- Novice crypto traders are overwhelmed with fear, but seasoned market analysts advise otherwise.

- A combination of several ETH metrics indicates strong bullish sentiment due to increased wallet activity.

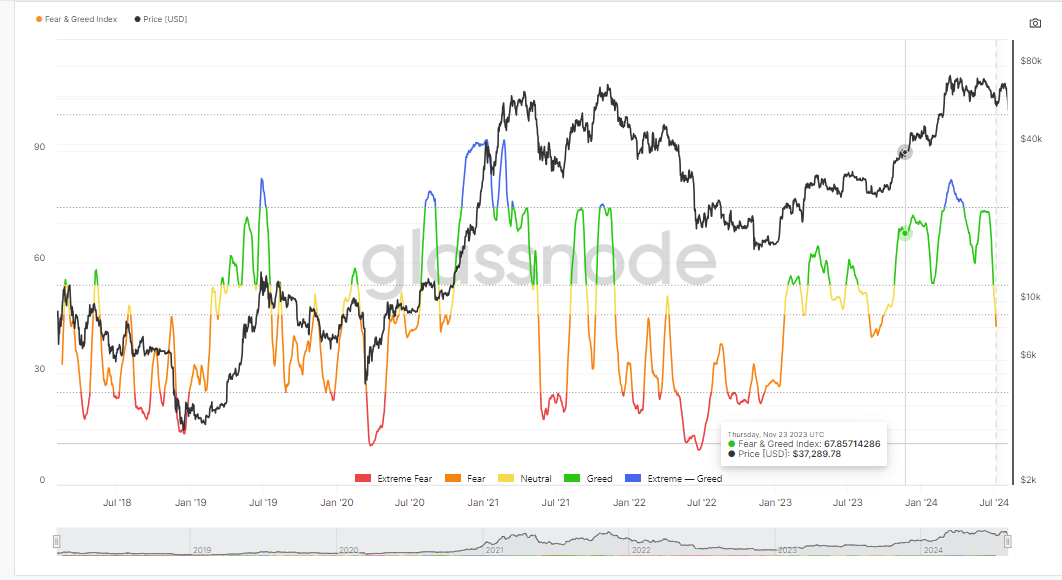

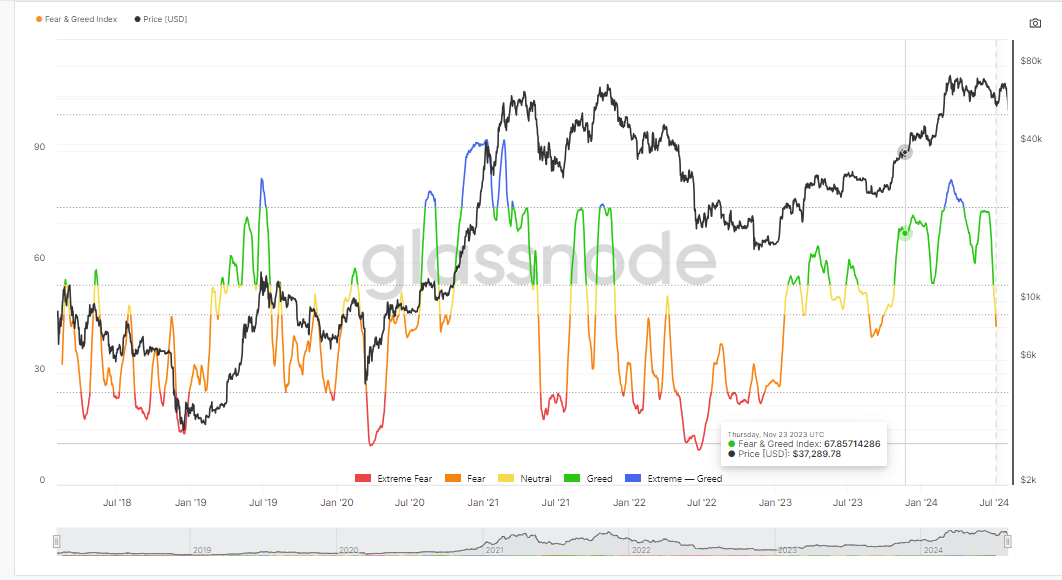

Fear currently dominates the crypto markets, and seasoned analysts often advise to “be greedy when others are fearful.”

This strategy has proven effective over time because it uses emotional intelligence to navigate market cycles.

Market analyst Quinten cited on X (formerly Twitter) that the current fear in the market is a signal to buy more crypto.

Historical patterns show that such fear often precedes major price increases, as seen when most cryptos moved to new ATHs earlier, according to data from Glassnode.

Source: Glassnode

What is Ethereum up to?

Despite concerns about a global recession and potential world conflict, Ethereum remains [ETH] showed promising signs of growth as wallet activity on the Ethereum blockchain has skyrocketed recently.

Combined key metrics including active wallet addresses in the past 30 days, circulation, network growth, and transaction volume are all on the rise, as Santiment’s chart indicates.

This upward trend suggests that now is not the time to panic, but rather an opportunity to invest in ETH assets.

Source: Santiment

ETH: Covid crash versus now

During the Covid-19 crash, Ethereum hit a low that scared many new investors, causing them to sell during the market decline.

However, soon after, Ethereum’s price rose as the market recovered. The recent crash over the past 24 hours resembles the Covid-19 downturn, suggesting we could see a similar rally soon.

The current market fear could signal an upcoming uptrend for Ethereum, mirroring the recovery pattern seen previously.

Source: ETH/USD index on TradingView

Ascending triangle tested again

The recent market sell-off is seen as a major test of Ethereum’s previous price patterns.

Is your portfolio green? Check out the ETH profit calculator

Technically, Ethereum’s price action is revising the old breakout level and could potentially surge to a new all-time high by the third quarter of 2024.

The strategy is to aggressively buy Ethereum when the price falls below $2300 and hold it, anticipating future gains when the market recovers.

Source: TradingView