- Whales have caused a considerable sales pressure, with Ethereum testing critical support levels.

- Active addresses and rising transaction fees suggest that Ethereum will soon be able to regain the market momentum.

Whales have sold more than 440,000 Ethereum last week, which causes a considerable shift in the market.

Recent reports shown That one wallet sold 8,074 ETH at an average price of $ 2,431, while another 10,000 ETH worth $ 23.44 million transferred to Binance in just two days.

Ethereum’s [ETH] Price at the time of the press was $ 2,354.64, which marked a decrease of 5.46% in the last 24 hours.

This large -scale panic sale has expressed concern, but some investors believe that Ethereum can find support at the current level.

In or out? Insight into the market sentiment

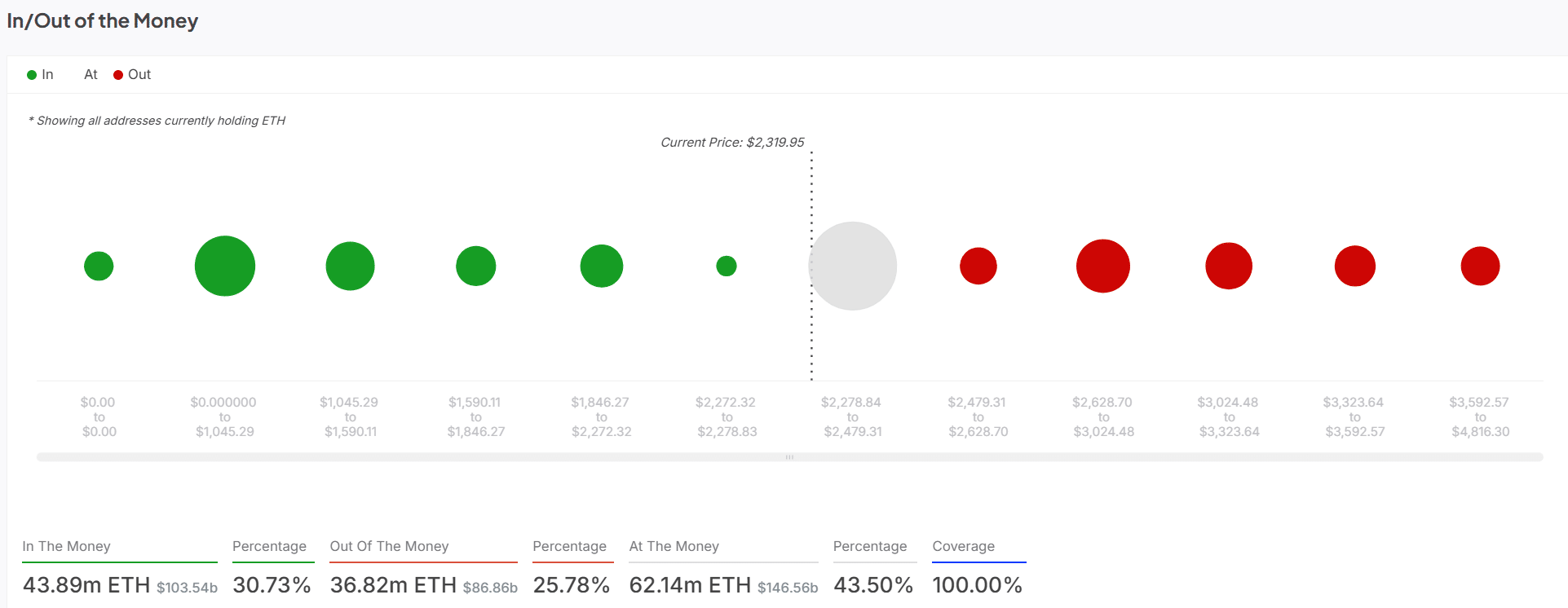

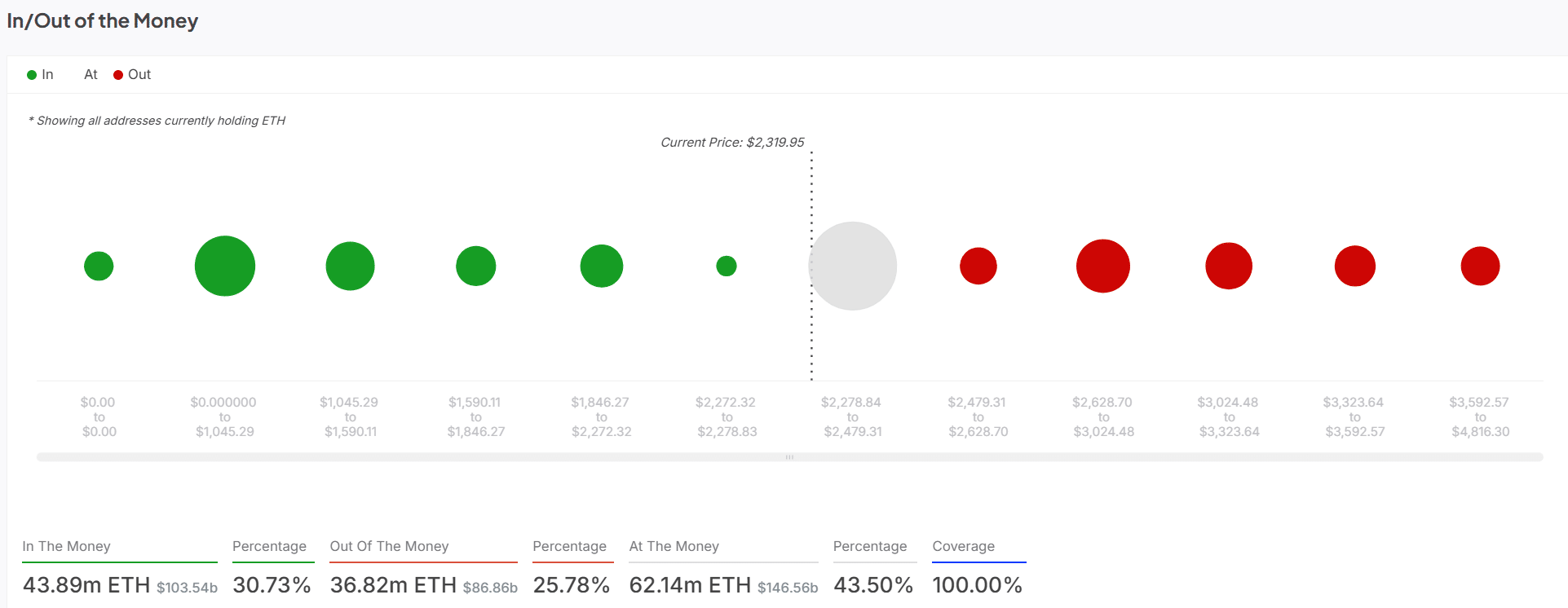

Ethereum’s in/out-of-the-money data offer a valuable view of market sentiment. At the time of writing, 43.5% of the addresses were ‘in the money’, with the most clustered between the price levels of $ 2,479.31 and $ 2,628.70.

However, a considerable 36.82% of the addresses fall ‘from the money’, in particular those with ETH between $ 2,479.31 and $ 3,024.48.

This indicates that a considerable part of the investors retains with a loss, which can increase the sales pressure if the price continues to fall.

Source: Intotheblock

ETH price promotion: Is support for support?

