- Ethereum witnessed a more severe correction than Bitcoin last week.

- Statistics suggested that selling pressure on BTC and ETH was high, but ETH had an edge.

Bitcoin [BTC] remained in the spotlight last week as the price approached $70,000, but later plummeted to $66,000. Ethereum [ETH] had a more difficult week as there was relatively more correction.

However, the latest update showed that investors should consider accumulating ETH as its volatility has increased slightly.

Weekly achievements

CoinmarketCaps facts revealed that BTC’s price fell after being rejected from the $70k zone. At the time of writing, it was trading at $66,491 with a market cap of over $1.31 trillion.

On the other hand, ETH witnessed a 3% price correction last week. At the time of writing, ETH was valued at $3,325 with a market cap of over $399 billion.

According to QCB Broadcast’s insightsthe price of BTC started to fall after the US stocks opened. Another reason was the US government’s $2 billion sell-off of BTC.

The insight also mentioned that investors could consider accumulating Ethereum as it has already gained mild volatility and could see fluctuations in the coming week.

Ethereum could soon gain momentum as the market may become immune to key outflow figures due to the rotation from pricier ETHE to cheaper ETFs.

Ethereum vs Bitcoin

AMBCrypto then planned to check and compare these two cryptos, to find out if Ethereum can surpass BTC this week.

