aimed at prioritizing transactions when validating blocks.

Further information from Dune, the analytics platforms, showed that projects like Uniswap [UNI]Circle [USDC]and NFT marketplace OpenSea played a critical role in the increase.

At the time of writing, nearly 300.00 ETH each had been burned through Uniswap and OpenSea. And the reason for this is obvious. Uniswap maintained its position as the leading Decentralized Exchange (DEX).

So many ETH swaps with other tokens have influenced the rise. For OpenSea, its place as number one on the Ethereum-based marketplace puts it in the positions mentioned above. As for USDC, its position as the stablecoin of choice in DEXs helped lift its ranking.

Source: Dune analysis

Gas consumption drops

However, the Ethereum gas used had declined at the time of writing. According to Sanitation, the ETH gas used was 16.05 billion. Used gas consumption spines when there is a lot of activity on the network.

And this demand for ETH causes a rise in gas prices. So the fall in use reflects a relatively less busy period for the Ethereum network.

Looking at network growth, the on-chain data provider revealed that metrics had plummeted. Typically, network growth measures the rate of adoption and influx of new users into a network.

So when network growth picks up, it means a project has impressive traction. However, when the metric decreases, it means usage is low. And this is usually accompanied by low liquidity.

![Ethereum [ETH] gas consumption and network growth](https://statics.ambcrypto.com/wp-content/uploads/2023/07/Ethereum-ETH-12.45.52-17-Jul-2023.png)

Source: Sentiment

In conclusion, Ethereum’s burn mechanism has relatively allayed the network’s concerns about transaction fees.

Also, the significant amount of ETH burned also demonstrates the demand and usage of the Ethereum network, as well as the effectiveness of creating a more deflationary ecosystem. Whether it will improve or not, time will tell.