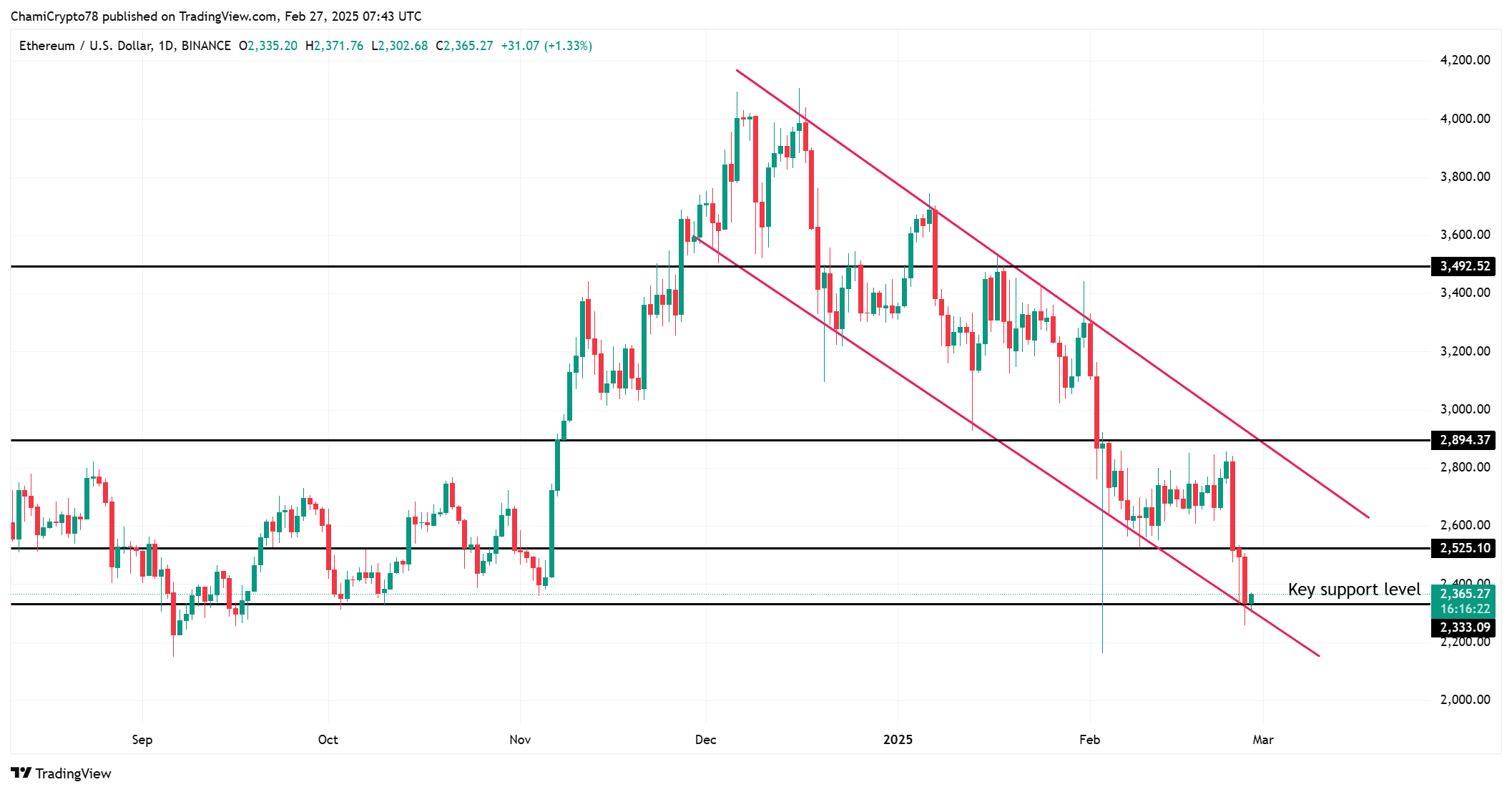

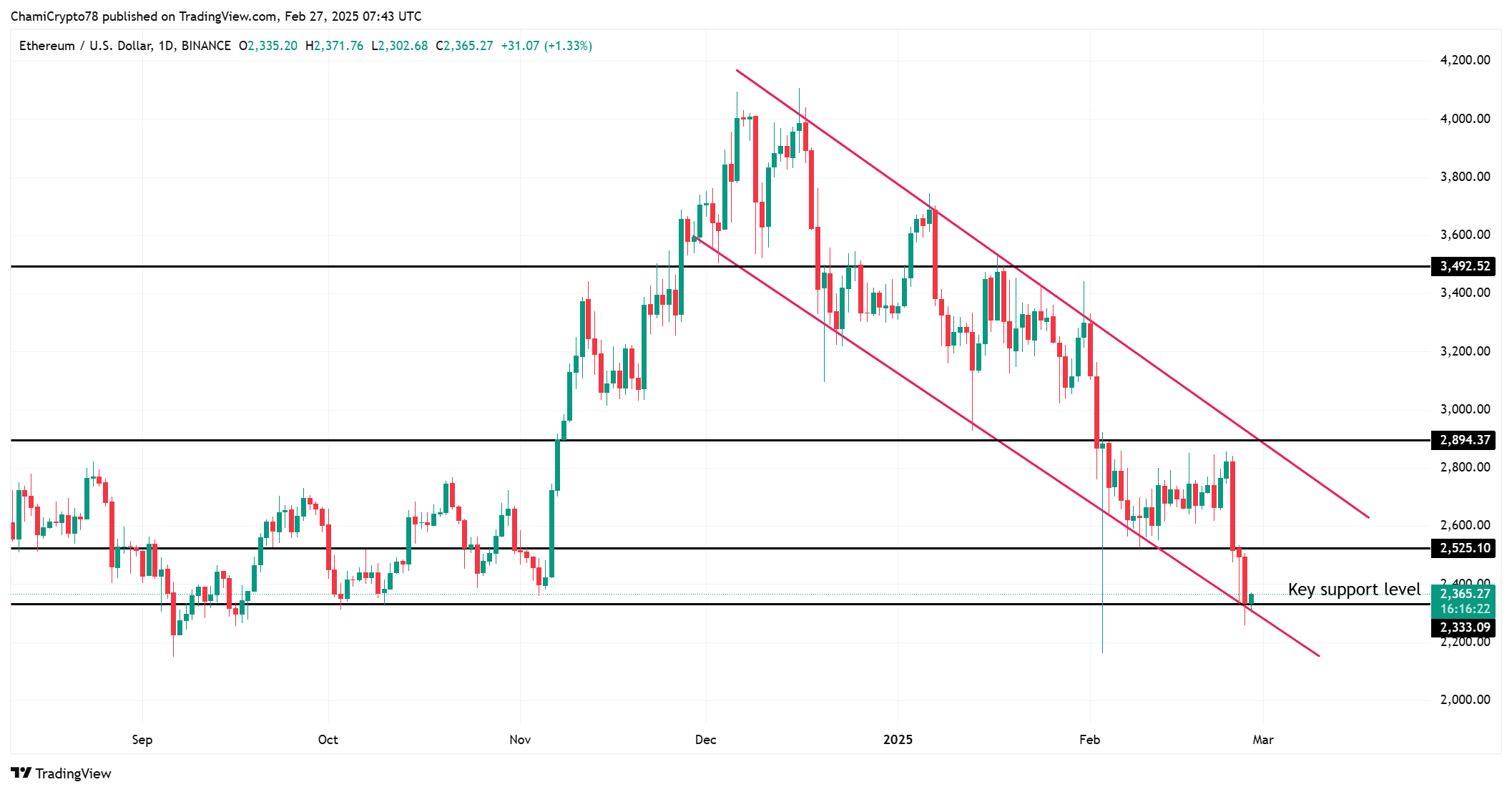

Ethereum has had a downward trend, with its price that fluctuates almost critical support for $ 2,347.21. If this level does not hold, ETH can fall to the next major support at $ 2,272.32.

However, the price was recently bounced of the $ 2,347.21 zone, indicating that the support could still be intact.

In the short term, ETH can experience resistance at the level of $ 2,479.31. If it breaks above this price, the market may see a reversal.