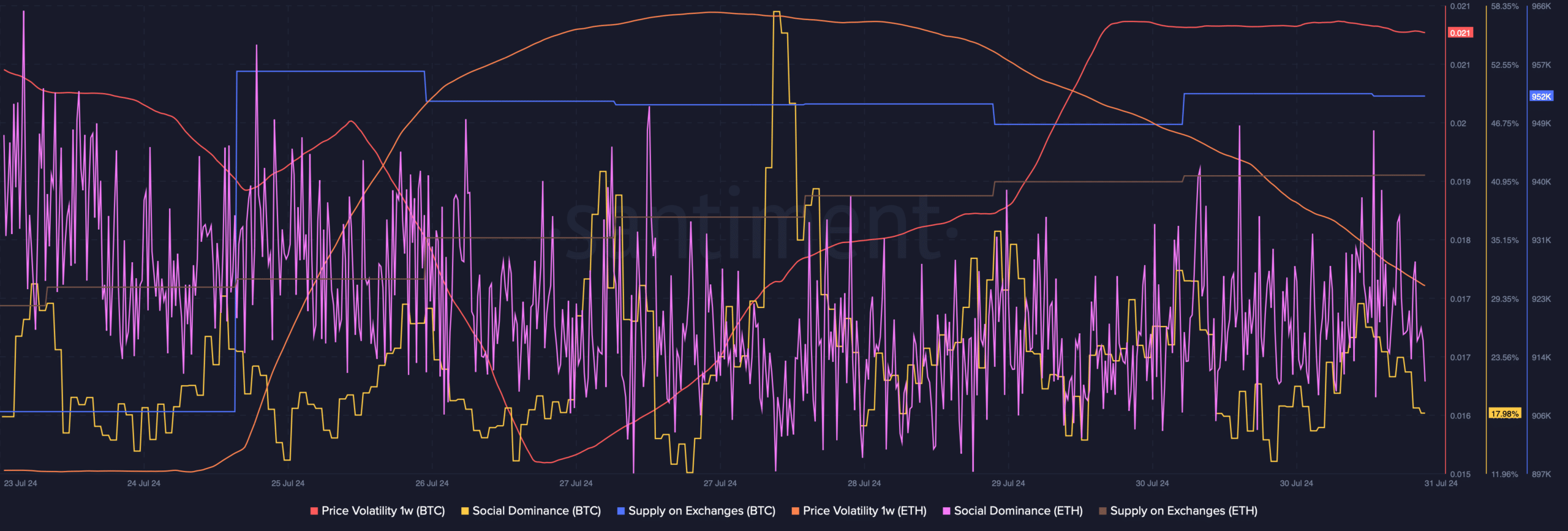

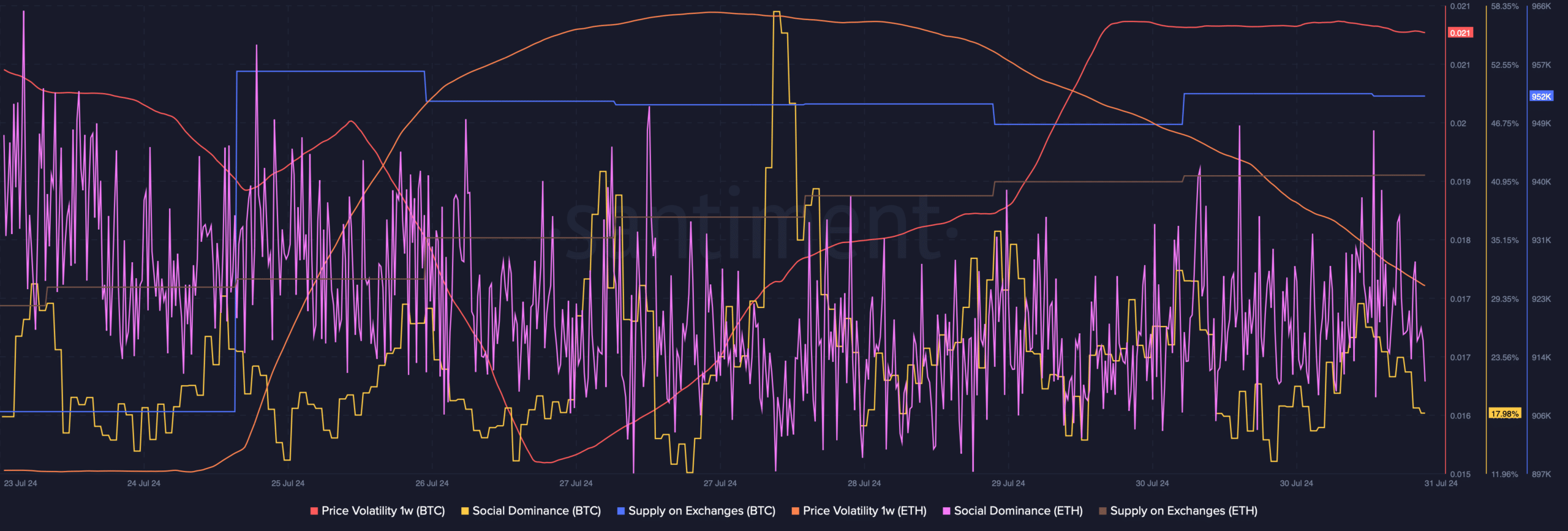

According to our analysis of Santiment’s data, BTC’s social dominance remained relatively higher than ETH’s. Both cryptos also witnessed an increase in their offerings on exchanges.

This suggested that investors were considering selling BTC and ETH.

Also BTC’s price volatility 1w increased sharply, while ETH’s price volatility decreased. While this may look negative for Ethereum, the reality may be different.

The drop in price volatility over a week could indicate an end to the token’s bearish price action, which in turn could signal a bullish trend reversal.

