The recent actions of Ethereum (ETH) whales have attracted massive attention from crypto enthusiasts, as they have dumped a quarter of a billion worth of ETH in the past 24 hours. This significant dump has raised questions among investors and traders: is the market about to crash or what, why are whales and institutions dumping their ETH holdings?

Whale sent $257 million to ETH exchanges

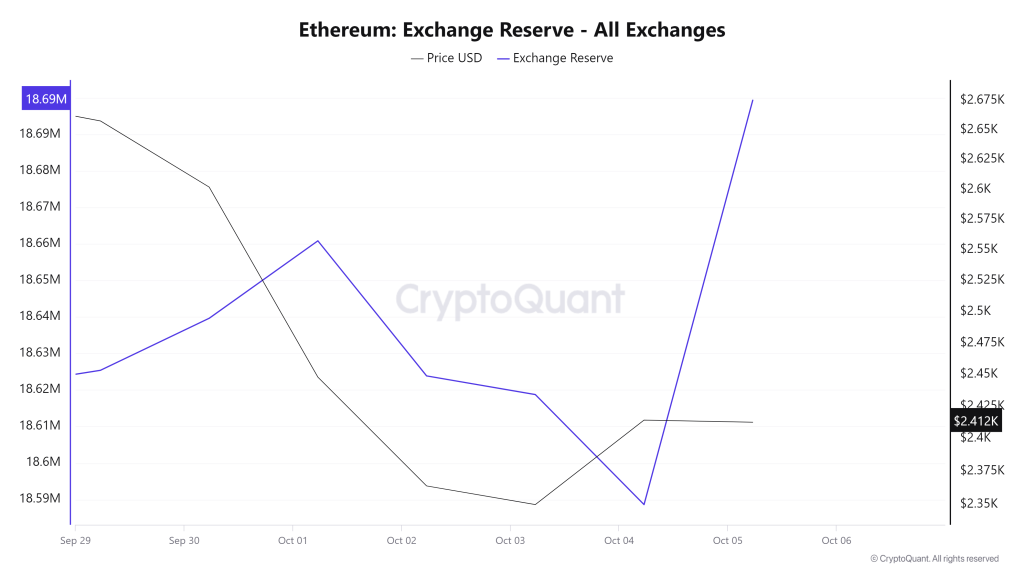

According to an on-chain analytics company CryptoQuantEthereum whales have dumped nearly 107,000 ETH worth $256.8 million to cryptocurrency exchanges in the past 24 hours. This is a negative sign for the market: when the exchange rate reserve increases, there will be selling pressure and a huge drop in prices.

However, these significant dumps occurred as the overall market began to recover on October 5, 2024. After this dump, ETH has not seen any major price drops.

Ether Current Price Momentum

At the time of writing, it is trading near $2,406 and has experienced a decline of over 0.75% in the last 24 hours. Meanwhile, trading volume has fallen 46% over the same period, indicating lower participation from traders and investors, possibly due to fears of price drops or a market crash.

Technical analysis of Ethereum and upcoming levels

According to expert technical analysis, Ether is currently facing strong resistance around the $2,445 level. Following Iran’s attack on Israel, the recent price drop caused ETH to test the support of its rising trendline. However, it is crucial that ETH keeps itself above the trendline and the $2,335 level to avoid further price declines.

Based on the historical price momentum, if ETH breaks the trendline and closes a daily candle below the $2,335 level, there is a high possibility that it could experience a further price drop towards the $2,200 level in the coming days.

As of now, ETH is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a downtrend. The 200 EMA is a technical indicator used to analyze the asset regardless of whether it is in an up or down trend, and traders and investors make decisions based on that analysis.