Source: TradingView

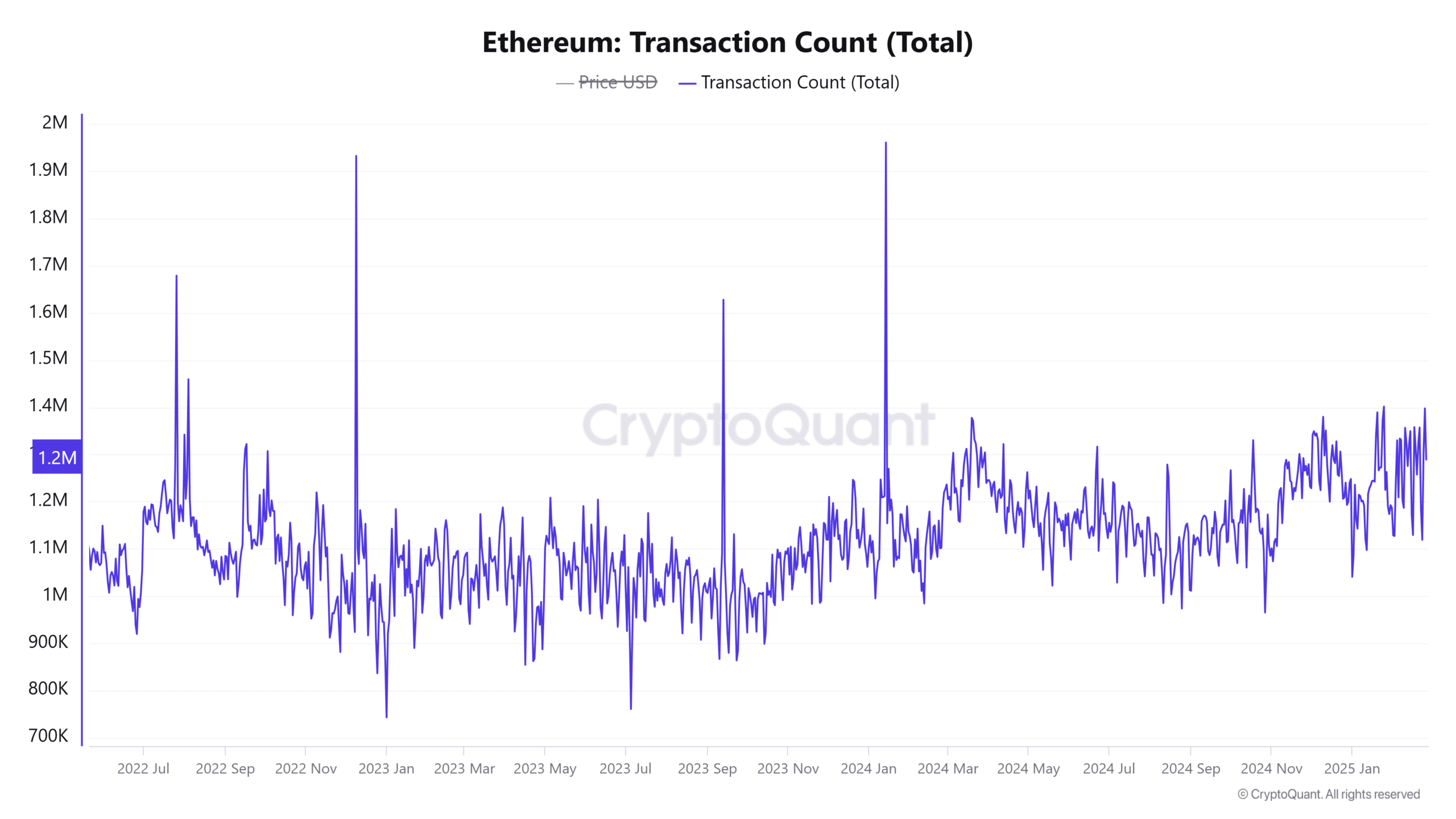

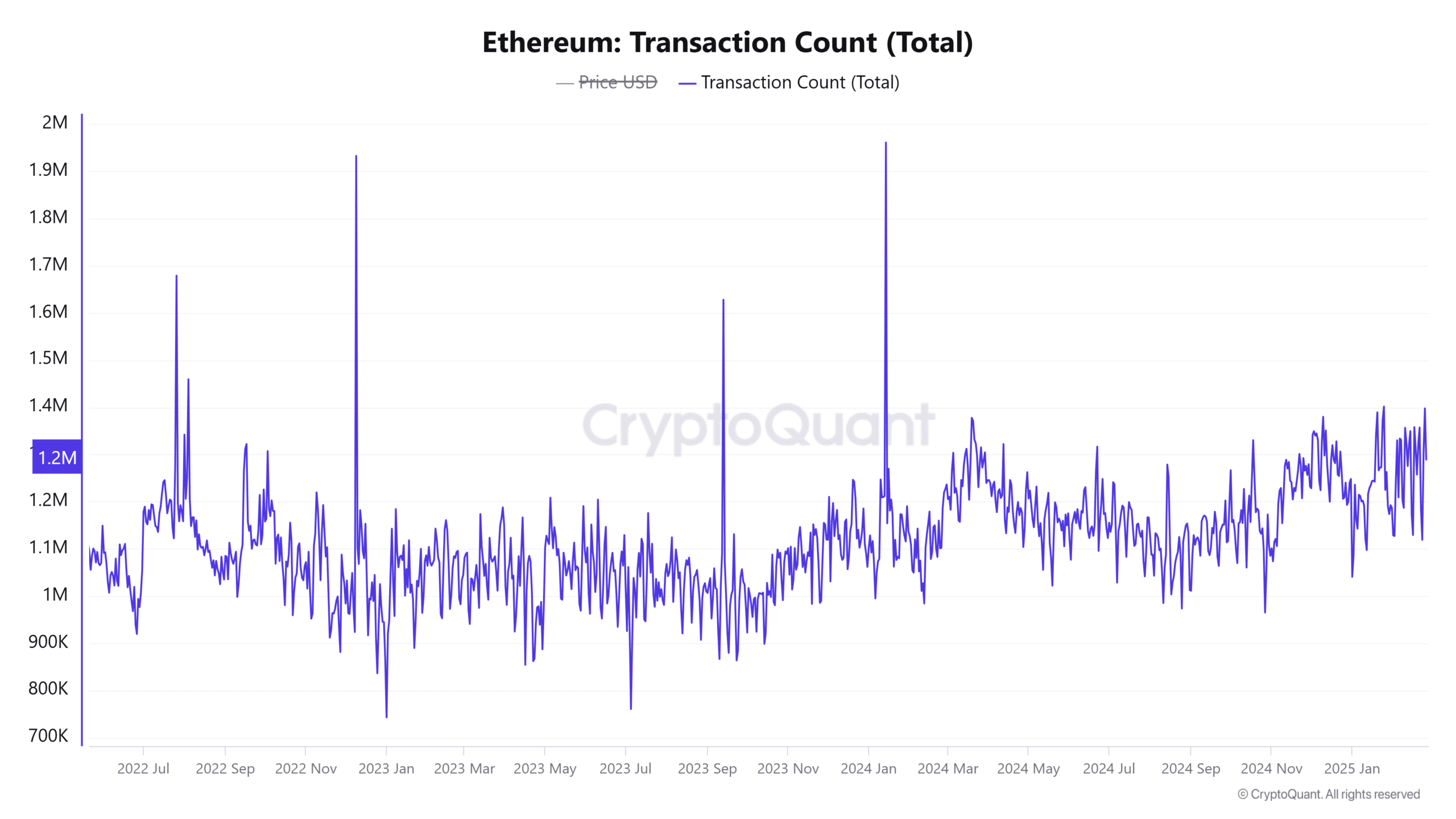

Active addresses and transactions: Market participation

Despite the price fall, the network activity of Ethereum remains consistent. Active addresses have increased by 1% in the last 24 hours, with 21,283.3k unique addresses that deal with the network.

Moreover, the total number of transactions has risen by 0.96%, indicating that investors, although careful, are still involved in Ethereum.

This activity suggests that the basic principles of Ethereum remain intact and that the market could possibly return if confidence returns. Although the market is confronted with sales pressure, the engagement levels show that retail investors are still active.

Source: Cryptuquant

Ethereum is likely to bounce back from support

Given the current market dynamics and the recent price action of Ethereum, ETH will probably bounce back after touching the support zone at $ 2,347.21.

The sales pressure can be partially attributed to the Bybit -Hack, where $ 1.4 billion was influenced in ETH, which causes some panic on the market.