Source: Santiment

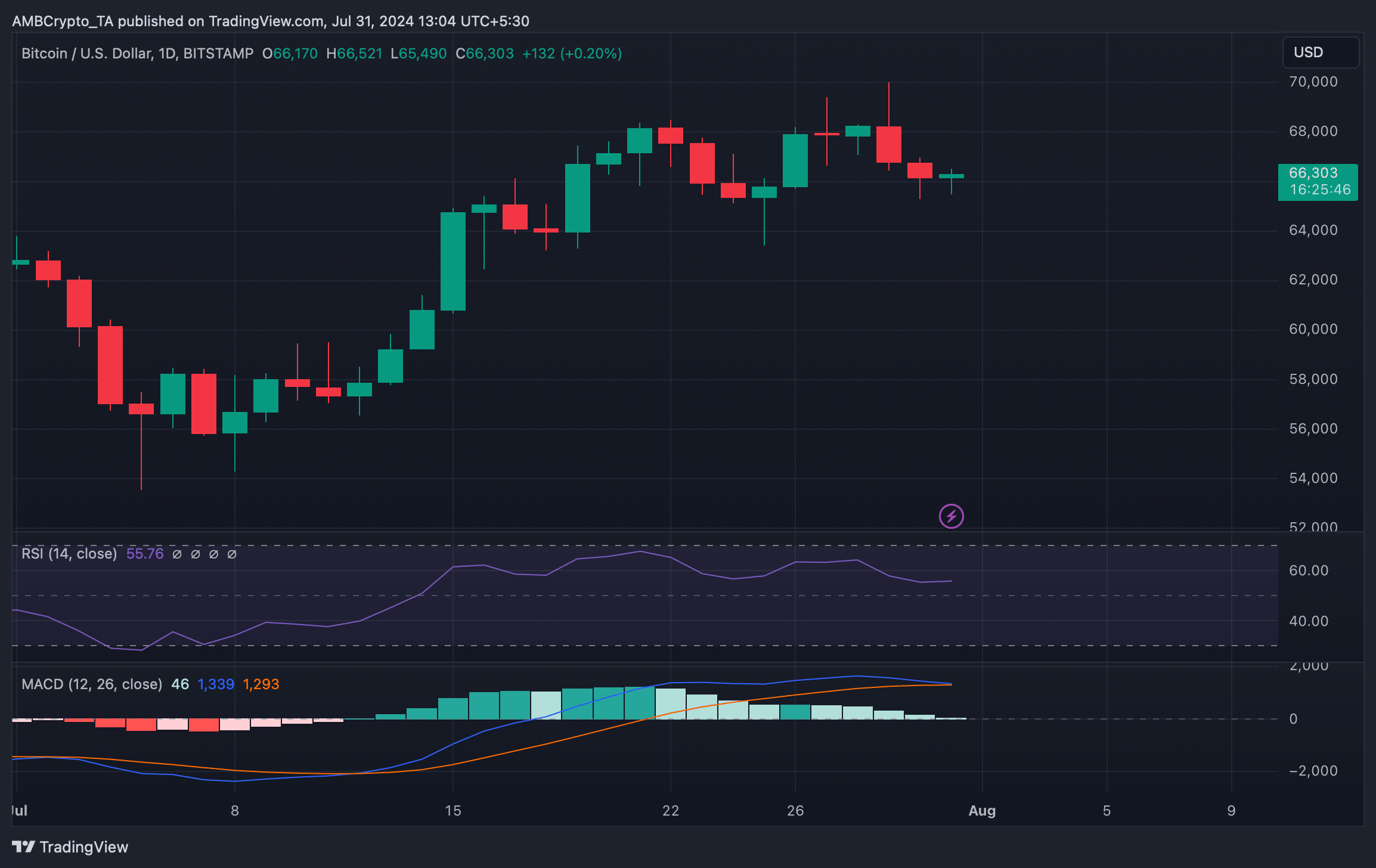

We then checked the daily charts of Bitcoin and Ethereum to better understand which way they were heading. We found that BTC’s MACD showed a bearish crossover.

Read Ethereums [ETH] Price prediction 2024-25

Moreover, the Relative Strength Index (RSI) registered a downtick and then moved sideways. These indicators suggested that the chances of correction or less volatile price action were high.

Source: TradingView

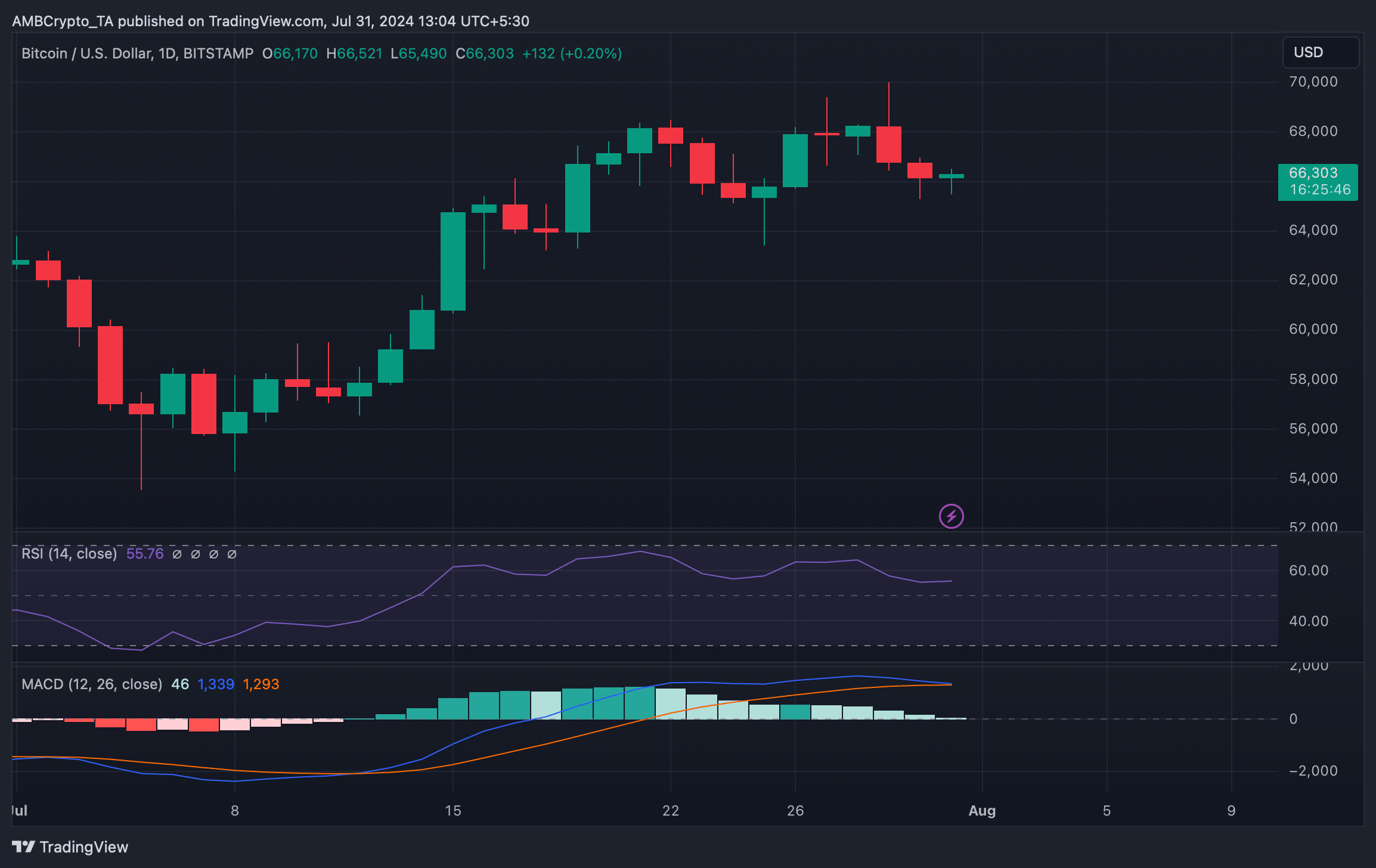

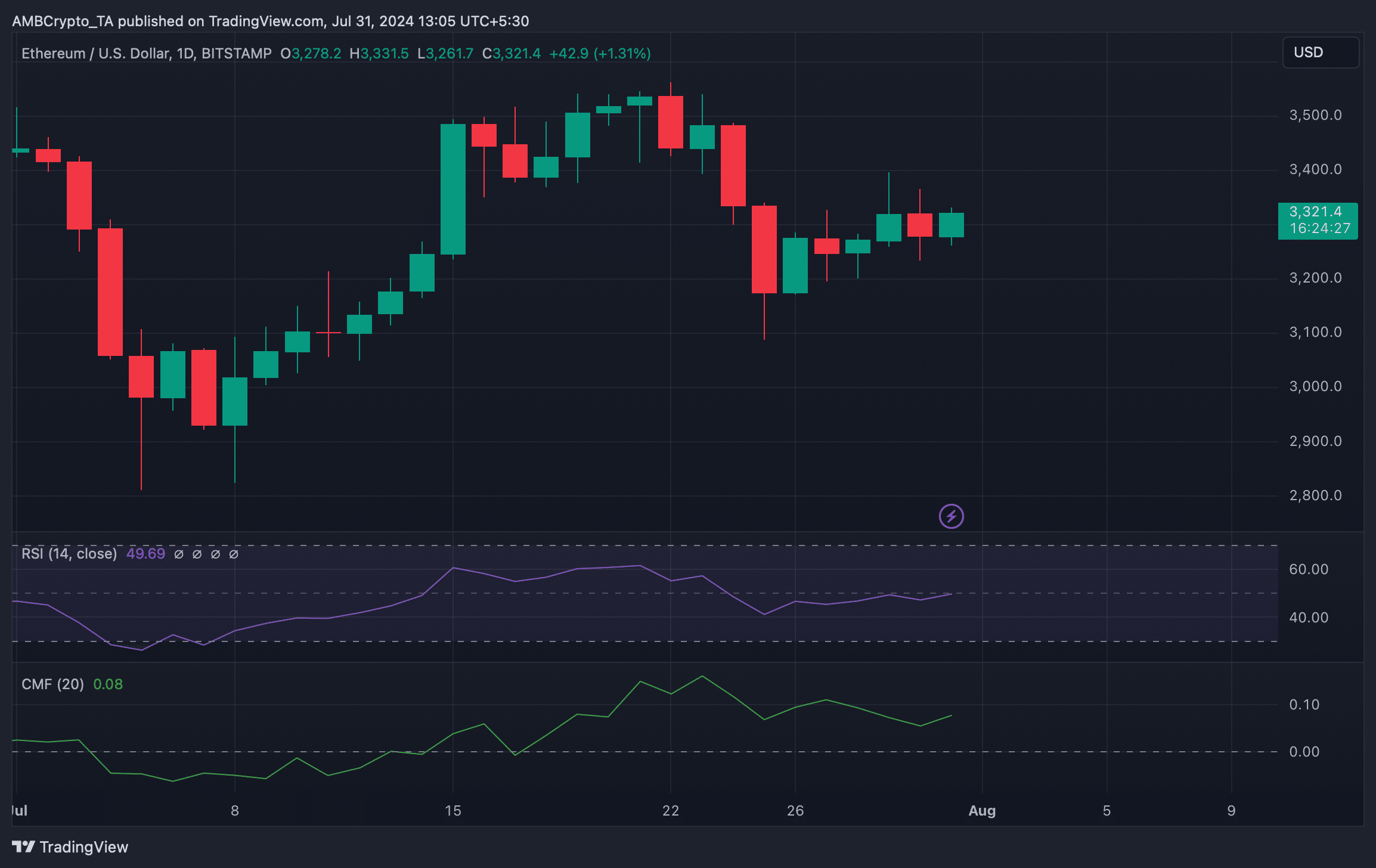

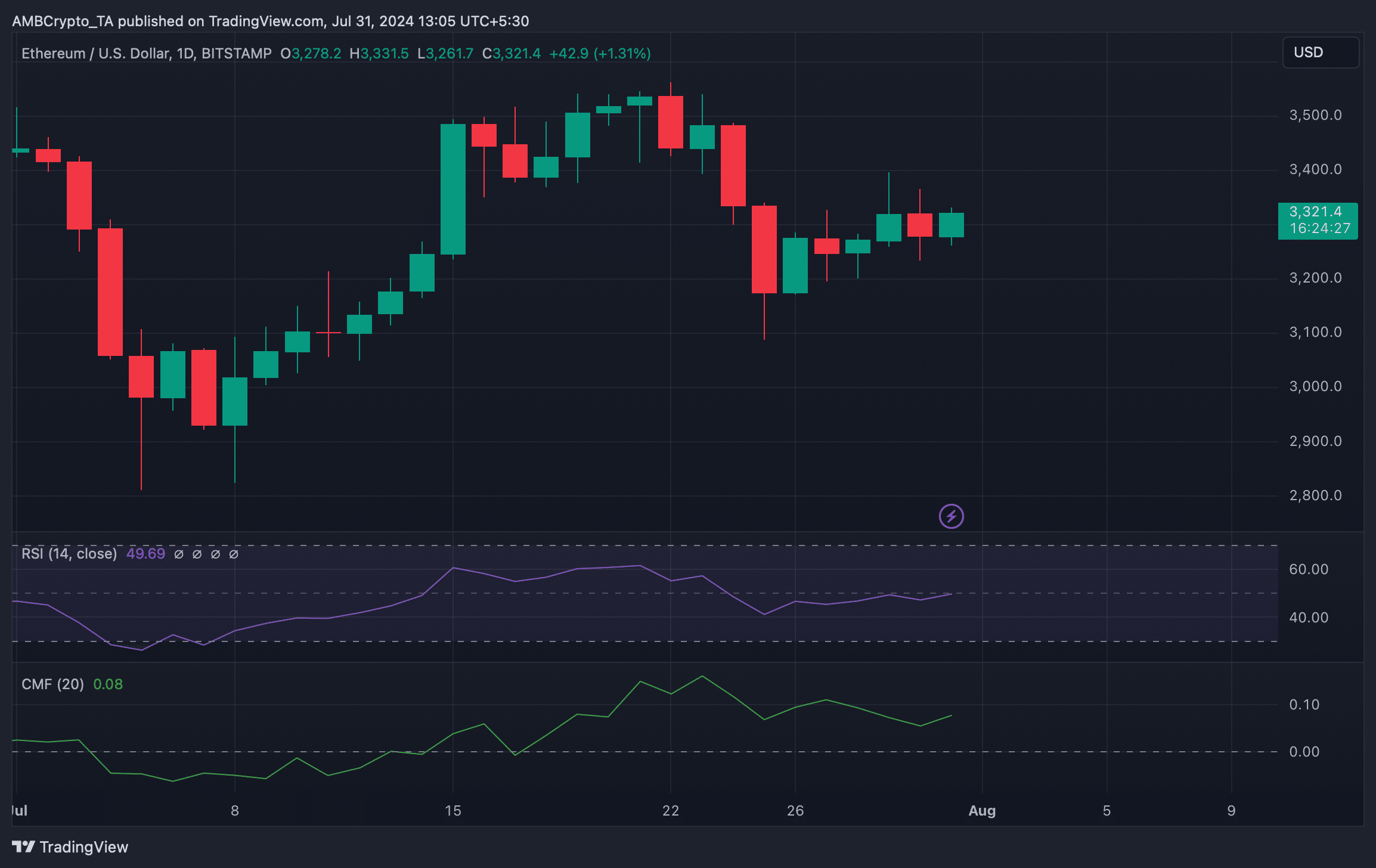

On the contrary, Ethereum’s Relative Strength Index (RSI) gained bullish momentum. The Chaikin Money Flow (CMF) also followed a similar trend, indicating that ETH could gain bullish momentum ahead of Bitcoin.

Source: TradingView